Does a power of attorney have to be recorded in Alabama?

If your agent will have the ability to handle real estate transactions, the Power of Attorney will need to be signed before a notary and recorded or filed with the county.

Does power of attorney need to be recorded in Florida?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

Does a power of attorney need to be recorded in Washington state?

The power of attorney should be recorded because recording provides notice of the agent's authority, allows the agent to obtain certified recorded copies, and is usually required by title companies and other entitles involved in land transactions.

Does a power of attorney have to be recorded in Tennessee?

If your agent will manage real estate transactions, the Power of Attorney will need to be signed by a notary and filed or recorded with your county.

Who holds the original power of attorney?

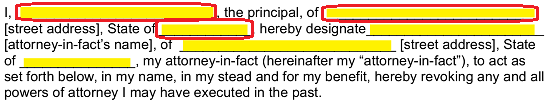

The person authorizing the other to act is the principal, grantor, or donor (of the power). The one authorized to act is the agent, attorney, or in some common law jurisdictions, the attorney-in-fact.

Can a family member override a power of attorney?

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian.

Can you sell a property if you have power of attorney?

To reiterate, with a power of attorney property can only be sold if the subject is incapable of making a decision - but the sale must be in the subject's interests.

What happens when a power of attorney document is lost?

Registered User "What if the original Enduring Power of Attorney has been lost? If the original EPA is lost a certified copy can be registered. Office copies of a registered EPA can be obtained from the OPG for a fee." The implication is that you may register a certified copy only if the original has been lost.

How does power of attorney work in Washington state?

(1) A power of attorney must be signed and dated by the principal, and the signature must be either acknowledged before a notary public or other individual authorized by law to take acknowledgments, or attested by two or more competent witnesses who are neither home care providers for the principal nor care providers ...

Does a power of attorney end at death Tennessee?

A durable power of attorney becomes effective when signed and remains in effect until the person granting the power either revokes it or dies.

How do I get a financial power of attorney in Tennessee?

You can write a power of attorney yourself, use a template or ask a lawyer to write one for you. As a legal document, it must be carefully worded. The Tennessee government offers power of attorney templates for health care, taxes and vehicle transactions, which you can download and fill out.

What can a POA do and not do?

The POA cannot change or invalidate your Will or any other Estate Planning documents. The POA cannot change or violate the terms of the nominating documents -- otherwise they can be held legally responsible for fraud or negligence. The POA cannot act outside of the Principal's best interest.

What formalities does Florida require for execution of a power of attorney?

Execution Requirements In order to be effective, a Florida power of attorney must be signed by the principal and by two witnesses, and be notarized. In the event the principal is physically unable to sign, the notary public may sign the principal's name on the document.

Does a lasting power of attorney have to be registered?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

Do wills have to be recorded in Florida?

Yes. All original wills must be deposited with the Court. If you are in control of an original will you must deposit it within ten (10) days after receiving information that the testator is dead.

How long is a power of attorney good for in Florida?

But as a general rule, a durable power of attorney does not have a fixed expiration date. Of course, as the principal, you are free to set an expiration date if that suits your particular needs. More commonly, if you want to terminate an agent's authority under a power of attorney, you are free to do so at any time.

Where to check power of attorney?

Check the power of attorney records at the register or recorder of deeds in the county where the individual who created the instrument resides. In some states a power of attorney can be filed with the register or recorder of deeds. However, this is not the common practice today.

How to verify a power of attorney?

Verify the authenticity of the power of attorney document presented to you. In many states, a power of attorney must be notarized. The presence of a notary's stamp and signature is usually enough evidence that the power is a legitimate document. If you're concerned, run an internet search for the notary and ask him or her to verify that the stamp on the document is the notary's official seal. Contacting witnesses is another avenue to explore. Often, powers of attorney bear the signature of an independent witness who watched the principal sign the power. See if you can contact the witness – the address should be written beneath the witness's signature – and ask if she remembers attending the signing.

What happens if a power of attorney is not authentic?

If a power of attorney does not appear authentic to you, and you cannot independently verify its authentic ity, do not transact business with the purported agent. If the power of attorney turns out to be fraudulent, you can be held liable for any losses sustained by the alleged grantor through the transaction.

What is a notary signature line?

Types of Notarial Acts. A power of attorney is an instrument that a person uses to grant authority to an agent to act on his or her behalf. The two different types of instruments are health care and financial powers of attorneys. A third party preparing to transact business or take action in reliance on a power ...

What does a third party need to know about a power of attorney?

A third party preparing to transact business or take action in reliance on a power of attorney needs to verify who really does have authority under such an instrument to make decisions for another person.

Who is the grantor of a power of attorney?

The grantor is the individual who drafted and executed the power of attorney. Though this might seem to defeat the purpose of designating an agent to act on behalf of a grantor via a power of attorney, the typical grantor appreciates a third party taking the time to confirm the authenticity of a power of attorney.

Do you have to review the original power of attorney?

A duly authorized agent named in a power of attorney should have the original instrument in his or her possession. If you are being asked to take action by an individual contending he or she is an agent authorized to make decisions through a power of attorney, you must review the original instrument.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a POA in estate planning?

Understanding Power of Attorney is key to setting up an Estate Plan that has all your bases covered. Having a Financial Power of Attorney (POA) in place ensures you’re establishing a way for your affairs to be managed when it matters most - when you can’t do it yourself.

Is a durable power of attorney the same as a living will?

A Durable Power of Attorney and a Living Will are similar in nature but have distinct differences. When you’re talking about POA in this sense, you are talking about Medical Power of Attorney (not financial). The main difference between the two follows.

Do you need a POA?

Determine need. Do you actually need a Financial POA? If you’re married and have joint assets, this may not always be necessary right now. Likewise, if you have a Living Trust holding your assets, and you’ve appointed a Trustee to act on your behalf, a Financial POA may not be a great need at this time. That said, a Durable Financial POA can still be a good idea, and they can be the same person as your Trustee.

Is it natural to choose a POA?

From the trust aspect, it probably seems natural to select a family member who is close to you. But sometimes the POA you choose actually isn’t the person closest to you, as emotions can become a factor and the responsibilities could be burdensome. At the end of the day, as long as you’re placing a person you trust in the role, you'll be more confident in your decision.

Does POA last after death?

Two last points - note that some states will automatically see a Financial POA as “Durable,” meaning it lasts even if you’re suddenly incompetent. Also, the role dissolves upon your death unless you’ve written in specific language noting otherwise elsewhere in your Estate Plan (such as your POA could then become Trustee of your Trust or Executor of your Will).

What does a financial power of attorney do?

In many situations, a Financial Power of Attorney will authorize an agent to sell property on behalf of the principal ( the person who made the Power of Attorney).

Do you need to be registered for a power of attorney?

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

Can a power of attorney be taken to the bank?

For instance, if your agent needs access to your bank account in order to pay bills on your behalf, he or she will take the Power of Attorney to the appropriate bank to prove that you have authorized such access.

What is a power of attorney?

This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (you are the “principal”). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself. This power of attorney does not authorize ...

What happens if my power of attorney is unable to act?

If your agent is unable to act for you, your power of attorney will end unless you have named a successor agent (a replacement). You may also name a second successor (replacement) agent. Revoking a Power of Attorney.

Is an agent entitled to be paid?

Your agent is entitled to be reasonably paid for his or her services unless you state otherwise in the Special Instructions.

Do power of attorney forms need to be filed with court?

Power of Attorney forms are not filed with a court; however, it is very important to keep the form in a secure place where it will not be damaged. Additionally, it is very important that all people involved with the power of attorney form are aware of the location of the form for future reference.

Can you cancel a power of attorney if you die?

Unless you say otherwise, the agent's authority will continue until you die or revoke the power of attorney, or the agent resigns or is unable to act for you. This form will not revoke or cancel a power of attorney previously signed by you unless you add that the previous power of attorney is revoked by this power of attorney.

How to handle a power of attorney?

You may consider choosing clergy, a family friend or another community member as an agent. You can also hire a professional to handle the power of attorney. Banks and trust companies may take on this role, as can accountants and lawyers. Keep in mind that professionals are likely to charge fees, which can quickly become costly. If you do choose to hire a professional, interview them carefully, and make sure they understand your parent’s wishes. You may also wish to choose a professional based on what the POA is for, such as choosing an accountant to handle financial affairs.

How to get a POA?

When you’re ready to set up the POA, follow these steps: 1 Talk to Your Parents: Discuss what they need in a POA and what their wishes are when it comes to their finances and health care. You must also confirm their consent and make sure they agree with everything discussed. 2 Talk to a Lawyer: Everyone who gets a POA has different needs and the laws are different in each state. It’s important to get legal advice so that your parent’s wishes are taken into consideration and the document is legal. 3 Create the Necessary Documentation: Write down all the clauses you need that detail how the agent can act on the principal’s behalf. This ensures your parent’s wishes are known and will be respected. Although you can find POA templates on the internet, they are generic forms that may not stand up to legal scrutiny and probably won’t have all the clauses you require. 4 Execute the Agreement: Sign and notarize the document. Requirements for notarization and witnesses differ, so make sure you check what’s required in your state.

Why Do You Need a Power of Attorney?

A power of attorney allows someone else to take care of your parent’s affairs. It can be temporary, for example paying bills while someone is on a long vacation, or lasting, such as making medical decisions after a car accident. As parents get older, it makes sense to be prepared for health issues that may mean they need help. A POA allows children, or another agent, to step in when the need arises. Jeter states, “Any person with an elderly parent should have the conversation with their parent about getting a power of attorney in place if one does not already exist. In my practice, I advise people not to wait when it comes to getting a power of attorney because there are just too many things that can come up in life.”

How does a durable power of attorney work?

A durable power of attorney lasts after the principal’s incapacitation. What you can do with a durable POA is based on both the document and state laws. In some cases, you may only be able to manage the principal’s finances and will need a separate medical power of attorney to make health care decisions. These POAs are used when a person can no longer handle their affairs, and it can end in several ways. They can be revoked upon the principal’s death or when a guardian is appointed. The principal can revoke the POA if they’re no longer incapacitated. For example, if a person wakes from a coma, they can take back control of their finances. There may also be conditions in the document that, if fulfilled, end the POA. A durable power of attorney comes into effect on the day it’s signed unless otherwise specified.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

What is a medical POA?

A medical POA is different from a living will , which states what medical procedures a principal does and does not want done. In the case of a medical POA, the agent can make all health care decisions for the principal. Because of this, your parent needs to make their wishes known to the agent before they’re incapacitated. The American Bar Association has detailed information available about medical powers of attorney and the process of giving someone that power.

Popular Posts:

- 1. what is the penalty for an attorney who refuses a congressional subpoena

- 2. what is the average cost for murder private attorney

- 3. what to do if your attorney does not cooperate

- 4. can one appoint a power of attorney when in a mental hospital?

- 5. finding an attorney for custody when you don't have money

- 6. how to deal with my attorney if he says to accept insurance offer

- 7. who won the district attorney election for smith county, texas in 2003

- 8. what can an attorney do to avoid foreclosure?

- 9. why is pam bondi not attorney general

- 10. how much does a patent attorney make in california