How to Get Power of Attorney (5 Steps)

- Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. ...

- Select Your Power of Attorney. Durable ($) – Financial only. Remains in-effect if the Principal becomes *incapacitated. General – Financial only.

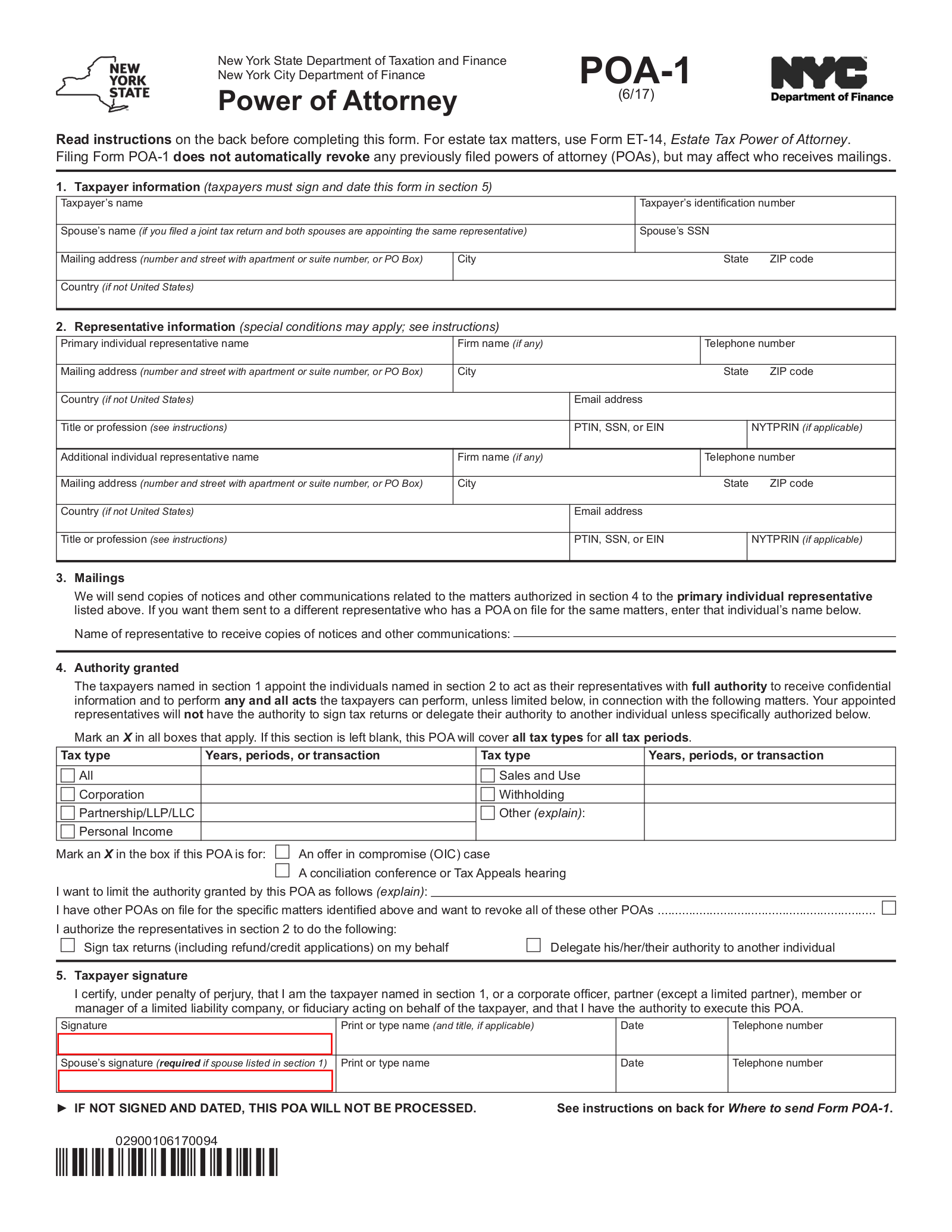

- Signing Requirements. After completing, you and the Agent (s) selected will need to check the bottom of the form for the requirements for authorization.

- Holding and Accessing Original Copies. It is important for all parties involved to have copies of their form. ...

- Cancelling Power of Attorney. A Principal may terminate this arrangement by signing a Revocation Form. Otherwise, it will only cancel upon the death of the Principal.

Full Answer

How can I set up a power of attorney?

Jul 16, 2021 · Choosing someone to act as a power of attorney is a critical decision. The agent can act on behalf of your parent, so it must be someone your parent trusts and is comfortable with. It should also be someone willing to discuss options and …

What can you do with a power of attorney?

May 02, 2019 · How to Handle Sibling Disputes Over a Power of Attorney. Right to information. Your parent doesn't have to tell you whom he or she chose as the agent. In addition, the agent under the power of attorney isn't ... Access to the parent. An agent under a financial power of attorney should not have the ...

What can a power of attorney really do?

Oct 18, 2019 · Often times, the person who had the power of attorney will seek to become the executor or administrator of the estate. As a result, an important first step is usually to object to that person’s appointment. By objecting, it will open an opportunity to gather information through the discovery process.

What does a power of attorney allow me to do?

Apr 18, 2022 · We do not know when our capacity to manage finances or make healthcare decisions will be lost. Speak with an estate planning attorney about the POA to best serve your circumstances before it is needed. Reference: Tyron Daily Bulletin (March 7, 2022) “How to get power of attorney for a loved one”

What happens when someone takes power of attorney?

A power of attorney gives the attorney the legal authority to deal with third parties such as banks or the local council. Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor.

What is the most powerful power of attorney?

A general durable power of attorney both authorizes someone to act in a wide range of legal and business matters and remains in effect even if you are incapacitated. The document is also known as a durable power of attorney for finances.Jul 13, 2021

Who is the best person to give power of attorney?

Most people select their spouse, a relative, or a close friend to be their power of attorney. But you can name anyone you want: Remember that selecting a power of attorney is not about choosing the person closest to you, but rather the one who can represent your wishes the best.Mar 14, 2020

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can a family member override a power of attorney?

If your loved one made an Advance Decision (Living Will) after you were appointed as their attorney, you can't override the decisions made in their Advance Decision.

Is power of attorney a good idea?

Indeed a power of attorney is vital for anyone – regardless of age – who has money and assets to protect and/or who wants someone to act in their best interest in terms of healthcare choices should they be unable to make decisions for themselves.Mar 26, 2015

What type of power of attorney covers everything?

General power of attorney With a general power of attorney, you authorize your agent to act for you in all situations allowed by local law. This includes legal, financial, health, and business matters.Jun 11, 2021

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

Breach Of Power Of Attorney

In our office, we see situations where a person holding a power of attorney sometimes takes advantage of the situation. We call this a breach of power of attorney.

What To Do When A Breach Of Power Of Attorney Occurs

When a person holding a power of attorney has acted improperly, it is not uncommon for them to try to cover their actions through the estate.

What If The Person Is Already The Executor Or Administrator?

But, what if the person has already been appointed as the executor or administrator when things come to light?

Next Steps

Everything discussed in this article is for general information and is not legal advice.

Sibling disputes over power of attorney in the UAE

In most families in the UAE, the eldest sibling stands a higher chance of getting awarded Power of Attorney. Whilst some families have no problem with this since they deem the first born as being the most responsible and having a better knowledge of the family history, it is not automatic that the rest of the siblings will agree to this.

The leading cause of sibling dispute over the power of attorney

One of the leading causes of sibling dispute when it comes to POA is failing to act towards the wishes and interests of the principal. That is why it is essential that the principal correctly understands their children in order to choose the right child to award medical or financial power of attorney to.

What are the legal powers of an attorney in fact?

Some of the legal authorities that an attorney-in-fact has include: Filing taxes. Managing retirement accounts. Handling bank accounts. Signing checks and documents. Making decisions about the principal’s health. Selling property and assets.

What happens if a sibling abuses a power of attorney?

If a person suspects their sibling is abusing a power of attorney, they can inform the rest of the family and sign a petition to file a lawsuit. If the abuse gets out of hand, the family can press criminal charges against the agent. The penalties for the abuse of power of attorney include damages and imprisonment.

How to prevent disputes between siblings?

Name the children as joint or co-agents —The easiest way to prevent disputes between siblings is to make them all agents and divide responsibilities. Revoke a power of attorney —If the parent isn’t incapacitated, they can revoke the power of attorney to put an end to disputes between siblings. Take power of attorney away from the agent —When ...

What happens when a parent appoints a POA?

If a parent decides to appoint one of their children as a POA agent, it can lead to conflicts between family ...

What is a POA?

A POA is a legal document through which one person—the principal—gives another individual—the agent—the power to make important decisions and act on their behalf.

What is a trusted legal professional?

Trusted legal professional. Someone good with finances, such as a banker, accountant, or financial advisor. Medical professional. The eldest child or the child who lives the closest to the principal. The child most aware of their parent’s medical and financial situation.

Can a power of attorney be taken away from an agent?

Take power of attorney away from the agent —When the principal’s incapacitated and other siblings and family members don’t agree with the appointed agent, they can sign a petition and file it to the appropriate court to take the duty from the problematic sibling away.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

Why do you need a power of attorney?

For instance, you may want to give someone access to your bank accounts so they can pay bills and deposit checks on your behalf. This can be very important if you become incapacitated.

How to set up a power of attorney?

If you’re ready to set up a power of attorney, the best way to do so is by consulting a professional. Unfortunately, consulting a professional costs more than doing it yourself. However, their advice could save you from making a decision that has unintended consequences that you later regret.

What to do if you move from one state to another?

If you move from one state to another, you should review your power of attorney documents to make sure they’re still in effect. You should consult a lawyer before making any power of attorney decisions to make sure you’re not giving up any powers you aren’t aware of.

What happens if you don't consult a professional?

If you don’t consult a professional, you might find yourself in a sticky situation later. Power of attorney forms can be useful in a number of different situations. In fact: There are many different types of power of attorneys you can grant. In general, a power of attorney has a fiduciary duty to act in your best interests.

What is durable power of attorney?

A durable power of attorney is like a general power of attorney, except it continues to remain in effect after you become incapacitated. The person that is granted a power of attorney is known as an attorney in fact.

Can a power of attorney change beneficiaries?

In theory, certain power of attorney situations may give the attorney in fact access to change beneficiaries on your financial accounts. This is another reason to be careful with the powers you give. Even so, a person that has power of attorney is supposed to act in your benefit interests.

Can you have a power of attorney before you become incapacitated?

Usually, this event is you becoming incapacitated. This way, the person doesn’t have power of attorney before you become incapacitated.

Who must sign a power of attorney?

At a minimum, the person who granted the power of attorney must sign the document. In some cases, a person can sign on the creator’s behalf if the creator is unable to do so. Some states require witnesses to watch the signing of the document. Other states require only that a notary public watch the signature. ...

What happens if a power of attorney is not signed?

Lack of Capacity. If the principal did not have the mental capacity to sign a power of attorney document, any power granted under the document is void. Mental capacity, sometimes referred to as “sound mind,” is a legal requirement that the person who creates a power of attorney have the ability to understand what she is doing.

What can a challenger argue about a power of attorney?

A challenger can focus on the document’s creation or claim the document was revoked. In some cases, a person challenging the validity of the power of attorney can argue both. The burden in either scenario is on the person challenging the document. Perhaps the most straightforward claim is the document was not executed properly. If, for example, the law requires witnesses to watch the signing, and the required number of witnesses did not watch the signing, the document is probably void. Proving a lack of capacity, the existence of fraud or undue influence, or the document was revoked is more challenging. Witnesses who can testify as to the creator’s mental condition, or to the circumstances surrounding the document’s creation or revocation, can be invaluable, as can a letter from a physician stating the creator lacked the capacity to sign the document.

What does it mean when a power of attorney is void?

A power of attorney document signed as a result of fraud or undue influence is void. Fraud can mean the person who signed the document was misled as to what she was signing. For example, if a person was fooled into signing a power of attorney rather than some other document, the power of attorney is void.

What happens if you don't watch the signing?

If, for example, the law requires witnesses to watch the signing, and the required number of witnesses did not watch the signing, the document is probably void. Proving a lack of capacity, the existence of fraud or undue influence, or the document was revoked is more challenging.

What happens to Jane's daughter in Jane's Power of Attorney?

Jane becomes incapacitated and her daughter, Sus an, wants to void the power of attorney. If Susan can show that her mother’s medication prevented her from understanding that she was signing a power of attorney, the document is probably void. In all states, only an adult may create a power of attorney, as a minor is presumed to lack ...

Who can testify to the creator of a document?

Witnesses who can testify as to the creator’s mental condition, or to the circumstances surrounding the document’s creation or revocation, can be invaluable, as can a letter from a physician stating the creator lacked the capacity to sign the document. John Stevens has been a writer for various websites since 2008.

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

What is a power of attorney?

Power of attorney is a legal document that allows an individual (known as the “Principal”) to select someone else (“Agent” or “Attorney-in-Fact”) to handle their business affairs, medical responsibilities, or any decision that requires someone else to take over an activity based on the Principal’s best interest and intentions. ...

How many witnesses do you need for a notary?

In most cases, a Notary Public will need to be used or Two (2) Witnesses. STATE. DURABLE.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

Do you need to record a power of attorney?

It is important for all parties involved to have copies of their form. A power of attorney does not need to be recorded with any government office and is primarily held by the Principal and Agent (s).

Is a power of attorney valid for a principal?

Although, the general power of attorney is no longer valid if the principal becomes mentally incompetent. IRS Power of Attorney (Form 2848) – To hire or allow someone else to file federal taxes to the Internal Revenue Service on your behalf. Limited Power of Attorney – For any non-medical power.

Popular Posts:

- 1. how to file lawsuit against an attorney in nj

- 2. austin attorney who handles violations of zoning

- 3. when is an estate finalize by attorney

- 4. what to know about a power of attorney https://seantankolaw.com

- 5. when does power of attorney take over

- 6. how long attorney review house abstract

- 7. what can u do if the district attorney didnt press charges

- 8. who can help me with irs tax problems, when i can't afford an attorney

- 9. who holds the attorney client privilege - the attorney or the client?

- 10. how to select the best attorney to recover an investment loss