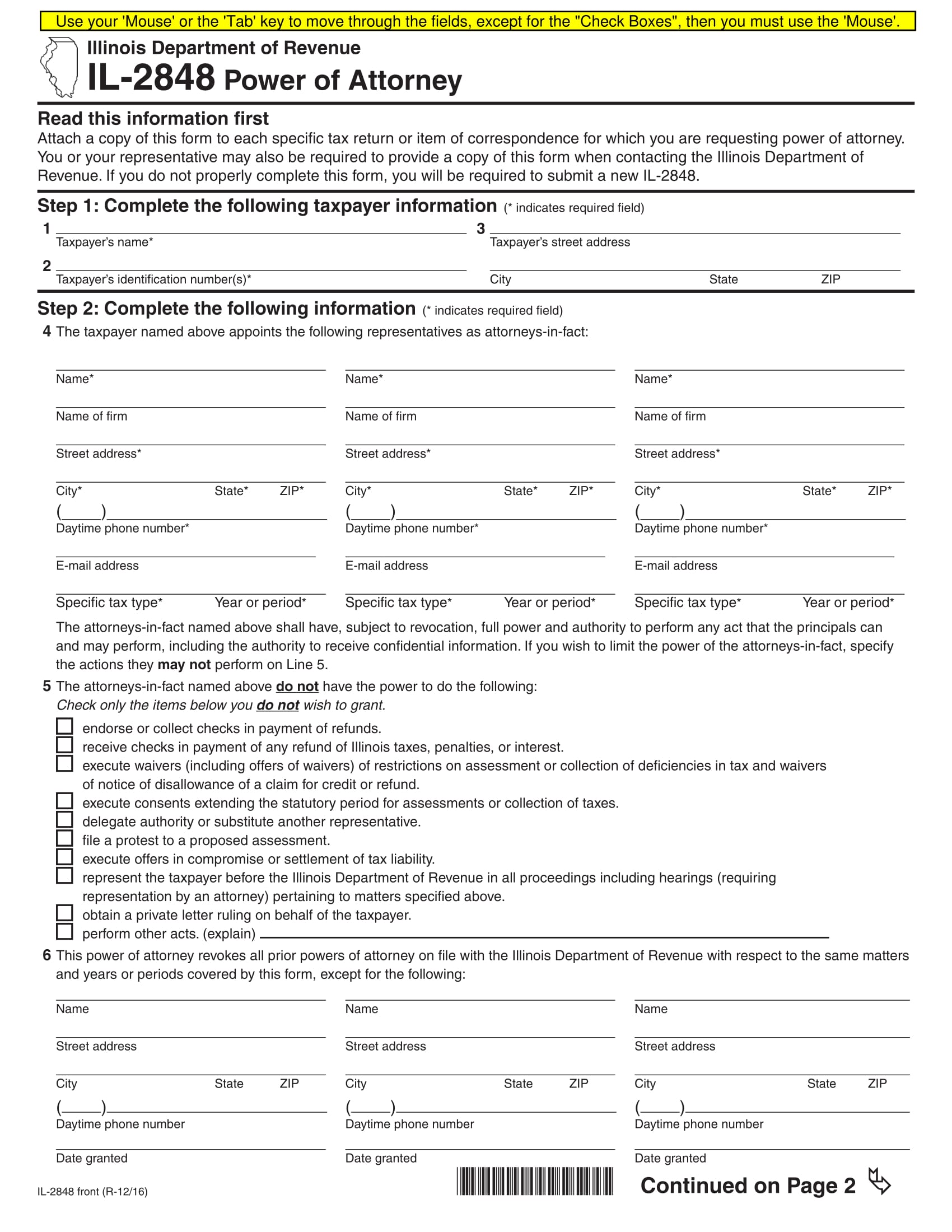

Give your CPA a Power of Attorney. To have your CPA represent you in front of the IRS, you will need to complete Power of Attorney – Form 2848 . Caution must be exercised so that this form is filled out accurately and completely. If it is not, the IRS will reject the form.

What is power of attorney and how does it work?

Jul 27, 2017 · Many people a give power of attorney to their certified public accountant (CPA) to act on their behalf in financial matters. This gives the CPA the right to make financial transactions, request private financial information and sign your name to certain types of paperwork. Choose a CPA to be your power of attorney holder.

What is banking power of attorney?

To have your CPA represent you in front of the DRS, you will need to have completed Power of Attorney–Form LGL-001. Interestingly enough, only the taxpayer is required to sign and date the State of Connecticut Power of Attorney. The CPA does not does not have to sign. ACTION ITEM: Taxpayers that are being audited or need other IRS representation should give a Power of …

How to make your power of attorney?

Sep 19, 2019 · August 23, 2016. by Barbara Weltman. In order for the IRS to discuss your tax issues with your CPA, you must sign IRS Form 2848, Power of Attorney and Declaration of Representative to give him or her power of attorney (POA). Merely checking the box on your tax return to let the IRS speak to the person who prepared the return is only giving limited authority …

What exactly is power of attorney?

What Is a Power of Attorney? A power of attorney (POA) is a legal document in which the principal gives power to the agent to act on their behalf in legal, business, healthcare, and real estate matters. A power of attorney holder can have the general power to make all decisions or limited powers to make specific decisions, depending on the ...

Can accountants be power of attorney?

You can ask a professional, such as an accountant or solicitor to be your attorney. This is something to think about for a property and affairs LPA if you don't have anyone you feel happy about choosing or if there are conflicts within your family.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

What is a POA CPA?

Many people a give power of attorney to their certified public accountant (CPA) to act on their behalf in financial matters. This gives the CPA the right to make financial transactions, request private financial information and sign your name to certain types of paperwork.

Does CA accept Form 2848?

Beginning Jan. 2, the FTB will no longer process federal Form 2848; prior versions of FTB 3520; and non-FTB POAs, such as CDTFA 392 (formerly BOE 392) joint agency power of attorney form. ... The FTB does highly recommend that a completed FTB 3520 is attached to ensure faster processing.Jan 1, 2018

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How do I get power of attorney?

How To Prepare Power Of Attorney OnlineSelect your State and start Preparing your Power of Attorney document.Fill the form and make payment online.Print the document and register it.

Should I give Power of Attorney to my CPA?

If there is any possibility of a criminal claim by the IRS, it's not advisable to give a POA to a CPA. In this situation, you want an attorney representing you so you have full attorney-privilege confidentiality. Be sure that the scope of authority given to your CPA is broad enough to meet your needs.Aug 23, 2016

How long is a Power of Attorney valid for?

It must be signed by the grantor and 2 witnesses and will remain valid until such time as it is revoked, when the mandate is completed or where the agent or grantor passed away, is sequestrated or becomes mentally unfit.Aug 28, 2019

Where do I send my 2848?

Power of Attorney - Form 2848THEN use this address...Fax number*Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268901-546-4115Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404801-620-42492 more rows

Does a power of attorney need to be notarized in California?

Yes, California law requires that the Durable Power of Attorney must be notarized or signed by at least two witnesses. In California, a principal cannot act as one of the witnesses.

How do I file taxes as a power of attorney?

How to file a POAYou and the authorized person (called a representative) must agree on the POA representation and both sign the Form 2848.After it's filed with the IRS, the representative can act as you in the eyes of the IRS.The POA stays in effect until you or your representative withdraws the authorization.More items...

What is POA Tia unit?

Generally, a tax information authorization (TIA) only allows representatives to review your tax account information for: Individuals. Fiduciary (estates and trusts) Group nonresident.Sep 23, 2021

Who can file Form 2848?

When do you need Form 2848?Attorneys.CPAs.Enrolled agents.Enrolled actuaries.Unenrolled return preparers (only if they prepared the tax return in question)Corporate officers or full-time employees (for business tax matters)Enrolled retirement plan agents (for retirement plan tax matters)More items...•Jan 18, 2022

Does the IRS accept durable power of attorney?

As for the Internal Revenue Service, Menashe says the IRS accepts a durable power of attorney when the document authorizes the named decision-maker to handle tax matters. Even so, the person will be required to execute IRS Form 2848 and file an affidavit before being recognized by the IRS.Oct 29, 2007

What is a tax POA?

The power of attorney (POA) is the written authorization for an individual to receive confidential information from the IRS and to perform certain actions on behalf of a taxpayer.Apr 1, 2016

What is the difference between 2848 and 8821?

Form 2848 is a taxpayer's written authorization appointing an eligible individual to represent the taxpayer before the IRS, including performing certain acts on the taxpayer's behalf. ... Form 8821 is a taxpayer's written authorization designating a third party to receive and view the taxpayer's information.Jan 25, 2021

How do you complete 2848?

0:352:24Learn How to Fill the Form 2848 Power of Attorney and ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe name and address followed by the CAF. Number telephone number and fax number the form 2848.MoreThe name and address followed by the CAF. Number telephone number and fax number the form 2848. Allows the taxpayer to elect the scope of the power of attorney granted.

Where do I file a 2848?

Forms 2848 with an electronic signature image or digitized image of a handwritten signature may only be submitted to the IRS online at IRS.gov/Submit2848. A signature created using third-party software.Sep 2, 2021

How long does it take the IRS to process a power of attorney?

The Internal Revenue Manual (or IRM) specifies that “receipts” [of authorization requests] are processed within five business days. Nevertheless, over the last few years processing times of three to six weeks or even longer have become increasingly common.Jul 26, 2021

What is the 2848 form used for?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.Mar 8, 2021

What is an 8821 form?

SBA requires you to complete the IRS Form 8821 as a part of your disaster loan application submission. The form authorizes the IRS to provide federal income tax information directly to SBA. Although the form is available online, it cannot be transmitted electronically.

How long is a power of attorney valid for?

It must be signed by the grantor and 2 witnesses and will remain valid until such time as it is revoked, when the mandate is completed or where the agent or grantor passed away, is sequestrated or becomes mentally unfit.Aug 28, 2019

How do I file a power of attorney with the IRS?

Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.Feb 11, 2020

Does CA accept form 2848?

Beginning Jan. 2, the FTB will no longer process federal Form 2848; prior versions of FTB 3520; and non-FTB POAs, such as CDTFA 392 (formerly BOE 392) joint agency power of attorney form. ... The FTB does highly recommend that a completed FTB 3520 is attached to ensure faster processing.Jan 1, 2018

What is IRS CAF no?

What is a CAF number? A CAF number is a unique nine-digit identification number and is assigned the first time you file a third party authorization with IRS. A letter is sent to you informing you of your assigned CAF number. Use your assigned CAF number on all future authorizations.

What is a form 3903?

Use Form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). If the new workplace is outside the United States or its possessions, you must be a U.S. citizen or resident alien to deduct your expenses.Mar 24, 2021

Can 2848 be signed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.Nov 15, 2021

What happens if you don't sign a POA?

If you don’t sign a POA and you alone receive an IRS communication, you could forget to tell your CPA. Or you may be ill and can’t respond. Again, this can create problems for time-sensitive actions.

What is the scope of authority of a CPA?

Scope of authority. Be sure that the scope of authority given to your CPA is broad enough to meet your needs. You must specify on the POA form the tax years and types of returns over which the CPA has authority to represent you.

What happens if you sign a CPA form?

If you sign the form designating your CPA as your agent, both the CPA and you will be notified of any issues on your returns. This can be helpful because: If you travel, you could miss IRS notices, which are usually time-sensitive.

Can you wait to sign a POA?

You can wait to sign a POA until it becomes necessary. Or you can opt to sign one in advance of any tax problems just in case. The decision about signing a POA is yours.

Can you give a POA before it is needed?

You may prefer not to give a POA before it’s needed. The reason: if the IRS is questioning something on your return, you may have lost confidence in the preparer and want someone other than the person who prepared the return to deal with the IRS on the matter. Of course, if you did sign a POA, you can always revoke it and sign a new one.

Who can hold a power of attorney?

Most people select the following persons to hold the power of attorney: Spouse. Child, if they are above 18 years of age. Close friend. Trusted accountant or lawyer.

When does a power of attorney become effective?

The power of attorney becomes effective if a certain event takes place, such as when the principal becomes mentally incapacitated. Durable. The power of attorney is effective even if the principal has become ill or is unable to manage their affairs. Medical.

What is a POA?

What Is a Power of Attorney? A power of attorney (POA) is a legal document in which the principal gives power to the agent to act on their behalf in legal, business, healthcare, and real estate matters.

What to look for in a POA agent?

Although it is easy to select someone you know, you also need to make sure that they will respect your wishes and act in your best interests. The person you choose will have access to your legal, business, and other important documents.

What do you need to include in a POA?

There are various details that you need to include when creating a POA document: Relevant state laws and regulations. Effective date and duration of the agreement. The amount of responsibility you hand to the agent. The number of agents you want to hand over the responsibility to.

Who is the person who can make the best decision for you?

Someone who lives in or near your house. A person you can trust to make the best decision for you. Someone who can be assertive when making difficult decisions. A person who is willing to act in your best interest and can make the time to carry out the responsibilities.

Can a principal sign a document with more than one person?

It is imperative that they fully understand the nature and contents of the document before they sign it. The principal can select more than one person to act as their agent. Bear in mind that if you have multiple agents, they might have different perspectives on how to deal with your financial and other key issues.

What is a power of attorney in Pennsylvania?

When you act as someone’s power of attorney the law refers to you as the “agent” and the person for whom you are acting as “the principal.”. In Pennsylvania your duties as agent are specified in the Probate, Estates and Fiduciaries Code.

Why is it important to keep receipts?

It is important that you retain receipts and maintain good records of all checks written, other disbursements made, all liabilities of the principal with which you have involvement or knowledge, all income and other assets you receive, and all actions you take on behalf of the principal.

Can a parent be a financial power of attorney?

Serving as Financial Power of Attorney for a parent or friend is serious business. You may see it as just helping mom pay her bills. But the law imposes many significant legal duties on someone who acts as power of attorney for another.

What is a durable power of attorney?

A durable power of attorney is a routine part of many people's estate plan . Unfortunately, sometimes the person designated under the power of attorney--the agent--no longer deserves the principal's special trust. My previous blog discussed steps involved in revoking a durable power of attorney. At that blog's conclusion, I mentioned that a demand for an accounting of all actions the agent took under the power of attorney should be made. This blog takes a closer look at what goes into an accounting.

What is an agent's complete account of receipts, disbursements, and other actions?

Each action taken or decision made by the agent; A complete account of receipts, disbursements, and other actions of the agent that includes the source and nature of each receipt, disbursement, or action, with receipts of principal and income shown separately;

How long does a principal have to reply to an estate in Texas?

The principal can set the length of time the agent has to reply. Texas Estates Code Section 751.105 sets the deadline at 60 days unless the principal sets a shorter time, after which the principal can bring suit through the courts to compel the accounting, if necessary.

What is cash balance on hand?

The cash balance on hand and the name and location of the depository at which the cash balance is kept; Any other information and facts known to the agent as necessary for a full and definite understanding of the exact condition of the property belonging to the principal.

Steven J. Fromm

If there is a court order then you probably can not do an informal accounting but must do an accounting that complies with the format of the PA Estates and Fiduciaries Code.#N#As to your second question, if they parties have no interest in the trust they have no more rights than some other person, namely, no rights to demand an accounting...

Walter Chester Zaremba

I find your question a little unclear. Your 1st question seems completely unrelated to the 2nd question unless certain assumptions are made.

What to do if you need a new power of attorney?

If you need to execute a new power of attorney, then proceed with naming an appropriate agent to act on your behalf regarding medical or financial matters. By confirming that you have destroyed all previous copies of your canceled power of attorney, you can eliminate any confusion.

Why do I have to cancel my power of attorney?

You may want to cancel your power of attorney for several reasons. Your current situation may have changed, thus requiring you to appoint a new one. You may want to appoint someone who is more suitable to your needs. Or you might have lost trust in the individual you initially chose.

Who should I contact about a power of attorney revocation?

Contact any financial institutions, real estate agents, investment advisers, health care professionals, or other relevant parties.

Can I use my revoked power of attorney?

Once you complete the revocation, you should destroy or attach a copy of the revocation to all copies of your current power of attorney. In canceling your power of attorney, you should confirm that no one can use your revoked power of attorney.

What authority is granted by a power of attorney?

What authority is granted depends on the specific language of the Power of Attorney. A person giving a Power of Attorney may make it very broad or may limit it to certain specific acts. In more simple terms, a person can create a document that gives their power to do something, to someone else.

What is a power of attorney in Florida?

What is a power of attorney? According to the Florida Bar, a power of attorney is a legal document delegating authority from one person to another. In the document, the maker of the Power of Attorney (the “principal”) grants the right to act on the maker’s behalf as their agent. What authority is granted depends on the specific language ...

What happens if an agent breaches their fiduciary duty?

An agent may have breached their fiduciary duty, committed fraud, and/or theft. Under Florida’s Power of Attorney Act, a court has the authority to review the agent’s conduct, terminate the agent’s authority, remove the agent, or grant other appropriate relief.

How to act in good faith?

Act in good faith. Act loyally for the sole benefit of the principal. Act so not to create a conflict of interest that impairs the agent’s ability to act impartially to the principal’ s best interest. Act with care, competence, and diligence originally exercised by agents in similar circumstances.

Who is Persante Law Group?

The Persante Law Group brings actions against brokers and broker-dealers. If you believe that you may need legal assistance regarding a Florida securities litigation matter, please contact us at (727) 796-7666.

Who can file a lawsuit in Florida?

The following persons may petition the court: The principal or the agent, including any nominated successor agent. A guardian, conservator, trustee, or other fiduciary acting for the principal or the principal's estate.

Can an agent be delegated in Florida?

Although the authority that can be delegated is quite expansive, Florida does prohibit the following from being delegated. An agent may not: Perform duties under a contract that requires the exercise of personal services of the principal; Make any affidavit as to the personal knowledge of the principal;

Popular Posts:

- 1. how long takea a irs power of attorney to be responded

- 2. what is attorney general do yahoo answer

- 3. what attorney specialty for bankruptcy lift of stay in stockton, ca

- 4. how much its going to cost for attorney general to sign property papers in us

- 5. a limited power of attorney in pa is good for how many days

- 6. your attorney gets a co counsel what amount would cause value be

- 7. how much does an attorney charge to set up an llc

- 8. what attorney helps you get out of an automobile loan within 3 days

- 9. what does department of correction attorney mean

- 10. how to end durable power of attorney