How do I transfer title to a car with power of attorney?

Feb 26, 2020 · You can use the notarized, durable power of attorney to complete a transfer of ownership for the car and mobile home by visiting https://www.etags.com/app/fl/title/transfer?utm_source=blog_question We will require an image of the original title, your driver’s license or passport, proof of Florida liability insurance (if the …

Can a power of attorney make gifts?

To transfer a car title, you will need to set up a financial power of attorney that only covers that one transaction. The type of document you need is a limited power of attorney, which states that your agent or attorney-in-fact is only mandated to act on …

What is a power of attorney letter for a vehicle?

While not directly on point, In re Francis, 19 Misc. 3d 536, 853 N.Y.S.2d 245 (N.Y. Sur. 2008), is an example of the misuse of a power to gift by an attorney-in-fact. There, a 98-year-old woman gave a power of attorney to her neighbor. The instrument included a broad power to make gifts, including gifts to the attorney-in-fact.

Can power of attorney be used to buy a car?

Mar 27, 2013 · If the durable power of attorney states in general language that the agent is authorized to make gifts, without express limitations, by law the agent is authorized to make a gift up to the amount of the annual federal gift tax exclusion, or twice that amount if the principal’s spouse consents to a split gift, as defined by the tax code.

What is a vehicle POA?

DESCRIPTION: The Power of Attorney for Vehicle Transactions is a document giving an “attorney in fact” the authority to conduct vehicle titling and registration related transactions on behalf of an owner or registrant.Sep 3, 2021

How do I transfer a car title to a family member in NY?

To transfer ownership of the vehicle to another person, the spouse or guardian must complete an Affidavit for Transfer of Motor Vehicle (PDF) (MV 349.1). The form must be notarized. The spouse or guardian also gives the new owner a photocopy of the death certificate or certification of death.

Who can override a power of attorney?

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

What can a POA do in Ontario?

An attorney for property can make decisions about your financial affairs including:paying your bills.collecting money owed to you.maintaining or selling your house.managing your investments.

Is it better to gift a car or sell it for $1 in NY?

While some car owners consider selling the car for a dollar instead of gifting it, the DMV gift car process is the recommended, not to mention more legitimate, way to go. ... They might not like the car or might be offended by a hand-me-down gift.Jun 11, 2020

Do you pay tax on a gifted car in NY?

If the vehicle was a gift or was purchased from a family member, use the Statement of Transaction {Sales Tax Form} (pdf) (at NY State Department of Tax and Finance) (DTF-802) to receive a sales tax exemption. ... The bill of sale must show the purchase price and the amount of out-of-state sales tax paid to the dealer.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. ... Gifts can be on occasions such as births, marriages, birthdays, or anniversaries etc., and only to those people who are closely connected with the donor.

Can a power of attorney gift money in Canada?

The Act stipulates that a gift or loan to a friend or relative, or a charitable gift, not be made if the incapable individual expresses a wish to the contrary. Give this some thought before executing your Power of Attorney.

How much does a power of attorney get paid in Ontario?

Unless the PoA excludes compensation, an attorney for property is generally entitled to compensation at the following rates: - 3% of income and capital receipts - 3% of income and capital disbursements - 0.6% per year of assets under management.

Can power of attorney sell property before death Ontario?

Realtors should note that a Power of Attorney is only valid to sell the property while the Donor is alive. If the Donor should pass away prior to executing a Form A Transfer, the power of attorney will not be legally sufficient to transfer title to the lands.Feb 19, 2013

What is a durable power of attorney?

In a durable power of attorney, the principal appoints someone to oversee his financial affairs, including in the event he becomes incompetent as a result of injury or illness . A broad durable power of attorney may authorize the agent to take any action as fully and effectually in all respects as the principal could do if personally present.

Can a power of attorney give a gift?

However, even the most broadly stated power of attorney does not authorize the agent to make gifts on behalf of the principal unless the power of attorney expressly grants the agent such power. The law requires that gifting powers be expressly stated in the durable power of attorney in order to reduce the risk that the agent will engage in ...

How to create a POA?

Follow these steps when doing so: 1. Prepare the document. Include language that gives your agent or attorney-in-fact the power to transfer your property.

What is a POA in real estate?

If you want someone to transfer this property for you, you will need to create a power of attorney (POA). Since you are giving the power to someone else, you are the principal, and the person acting for you is the agent or attorney-in-fact. Among the potential duties your agent will fulfill is the ability to transfer a deed or title.

When does a POA become effective?

A springing POA only becomes effective if you become incapacitated. Regardless of which type of authority you choose to give, the document must give your agent the power to transfer title from you to another person and must list the agent's exact authority.

What to do when you transfer a property?

If you're transferring the property immediately, give the title or deed to your agent. If you're transferring the property at a later date, let the agent know where they can find your title or deed.

Can you give someone a durable power of attorney?

You also can give someone either durable or springing authority. A durable power of attorney (DPOA) is effective immediately and, if you should become incapacitated, the agent can still act on your behalf under the DPOA. A springing POA only becomes effective if you become incapacitated.

What is a gift clause in a POA?

Gift clauses raise a myriad of issues and should never be considered “boilerplate” or standard. They should always be tailored to appropriately address your client’s ...

Can a power of attorney make gifts?

This statute provides that an agent can only make gifts under a POA if the POA express ly authorizes it.

How to contact Toms River?

Call our Toms River office at 732-505-1212, our Manchester office at - , our Brick office at - or call us toll free at 800-556-7432. You can also contact our firm online.

Can you gift a power of attorney?

Remember, that your power of attorney will not allow gift giving unless you specifically state in your power of attorney that you want your attorney-in-fact to have gifting powers. The decision as to whether your power of attorney should allow gift giving is one that you should discuss with your attorney when you prepare your power of attorney.

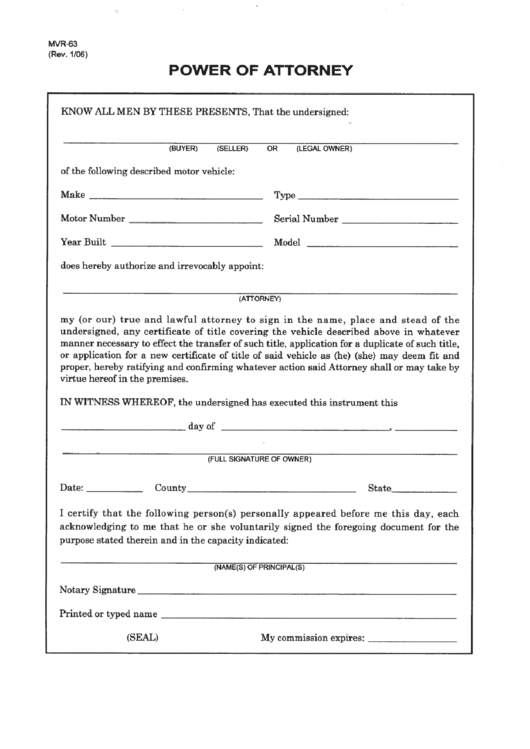

Power of Attorney Letters for Vehicle

A power of attorney letter is a letter that gives a person other than the owner, the right to make decisions about an asset, business or property. A power of attorney is a legal document and holds in court.

1- Power of attorney for car title transfer

This document certifies that [enter name of company or individual] having mailing address ____________ grants [enter name of agent] located at ____________________ or its representative limited power of attorney for a period of ____ months to act on its behalf, for matters involving the transfer of car title.

2- Power of attorney for vehicle transactions

This document certifies that [enter name of company or individual] having mailing address ____________ grants [enter name of agent] located at ____________________ or its representative limited power of attorney for an unlimited time to act on its behalf, in matters relating to buying and selling of vehicles, and vehicle transfers.

3- Power of attorney for car use

This document certifies that [enter name of company or individual] having mailing address ____________ grants [enter name of agent] located at ____________________ or its representative limited power of attorney for a period of ____ months allowing use of car only.

Popular Posts:

- 1. what type of attorney deals with wrongful termination due to health

- 2. who pays attorney fees for guardianship in wa

- 3. when to give someone power of attorney

- 4. what does the attorney general in texas do?

- 5. attorney who issues llc

- 6. who can do power of attorney c222 form

- 7. what does cop stand for attorney

- 8. how to be an irish attorney with a florida bar license

- 9. what is power of attorney malaysia

- 10. how to remove my attorney from my case in north carolina myself