How To Get a Durable Power of Attorney in WV

- Draw up a POA on Your Own. Sign the document along with the agent in the presence of a notary.

- Download an Online Template. In case you don’t want to write a POA on your own, you can also download a template from one of the various websites that offer ...

- Hire a Lawyer. ...

What can you do with a power of attorney?

Jan 27, 2022 · How to Get a Power of Attorney in Virginia. A Virginia Power of Attorney can be filled-in fully online with our step-by-step form completion survey. All you need to do is answer the questions and add in your own information to create a fully complete POA tailored to …

Who should get a power of attorney?

Jun 06, 2019 · How do I get power of attorney papers in Virginia? To create a POA in Virginia, you must be at least 18 years of age and have the capacity to make decisions and understand what you are doing. You complete the form, naming your agent and choosing the powers you want to give them. You must choose the powers you are specifically granting to your agent.

How to obtain a power of attorney?

To be valid in all states, your power of attorney must also be signed in the presence of two witnesses who are not the agent or a family member. However, this is not absolutely necessary in the state of Virginia. Powers of attorney can be permanent or indefinite. The permanent power sup

How to make a power of attorney?

Steps for Making a Financial Power of Attorney in Virginia. 1. Create the POA Using Software or an Attorney. Some private companies offer forms or templates with blanks that you can fill out to create your POA. However, because these forms are often full of legalese, it's not always apparent how to fill them out.

Does power of attorney need to be notarized in Virginia?

The power of attorney goes into effect immediately at signing, or at a future date that is specified in the document. In the Commonwealth of Virginia, the original document must be signed and should be notarized. A POA remains valid until: The principal dies.Jan 10, 2019

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

How do you obtain power of attorney?

Here are the basic steps to help a parent or loved one make their power of attorney, and name you as their agent:Help the grantor decide which type of POA to create. ... Decide on a durable or non-durable POA. ... Discuss what authority the grantor wants to give the agent. ... Get the correct power of attorney form.More items...•Jun 14, 2021

How do I get power of attorney for elderly parent in Virginia?

How to Get a POA for Elderly Parents in Good HealthTalk it through with your parent(s) At this point, you should have a better idea of what type of power of attorney would suit your situation. ... Consult with a lawyer. The laws governing powers of attorney vary from state to state. ... Document your rights. ... Execute the document.

Can I do power of attorney myself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How long does it take for a power of attorney to be registered?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Who makes decisions if no power of attorney?

If you have not given someone authority to make decisions under a power of attorney, then decisions about your health, care and living arrangements will be made by your care professional, the doctor or social worker who is in charge of your treatment or care.Mar 30, 2020

Who can witness a power of attorney in Virginia?

You must sign your power of attorney or direct another person in your presence to sign your name for you if you are physically unable to sign. You do not need witnesses, but you should have it notarized by a notary public. You must sign your advance directive with two adult witnesses present.Jun 2, 2021

What is the difference between a conservatorship and power of attorney?

Power of attorney is when you voluntarily assign someone the right to make legally binding decisions on your behalf. A conservatorship is when the court assigns someone the right to make those decisions for you. While you can rescind power of attorney at any time, only a court order can rescind a conservatorship.Aug 31, 2021

How do elderly parents take over finances?

Here are eight steps to taking on management of your parents' finances.Start the conversation early. ... Make gradual changes if possible. ... Take inventory of financial and legal documents. ... Simplify bills and take over financial tasks. ... Consider a power of attorney. ... Communicate and document your moves. ... Keep your finances separate.More items...

How to create a POA in Virginia?

To create a POA in Virginia, you must be at least 18 years of age and have the capacity to make decisions and understand what you are doing. You complete the form, naming your agent and choosing the powers you want to give them. You must choose the powers you are specifically granting to your agent. If you do not specifically indicate the following powers, they are not available to your agent: 1 Ability to change beneficiary designations 2 Ability to create or change rights of survivorship 3 Authority to create, amend, revoke, or terminate a living trust 4 Delegation of power 5 Right to waive beneficiary rights in a joint or survivor annuity or retirement plan 6 Exercise of fiduciary duties the principal has authority to delegate

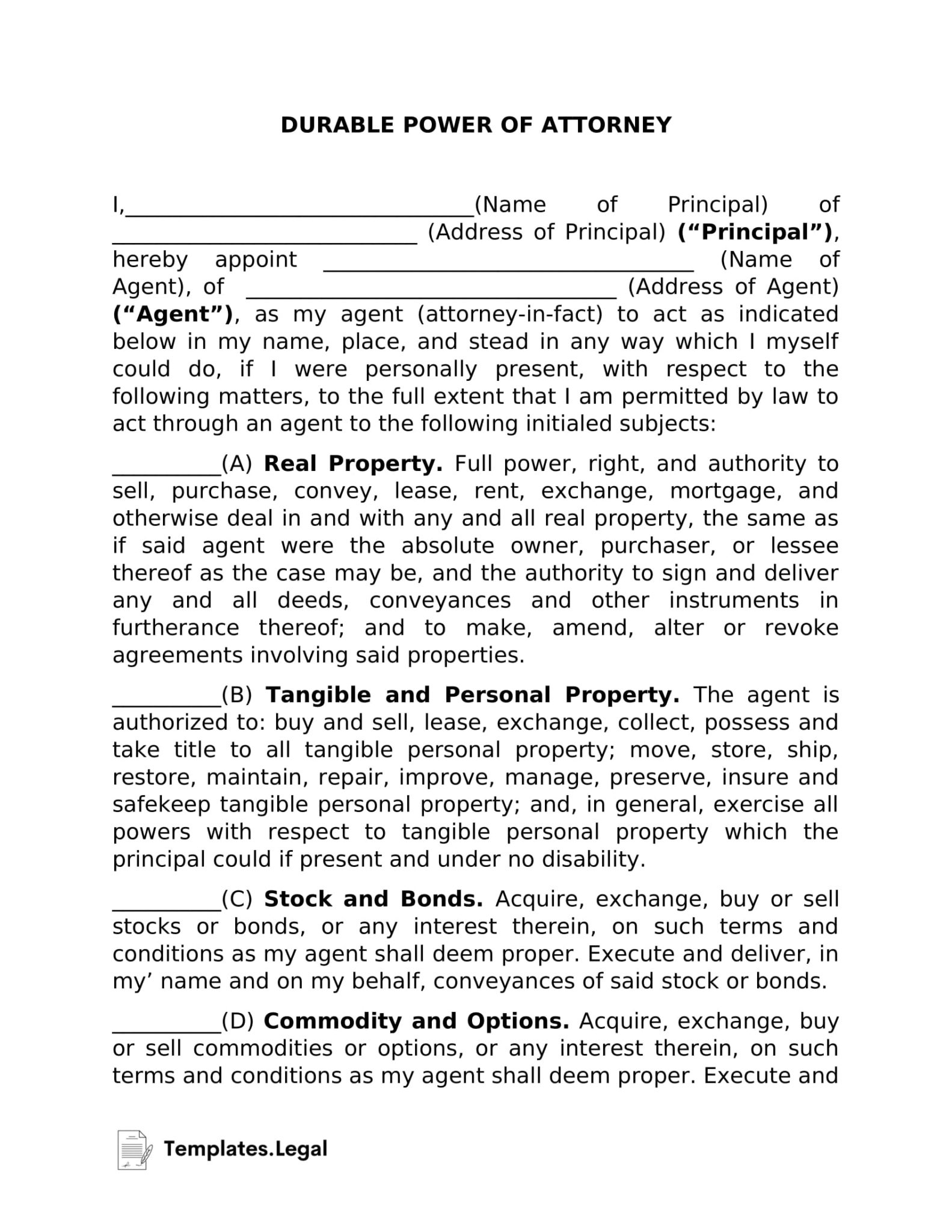

What is a durable power of attorney?

A durable power of attorney (POA) is an important financial and planning tool that ensures your affairs can be managed if you are ever unable to do so yourself. Virginia has specific legal requirements to ensure it is valid.

What is a springing POA?

A springing POA is one that does not become effective until the occurrence of a specific event, such as the principal becoming incapacitated, and remains in effect until revoked. When you create one in Virginia under the Uniform Power of Attorneys Act, it is automatically durable unless specified otherwise.

What is POA in banking?

A POA is a legal document in which the principal—the person executing it—authorizes an agent to handle financial and business transactions on his behalf. (Note that it does not include health care decisions.)

Can you revoke a POA?

You can revoke it at any time so long as you are mentally competent. To do so, you can either destroy it or state in writing that you wish to revoke the POA, providing copies of the revocation to the agent and any business or organization that might have received a copy. If you are not mentally competent, a court can appoint a guardian or conservator on your behalf who can then revoke the authority previously given.

What is delegation of power?

Delegation of power. Right to waive beneficiary rights in a joint or survivor annuity or retirement plan. Exercise of fiduciary duties the principal has authority to delegate. You must sign the document before a notary for it to be legally valid.

What is durable POA?

A durable POA is a useful tool that provides the convenience of allowing someone else to conduct transactions for you and the protection of knowing your financial life will be managed should you be unable to do so. This portion of the site is for informational purposes only. The content is not legal advice. The statements and opinions are the ...

Types of Power of Attorney in Virginia

There’s more than one type of Power of Attorney in Virginia and selecting the correct variant can be critical. Each kind offers different types of powers to an Attorney-in-Fact (also known as an Agent). Therefore, you must create the right class of document, in order for your POA to work as intended.

How to Get a Power of Attorney in Virginia

A Virginia Power of Attorney can be filled-in fully online with our step-by-step form completion survey. All you need to do is answer the questions and add in your own information to create a fully complete POA tailored to your necessities.

Virginia Power of Attorney Requirements

In order to make sure your POA is fully valid upon completion and signing, you must make sure that you follow the right steps to prepare your Virginia Power of Attorney document before successfully putting it into action.

FAQs About Virginia Power of Attorney Forms

It is important to have a good understanding of what Virginia Power of Attorney forms can do before filling in your own. Read through our FAQs below to get a better idea of the key information needed as well as any other special considerations.

What is POA form?

Fill in the oval or select the checkbox on your return to authorize Virginia Tax to speak with your preparer for the specific tax year being filed. Personal Representative.

What is a PAR 101?

The PAR 101 is a legal document. For the tax matters you list on the form, your representative will be able to receive and inspect your confidential tax information and take the same actions you can, including consenting to extend the time to assess tax or executing consents that agree to a tax adjustment.

What is a CPA?

An authorized tax professional (CPA, enrolled agent, tax preparer, or payroll service provider) needs to discuss routine issues like a return that was filed or a payment that was made by the tax professional on your behalf.

What is an authorized employee?

An authorized employee or officer of your business needs to discuss routine issues like a return that was filed or a payment that was made by your business. A fiduciary (trustee, receiver, or guardian) acts as an authorized agent because a fiduciary already stands in the position of the taxpayer.

What is an executor of an estate?

Executor or Administrator of an Estate. A Letter of Qualification from the court of proper jurisdiction on file naming the executor/administrator and giving authority over the deceased taxpayer's tax matters. An executor or administrator of an estate can also be appointed by the Last Will and Testament of the deceased.

What does "agent" mean in a power of attorney?

For the purposes of this chapter, unless the context requires otherwise: "Agent" means a person granted authority to act for a principal under a power of attorney, whether denominated an agent, attorney-in-fact, or otherwise.

What is the meaning of power of attorney?

The meaning and effect of a power of attorney is determined by the law of the jurisdiction indicated in the power of attorney and, in the absence of an indication of jurisdiction, by the law of the jurisdiction in which the power of attorney was executed.

What is a power of attorney in Virginia?

Virginia power of attorney forms allow a person to choose someone else to represent their best interests and make decisions on their behalf. The most common types related to financial and medical matters but the form can be to elect any person to represent someone’s affairs for any legal action.

What is advance directive?

Advance Medical Directive – This allows you to appoint another to make health care decisions and communicate with your medical providers on your behalf in the event you can no longer communicate your wishes competently.

How long does a power of attorney last?

A power of attorney can last for a temporary time period or the entire life of the principal.

Types of Powers of Attorney

Choosing An Agent

- The agent you name in your POA has wide-ranging authority to manage your affairs on your behalf, so it's important to choose someone you trust, such as a family member or close friend. The agent must act in your best interest. It's a good idea to first talk with the person you want to choose, to make sure they are comfortable taking on the role. They are not obligated to assume …

Requirements in Virginia

- To create a POA in Virginia, you must be at least 18 years of age and have the capacity to make decisions and understand what you are doing. You complete the form, naming your agent and choosing the powers you want to give them. You must choose the powers you are specifically granting to your agent. If you do not specifically indicate the following powers, they are not avail…

Revocation of Authority

- You can revoke it at any time so long as you are mentally competent. To do so, you can either destroy it or state in writing that you wish to revoke the POA, providing copies of the revocation to the agent and any business or organization that might have received a copy. If you are not mentally competent, a court can appoint a guardian or conservator on your behalf who can then …

Power of Attorney and Declaration of Representative

- Use this form to: 1. authorize a person to discuss designated tax matters with Virginia Tax and receive correspondence on your behalf 2. revoke a prior power of attorney authorization The PAR 101 is a legal document. For the tax matters you list on the form, your representative will be able to receive and inspect your confidential tax information and take the same actions you can, …

Form R-7 - Application For Enrollment as Virginia Authorized Agent

- Use this form to register as a representative or authorized agent for a taxpayer. Once we process the completed form, you will receive your Authorized Agent Number by mail. As an authorized agent, you're eligible to receive any correspondence, documentation, or other written materials related to specific tax matters for which the Form PAR 101 has been filed. All correspondence w…

Acceptable Alternative Forms of Authorization

- We prefer you complete and submit Form PAR 101, but we will also accept the following (representatives designated by these methods won't receive automatic copies of correspondence): Note: Federal Form 8821, Tax Information Authorization, will not be accepted as a POA.

Account Authorization For deceased Taxpayers

- Federal Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, does not authorize discussion of the deceased taxpayer's account or release of any other tax documents to the person named on the form. Form 1310 only gives Virginia Tax permission to release a deceased taxpayer's refund to the person identified on the form.

Popular Posts:

- 1. what is a universal power of attorney

- 2. who is biden's nominee for attorney general

- 3. who is attorney general 2018

- 4. how you call when you hire an attorney for husband you don't know where he is

- 5. how to make a power of attorney in oregon

- 6. how to write to attorney general sessions

- 7. how to move in ace attorney online

- 8. who did nixon appoint as his last attorney general

- 9. how to get transactional attorney experience

- 10. who was the attorney who represented the naacp