Draft the Power of Attorney for NRIs with attestations. Reach to the Indian Embassy or Consulate of that country and get it stamped and sealed from the embassy. Alternatively, Public Notary of that country can also notarize along with mentioning the notary registration number on the seal on every page of the document.

- Draft the Power of Attorney deed online or hire a lawyer in India to draft it for you.

- Get the deed attested by the Indian embassy or consulate in that country. ...

- The person making the deed, the Grantor, should sign the deed in all pages.

How to get power of attorney in India for NRI?

The method of getting a power of attorney in India by an NRI (holding an Indian passport and not being present in India) is as follows – The important points should be written by the NRI on a piece of paper in plain and understandable English. The main reason behind this is that all that as to be shared with a POA holder can be done easily.

Can a minor get a power of attorney in India?

May 10, 2021 · For an NRI, creating a Power of Attorney can help solve many property related complications and the procedure followed in making of a Power of Attorney is fairly simple. Just follow the below mentioned steps and get yourself a Power of Attorney to take care of your financial transactions or properties within India.

How much does it cost to get power of attorney in India?

Jun 23, 2021 · Power of Attorney In India For NRI. Also Check: 6 Investment Planning Sins of NRI Power of Attorney In India For NRI. With a Power of Attorney (POA) holder standing in for you, you can buy and sell real-estate, physical movable properties, and even get representation at government and financial institutions.

What is the relation between NRI and Poa holder?

Jul 09, 2020 · A power of attorney for an NRI after its initiation needs to be registered in India. One copy of the power of attorney deed (signed by you and notarized by the Indian Embassy Consulate) should be registered by the holder who is receiving the power of attorney in India at the Registrar office. Registering the Power of Attorney is a simple process.

How can a NRI give power of attorney?

“In India, the NRI can get the PoA executed in the Sub-Registrar's office. However, the POA should be drafted on a non-judicial stamp paper of Rs 100 value. Also, two legal representatives and witnesses would be required to execute the deed. All the members should have their valid ID proofs and photographs.Nov 10, 2020

How can I get general power of attorney in Bangalore?

Please approach the Sub registrar office and confirm the date for registration. Procure stamp paper for registration of Power of Attorney (POA) as per the arrived/advised value. on the scheduled date principal person, agent (power of attorney) and witnesses should go to the registrar office and wait for their turn.Apr 17, 2021

Can power of attorney be done online in India?

Requirements for a Power of Attorney POA is signed and acknowledged before a notary public and is signed by two witnesses. The witnesses cannot include attorney-in-fact in case of a durable POA. In the case of an online POA, Aadhar card and ID card is mandatory. Also, the document should be notarized.

How much does it cost for power of attorney in India?

Generally, the stamp duty payable for a power of attorney is Rs 100. For registration , the fee payable is also Rs 100. For a general power of attorney given to promoters and developers, the stamp duty applicable is Rs 1000 and registration charges are Rs 100.Aug 3, 2008

Is notarized power of attorney valid?

Notarization is one of the proper form of authenticating power of attorney in the eye of law and as such General power of attorney dated 28.08. 2008 is valid and properly ratified.

How long does it take to get a power of attorney registered?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form.

What are the documents required for power of attorney in India?

Passport size photo of parties. Address proof of parties. Identification proof like Driving License, Voter ID card, Aadhaar Card, etc. Tax Receipt or Index II or Electricity Bill of the Property (in case PoA is related to the property).

How long is power of attorney valid in India?

Durable PoA: A durable POA remains effective for a lifetime, unless it is explicitly cancelled. A specific clause can be inserted in the document, stating that the representative's power would remain valid even if the principal becomes incapacitated.Oct 11, 2021

How do I register a power of attorney in India?

The Power of Attorney registration process includes the following formalities:Drafting of the Power of attorney whether general or special, by a.Submitting the POA with the Sub-Registrar.Attaching the supporting documents with the POA.Attesting the POA before the Registrar.Attesting of the POA by 2 witnesses.Mar 7, 2019

Does power of attorney need to be notarized in India?

Registration of power of attorney is optional In India, where the 'Registration Act, 1908', is in force, the Power of Attorney should be authenticated by a Sub-Registrar only, otherwise it must be properly notarized by the notary especially where in case power to sell land is granted to the agent.

Who can be given power of attorney in India?

Power of Attorney is a legal document executed by one or more persons giving an authority to one or more persons to act on his or her behalf. Power of Attorney is governed by the Powers of Attorney Act, 1888. The person giving authority is called the attorney of the party giving the authority.

Do I need to register my power of attorney?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

Are illegitimate children legal heir?

Yes. Illegitimate children that are born form a man and a woman out of wedlock or they are not married will be considered as legal heirs.

Can a person having the legal heir certificate sell the property of the deceased person?

A succession certificate holder can sell the deceased's property. However, a legal heir certificate holder can sell the property of the deceased pe...

Can a succession certificate be granted for an immovable property?

A succession certificate cannot be granted for immovable property. According to the provisions of the Indian Succession Act, a succession certifica...

Can legal heir certificate be applied online?

Yes, a legal heir certificate can be applied online. You can fill out the application form on the e-portal of a district of the relevant jurisdicti...

Can succession certificates be challenged?

Yes, it can be challenged. Once the application for succession certificate is filed in the Court, the court will issue notices to all the relatives...

How can I get a succession certificate?

To get a succession certificate, a petition must be prepared and filed in the relevant district court as per the jurisdiction. The relevant jurisdi...

How much time does it take to get a succession certificate?

The process to get a succession certificate may take 5 to 7 months. At least 15 to 30 days are required to issue a legal heir certificate.

Is a married daughter a legal heir?

Yes. Both married and unmarried daughters will be considered legal heirs. They will have the same rights as that of a son according to the amendmen...

Is a second wife a legal heir?

Yes. If the second wife of the deceased is married legally under the provisions of the Hindu Marriage Act, 1955, then she will be considered as the...

Who is a legal heir when the deceased person does not have children, a spouse or parents?

Generally, the spouse, parents and children of the deceased's person will be considered as the immediate legal heirs. However, if the deceased does...

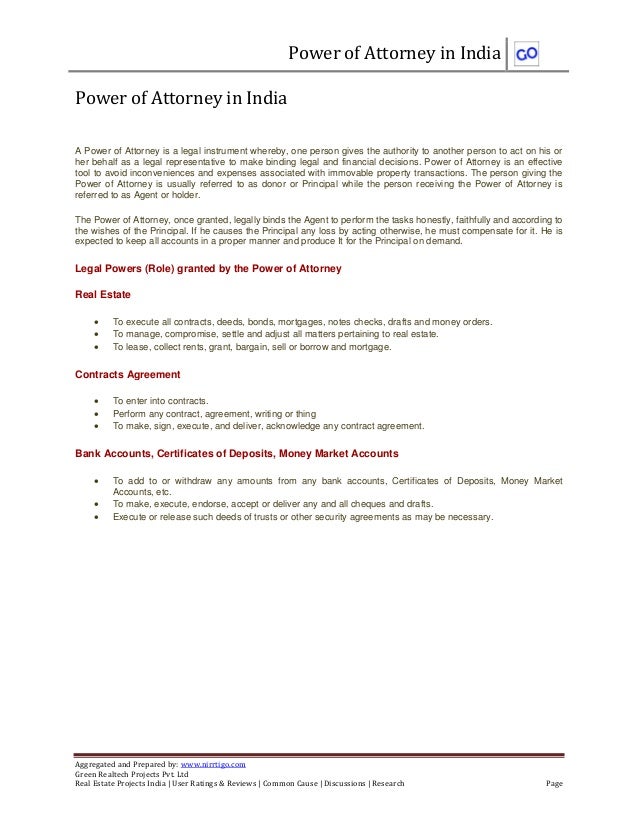

What is a power of attorney?

A power of attorney is a unilateral document that allows for the donor or principal to give authoritative power to the agent by signing the document and the agent’s signature is not always needed. A power of attorney can be executed by any person who is capable of entering into a contract.

What is a GPA in India?

A GPA is a general-purpose deed granting authority to an individual to take care of almost all legal and financial affairs in India. It grants the holder all rights for all your properties in India. Or it can grant all rights for the listed properties or grant all rights related to handling your banking or financial transactions. A General Power of Attorney for India must be considered when you are absolutely certain that the agent will always act in good faith and in your best interest.

Does delegation of authority absolve you of responsibility?

The delegation of authority does not absolve you from the responsibility and you are ultimately responsible for the actions of the POA holder. Therefore, the following safeguards and caveats can help you navigate the waters rather smoothly:

Is Hemant Beniwal a financial planner?

Hemant Beniwal is a CERTIFIED FINANCIAL PLANNER and his Company Ark Primary Advisors Pvt Ltd is registered as an Investment Adviser with SEBI. Hemant is also a member of the Financial Planning Association, U.S.A and registered as a life planner with Kinder Institute of Life Planning, U.S.A. He started his Financial Planning Practice in 2009 & is among the first generation of financial planners in India. He also authored Bestseller book "Financial Life Planning".

Benefits of Power of Attorney

Staying abroad makes it difficult to micro-manage your bank accounts and other financial transactions or investments in India. A reliable and trustworthy Power of Attorney can ease out your difficulties with:

Types of Power of Attorney

Power of attorney is a written deed to provide authority to a person on your behalf for legal matters or business transactions. The person providing the authority is the principle, donor, or grantor and the person receiving the power is the holder or agent.

General Procedure and Rules of Power of Attorney

A power of attorney can be given to one or multiple people who can be your family, friends or neighbours. The basic element involved here is trustworthiness. The procedure to create them has certain steps that you need to follow. Let’s explore:

Precautious Points to Remember while executing the Power of Attorney Deed

Always prefer a special power of attorney over the general power of attorney

Payment Procedure to NRI Seller

Follow these procedures to avoid the kinds of issues that involve physical and mental harassment coupled with wealth loss.

Revoking the Power of Attorney

It is pretty simple to revoke the power of attorney, based on the revoking preference, which is categorised as:

What is a power of attorney?

Power of Attorney of property is a legal document transmitting the legal right to the attorney or agent to manage and access the principle’s property in the circumstance the principle is unable to do so by themselves.

When was the power of attorney established?

The Power of Attorney Act, 1882 established in India to give a legal framework and guidance to the conduct of Power of Attorney and describes how to give power of attorney from USA for India for NRIs. Get your Power of Attorney drafted by a lawyer NOW!

Is a specific power of attorney work specific?

The Specific power finishes once the task or specific act is done. Therefore, it is work specific only. Also, under this one cannot assign a Specific Power of Attorney for many acts. In that case you have to establish separate Specific Power of Attorney deeds for each act.

What is the meaning of "renting the whole or any part of the property"?

Renting the whole or any part (s) of the said property on terms and conditions as the attorney in his judgment deems fit and accepts the surrender of ownership from such tenant/lessee or other occupier and to take possession and obtain rents, profits, and income from the property in whole or in part.

Is a power of attorney a transfer?

To summarize, the law bears that a power of attorney is not a tool of transfer in regard to any right, title or interest in an immovable property but any genuine contract carried out through General Power of Attorney is deemed valid under the law. Click here to download the Power-of-attorney-format-for-sale-and-purchase-of-real-estate-for-an-NRI ...

Can an NRI be a power of attorney?

An NRI or non-resident Indian can become a Power of Attorney deed even by living outside India and without having to travel to India for that purpose. Most NRIs have properties ( read our resource on How to sell your property in India and bring back money to USA) and banking business in India which may require their presence while transactions occurs. Hence, NRIs can always assign the powers to transact to another individual who is either a family member or a friend. Both specific and General Power of Attorney can be assigned by NRIs. Let us understand the procedure for making a Power of Attorney Deed

What is a special power of attorney?

the power comes to an end. This type of power of Attorneys are termed as special power of Attorney. Special Power of Attorney is made only for a single task or act. You can hire us to create a Special Power Of Attorney quickly and in a cost effective manner.

What is a GPA?

If you wish to give all the rights for all your properties or all the rights for one property or all rights of banking etc. you should create general power of attorney or commonly termed as GPA. But if you want to give the power to the Attorney to do any specific act and after the act is done. the power comes to an end.

What is a general POA?

· General PoA: This kind of authority can be fruitful in case the giver wants to handover substantial powers, like making monitory transactions.#N# · Particular/Specific PoA: This power is specifically granted for special reasons, like signing property papers.

What is a POA?

Power of Attorney (PoA) can do favour to them by introducing relief and comfort in settling down property disputes and exchanging old currency notes under demonetization. But it should be attested from Indian embassy.

Can emigrants use the Hague Convention?

The member countries of the Hague Convention have a right to enjoy the PoA facility. Provided that the granted authority is notarized and apostilled, the emigrants can entrust their certain powers. They should remember that the mandatory certificate attestation services must be carried out by the Indian Consulate or Embassy. Find the nearest consulate office in your locality abroad to do so.

Reason for Execution of Power of Attorney

As i mentioned and being candid about my opinion. A resident Indian buyer should AVOID property transaction through Power of Attorney holder of an NRI. The best case scenario is the presence of an NRI seller in India for execution of sale deed.

Process to Execute Power of Attorney

The most critical step is to check whether the Power of Attorney is executed as per the laid down process. It’s a 2 step process i.e. attestation of POA at Indian Consulate/Embassy and the registration of same in India. Attestation of POA is required even if the seller is not an NRI i.e. not completed 180 days outside India.

Payment to NRI Seller

In a recent case, i observed that buyer was cheated by Power of Attorney holder of an NRI Seller. It’s a misconception that payment towards property transaction should be transferred to POA holder. Please understand that Power of Attorney holder is only a representative of an NRI seller.

Indemnity Clause

Lastly, each property transaction is unique with multiple permutations and combinations. Therefore, a buyer can safeguard his/her financial interests by including a blanket indemnity clause in the sale deed. To avoid being caught on the wrong side also ensure that sale deed clauses are in concurrence with the terms and conditions of the POA.

Popular Posts:

- 1. what is required to get power of attorney

- 2. why i jeff sessions such a horrible attorney general

- 3. what are the rings for attorney maloney

- 4. who pays attorney fees in small claims court

- 5. who plays clark attorney on bones when he is accused of murder

- 6. how to get power of attorney for parent- california

- 7. what does p.c. after an attorney name mean

- 8. what is attorney engagement letter

- 9. which box in a 1099 does an attorney payment go to

- 10. what is a consertion aid agreement dui attorney