Steps for Making a Financial Power of Attorney in Illinois

- 1. Create the POA Using a Statutory Form, Software, or Attorney ...

- 2. Sign the POA in the Presence of a Notary Public ...

- 3. Store the Original POA in a Safe Place ...

- 4. Give a Copy to Your Agent or Attorney-in-Fact ...

- 5. File a Copy With the Recorder of Deeds ...

- 6. Consider Giving a Copy to Financial Institutions ...

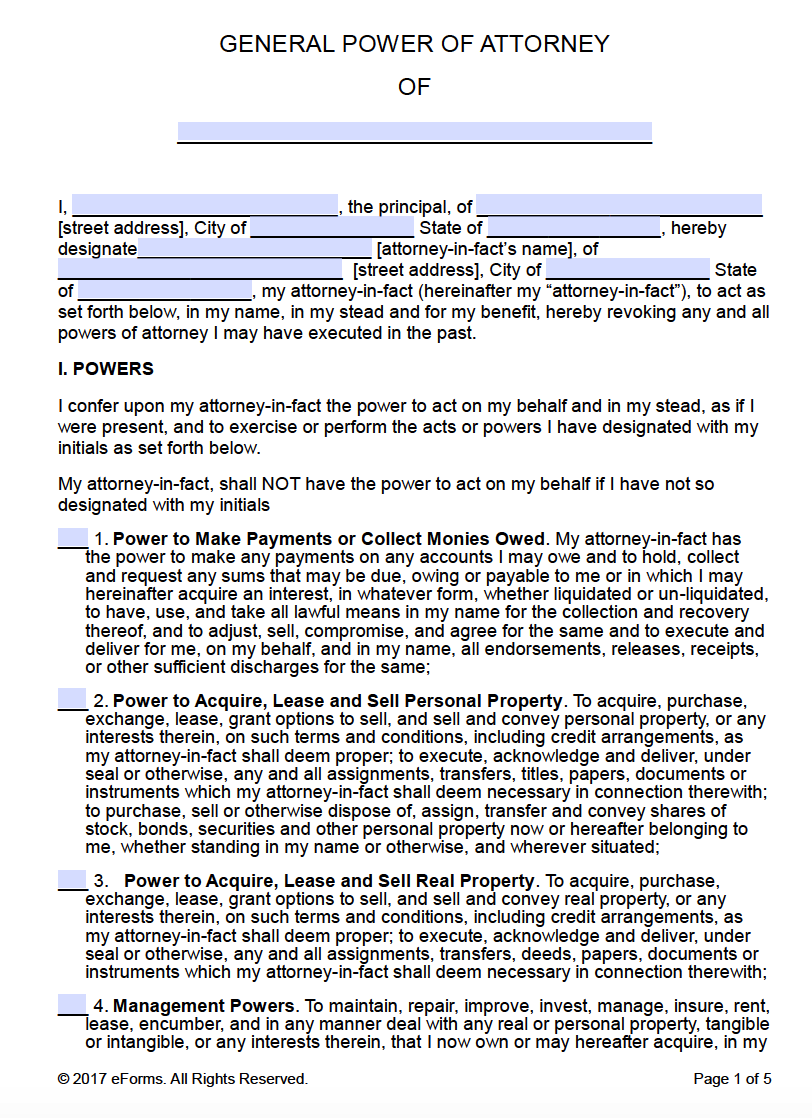

- Create the POA Using a Statutory Form, Software, or Attorney. ...

- Sign the POA in the Presence of a Notary Public. ...

- Store the Original POA in a Safe Place. ...

- Give a Copy to Your Agent or Attorney-in-Fact. ...

- File a Copy With the Recorder of Deeds.

Does Illinois allow joint power of attorney?

While the Illinois Power of Attorney Act allows a Principal to appoint co-Agents (that is, two or more people who act as Agent at the same time), the short-form, fill-in-the-blank powers of attorney found in the act do not allow for that, which are discussed more below.

How to establish a power of attorney?

You can create a POA:

- By yourself —Make sure you meet your state legal requirements when preparing a power of attorney letter

- Use online templates —Pick an appropriate type of power of attorney and consult the state law to amend the downloaded sample accordingly

- Hire an attorney —Keep in mind that you might end up paying a hefty sum for this service

How do you file for power of attorney?

- Sign up with DoNotPay in your web browser

- Go to our Create a Power of Attorney feature

- Follow the prompts and fill in the details you want included

How to obtain power of attorney?

Part 4 Part 4 of 6: Preparing Your Power of Attorney Document Download Article

- Download an appropriate power of attorney form. California makes it easy to access and create a power of attorney document.

- Name the parties. When filling out either form, the first step will be two identify each party to the power of attorney.

- Choose the powers you want the agent to have. ...

- Note powers that cannot or will not be conferred. ...

Do I need a lawyer for power of attorney in Illinois?

A power of attorney document does not have to be executed by an attorney, nor in the presence of an attorney. But consulting an attorney will ensure that process is done properly and meets all of Illinois' legal requirements.

What happens if you don't have a power of attorney in Illinois?

Who Makes Decisions When There is No Power of Attorney in Illinois? If a person is not able to make decisions for themselves and there is no power of attorney established for them, the decision will fall on the family of the person.

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

Can I do power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

Who makes decisions if no power of attorney?

If you lose your mental capacity at the time a decision needs to be made, and you haven't granted powers of attorney to anyone (or you did appoint attorneys, but they can no longer act for you), then the court can appoint someone to be your deputy.

Can a family member override a power of attorney?

If the agent is acting improperly, family members can file a petition in court challenging the agent. If the court finds the agent is not acting in the principal's best interest, the court can revoke the power of attorney and appoint a guardian.

Do I need a power of attorney if I have a will?

A will protects your beneficiaries' interests after you've died, but a Lasting Power of Attorney protects your own interests while you're still alive – up to the point where you die. The moment you die, the power of attorney ceases and your will becomes relevant instead. There's no overlap.

Does power of attorney override a will?

Can a Power of Attorney change a will? It's always best to make sure you have a will in place – especially when appointing a Power of Attorney. Your attorney can change an existing will, but only if you're not 'of sound mind' and are incapable to do it yourself. As ever, these changes should be made in your interest.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

Can a family member witness a power of attorney?

A: Yes, family members can witness a power of attorney. If it is a health care POA, at least one of the witnesses cannot be one of the person's health care providers or an employee of one of their health care providers, or entitled to inherit under the person's will.

Why do you need power of attorney?

A power of attorney is a legal document that allows someone to make decisions for you, or act on your behalf, if you're no longer able to or if you no longer want to make your own decisions.

What are the 3 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.

How do I get power of attorney in CT?

Steps for Making a Financial Power of Attorney in ConnecticutCreate the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Land Records Office.More items...

How much does it cost to get power of attorney in Florida?

How much does a power of attorney cost in Florida? Though a power of attorney can be drafted online and later notarized for less than $100, it is best to consult a lawyer when completing such an important legal document. That being said, the average legal fees range from $250 to $500.

Do you need a lawyer for power of attorney in Florida?

A power of attorney is an important and powerful legal document, as it is authority for someone to act in someone else's legal capacity. It should be drawn by a lawyer to meet the person's specific circumstances. Pre-printed forms may fail to provide the protection or authority desired.

Does a power of attorney need to be recorded in Tennessee?

If your agent will manage real estate transactions, the Power of Attorney will need to be signed by a notary and filed or recorded with your county.

What is a power of attorney for a minor in Illinois?

The Illinois minor (child) power of attorney form allows parents to grant a representative the authority to make decisions and perform actions to ensure the proper care of a child. The person accepting the parental powers may be asked to provide care in the form of transportation, shelter, clothing, and food. Illinois power of attorney law only regulates the delegation of such authority when it concerns…

What happens if a power of attorney is durable?

If the power of attorney is durable, the authority will sustain the incapacitation of the principal, meaning that even if the individual for whom the power of attorney was created becomes sick and unable to make decisions, the agent will still be able to perform on his or her behalf.

Who can execute a power of attorney in Illinois?

The Illinois real estate power of attorney form can be executed by a principal who wishes to hand over certain real estate powers to a trusted agent (also known as an attorney-in-fact). The agent will have the authority to manage any of the real estate matters detailed in the power of attorney document. These range from closing a sale or purchase of a property to…

What is durable power of attorney?

Durable (Statutory) Power of Attorney – Generally confers broad financial powers on a representative and it continues even if the person creating the power is adjudged incapacitated.

How many witnesses are needed for a CPA?

Signing Requirements: Two (2) witnesses if the agent is an attorney or a certified public accountant (CPA). Two (2) witnesses and a notary public if the agent is any other person. Vehicle Power of Attorney – This allows you to appoint someone to act on your behalf with regard to registering and titling vehicles.

What is power of attorney in Illinois?

Illinois power of attorney forms that let a person choose someone else to make decisions on their behalf for medical, financial, parental, or other related purposes. Depending on the type of form, it will be required to complete and sign in accordance with State law.

How to submit Illinois 2848?

To submit Form IL-2848 or Form IL-56 for immediate processing send your completed and signed form by email or fax. For an email request, submit your completed form to [email protected]. You should scan and save each Form IL-2848 as a separate PDF document and attach it to your email request.

What is the number for Illinois Department of Revenue?

PO BOX 19001. SPRINGFIELD IL 62794-9001. For questions, see the instructions for Form IL-2848, call us at 1 800 732-8866 or 1 217 782-3336 , or call our TDD-telecommunications device for the deaf at 1 800 544-5304.

What form do you use to be a third party representative?

If you have not been appointed as third-party designee or if you are required to perform acts beyond a third-party designation, you must be authorized as a taxpayer’s representative on Form IL-2848, Power of Attorney.

Is IL 2848 a secure form?

For a fax request, submit your completed form to 1 217-782-4217. You should send each Form IL-2848 as a separate fax. Do not include a cover page.

Do tax practitioners have to be designated as third party designees?

In order to protect the confidentiality of tax information, we require tax practitioners, preparers, etc., to have been designated as third-party designee on a tax return on file with the Department before discussing the return with any representative. This authorization will allow you to answer any questions that arise during the processing of your return, call us with questions about your return, and receive or respond to notices we send.

How many witnesses do you need to sign a notary?

The principal must sign with one (1) witness and a notary public. The agent must sign on the last page located on the Agent’s Certification ( 755 ILCS 45/3-3.6)

What is a durable power of attorney in Illinois?

An Illinois durable power of attorney is a statutory form that allows a person to select someone else to act in their benefit for financial-related decision-making. The term “durable” refers to the form remaining valid even if the person who handed over power becomes incapacitated or mentally not able to speak for themselves.

What happens if an attorney in fact steps down?

If the Attorney-in-Fact is unable or cannot act in the role the Principal assigned (for any reason including revocation), then the Principal can be left without the aid he or she requires with certain financial actions. This can be avoided by naming two Agents who can assume the authority to carry out the Principal’s directives in the State of Illinois. The first Successor Agent appointed with this role will only be able to wield this power if the Attorney-in-Fact steps down, has his or her power revoked, is unable to represent the Principal, or can no longer do so. Similarly, the Second Successor Agent will only be able to assume the Attorney-in-Fact role if the originally named Illinois Agent or Attorney-in-Fact and the First Successor Agent both become ineligible or unable to wield principal power.

How many witnesses are needed to sign a signature in Illinois?

(16) Witness 1 Name. Only one Witness to the Principal’s signature is required to sign this form to execution in the State of Illinois. His or her full name should be presented beforehand in print.

Why is the principal unavailable?

At times, the Principal may be unavailable (i.e. due to extended travel or extenuating circumstances) thus leaving the Attorney-in-Fact without specific direction in unforeseen situations. If desired, the Principal can use this form to impose conditions on or limit the level of authority of the powers being granted.

What does "durable" mean in Illinois?

Definition of “Durable”. The Illinois Compiled Statutes do not define “durable,” but refer to enduring through “incapacity” in the Act’s section on Durable Powers of Attorney.

Do you need a second witness to sign a document?

(19) Witness 2 Name. Quite a few jurisdictions will require a second Witness to verify the Principal’s signature thus, it is recommended to sign this document before two Witnesses (if possible). In such a case, the Second Witness must also print his or her name to properly testify to the Principal’s signature.

Popular Posts:

- 1. what is a crackerjack attorney

- 2. the night of who played district attorney

- 3. what is the maximum an attorney can charge for a personal injury issue

- 4. how much does it cost to file bankruptcy in florida with attorney

- 5. what can be done if attorney does not gove me my settlement

- 6. who won loudoun county commonwealth attorney race

- 7. what episode of murder she wrote has character attorney oliver quayle

- 8. what is necessary to be able to use a durable power of attorney

- 9. an attorney can do what a paralegal can do quotes

- 10. what is an alto from attorney