Can I close on a house without being present?

Do you have to be present at closing in Florida?

Does POA have to be registered in NC?

How do you close on a house in Florida?

- Both parties enter into a fully executed contract. ...

- Earnest money is deposited. ...

- The buyer applies for a home loan. ...

- The property is appraised. ...

- The property is inspected. ...

- A title examination is conducted, and a title policy is issued. ...

- A survey is conducted.

How long does a closing take in Florida?

This process typically happens between 4-8 weeks after the parties in a real estate transaction reach an agreement. When the date of the closing finally arrives, both parties are ready to sign the contract that will officially settle the transaction between them.Apr 5, 2021

How does power of attorney work in NC?

Does power of attorney need to be notarized?

How does power of attorney work in North Carolina?

How to hire a real estate attorney for closing?

Before you select an attorney, visit your state’s bar association website and search for the list of attorneys that specialize in real estate. Cross-reference these names with lawyer review websites to find the right fit for you. It’s also helpful to ask friends and family for recommendations. It’s likely someone you know has a real estate attorney they would recommend. Once you narrow it down, you’ll want to schedule a consultation with at least a couple of different attorneys. You should ask to see their credentials and ask about their fees. To learn how to organize the documents you need for the real estate transaction, read on!

What to do before closing on a real estate transaction?

Provide your attorney with all documents related to your real estate transaction. This step will allow your attorney to become familiar with your legal matter and ask any necessary questions before a real estate closing occurs. This process also allows the attorney to identify any problems or issues that he or she sees with your real estate transaction before reaching the point of closing.

How to pay for a real estate attorney?

At this point, you will either need to pay the attorney the agreed-upon price, as many real estate transactions are priced at a flat fee, or pay the attorney a retainer, which is a set amount of money necessary to hire the attorney. As he or she does work on your real estate transaction, the attorney will deduct his or her hourly fees from your retainer.

How to get a recommendation for a real estate attorney?

Ask for a recommendation from friends, family members, or colleagues. Almost everyone who buys or sells a house will hire a real estate attorney to represent him or her at some point during the transaction. Ask people you know that have bought or sold real estate whether they would recommend the attorney that they hired. You can even ask your real estate agent for a recommendation. Personal recommendations are a good tool to use when selecting an attorney, because they give you an opportunity to understand how the attorney handled your friend or family member’s particular case.

What is a real estate closing?

A real estate closing is often a nerve-wracking experience for both the buyer and seller. Typically, a large amount of money changes hands during closing and both parties to the transaction have done a lot of work leading up to the closing date. Plus, real estate contracts tend to be full of legal jargon that can be difficult for ...

How to judge if an attorney is the right fit for you?

By reviewing other individuals’ experiences with a particular attorney , you can judge whether an attorney might be the right fit for you. For an example of a popular lawyer review site, click here.

What is the job of a lawyer?

It is your lawyer’s job to give you legal advice about your legal matter. That is the reason that you are paying him or her to represent you in a real estate closing. As a result, you should cooperate with your lawyer and take his or her advice for the best possible outcome in your case.

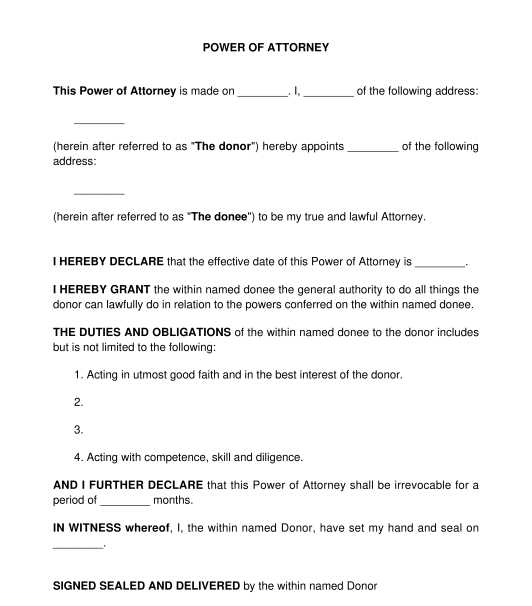

What is POA in closing documents?

This document allows an individual, referred to as the principal, to give someone else, their attorney-in-fact or agent, the power to act on the principal’s behalf. It’s pretty simple really. The principal signs the POA in advance and then the agent signs all the closing documents on behalf of the principal.

What is the most common closing snag?

This article addresses one of the most common, and least understood, closing snags – the absent party. With preplanning an absent party is no big deal. Without preplanning and proper documentation, the absence will delay the closing and could cost you the deal.

What is a POA form in Colorado?

The Colorado Legislature has approved a general financial power of attorney that allows the principal to delegate all kinds of powers to the agent. That form is available here: POA Form

When does a POA end?

Some POAs automatically terminate when the specific purpose is concluded , or upon the happening of some event or date. If your POA is over 30 days old most title companies will require that the agent sign an affidavit that the POA is still in force. The agent will affirm that s/he has no knowledge of the revocation or termination of the POA by death, disability, or incompetence of the principal

Can you use POA after principal dies?

We’ve encountered several occasions where an agent wanted to use the POA after the principal died. This doesn’t work. If you’re dead, you don’t have any power left, therefore, your agent doesn’t either. The personal representative of the estate will have to sell the property..

Do you need a photocopy of a POA?

When a POA is used by an agent to convey or encumber property the title company will need the original signed and notarized document so that it can be recorded with the conveyance deed or deed of trust. Make sure you don’t show up at closing with just a photocopy.

Can a title company accept a POA?

Don’t use a POA unless absolutely necessary, and always have a third party, or party aligned with the principal, act as the agent. Expect the title company to want to contact the principal to confirm that the principal is aware of the transaction. There are certain transactions, like short sales, where the title company may refuse to accept a POA on behalf of the seller. Find this out when you order title, not when you’re at the closing table.

Can a power of attorney be revoked?

A power of attorney may be revoked, but most states require written notice of revocation to the person named to act for you. The person named in a power of attorney to act on your behalf is commonly referred to as your "agent" or "attorney-in-fact.". With a valid power of attorney, your agent can take any action permitted in the document.

How long does a power of attorney last?

Today, most states permit a "durable" power of attorney that remains valid once signed until you die or revoke the document.

What is a power of attorney?

A power of attorney gives one or more persons the power to act on your behalf as your agent. The power may be limited to a particular activity, such as closing the sale of your home, or be general in its application. The power may give temporary or permanent authority to act on your behalf. The power may take effect immediately, or only upon ...

What is a springing power of attorney?

The power may take effect immediately, or only upon the occurrence of a future event, usually a determination that you are unable to act for yourself due to mental or physical disability. The latter is called a "springing" power of attorney.

Can an attorney in fact make gifts?

Gifts are an important tool for many estate plans, and your attorney-in-fact can make gifts on your behalf, subject to guidelines that you set forth in your power of attorney. For example, you may wish to permit your attorney-in-fact to make "annual exclusion" gifts (up to $14,000 in value per recipient per year in 2013) on your behalf ...

Who is Michael Douglas' wife?

Assume Michael Douglas appoints his wife, Catherine Zeta-Jones, as his agent in a written power of attorney. Catherine, as agent, must sign as follows: Michael Douglas, by Catherine Zeta-Jones under POA or Catherine Zeta-Jones, attorney-in-fact for Michael Douglas. If you are ever called upon to take action as someone’s agent, ...

3 attorney answers

If properly done, a durable power of attorney should be enough. It is done more often than most might believe.

Michael J. Szklasz

As mentioned by the other answer, you'll have to comply with the requirements of your lender. Much is required by the lender and or closing attorney to protect them from any later claims against them. Check with your real estate attorney (the one who just represents you, and not the lender's attorney) and they may be able to help sort things out.

Herbert Warren Cooper IV

You should talk with closing agent to see what is needed for the acceptance of the POA. Technically it should be fine but different underwriters have different policies.

How to get a power of attorney?

How to get power of attorney if you need it 1 Understand the obligations of being an agent in a POA arrangement. 2 Evaluate that the principal has the capacity to sign a power of attorney agreement. 3 Discuss the issue with the financial institutions (mortgage holders) and physicians (whenever there may be questions about capacity). 4 Hire an attorney or contact a legal website like Legal Zoom, online on-demand legal services with a 100% satisfaction guarantee on all their filings. 5 Be supportive. Giving up control of a real estate transaction can be a hard adjustment for an elder family member. 6 Ask a lot of questions and make sure you understand the obligations for all parties under the document. 7 Make sure that the document outlines actions with as much detail as possible to avoid any gray areas that can be misinterpreted. 8 Get the final document notarized or witnessed — depending on your state’s requirements if they haven’t enacted the Uniform Power of Attorney act of 2006. 9 Record the power of attorney with the county clerk office where the home is located — depending on your state or county requirements. 10 Make authenticated copies of the document for safekeeping. 11 Always present yourself correctly as someone’s agent.

When does a power of attorney kick in?

This type of power of attorney kicks in as soon as the principal is incapacitated and stays valid until the principal’s death. However, incapacitation puts both the principal and agent at risk of a variety of scams that target elderly or infirm people.

Why is a power of attorney important?

Because it’s limited in both time and scope, it’s a great tool when you want to give someone a very specific responsibility. A medical power of attorney gives an agent (often a family member) authority over someone’s medical care once a doctor determines they are unable to make decisions on their own.

What is a POA in real estate?

“Power of attorney” (POA) is a flexible legal tool that grants permission for someone to act on another’s behalf on a temporary or permanent basis. In real estate, this can be an incredibly useful option for all sorts of situations, like if you had to sell your house but couldn’t be there due to a job relocation or deployment.

When to take steps to make sure your own estate planning is buttoned up?

The death of a spouse or another close family member: When your family has to deal with an estate or probate process, you may want to take steps to make sure your own estate planning is buttoned up.

Can a property be sold to an agent?

And there are some rules: The property cannot be sold to the agent (unless there’s an express agreement to do so) or sold at a price far below market value. These both constitute a breach of fiduciary trust, an abuse of power of attorney duties and, in some instances, a crime.

Who is the principal of a power of attorney?

The principal is the person granting the power of attorney to someone else.

How do title companies send closing documents?

Title company sends closing documents to you via email, overnight mail, or courier. You find a notary and then return the documents back via overnight mail.

Who must provide original power of attorney?

Original Power of Attorney document must be provided to title company at closing

Why does notary delay transfer of title?

It can delay actual transfer of ownership because of the time required for the documents to make their way back to the title company.

Why have title experts on hand to answer any questions?

Have title experts on hand to answer any questions because they are familiar with the documents/industry

What is a power of attorney?

Power of Attorney. You sign a legal document giving another person full legal authority to sign on your behalf. This is typically a spouse, trusted friend, or advisor. You must trust the person to whom you give the power of attorney. Original Power of Attorney document must be provided to title company at closing.

Does life stop when you sign a contract?

As much as we in the real estate industry like to believe that each real estate transaction is everyone’s top priority at all times throughout an entire transaction, the reality is that life does not stop just because you’ve signed a contract and will soon be closing on a home. What this means at times is that coming together at ...

Can a title company ask for a closing?

As a favor, one title company can ask one of their sister or partner offices to do the closing at that location.

What is a power of attorney?

A Power of Attorney is a form that you would sign as the buyer, giving someone (your spouse as an example) power to sign documents on your behalf and to bind you to the terms and conditions of those documents.

Can you send someone in your place to close?

The short answer is YES, you may send someone in your place to “close” for you. A closing is essentially a “signing” of documents, documents drafted by both the closing attorney and your lender. Therefore, the question of whether you can send someone else in your place is really “can someone sign my documents on my behalf?”.

Can I close on my mom's behalf?

So YES, send your mom, your brother, your spouse to close on your behalf, but make sure you (i) ask your lender’s permission (ii) notify your closing attorney and (iii) buy whomever signs on your behalf lunch because they will have a massive amount of signing to do!

Do you need a power of attorney to not attend a closing?

If your lender allows the use of a Power of Attorney, you need to notify your closing attorney immediately of your plans to not attend closing. This will allow them to coordinate with the lender to ensure the lender fills out the loan documents correctly.

Popular Posts:

- 1. why does attorney tom have an eye patch

- 2. you tube what questions to ask pi attorney during first visit

- 3. what does it mean if physician request you bring power of attorney paperwork?

- 4. what services can an attorney provide a small business

- 5. how to start paying back attorney general

- 6. what are the responsibilities of a person with power of attorney?

- 7. what happens if an attorney threatens to kill you

- 8. what is the procedure to get power of attorney

- 9. how much does an attorney charge to file chapter 7

- 10. what to do with power of attorney when someone is incapacited