What is a West Virginia tax power of attorney form?

State of West Virginia . STATUTORY FORM POWER OF ATTORNEY . IMPORTANT INFORMATION . This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or

What is a “durable power of attorney”?

Dec 22, 2020 · In West Virginia, a power of attorney is presumed to be durable unless it’s specified to be non-durable on the form. Step 4: Sign and Date the Form. To complete the paperwork, the agent and the principal sign and date the durable power of attorney form. Don’t forget that in West Virginia, your form also needs to be notarized. 3.

What happens to a power of attorney when the principal dies?

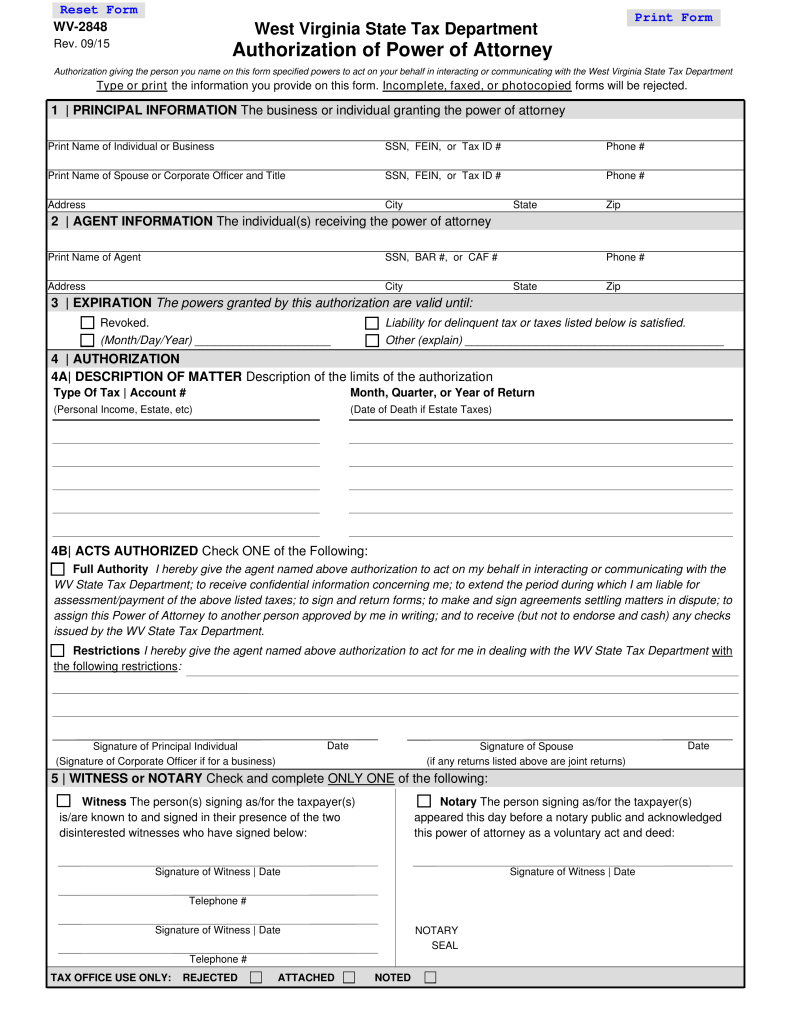

Authorization of Power of Attorney The WV-2848 Authorization of Power of Attorney gives the person you name on this form specified powers to act on your behalf in interacting or communicating with the West Virginia State Tax Department. Type or print the information you provide on this form. Incomplete, faxed, or photocopied forms will be REJECTED

What is a medical power of attorney for a principal?

West Virginia Power of Attorney Forms. West Virginia Power of Attorney Forms lets a person step-in and make decisions on behalf of someone else. The representative, known as an “attorney-in-fact” or “agent,” must act in the person’s best interest when making financial, medical, tax filing, and motor vehicle (DMV) decisions.

Can I do power of attorney myself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

How do you obtain power of attorney?

Here are the basic steps to help a parent or loved one make their power of attorney, and name you as their agent:Help the grantor decide which type of POA to create. ... Decide on a durable or non-durable POA. ... Discuss what authority the grantor wants to give the agent. ... Get the correct power of attorney form.More items...•Jun 14, 2021

Does a durable power of attorney need to be notarized in Virginia?

Any power of attorney executed in Virginia after July 1, 2010 is deemed durable unless it expressly states otherwise. A power of attorney is not required to be acknowledged before a notary public but the party's signature is deemed to be genuine if acknowledged before a notary public.Nov 1, 2010

How do you get a power of attorney letter in Virginia?

Use our Virginia Power of Attorney form to let someone make legal and financial decisions for you....The POA document must be in writing, and include the:signature of the principal.name and contact information of the agent(s)date of the agreement.powers granted.when the powers begin and end.signature of a notary public.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

How do I get a durable power of attorney in Virginia?

To create a POA in Virginia, you must be at least 18 years of age and have the capacity to make decisions and understand what you are doing. You complete the form, naming your agent and choosing the powers you want to give them. You must choose the powers you are specifically granting to your agent.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How do I get a durable power of attorney?

To create a legally valid durable power of attorney, all you need to do is properly complete and sign a fill-in-the-blanks form that's a few pages long. Some states have their own forms, but it's not mandatory that you use them. Some banks and brokerage companies have their own durable power of attorney forms.

Does a power of attorney need to be recorded in Virginia?

A POA used for real estate purposes may need to be recorded: Virginia Code § 64.2- 1603 provides that “in order to be recordable [a POA] shall satisfy the requirements of § 55-106.” Recordation requirements as set forth in Virginia Code § 17.1-223 may require the surnames of the Principal and Agent be capitalized and ...

Who can witness a power of attorney in Virginia?

You must sign your power of attorney or direct another person in your presence to sign your name for you if you are physically unable to sign. You do not need witnesses, but you should have it notarized by a notary public. You must sign your advance directive with two adult witnesses present.Jun 2, 2021

How long does a power of attorney take to get?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What is a durable power of attorney in West Virginia?

A West Virginia durable power of attorney form is a document that grants someone (the “agent”) the legal authority to act and make decisions for another person (the “principal”) in the state of West Virginia.

What is a durable power of attorney?

Unlike a regular non-durable power of attorney (POA), a durable power of attorney (DPOA) stays in effect even if the principal becomes incapacitated and legally can’t make their own decisions. This form is sometimes called a general durable power of attorney and a durable power of attorney for finances, and is used for financial ...

What does the principal need to mark on the form?

The principal needs to mark on the form which areas of their life they want to give the agent legal power over. This can be general authority (e.g., operation of a business) or specific authority (e.g., make a loan). They can also write specific instructions about which actions the agent can perform on their behalf.

What is a durable power of attorney in West Virginia?

A West Virginia durable statutory power of attorney form is created for the purpose of choosing a person to act as an agent and handle the financial affairs of someone else (“principal”). The term “durable” means the designation can last for the lifetime of the principal unless revoked.

What is a power of attorney in Virginia?

“Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used ( WV Code § 39B-1-102 (7) ).

What is a successor agent in West Virginia?

A Successor Agent can be held in reserve in case the West Virginia Agent is unwilling to carry out directives or wield principal power, is unable to fulfill the role , or has had his or her powers revoked. This enables the authority defined in this document to be transferred to the Successor Agent for use in West Virginia thus ensuring ...

What is inter vivos trust?

(13) Inter Vivos Trust. Certain actions must be approved beforehand by the Principal before the Agent can be allowed to take them. This is the case even if the above list was tendered with the appropriate approvals and additional provisions have been provided. Thus a list of principal actions must be reviewed so that each action approved can be shown as an authorized action with the Principal’s initials. For example, in the first list item, the Principal can approve the Agent’s interaction and use of principal control over Inter Vivos Trusts by initialing the accompanying line or the Principal can show that the Agent does not carry the authority to handle Inter Vivos Trusts by leaving this item unmarked.

Durable Power of Attorney West Virginia Form – Adobe PDF

The West Virginia durable power of attorney form can be created by a resident to designate someone else to have the ultimate rights to handle every facet of their financial capabilities.

General Power of Attorney West Virginia Form – Adobe PDF

The West Virginia general power of attorney form grants an individual the ability to select someone else, known as an “agent,” to have the unlimited power with regard to the management of another individual’s finances.

Limited Power of Attorney West Virginia Form – Adobe PDF

The West Virginia limited power of attorney form allows a resident to choose someone else to handle a specific financial activity or decision on their behalf. This restricted appointment may be anything as serious as handling a real estate transaction, more commonly a closing, to simple tasks such as paying bills.

Medical Power of Attorney West Virginia Form – Adobe PDF

The West Virginia medical power of attorney form is part of an Advance Directive which consists of both a medical power of attorney and a living will. With the medical power of attorney, the principal appoints an agent who will make all their health care decisions when they are incapacitated and cannot do so on their own.

Minor (Child) Power of Attorney West Virginia Form – PDF

The West Virginia minor child power of attorney form is a document that is created to grant a guardian power of attorney over a minor child. The trusted individual will be able to, for the duration of the term dictated in the form, make every decision the parents or legal guardians would be able to make if they were available to do so themselves.

Real Estate Power of Attorney West Virginia Form – PDF – Word

The West Virginia real estate power of attorney enables an agent to act on behalf of a homeowner or buyer with regard to the sale and purchase of property located in West Virginia.

Tax Power of Attorney West Virginia Form – Adobe PDF

The West Virginia tax power of attorney form, also known as form WV-2848, allows a resident to grant a representative the authority to file their taxes with the West Virginia State Tax Department.

What is the power of attorney act in West Virginia?

In West Virginia, the Uniform Power of Attorney Act says that you can execute one form regarding decision-making about your property, including your money, investments, taxes, trusts, and real estate.

How to make a power of attorney?

When you make a general of power of attorney, you call the shots: 1 You decide when it takes effect. It will remain in effect once you are incapacitated (durable power of attorney) unless you specify differently 2 You can add special instructions about naming a conservator or guardian in case you become incapacitated 3 You can name your agent in the power of attorney as a fiduciary, if you wish

What happens when you execute a power of attorney?

It is important to understand that when you execute a power of attorney, any act your agent performs is binding on you and your estate. If you need help understanding or executing any of your property transactions, you should seek help in executing a power of attorney for those transactions.

What documents are not included in the Uniform Power of Attorney Act?

Planning for those decisions typically involves two documents: a living will and a medical power of attorney.

What is a living will?

The living will includes your wishes about medical interventions to prolong your life in special circumstances. The medical power of attorney allows your representative to make health care decisions for you when you are incapacitated and allows access to your medical records as needed.

What is a medical power of attorney?

A medical power of attorney appoints a representative to make “health care decisions relating to medical treatment, surgical treatment, nursing care, medication, hospitalization, care and treatment in a nursing home or other facility, and home health care.” The person you appoint can consent to treatment, refuse treatment, or withdraw treatment on your behalf. It is important for this person to know your wishes and the type of decisions you would make about your health care, as well as the values you hold that impact those types of decisions. Your medical power of attorney must make the decisions you would make to the best of his/her knowledge.

Can a power of attorney be trusted?

Assigning power of attorney to a trusted person or an “ agent ” acting on your behalf can be very beneficial to you and your estate, but it needs to be executed with knowledge of what that means and how it works. In many cases, the best and only way to make sure your power of attorney does what you want it to do ...

What is a power of attorney?

IMPORTANT INFORMATION. This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself.

What happens when you accept a power of attorney?

When you accept the authority granted under this power of attorney, a special legal relationship is created between you and the principal. This relationship imposes upon you legal duties that continue until you resign or the power of attorney is terminated or revoked. You must:

Can an agent use my property to benefit the agent?

LIMITATION ON AGENT’S AUTHORITY. An agent that is not my ancestor, spouse, or descendant MAY NOT use my property to benefit the agent or a person to whom the agent owes an obligation of support unless I have included that authority in the Special Instructions.

Do coagents have to act together?

Coagents are not required to act together unless you include that requirement in the Special Instructions. If your agent is unable or unwilling to act for you, your power of attorney will end unless you have named a successor agent. You may also name a second successor agent.

Signing Requirements

- The principal must have their signature acknowledged before a notary public. If the agent decides to use the optional Agent Certification form, the agent must sign said document in the presence of a notary public and attach it to the power of attorney (§ 39B-1-105, § 39B-3-102).

Designation of Agent

- (1) Name Of Principal.The Issuer behind this paperwork, known as the West Virginia Principal, must be named. (2) Name Of Agent.The West Virginia Agent who will be able to use the authority this document conveys to carry out the Principal’s directives must be identified. (3)Agent’s Address. (4)Agent’s Telephone Number. (5) Successor Agent Name.A Successor Agent can be h…

Grant of Specific Authority

- (13) Inter Vivos Trust. Certain actions must be approved beforehand by the Principal before the Agent can be allowed to take them. This is the case even if the above list was tendered with the appropriate approvals and additional provisions have been provided. Thus a list of principal actions must be reviewed so that each action approved can be shown as an authorized action w…

Agent’S Authority

- (21) Special Instructions.This document presents the wording required to approve or authorize the West Virginia Attorney-in-Fact’s use of principal authority. The Principal can apply additional directives, restrict his or her Agent’s use of the granted authority, or even allow for conditions by using the first optional area provided to do so.

Nomination

- (22) Nominee For Conservator Of Estate.The Principal has the option of nominating a Conservator (or Guardian) to his or her estate. This can be useful in a case where West Virginia Courts determine that he or she requires a court-appointed Guardian of Estate (or Conservator). Nominating a specific Party holds no guarantees to this appointment since this is strictly up to t…

Agent’S Duties

- (30) Signing As Principal.An opportunity for the Agent to display the Principal’s printed name with the Agent’s signature is available to the Agent with the paperwork that he or she must review. It is recommended that the Agent take advantage of this practice area. Agent’s Certification (31) Location Of Agent Statement.The Agent’s acknowledgment of his or her appointment to the Atto…

Important Information

- This power of attorney authorizes another person (your agent) to make decisions concerning your property for you (the principal). Your agent will be able to make decisions and act with respect to your property (including your money) whether or not you are able to act for yourself. The meaning of authority over subjects listed on this form is explained in the Uniform Power of Attorney Act, …

Designation of Agent

- I __________________________ name the following person as my agent: (Name of Principal) Name of Agent:____________________________________________________ Agent’s Address:___________________________________________________ Agent’s Telephone Number:__________________________________________ If my agent is unable or unwilling to act for …

Grant of General Authority

- I grant my agent and any successor agent general authority to act for me with respect to the following subjects as defined in the Uniform Power of Attorney Act, §39B-1-101 et seq. of this code: (INITIAL each subject you want to include in the agent’s general authority. If you wish to grant general authority over all of the subjects you may initial “All Preceding Subjects” instead o…

Grant of Specific Authority

- My agent MAY NOT do any of the following specific acts for me UNLESS I have INITIALED the specific authority listed below: (CAUTION: Granting any of the following will give your agent the authority to take actions that could significantly reduce your property or change how your property is distributed at your death. INITIAL ONLY the specific authority you WANT to give your agent.) (…

Limitation on Agent’S Authority

- An agent that is not my ancestor, spouse, or descendant MAY NOT use my property to benefit the agent or a person to whom the agent owes an obligation of support unless I have included that authority in the Special Instructions.

Special Instructions

- You may give special instructions on the following lines: ______________________________________________________________________________________________…

Effective Date

- This power of attorney is effective immediately unless I have stated otherwise in the special instructions.

Nomination of

- If it becomes necessary for a court to appoint a [conservator or guardian] of my estate or [guardian] of my person, I nominate the following person(s) for appointment: Name of Nominee for [conservator or guardian] of my estate: _________________________________________________________________ Nominee’s Address:_________…

Important Information For Agent

- Agent’s Duties When you accept the authority granted under this power of attorney, a special legal relationship is created between you and the principal. This relationship imposes upon you legal duties that continue until you resign or the power of attorney is terminated or revoked. You must: (1) Do what you know the principal reasonably expects you to do with the principal’s property or, …

Termination of Agent’S Authority

- You must stop acting on behalf of the principal if you learn of any event that terminates this power of attorney or your authority under this power of attorney. Events that terminate a power of attorney or your authority to act under a power of attorney include: (1) Death of the principal; (2) The principal’s revocation of the power of attorney or your authority; (3) The occurrence of a ter…

Popular Posts:

- 1. cook county judge who is not an attorney

- 2. how to fill out the volkswagen tdi power of attorney form

- 3. what did martin luther king jr and attorney general robert kennedy have in common

- 4. g what is a durable power of attorney

- 5. need an attorney who is well versed in joint ventures

- 6. how old is millard farmer attorney

- 7. how old should son or daughter be to have power of attorney

- 8. who appointed rosenstein as assistant attorney general.

- 9. what most people type in to search for a local divorce attorney?

- 10. how to advertise personal injury attorney