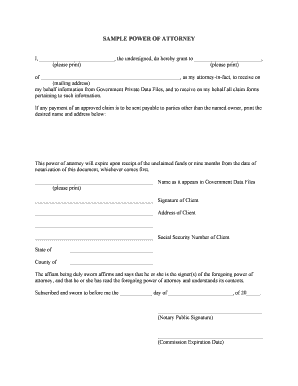

Follow the step-by-step instructions below to design your power of attorney form:

- Select the document you want to sign and click Upload.

- Choose My Signature.

- Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature.

- Create your signature and click Ok.

- Press Done.

Full Answer

Where can one obtain a power of attorney form?

You can obtain the necessary forms in several ways, including from a licensed attorney, from a legal services provider, or directly from your state. 1. Determine your state's requirements. State statutes authorize power of attorney forms. Many states' laws follow the Uniform Power of Attorney Act.

How can I set up a power of attorney?

Setting up a lasting power of attorney

- Contact the Office of the Public Guardian to get the relevant forms and an information pack. ...

- You can fill out the forms yourself, or with the help of a solicitor or local advice agency. ...

- Have your LPA signed by a certificate provider. ...

- The LPA must be registered with the Office of the Public Guardian before it can be used. ...

Where can I get durable power of attorney forms?

While this may appear to be the quick and easy way of creating your power of attorney, or POA, it may cost you far more in the long run. In today’s electronic age a wide variety of legal forms can be purchased at Staples or Office Depot as well as downloaded from the internet.

Where can I get a free power of attorney form?

You can get a power of attorney form from the following places: your state government offices or websites (e.g., the Department of Health Services) your lawyer; our selection of free state-specific power of attorney forms; our free online power of attorney form builder; You can also pick up a power of attorney form from your local bank. Many banks and financial institutions have durable power of attorney forms available. 3.

Can you DocuSign POA?

With DocuSign Notary, the claimant can now sign and get their POA notarized electronically and remotely — removing the hassles of meeting in person and saving time for both the signer and the company.

How do I get power of attorney in Illinois?

Steps for Making a Financial Power of Attorney in IllinoisCreate the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Recorder of Deeds.More items...

How do I get power of attorney in Ohio?

Here are the basic steps to make your Ohio power of attorney:Decide which type of power of attorney to make. ... Decide who you want to be your agent or surrogate. ... Decide what powers you want to give your agent or surrogate. ... Get a power of attorney form. ... Complete the form, sign it, and then have it notarized or witnessed.More items...•

What is the best form of power of attorney?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

Does a power of attorney have to be filed with the court in Illinois?

For real estate transaction, Illinois requires the filing of a standard power of attorney form called the Illinois Statutory Short Form Power of Attorney for Property. It is a boilerplate document anyone can fill out, sign, and have notarized with the help of a licensed attorney.

Can I do power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

Does a power of attorney have to be filed with the court in Ohio?

No, power of attorney documentation is not filed with the courts. However, in some parts of Ohio, the property will get filed with the county recorder's office to allow the attorney to manage real estate property. Otherwise, simply signing the document is all that the law requires.

Does a power of attorney need to be notarized in Ohio?

While Ohio does not technically require you to get your POA notarized, notarization is strongly recommended. Under Ohio law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuine—meaning your POA is more ironclad.

Does a power of attorney need to be recorded in Ohio?

A power of attorney for the conveyance, mortgage, or lease of an interest in real property must be recorded in the office of the county recorder of the county in which such property is situated, previous to the recording of a deed, mortgage, or lease by virtue of such power of attorney.

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

How do you activate a power of attorney?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.

Do I need a power of attorney if I have a will?

A will protects your beneficiaries' interests after you've died, but a Lasting Power of Attorney protects your own interests while you're still alive – up to the point where you die. The moment you die, the power of attorney ceases and your will becomes relevant instead. There's no overlap.

Does a power of attorney need to be notarized in Illinois?

It does not need to be notarized. Like the financial form, this form includes detailed instructions, including an explanation of the types of persons who may not serve as a witness. This form may be found in the Illinois Compiled Statutes, Chapter 755, Article 45, Section 4-10.

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What are the 3 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.

Who makes medical decisions if there is no power of attorney Illinois?

Health Care Surrogate Act, Section 15. The law permits family members to make decisions about medical conditions outside the scope of existing powers of attorney or similar.

How to sign a POA?

Step 1: Bring Your Power of Attorney Agreement and ID. When signing as a POA, you need to bring the original power of attorney form to the meeting — even if you’ve already registered a copy of the document with the institution (such as a bank, financial agency, or a government institution). You also need to bring government-issued photo ...

What is a power of attorney?

A power of attorney is a document that creates a legally binding agreement between two parties — a principal and an attorney-in-fact. A power of attorney form grants an attorney-in-fact the right to: access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs.

How to act as an attorney in fact?

access the principal’s financial accounts. sign legal documents on the principal’s behalf. manage the principal’s legal and business affairs. As an attorney-in-fact, you must act in the principal’s best interest, and adhere to their wishes when signing documents for them. This means doing what the principal would want you to do, no matter what.

Can you sign a contract on the principal's behalf?

Failing to indicate that you’re signing on the principal’s behalf can invalidate the agreement, and even lead to civil or criminal lawsuits.

Do you use the principal's name?

And remember to use the principal’s full legal name. If you see their name listed on any pre-existing paperwork at the institution, be sure to replicate its format.

Can you sign a power of attorney?

When someone gives you power of attorney (POA), you’re legally able to sign legal documents on their behalf if necessary. However, signing as power of attorney isn’t as simple as writing down both of your names. For a power of attorney signature to be valid, you must take the proper steps.

How to choose a power of attorney?

Step 1 – Choose an Agent. Select and ask someone that you trust if they would like to be your “Agent” or “Attorney-in-Fact”. Especially for a durable power of attorney, the agent selected should be someone you have trusted most of your life.

How many steps are required to get a power of attorney?

An individual may get power of attorney for any type in five (5) easy steps:

Why Have Power of Attorney?

Accidents happen. Any person who should become incapacitated through an accident or illness would need to make arrangements beforehand for their financial and medial affairs.

What does revocation of power of attorney mean?

Revocation Power of Attorney – To cancel or void a power of attorney document.

What is a general power of attorney?

General ($) Power of Attorney – Grants identical financial powers as the durable version. Although, the general power of attorney is no longer valid if the principal becomes mentally incompetent.

How many witnesses do you need for a notary?

In most cases, a Notary Public will need to be used or Two (2) Witnesses. STATE. DURABLE.

Can a principal use a power of attorney?

For other nominations, a principal may assign power of attorney under a special circumstance with the limited form. In addition, if the principal is looking to have someone only handle personal and business filings the tax power of attorney should be used.

What is a power of attorney?

In the United States, a Power of Attorney enables a person to legally make medical, financial, and certain personal decisions (such as recommending a guardian) for another person. You may need to grant someone power of attorney if you are incapable of handling all or part of your affairs for a period of time.

How many witnesses are needed to sign a power of attorney?

Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people. For instance, in Florida, a power of attorney document must be signed by two witnesses while in Utah, no witnesses are required.

How to get guardianship if you have no power of attorney?

Pursue legal guardianship if you cannot obtain power of attorney. If the person is already mentally incapacitated and did not grant power of attorney in a living will, it may be necessary to get conservatorship or adult guardianship. In most regards, the authority held by a guardian is similar to (but more limited than) those held by someone with power of attorney. A guardian is still accountable to the court, and must provide regular reports of transactions. To become a guardian of someone, a court must deem the principal to be “legally incompetent." In other words, they are judged to be unable to meet their own basic needs. If you believe someone you known meets the criteria for incompetence, you may petition the court to be named guardian.

What is an ordinary power of attorney?

An ordinary or general power of attorney is comprehensive. It gives the agent all the powers, rights, and responsibilities that the person granting POA has. A person can use an ordinary power of attorney if s/he is not incapacitated but needs help in some areas. An ordinary power of attorney usually ends with the death or incapacitation of the person granting POA.

Why is notarizing a power of attorney important?

Notarizing the power of attorney document reduces the chance that it will be contested by an outside party.

Why is it important to have a power of attorney?

Because the decisions that the person holding power of attorney makes are legally considered the decisions of the principal, it's vital that the agent be someone you trust absolutely and without question. Consider the following when thinking about possible agents: Consider how close the candidate is to the principal.

What happens when you file a guardianship petition?

Once you file the petition, the court will schedule a hearing. At the hearing, the proposed guardian must establish the incompetence of the proposed ward (the principal) and that no suitable alternatives to guardianship are feasible.

How to authorize a power of attorney?

Authorize with Form 2848 - Complete and submit online, by fax or mail Form 2848, Power of Attorney and Declaration of Representative.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

Where is my tax authorization?

Your Tax Information Authorization is recorded on the Centralized Authorization File (CAF) unless Line 4, Specific Use is checked. The record lets IRS assistors verify your permission to speak with your representative about your private tax-related information.

Do you have to meet your tax obligations when you authorize someone to represent you?

You still must meet your tax obligations when you authorize someone to represent you.

Who can authorize oral disclosure?

You can authorize your tax preparer, a friend, a family member, or any other person you choose to receive oral disclosure during a conversation with the IRS.

What is a power of attorney?

A "Power of Attorney" is a written document often used when someone wants another adult to handle their financial or property matters. A Power of Attorney is a legal form but is NOT a court form. A Power of Attorney cannot be used to give someone the power to bring a lawsuit on your behalf. Only licensed attorneys can bring lawsuits on behalf ...

Who is the principal of a power of attorney?

The "principal" is the person who creates a Power of Attorney document, and they give authority to another adult who is called an "attorney-in-fact.". The attorney-in-fact does NOT have to be a lawyer and CANNOT act as an attorney for the principal. The attorney-in-fact must be a competent adult (18 years or older).

What is a power of attorney in Missouri?

Missouri Power of Attorney Forms permit individuals to have third party representation by authorizing agents to act on their behalf. There are three (3) different types of contracts for assigning a financial agent: the durable, general, and limited power of attorney forms. The tax and motor vehicle forms are usually used for a single transaction involving tax filing or a vehicle sale, respectively. The durable power attorney forms allow the person being represented (the principal) to appoint a representative to make financial or medical decisions for them if they become incapacitated. There is no state statute that requires witnesses when executing the document but it is usually required to have a notary public acknowledge and stamp the completed and signed form.

What is a durable power attorney?

The durable power attorney forms allow the person being represented (the principal) to appoint a representative to make financial or medical decisions for them if they become incapacitated.

Popular Posts:

- 1. what are probate attorney fees in michigan?

- 2. who select the us attorney general

- 3. how does trilo quist make facial expressions ace attorney

- 4. when should an attorney do the deed title search

- 5. ns when a court revokes a power of attorney

- 6. who does the us attorney report to

- 7. what is the difference between a power of attorney and an attorney in fact?

- 8. how to play ace attorney on citra

- 9. why would i get a certified letter from the district attorney

- 10. district judge district attorney who is more powerful