How to find an estate or trust attorney?

Mar 26, 2016 · Ask people you trust where you work, within your family, or at your place of worship if they’ve personally worked with an attorney on estate or trust matters and whether they were satisfied with the service they received. * Referrals from other professionals or within law firms: You may already be working with a tax pro or an investment advisor who may have the …

What does a trust lawyer do?

Dec 14, 2021 · Trusts & Estates: Finding a Good Lawyer Research and Compile a List. In any case, you will need to do a little research to find a trusts and estates attorney... Talk to a Few Estate Planning Attorneys. After you’ve narrowed your list to just a few attorneys, do some deeper... Choose the Right Lawyer ...

Do I need an attorney for my Living Trust?

There are many benefits of hiring a trust law attorney. Whether you have a small or large estate, your trust attorney can help you determine what type of trust is best for you and what you can put in it. Your attorney can also explain any potential tax implications and legal formalities relating to the trust to ensure that your estate is protected. They can also advise you on the best avenues …

What is a power of attorney for a trust?

Apr 01, 2015 · Websites – There are a number of amazing websites that can help you when you want to make sure to find a trustworthy attorney. Search the Internet using keywords, which pertain to your particular case. Call the lawyer and get a feel for him/ her on the phone. Lawyer Directory – If you get stuck, there are a number of lawyer directories available.

What are the disadvantages of a living trust?

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. ... Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. ... Transfer Taxes. ... Difficulty Refinancing Trust Property. ... No Cutoff of Creditors' Claims.

What better trust or will?

Even if most of your assets are held in ways that avoid probate, it usually is advisable to have a will. With a carefully drafted will, although your estate will be subject to probate, the cost may be less than setting up and managing a trust.

How do you resolve a trust?

You may be able to resolve trust problems with a beneficiary by:Seeking a compromise as long as you are can do so without violating your fiduciary duty or your obligations as trustee.Considering a formal request for a new trustee or your resignation if the relationship is not working.

At what net worth do I need a trust?

Here's a good rule of thumb: If you have a net worth of at least $100,000 and have a substantial amount of assets in real estate, or have very specific instructions on how and when you want your estate to be distributed among your heirs after you die, then a trust could be for you.

What assets Cannot be placed in a trust?

Assets That Can And Cannot Go Into Revocable TrustsReal estate. ... Financial accounts. ... Retirement accounts. ... Medical savings accounts. ... Life insurance. ... Questionable assets.Jan 26, 2020

Can a trustee withdraw money from a trust account?

Trust money can only be dispersed in accordance with a direction given by the person on whose behalf the money is been held. Further, trust money can only be withdrawn by cheque or electronic funds transfer. Regulation 65 of the Regulations governs the withdrawal of trust money for the payment of legal costs.

How do you remove assets from a trust?

With your living trust, you can add or remove any property and ensure that your wishes are met.Begin an amendment for your living trust. ... Sign the amendment. ... Visit a notary public, and have your amendment notarized. ... Attach the notarized amendment to the original living trust.Restate the living trust.

How do I remove myself from a beneficiary of a trust?

This could be done by granting the trustee a power of attorney with a gift rider and an option to exercise a power of appointment to appoint a new beneficiary and remove the old beneficiary. You can see a situation where this would come in handy. Question 1: I set up an irrevocable trust with myself as the trustee.Aug 5, 2020

What can a trust and estates attorney do?

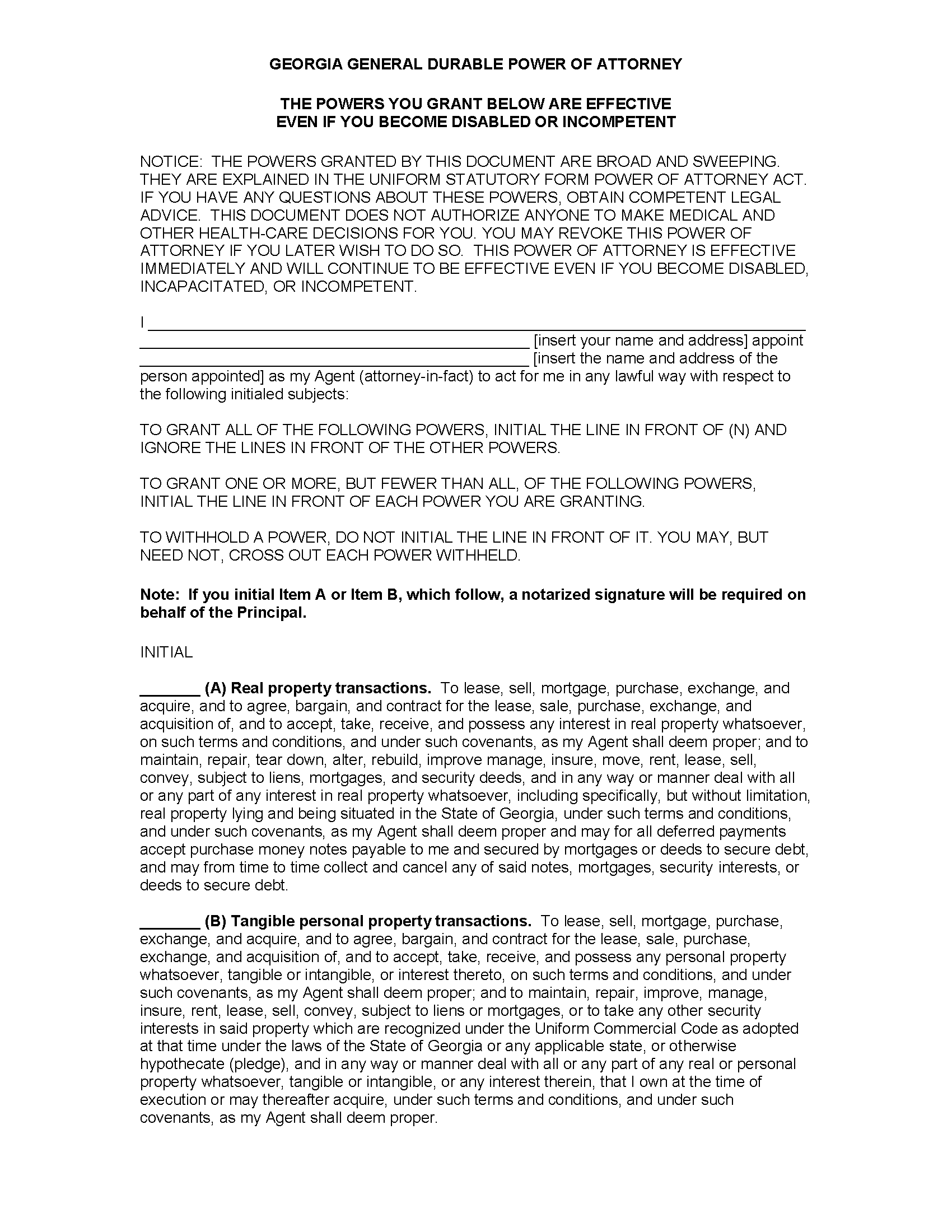

A trusts and estates attorney can help you: make a plan for what will happen your property when you die ( wills and trusts) avoid probate (living trusts, transfer-on-death tools, beneficiary designations) reduce estate taxes. plan for incapacity (powers of attorney and living wills) set up trusts for loved ones. manage ongoing trusts.

How should a lawyer's staff treat you?

At a minimum, you should expect to be treated courteously and professionally both by the staff and by the lawyer.

Does experience make a good lawyer?

After all experience does not necessarily make a good lawyer, and a newer attorney may very well become a great attorney. However, less experienced attorneys should also know when they are in over their heads, so make sure that any less experienced lawyer you hire has a more experienced attorney to consult, if needed.

Does Medicaid affect estate planning?

For example, if you're going to rewrite your will and your spouse is ill, the estate planner needs to know about how Medicaid will affect your estate plan. Unfortunately, there are some attorneys who hold themselves out as experts in trusts and estates, but who have little or no experience in this area of practice.

Does every state have a certified specialist in trusts?

Not every state certifies specialists in trusts and estates, or estate planning, but if your state does, selecting a lawyer with this certification provides an added assurance that he or she is qualified. (A certified specialist may charge more than someone without a certification.)

Do wills have to be made by attorneys?

Simple wills, trusts, and powers of attorney don’t have to be made by attorneys. And with good self-help products, you can either make your own documents or learn more about the documents that an attorney will make for you.

What is a Trust Lawyer?

A trust lawyer is a lawyer that specializes in laws related to trusts. A trust is a tool used in estate planning. In a trust, a relationship is created at the direction of an individual called a trustor or settlor.

Why is it Important to Have a Trust Attorney?

There are many different types of trusts. A trust attorney can help determine which may be the best fit for your needs.

What are Some Other Issues Related to Trust Law?

There are several requirements for creating a trust that must be satisfied in order for the trust to be valid. These include:

What are the Benefits of Hiring a Trust Law Attorney?

There are many benefits of hiring a trust law attorney. Whether you have a small or large estate, your trust attorney can help you determine what type of trust is best for you and what you can put in it. Your attorney can also explain any potential tax implications and legal formalities relating to the trust to ensure that your estate is protected.

What is a revocable trust?

Typically, revocable trusts are the most common types of trusts. Also referred to as inter vivos trusts, this type of trust is created while you’re alive and easily allows the Grantor to manage (add and remove) assets in the trust throughout his/her lifetime. Setting up a revocable living trust allows you to designate an individual to manage your estate upon your incapacity and death, including designating who will receive your property and how.

How to set up a trust?

The first thing you need to do is meet with an experienced trust attorney. Those with trust litigation experience generally draft better trusts. The attorney will help you determine what type of trust you need. To prepare for your meeting you should: 1 Catalog your assets. This includes real estate, financial accounts, and tangible property; 2 Select your initial trustee (s), the person in charge of managing the trust. If you’re setting up a revocable trust, this is usually you. If you are elderly or have trouble getting out of the house to manage your finances, you can name a family member or professional fiduciary; 3 Select successor trustees. These individuals are named to manage your trust assets and distribute property when you become either incapacitated or pass away. Typically, this person is a spouse, close friend, adult child, or a licensed professional fiduciary. If you have young children, you can specifically list a trustee who can manage their inheritance until they are of an age you choose; 4 Identify the beneficiaries and/or heirs who will inherit the trust.

Why do we have subtrusts?

Probably. Sub-trusts are created to limit distributions. This could be set up for a variety of reasons but the main reason to create subtrust is to protect a beneficiary. This allows you to write the rules for how the money can be spent, who manages it, and at what age the beneficiary can manage it on their own (if ever).

Can a testamentary trust be made in California?

Unlike living trusts, testamentary trusts don’t go into effect until the death of the Grantor, which means they cannot protect an individual in the event of incapacity. Testamentary trusts are uncommon in California. They are typically made within a will, and the Grantor is able to make changes up until his/her death.

Can an irrevocable trust be modified?

Unlike revocable living trusts, an irrevocable trust cannot be changed once it has been set up as the Grantor loses control of the assets in order to receive the full tax benefits. There are some circumstances under which irrevocable trusts can be modified but modifications can be difficult and costly in a way that revocable trusts are not. Irrevocable trusts can either be drafted as irrevocable (usually to achieve favorable tax benefits), or are revocable living trusts that have become irrevocable due to the death or incapacity of the Grantor.

Can a trust be a sacred document?

Yes. Similar to number three above, a trust is the sacred document that will list out your beneficiaries, what they will receive, when, and how. This allows you to plan the future of your assets along with protecting your beneficiaries from themselves and creditors.

Is probate a public process?

No. Probate is a lengthy and costly process. Additionally, probate is a public process where anyone willing to travel to the courthouse can obtain copies of your will and any associated documents. This will only add additional stress for your loved ones during an already challenging time.

What are the requirements for a trust?

Additionally, the requirements for forming a trust vary by state. However, the following requirements are typically necessary: 1 Settlor Capacity: In order to create a valid trust, the settlor must possess the proper mental capacity to create the trust. What this means is that they must intend to create a trust expressed with any necessary formalities of their state, such as the trust being made in writing; 2 Identifiable Property: Trust property is also known as “trust res,” and must be specifically identifiable. This means that there must be a sufficient enough description of the property to know what property is to be held in trust; 3 Identifiable Beneficiary: Generally speaking, the beneficiary or group of beneficiaries must be sufficiently identifiable. Meaning, they must be able to be determined at the time the trust is formed. However, in cases such as those involving charitable trust, this requirement is often not necessary; and 4 Proper Trust Purpose: The trust that is being formed must be proper. This means that the trust cannot be created for an illegal reason. An example of this would be how a person cannot create a spendthrift trust and hold the property in their own name for their benefit, simply to avoid creditors reaching their assets. Courts will usually hold that such trusts are invalid.

Why do trusts have fiduciary duties?

Once a trust has been established, the trustee has a fiduciary duty to act in the best interest of the trust and its recipients, the beneficiaries. This constitutes one of the most common reasons why trusts are created: to ensure the safekeeping ...

What is a trust dispute?

Trust dispute litigation is a civil lawsuit filed in probate court with the intention of resolving any disputes related to the trust in question.

What is a trust contest?

Conflicts over what a trust says are referred to as trust contests. To contest a trust means to challenge the authority or validity of the trust, as well as its provisions. Some of the most common examples of will and trust contests include: Disputes concerning which family member is entitled to what specific property;

What does it mean when a trust is a beneficiary?

This means that there must be a sufficient enough description of the property to know what property is to be held in trust; Identifiable Beneficiary: Generally speaking, the beneficiary or group of beneficiaries must be sufficiently identifiable. Meaning, they must be able to be determined at the time the trust is formed.

What is constructive trust?

A constructive trust can counteract the trustee’s initial mismanagement of the trust. Additionally, if a court finds that a trustee used assets from the trust to their own personal benefit, the trustee may be held liable for and be ordered to fully reimburse the beneficiaries.

What is a trust relationship?

A trust is a specific type of fiduciary relationship in which one party holds legal title to property, for the benefit of named individuals. A trust occurs when an individual (known as the “trustor” or “settlor”) creates a legal relationship by giving another individual (known as the “trustee”) control over their property or assets.

Popular Posts:

- 1. what to look for in a wrongful death attorney

- 2. which admendmant allows an attorney to question witnesses

- 3. what was the attorney name for the hit-and-run in opelousas louisiana

- 4. can you hire an attorney who used to represent your ex

- 5. what was the name of charles manson's defense attorney who disappeared

- 6. what dooes it mean when my attorney says he has "rs" for me to sign?

- 7. how to type a power of attorney document for medical and school alabama

- 8. how much are attorney fees for dwi in college station

- 9. who does the manhatten district attorney anser to?

- 10. how to not be someone's power of attorney