Can you buy a car with a power of attorney?

In compliancew ith federal law, the secure Power of Attorney for Transfer of Ownership to a Motor Vehicle (Form VTR-271-A) must be used when use of a power of attorney is permitted by the applicable regulations for a vehicle subject to federal odometer disclosure. If a power of attorney is used to apply for title, initial registration, or a certified copy of title, the grantor …

What is durable power of attorney in Texas?

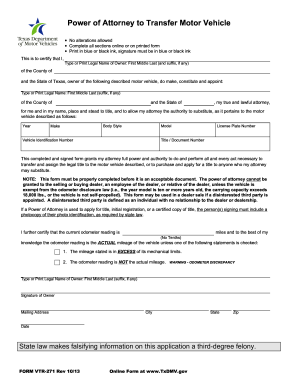

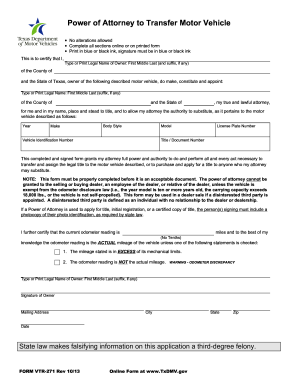

Vehicle Identification Number Title / Document Number This completed and signed form grants my attorney full power and authority to do and perform all and every act necessary to transfer and assign the legal title to the motor vehicle described, or to purchase and apply for a title to anyone who my attorney may substitute.

Can a power of attorney sell property in TX?

Jun 11, 2021 · Filling Out the Texas Vehicle POA Form. 1. Get the Correct Template of the POA Form. If you need to complete a Texas vehicle power of attorney form, you should ensure that you have chosen the correct template. In Texas, a vehicle POA form is also referred to as the VTR-271 Form. To get the file quickly, use our form-building software.

What is Texas real estate power of attorney?

VTR-271 Rev 12/15 Online form at www.TxDMV.gov Limited Power of Attorney for Eligible Motor Vehicle Transactions Instructions All sections of this form must be properly completed in black or blue ink in order for this to be an acceptable document. The signature must be in black or blue ink. No alterations are allowed on the form.

How do I fill out a Texas vehicle transfer form?

2:124:13Texas Title Transfer SELLER Instructions - YouTubeYouTubeStart of suggested clipEnd of suggested clipAlong with the buyer print. And fill out the form 130. You it's the application for Texas title and/MoreAlong with the buyer print. And fill out the form 130. You it's the application for Texas title and/or registration you and the buyer must sign it can be perfect from the resources.

Can a power of attorney transfer title?

Even an irrevocable Power of Attorney does not have the effect of transferring title to the grantee. So, Power of Attorney does not convey ownership. An attorney holder may however execute a deed of conveyance in exercise of the power granted under the power of attorney and convey title on behalf of the grantor.Feb 3, 2020

How do you transfer ownership of a car in Texas?

To transfer a Texas titled vehicle, bring in or mail the following to our offices:Texas title, signed and dated by the seller(s) and buyer(s). ... VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s). ... Proof of insurance in the buyer's name.Acceptable form of ID.Proof of inspection.Fees.Sep 23, 2019

How do I transfer ownership of a car to a family member in Texas?

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317). The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. This can be difficult to determine and may cause a conflict of interests between the interests of an Attorney and the best interests of their donor.

Can a power of attorney deed property to himself in Texas?

As a general rule, a power of attorney cannot transfer money, personal property, real estate or any other assets from the grantee to himself.Sep 21, 2021

Can I do a title transfer online?

Transfer your Title online! You can now transfer a title online. Learn more about the steps and get started.

Can I do title transfer online in Texas?

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: *PREFERRED METHOD* If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

How much does it cost to transfer a title in Texas?

Fees one can expect to pay when buying a car in Texas are as follows: Sales Tax: 6.25% of the total vehicle purchase price. Title Transfer Fee: $28 to $33 (varies by county) Tag / License Fee: $51.75 base fee, $10 local fee.

How do I transfer a car title to my son?

The procedures for transferring ownership are similar to buying or selling a car: the donor must include the odometer disclosure on the title, both parties must sign and date the title, and the recipient must go to the DMV and apply for a a new title in his/her name and pay the transfer fee.

Can I register a vehicle that is not in my name in Texas?

You may only register a vehicle on behalf of the titled owner with a Permission Letter and acceptable form(s) of ID for you and the owner.Jun 2, 2020

How much is a gift tax in Texas?

A motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into Texas.

How many heirs are required to sign a affidavit of heirship?

If the transfer is completed using an Affidavit of Heirship for a Motor Vehicle, only one heir is required to sign this affidavit as donor. When there are multiple donors or recipients signing, additional copies of this form should be used to document signatures and notary acknowledgements.

What is a power of attorney form for a car in Texas?

The Texas motor vehicle power of attorney form, also known as VTR-271, allows a person who owns a vehicle located in Texas to transfer its ownership through the use of an agent he or she selects. The person chosen must sell the vehicle in the best interests of the principal and should forward all sale proceeds to the principal.

What is a Durable Power of Attorney in Texas?

Texas Power of Attorney Forms enables an individual to choose a trusting person, called an “agent” or “attorney-in-fact,” to make financial, medical, parental/guardianship (minor child), and vehicle-related decisions on their behalf. There are also special forms, referred to as “Durable,” that allow the document to remain effective even if the principal (person being represented) should become incapacitated. Use of the Durable forms ensures the principal that their health and finances will be managed properly regardless of their mental capacity.

What is a durable financial power of attorney?

The Texas durable financial power of attorney, also known as the “Statutory” form, can be used to designate powers to another person for monetary reasons that are broad and sweeping.

Can a physician be a power of attorney in Texas?

The Texas medical power of attorney form allows a principal to name an individual to make all types of health care decisions on their behalf in the chance that they cannot do so because of mental incapacity. A physician can’t be an agent, and there are restrictions on choosing certain individuals professionally involved in the principal’s health care. When choosing an agent, local availability is…

How to submit a vehicle transfer notice?

To submit a Vehicle Transfer Notice, visit the TxDMV website where you have the option of submitting the application online, or printing out a form to mail. It's also recommended to keep a record of the buyer's information, including: Their name, address, and contact info. The date and price of sale.

How long do you have to register a car in Texas?

After moving to Texas, you have 30 days to title and register your out-of-state vehicle with the TX Department of Motor Vehicles. You'll first need to have your car inspected at your closest inspection station. This inspection will consist of a safety check for all vehicles, and an emissions check for specific counties.

How long is a title transfer permit good for?

This permit is good for 5 days, and you may ONLY drive to and from your county tax office. You will only be issued 1 permit.

How long do you have to title a car when buying from a private seller?

Buying from a Private Seller. If you purchase a car from a private seller, you must title your car within 30 days of the date of sale. The DMV recommends that you visit your county tax office with the seller. At minimum, you must bring the following with you to transfer ownership:

How long does it take to get a lien off a car?

When you finish paying off your car loan, your lender must release the lien within 10 business days. If your lender recorded the lien on a paper title, they must send the title certificate to you by mail. Once you receive the title, you will need to submit it along with the following to the DMV:

Popular Posts:

- 1. what is an attorney docket

- 2. how to find out if an attorney won a case

- 3. who is the wood county attorney in wisconsin rapids wisconsin

- 4. how many episodes will the ace attorney be

- 5. what does pierce county wa pay id public defense attorney

- 6. how power of attorney works in real estate closing

- 7. specific power of attorney for real estate california how to fill

- 8. what does it take to become an immigration attorney

- 9. what does "as power of attorney" mean in plaintiff name

- 10. is the original power of attorney required when recording a deed in arizona