How to fill out a customs power of attorney form?

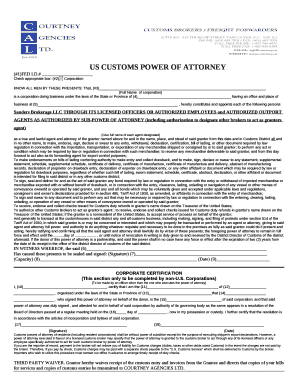

Instructions for Completing the Customs Power of Attorney . 1. Check the appropriate block indicating the type of organization – Individual, Partnership, Corporation, Sole Proprietor, LLC 2. Enter the company’s Federal Tax ID or IRS number in the indicated field a. Individuals will fill in their social security number b.

Do I need power of attorney for a customs broker?

Dec 16, 2021 · Customs Power of Attorney. A Customs Power of Attorney is a specific type of Power of Attorney designed to be used by Custom Brokers. The form is specifically used by importers and other shipping companies that allow them to make necessary decisions regarding shipments that are under the jurisdiction of the Customs and Border Protection agency.

Who is required to sign a PoA customs agreement?

Instructions for Completing the Customs Power of Attorney 1. Check the appropriate block which best identifies the type of importer you or your company will be. 2. Provide the company’s Federal Tax ID number or, if an individual, your Social Security Number.

Do I need a power of attorney to clear goods?

May 25, 2018 · Here are some ways the broker can validate a Power of Attorney: To the greatest extent possible, have POA’s completed in person so the grantor’s unexpired government issued photo identification (driver’s license, passport, etc.) can be reviewed. Check applicable web sites to verify the POA grantor’s business and registration with the ...

How do I fill out a US power of attorney form?

2:478:33The Customs Power of Attorney - YouTubeYouTubeStart of suggested clipEnd of suggested clipHere. You would insert the state where your company is doing business as in this example the stateMoreHere. You would insert the state where your company is doing business as in this example the state of Georgia. Then the form continues. Having an office and place of business at.

Why does the CBP require a POA between the shipper and the broker?

A power of attorney (POA) is a legal document used in shipping to grant a customs broker the authority to process Customs clearance on your behalf. A signed POA is necessary in order to clear your goods through US Customs.

What is a POA for shipping?

In shipping, Power of Attorney is used when an importer or an exporter appoints an agent to act on their behalf to handle parts of the shipment. POA is commonly used during customs clearance - this refers to the authorization the importer or the exporter gives to the customs broker to process clearance on their behalf.

How do I verify a power of attorney?

Record of rights of the concerned plot be verified. Search in the office of the Registering Authority where the POA was registered, to verify the authenticity of the POA. Payment be made by cheque executing a registered deed of Agreement to Sell.

What is Port of Entry?

A port of entry (POE) is a place where one may lawfully enter the nation. International airports are usually ports of entry, as are road and rail crossings on a land border, and major seaports. U.S. Customs and Border Protection enforces the import and export regulations and immigration programs of the U.S. government.

What is a customs POA?

A 'Power of Attorney' (POA) – also known as a 'Letter of Empowerment' – refers to the authorisation required to be given to the customs broker on behalf of the importer or exporter.Aug 20, 2020

Do you need a POA to file ISF?

Yes, you should get a POA from the NVOCC if they are responsible for filing the ISF-5 for FROB cargo.Mar 15, 2019

How does a customs bond work?

A Customs bond is a legal contract between a principal (importer or shipper), a Surety company, and CBP that guarantees the importer complies with Customs regulations and that CBP is paid for applicable import duties, taxes, fines and penalties.Jul 7, 2020

What is power of attorney?

Power of Attorney is a general legal concept with applications beyond customs brokerage. You’ve likely heard of it in other contexts, such as personal finance or medical situations. Regardless of the situation, the principle is the same; legal authorization to act on your behalf, in whatever capacity you decide.

How long does a power of attorney last?

If you’re establishing Power of Attorney (PoA) as a partnership (instead of as a corporation, sole proprietor, or individual) the PoA must be limited to a maximum of two years. If the partnership members change at any time during the agreement’s term, the previously signed PoA becomes invalid and a new agreement must be obtained.

Who is authorized to sign a contract?

Whoever signs the agreement must be authorized to do so, which means anyone with the title of President, Vice-President, Secretary, or Treasurer. Equivalent titles and roles that may substitute as the authorized person include Chief Executive Officer, Chief Operating Officer, and Chief Financial Officer.

What does "endorse" mean in a contract?

Endorse, sign, or declare requests for delivery, entry, or withdrawal; Process any declaration, certificate, protest, bill of lading, or affidavit; Collect drawback and duty refunds; and. Act as a grantor of any bond required for importing.

Do you need to notarize a power of attorney?

Second, your Power of Attorney document does not need to be notarized. You only need to ensure whoever signs the agreement was authorized to do so by appropriate company heads. Finally, a customs agreement for Power of Attorney only authorizes the broker to work on your behalf with regards to customs business.

Do I need a power of attorney to import?

Power of Attorney is required any time an importer works with a customs broker to clear goods, whether the importer is a resident or non-resident, an individual, or business. There is no situation where you can legally work with a customs broker for importing in the United States without giving them Power of Attorney.

Popular Posts:

- 1. how long does it take an attorney to win ssi payments for the client?

- 2. how much is it to have an inhouse attorney

- 3. what happens if attorney doesnt file divorce papers

- 4. who do i contact in the state of california to get power of attorney to have somebody committed

- 5. what attorney can suit a bank>

- 6. attorney who checks guardianship papers

- 7. how to prepare a malpractice claim to present it to a attorney

- 8. what to write when sending an offer to attorney

- 9. how to get a power of attorney in maryland

- 10. what kind o attorney can do deed transfers