The way to complete the Power of Attorney Form 2848 2018 on the internet:

- To begin the form, utilize the Fill & Sign Online button or tick the preview image of the blank.

- The advanced tools of the editor will lead you through the editable PDF template.

- Enter your official identification and contact details.

- Apply a check mark to point the answer where expected.

- Double check all the fillable fields to ensure total precision.

How do I fill out a form 2848?

You will need to have a Secure Access account to submit your Form 2848 online. For more information on Secure Access, go to IRS.gov/SecureAccess. Online. Submit your Form 2848 securely at IRS.gov/Submit2848. Fax. Fax your Form 2848 to the IRS fax number in the Where To File Chart. Mail.

How to fill out form 2848 aka Power of attorney?

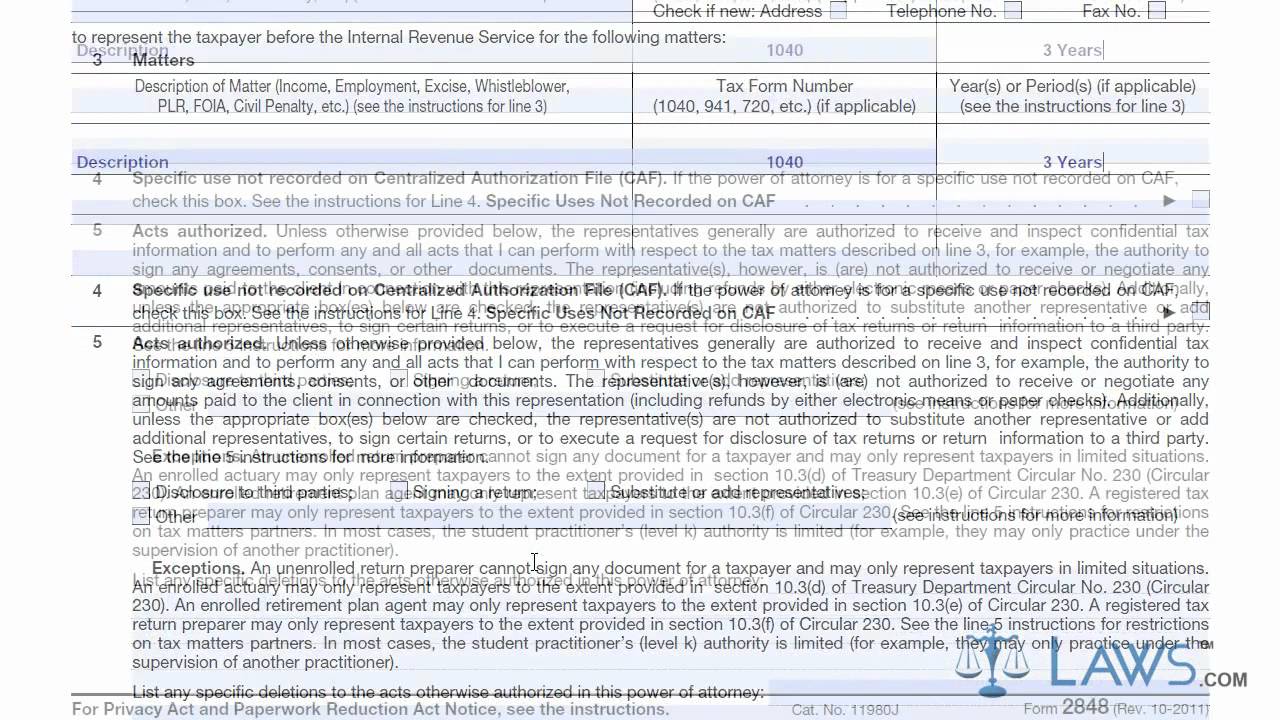

What is a Form 2848? Form 2848 allows taxpayers to name someone to represent them before the IRS. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. You can download a Form 2848 from IRS.gov or access the file in the image below. It’s just two pages but can be confusing if you’re …

How to complete form 2848?

If you check the box on line 4, mail or fax Form 2848 to the IRS office handling the specific matter. If you did not check the box on line 4, you can choose how to submit your Form 2848 from the options below. If you use an electronic signature (see Electronic Signatures below), you must submit your Form 2848 online. • Online. Submit your Form 2848 securely at IRS.gov/

How to suppress Form 2848?

Feb 18, 2022 · If you are completing Form 2848 as a business, list the business name, address, and Taxpayer Identification number. Line 2: List the name and address of the person (or persons) who you want to be your representative. Double check their name spelling and address before providing it on the form.

Who can fill out form 2848?

When do you need Form 2848?Attorneys.CPAs.Enrolled agents.Enrolled actuaries.Unenrolled return preparers (only if they prepared the tax return in question)Corporate officers or full-time employees (for business tax matters)Enrolled retirement plan agents (for retirement plan tax matters)More items...•Jan 18, 2022

Does form 2848 need to be notarized?

IRS Form 2848 (Power of Attorney and Declaration of Representative). If an original Form 2848 (which contains original signatures) is submitted to JSND, the form does not need to be notarized. If a copy of the form is submitted, the form must be notarized.

How long can you file form 2848?

Under “Years or Periods,” be specific. Do not write “all years.” Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.Nov 8, 2021

How do I submit power of attorney to IRS?

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.Jan 24, 2022

Can form 2848 be filed electronically?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.

Do I need to file form 2848?

A subsidiary must file its own Form 2848 for returns that must be filed separately from the consolidated return, such as Form 720, Quarterly Federal Excise Tax Return; Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return; and Form 941, Employer's QUARTERLY Federal Tax Return.Sep 2, 2021

What is the difference between 2848 and 8821?

IRS Form 8821, Tax Information Authorization, allows you certain access to your client's information. In that way, it is similar to a power of attorney but grants less authority. The biggest difference between Form 2848 and Form 8821 is that the latter does not allow you to represent your client to the IRS.Mar 23, 2021

How long does IRS take to process form 2848?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.Jan 26, 2021

Where can I get form 2848?

Page 1Form 2848. (Rev. January 2021) Department of the Treasury. ... Power of Attorney. and Declaration of Representative.▶ Go to www.irs.gov/Form2848 for instructions and the latest information.OMB No. 1545-0150. For IRS Use Only. Received by: ... / /Part I.Power of Attorney.Cat. No. 11980J. Form 2848 (Rev.More items...

Can I upload documents to IRS?

Depending on the situation, the acceptable types of documentation may include copies of pay statements or check stubs. You take a picture of your documentation and the Documentation Upload Tool enables you to upload the image. And just like that, the IRS can access the data and continue working the case.Aug 26, 2021

What is a 2848 form?

Form 2848 allows taxpayers to name someone to represent them before the IRS. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. You can download a Form 2848 from IRS.gov or access the file in the image below.

How many years can you list on a power of attorney?

Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.

What is line 3 on a 1040?

Line 3 – Acts authorized: These are the acts you, the representative, are being authorized to perform. If you’re simply filing a return for a parent, you can list “Income” under “Description of Matter.”. Write 1040 for the tax form number if you’re filing a basic tax return for your parent.

What to do if you don't have a CAF number?

If you don’t have one, enter “none” and the IRS will assign a number to you. You should get a letter from the IRS with your CAF number, which you will need to use when you send a Form 2848 along with each year’s tax return for your parent. You can leave PTIN blank (this is a number assigned to paid tax preparers).

What does "accept payment" mean?

accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative (s) or any firm or other. entity with whom the representative (s) is (are) associated) issued by the government in respect of a federal tax liability.

How to use Form 2848?

Use Form 2848 to authorizean individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS. Form 2848, Part II, Declaration of Representative, lists eligible designations in items (a)–(r). Your authorization of an eligible representative will also allow that individual to inspect and/or receive your confidential tax information.

What is Form 2848?

We ask for the information on this form to carry out the Internal Revenue laws. Form 2848 is provided by the IRS for your convenience and its use is voluntary. If you choose to designate a representative to act on your behalf, you must provide the requested information. Section 6109 requires you to provide your identifying number; section 7803 authorizes us to collect the other information. We use this information to properly identify you and your designated representative and determine the extent of the representative's authority. Failure to provide the information requested may delay or prevent honoring your power of attorney designation; providing false or fraudulent information may subject you to penalties.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

What is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.Limited representation rights. Unenrolled return preparers may only represent taxpayers before revenue agents, customer service representatives, or similar officers and employees of the Internal Revenue Service (including the Taxpayer Advocate Service) during an examination of the tax period covered by the tax return they prepared and signed (or prepared if there is no signature space on the form). Unenrolled return preparers cannot represent taxpayers, regardless of the circumstances requiring representation, before appeals officers, revenue officers, attorneys from the Office of Chief Counsel, or similar officers or employees of the Internal Revenue Service or the Department of the Treasury. Unenrolled return preparers cannot execute closing agreements, extend the statutory period for tax assessments or collection of tax, execute waivers, execute claims for refund, or sign any document on behalf of a taxpayer.Representation requirements. Unenrolled return preparers must possess a valid and active Preparer Tax Identification Number (PTIN) to represent a taxpayer before the IRS, and must have been eligible to sign the return or claim for refund under examination.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative(s) to inspect and/or receive confidential tax information and to perform all acts (that is , sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not includethepower to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreementto Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

Does the IRS require a new 2848?

If the representative's address has changed, the IRS does not require a new Form 2848. The representative can send a written notification that includes the new information and the representative's signature to the location where you filed the Form 2848.

What is a 2848 form?

About Form 2848, Power of Attorney and Declaration of Representative. Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

What is a 2848?

You can file Form 2848, Power of Attorney and Declaration of Representative, if the IRS begins a Foreign Bank and Financial Accounts (FBAR) examination as a result of an income tax examination.

What is a power of attorney?

Your power of attorney may list a specific problem, a specific year, a specific form, or a broad range of time. This helps to make clear exactly what the professional is helping you with. It also protects your personal information that isn’t needed for that representation.

Who should fill out an engagement letter?

Your Enrolled Agent, CPA, or tax attorney should provide you with a filled-out form. Make sure that what’s listed on your form matches your engagement letter and what you expect the tax professional to do. If you aren’t sure of what something means or why it’s there, ask questions before you sign.

Can I use a power of attorney form without signature?

The IRS allows substitute power of attorney forms with strict requirements. A general power of attorney is not enough. The substitute form must contain all of the information required on the IRS Form. Your representative must also attach a Form 2848 (without your signature) for IRS tracking purposes.

Do you need a signature for Form 2848?

You must use an original, handwritten signature for signing Form 2848. Because of the importance of this form, the IRS does not accept electronic signatures.

Do I need a 2848 form?

A Form 2848 is not needed to prepare your tax return assuming that you will review and sign it. A representative may never sign or endorse your refund check or deposit it into their own account even with a power of attorney. A Form 2848 is not needed if a tax professional helps you to write a response to the IRS that is sent under your name ...

Who can be named as a representative on Form 2848?

Only individuals may be named as a Representative on Form 2848. Individuals, corporations, firms, organizations or Partnerships can be named as an Appointee on Form 8821. Each form should contain the full nine digit CAF number. If the individual designated as Representative or Appointee does not have a CAF number the Form 2848 or Form 8821 should reflect a response of “None”. All other information must be fully completed and the form should be faxed, by EP Examinations, to the appropriate Service Center before the examination is completed.

What is EPTA form?

EPTA uses the practice of securing a form which provides written authorization from the employer that often designates specific personnel other then employees acting within the scope of their employment to: 1. furnish records and information; 2. discuss matters during preliminary stages; and 3. receive and/or negotiate proposed adjustments. The letter is on official corporate letterhead and signed by an officer of the corporation. It has been determined that the form is similar to Form 8821 and all of its attendant restrictions. In other words, the use of this form should be restricted to allow a third party to inspect or receive confidential information examined or generated during the course of the examination. Since the use of the authorization form is limited, it is necessary, therefore, to obtain a properly completed Form 2848 to address adjustments and issues pursuant to the guidance in this memo.

What is the 5500 exam?

There are three taxpayers in a Form 5500 examination—the sponsoring employer, the trust, and the plan participants or their beneficiaries. The instructions for both the Form 2848 and Form 8821 require that, for purposes of conducting a 5500 examination, Item 1 (Taxpayer Information) contain the plan name and number (if applicable) and the plan sponsor name, address and EIN. The plan and trust are two separate legal entities. The trust is an “accumulation of assets held in the name of the plan participants”. It is quite clear that unless the employer is also the trustee, it’s possible that a second POA will be necessary. This scenario applies equally to multiemployer and multiple employer plans which also have a plan sponsor and trust.

What is a Power of Attorney Form 2848?

By submitting the IRS Power of Attorney Form 2848, you grant permission for an eligible individual to examine your tax information. The IRS states that your representative must be an eligible person, such as a tax attorney or CPA, who will receive and review your confidential information. 2.

How to file Form 2848?

Taxpayers can download Form 2848 on the IRS website and complete it by hand by printing it out and mailing it in. The form can also be completed digitally in the provided PDF format. Here’s what you need to know: 1 Follow all instructions on the form closely and ask a tax professional to review it to ensure accuracy and completion. 2 The IRS website has a list of addresses and fax numbers where you can send your completed Form 2848, depending on which state you live in. 3 You may also submit your form online as long as you did not check the box on line 4 of the form (“Specific use not recorded on the Centralized Authorization File [CAF]”). 4 If this box is checked, the form must be mailed in or faxed. 5 The IRS has an online portal to submit Form 2848 by logging in to your account, answering a few questions about the form, and uploading your completed and signed Form 2848. 6 Do not submit the form in multiple formats (i.e., if you mailed it in, do not submit it again online). 7 You may only submit one form at a time through the system.

What is a POA form?

Commonly known as power of attorney, or POA, Form 2848 is a two-page IRS tax form that authorizes a qualified person to represent you before the IRS. By submitting Form 2848, you give permission for an eligible individual to examine your tax information. The IRS provides guidelines regarding Form 2848, noting that your representative must be an ...

What does a POA do?

Your designated POA may take on acts such as signing agreements in your name, receiving personal tax information, signing consents or waivers, or negotiating about tax matters on your behalf. This person can essentially make financial decisions for you and see the information needed to inform those judgments. 4.

What is Form 2848?

Form 2848 allows you to specify an individual who can receive confidential tax information about you. You might do this because you need assistance from a tax attorney with an audit, if you have a health issue preventing you from taking care of these matters on your own, or for your own reasons.

Why is it so hard to communicate with the IRS?

Communications can be especially difficult if you are being audited, have an unpaid tax balance, or are facing a court summons regarding your taxes. You have the option of authorizing a qualified tax specialist to represent you before the IRS if you find yourself overwhelmed by a challenging tax situation. Just complete and submit ...

Why do people go to tax court?

Further, many cases are settled before trial, in large part because taxpayers often hire tax attorneys to help ensure that their cases proceed as quickly and affordably as possible.

Popular Posts:

- 1. when you get power of attorney, how long does that stay in effect

- 2. does ur attorney set up a 3 way call when with your adjuster before the case is ready to settle

- 3. financial power of attorney how to file on behalf of family member kansas

- 4. how can a denver county inmate do a power of attorney to a family member while in jail

- 5. how can you revoke a power of attorney

- 6. how to review a texas attorney

- 7. how can an attorney file fincen on client behalf

- 8. how do i complain about a pa attorney

- 9. what happens if a attorney violates discovery?

- 10. what makes a good defense attorney