Begin by filling in the Attorney-in-Fact’s Name in the box labeled “Name Of Person Or Firm Appointed As Attorney” The table immediately below the heading “Description Of Vehicle” will present two rows so an account of the concerned Vehicle can be presented.

- 1 – State The Identity And Location Of Each Party. ...

- 2 – The Powers That Can Be Granted Are Listed For Approval. ...

- 3 – Only The Principal Can Definitively Authorize When The Agent Can Wield Principal Authority. ...

- 4 – This Template Is Completed And Executed Only With A Witnessed And Notarized Principal Signature.

How do you get a durable power of attorney form?

Part 2 Part 2 of 3: Creating a Durable Power of Attorney Download Article

- Find Durable Power of Attorney forms. Your principal may not be able to search for these forms, fill them out, or type them on her own.

- Complete the form, or draft your own document. If you have a fill-in-the-blank form, provide the information necessary to complete the form, but do not sign it yet.

- Sign the document in front of a notary. ...

Where can you get a free power of attorney form?

How to Write

- Download This Paperwork To Designate Your Attorney-in-Fact With Guardian Powers Over A Minor. ...

- Each Party Involved With This Authority Must Be Clearly Identified. ...

- Apply Your Preferences To The Extent Of The Granted Principal Guardian Powers. ...

- The Effect Of This Paperwork Is Only Valid When It Is Properly Executed. ...

What is power of attorney in Oregon?

Rule Rule 459-050-0310 Power of Attorney

- (1) Definitions. “Power of Attorney Document” means a written document expressly granting legal authority to another named individual (s) or agent (s) to act on behalf of and to manage ...

- (2) Designation of Power of Attorney. ...

- (3) Effective Date of Power of Attorney. ...

- (4) Revocation of Power of Attorney. ...

- (5) Permissible Actions Under A Power of Attorney. ...

What are general powers of attorney?

The scope of the power assigned to the attorney is generally straightforward, as it requires only a detailed definition of the actions to which the attorney is allowed. The documents must be presented to verify that the person who gave such powers is authorized to represent the company.

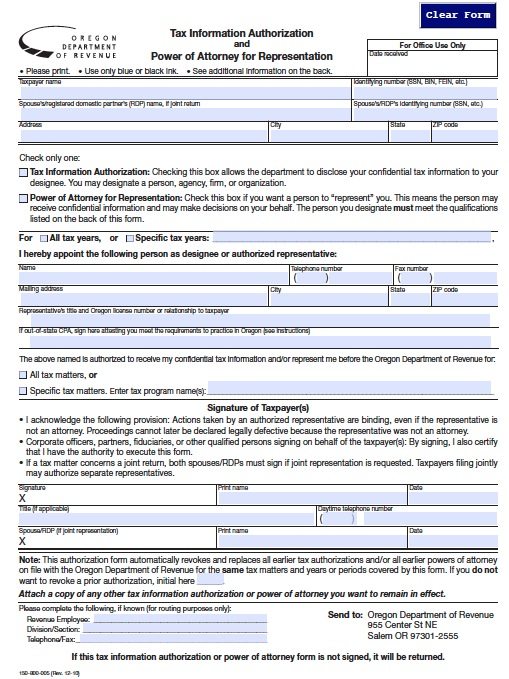

How do I fill out a power of attorney form in Oregon?

0:581:48How to Fill in an Oregon Power of Attorney Form - YouTubeYouTubeStart of suggested clipEnd of suggested clipOr two witnesses that have no relation to either party. Involved in the pop attorney. Form. AndMoreOr two witnesses that have no relation to either party. Involved in the pop attorney. Form. And what's that the signatures are witnessed by either a notary or the two witnesses.

Does a power of attorney in Oregon have to be notarized?

Sign your power of attorney document Unlike many states, Oregon does not require you to use witnesses or use a notary public. However, you should sign and date your power of attorney and ask a notary public to notarize it.

Can I write a power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

What is needed for power of attorney in Oregon?

Many people expect that a spouse or other family member automatically has the power to help with financial matters; but this is not true. Under Oregon law, someone must have special authority to act for another person. You accomplish this through a written document authorizing another person to act on your behalf.

How do I notarize power of attorney?

How to Complete a Notarized Power of AttorneyFill out the acknowledgement form, which should be attached to the POA. ... Affirm that the principal appeared before you voluntarily, that the terms of the POA are intended and that the signature on the document belongs to the principal. ... Ask the principal to sign the POA.More items...•

Is a handwritten will valid in Oregon?

The short answer is no. Wills that are handwritten and not witnessed are not recognized as valid in Oregon. A handwritten will that is witnessed by two individuals will be considered valid.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

What is the difference between a power of attorney and a lasting power of attorney?

An ordinary power of attorney is only valid while you have the mental capacity to make your own decisions. If you want someone to be able to act on your behalf if there comes a time when you don't have the mental capacity to make your own decisions you should consider setting up a lasting power of attorney.

How do I give someone power of attorney?

The Power of Attorney needs to be signed by the principal, giving the agent authority to act on his/her behalf. The principal's signature has to be co-signed by at least one witness to confirm that it was indeed the principal signing the document.

Who can witness a power of attorney in Oregon?

Finally, as a basic principle, your witness(es) must not be under the age of 18, and none of them should also be your PoA agent.

How does power of attorney work in Oregon?

In Oregon, “power of attorney” usually means a durable financial power of attorney. When you sign a durable financial power of attorney, you authorize someone else (called the agent or the attorney-in-fact) to manage your finances and to conduct business for you.

Do you have to activate a power of attorney?

You need to check that the lasting power of attorney (or LPA) is registered with the Office of the Public Guardian. If it is, there will be a stamp on every page. If not, you need to register it before activating the lasting power of attorney. Don't worry: it's simple.

What powers does the agent have to make payments?

The first paragraph, “1. Power To Make Payments Or Collect Monies Owed,” provides a detailed account of actions within this area the Agent may take in the Name of the Principal such as making debt payments or requesting any amount of money due to the Principal. The Principal will grant the Agent the Power to conduct these affairs by initialing the blank line preceding the number “1.” The Principal should initial the paragraph labeled “2. Power To Acquire, Lease And sell Personal Property” to give the Agent the Principal Authority to engage in the Principal’s Personal Property affairs (leasing, selling, conveying, delivering, etc.) as per the definition this statement provides The Principal’s ability “Power To Acquire, Lease And Sell Real Property” will be assigned to the Agent through the Principal’s act of initialing the blank line preceding the third paragraph. If it’s been determined the Agent must be able to perform actions such as maintenance, repairs, improvements, and other management duties on any kind of Property the Principal has Authority over, then the Principal must supply his or her approval by initialing the blank line corresponding to “4. Management Powers.” The Principal can enable the Agent to wield Principal Power with the goal of performing Banking tasks in the Principal’s Name, both with Banks and other financial institutions, by initialing the line labeled “5. Banking Powers” The Principal’s vehicles may be placed in the Agent’s Care when he or she is granted the Principal Power handle their paperwork and ownership. The Principal will be required to initial the “6. Motor Vehicles” paragraph to grant such Power to the Agent. The Principal’s Taxes and interaction with tax entities may be performed by the Agent with Principal Approval when the Principal initials the blank line corresponding to the “7. Tax Powers” paragraph The Agent will have the Principal Power to handle business regarding the Principal’s Safe Deposit Boxes once, the Principal initials the blank line labeled “8. Safe-Deposit Boxes.” The Principal can deliver the same Power to engage in various Gift Making Activities by initialing the ninth paragraph. If the Principal intends for the Agent to be able to perform “Lending And Borrowing” activities (making loans, obtaining loans, etc.) in his or her Name, the tenth paragraph will need to bear the Principal’s initials. The Principal can grant the Agent the Authority to enter any Contract (on behalf of the Principal) by initialing “11. Contracts” The Attorney-in-Fact can have the Principal Powers to represent the Principal’s Health Care interests if the Principal initials the blank line preceding the label “12. Health Care.” If the Principal initials the line associated with “13. HIPAA” he or she will be granting the Agent the representation Powers to act in the capacity defined by the Health Insurance Portability And Accountability Act Of 1996. The Principal Power to obtain professional services as well as arrange for payments can be delivered to the Agent in “14. Power to Hire And Pay For Services” as soon as the Principal initials the blank line preceding it If the Principal initials the paragraph labeled “15. Reimbursement Of Attorney-in-Fact,” he or she will be assigning the Principal Power the Agent requires to seek and gain Reimbursement by wielding Principal Power to do so. Should the Agent be able to enforce this document by initiating “16. Power To Sue Third Parties Who Fail To Act Pursuant To Power Of Attorney” The Principal can choose to add additional Granted Powers to the Agent by making sure they are recorded on the blank lines in “17. Other” then initialing that selection.

How many witnesses are needed for a notary?

The execution (signing) of this paperwork must be substantiated in a verifiable manner. That is, this action should be Witnessed by two individuals and Notarized. The first of these parties will be focused on in the “Witness” section. Each Witness must sign his or her Name and fill in his or her Address on the corresponding blank lines. There will be enough lines for two Witnesses to perform these actions beneath the “Witness” paragraph. The next party whose attention is required will be the Notary Public. This entity will need to use the space in the “Acknowledgment Of Notary Public” section to produce the information, credentials, and seal to notarize this document’s execution.

Why do some people prefer a fail safe form?

This type of fail-safe can be instrumental in safeguarding an incapacitated principal from an agent being contacted for a principal decision that he or she should be making only if the principal were available.

What is the banking power?

Banking Powers” The Principal’s vehicles may be placed in the Agent’s Care when he or she is granted the Principal Power handle their paperwork and ownership. The Principal will be required to initial the “6. Motor Vehicles” paragraph to grant such Power to the Agent.

What is a power of attorney in Oregon?

Oregon General (Financial) Power of Attorney Form confers specific financial authority to a specified person to handle your financial matters acting in your place. This legal form terminates if the person granting the powers (the principal) is no longer able to make his or her own decisions. This means that it is NOT considered a “durable” power ...

Do you need to notarize a power of attorney in Oregon?

However, the principal and their agent (s) should notarize the document to validate each signature.

Who can definely authorize when the agent can wipe principal authority?

3 – Only The Principal Can Definitively Authorize When The Agent Can Wield Principal Authority

What is a durable power of attorney in Oregon?

An Oregon durable power of attorney form is a document that grants someone (the “agent”) the legal authority to act and make decisions for another person (the “principal”) in the state of Oregon. Unlike a regular non-durable power of attorney (POA), a durable power of attorney (DPOA) stays in effect even if the principal becomes incapacitated ...

How to use a durable power of attorney?

To use the durable power of attorney, you need to give your agent a copy of the form. You should also give a copy to family members, a trusted friend, and third parties where it will be used (such as your landlord, bank, or a state agency).

What can an agent sign on your behalf?

The agent can then sign on your behalf as follows: [Principal’s name] by [Agent’s name] Power of attorney. Your agent can use a power of attorney to conduct almost any legal matter that you can do (if granted the authority).

How can a principal revoke a power of attorney?

A principal can revoke a power of attorney at any time by completing and filing a revocation of power of attorney.

What does the principal need to mark on the form?

The principal needs to mark on the form which areas of their life they want to give the agent legal power over. This can be general authority (e.g., operation of a business) or specific authority (e.g., make a loan). They can also write specific instructions about which actions the agent can perform on their behalf.

Can a power of attorney be made durable?

For the power of attorney to continue even if the principal is incapacitated, the form must be made durable.

Is an agent a fiduciary?

Although an agent has a ‘fiduciary duty’ to act in the principal’s best interest, this is not always the case. You should always choose someone you trust to be your agent.

What is a general power of attorney?

General (Financial) Power of Attorney – This form is similar to the “durable” type because it allows you to appoint another to handle a broad range of financial matters. However, this type terminates when the principal is determined to be incapacitated and unable to make his or her own decisions.

What is an advance directive?

Advance Directive – This form is for use when you want to appoint another to make health care decisions on your behalf in the event you cannot make them for yourself.

What is a power of attorney in Oregon?

Oregon power of attorney forms provide a way for a person (“principal”) to make another individual (“agent”) his or her legal representative for specific tasks or affairs. This is common among elderly adults that give their spouse or children rights over their financial and medical care in case they cannot speak for themselves.

How to fill out POA?

2. Fill Out the POA 1 Your details, such as official name and address, should go into the section reserved for the principal. 2 Your representative’s name and official address should go into the section reserved for the agent or attorney-in-fact. 3 If you intend to designate more than one person as attorney-in-fact, do so in the secondary agent section. The people you include in that section will act on your behalf if the first agent is not in a position to do so. 4 Read the general POA instructions on designating powers to your agent. You must be as clear and specific as possible. So, be sure also to include the duration a power of attorney will be in effect and the particular authority you are giving to your agent.

What is POA in business?

If you are looking to legally authorize another person to act on your behalf concerning business and personal matters, creating a power of attorney (POA) makes sense. However, your choice of power of attorney will depend on the extent to which you would like your representative to perform tasks on your behalf.

How to get a power of attorney notarized?

Take the power of attorney document and your state identification to a notary public. Sign and date the paper and ask him to notarize your signature. Make copies of the document for yourself and your agents.

How to eliminate powers of attorney?

A general power of attorney gives your agent broad authority, but you usually can eliminate some powers if you want to do so by putting a line through the powers. Follow the power of attorney's directions for the powers section. Write in any other powers you're giving that are not shown on the form using specific wording.

Is a POA valid until you sign it?

Another issue to bear in mind is whether your general POA will be immediate or springing. An immediate POA becomes valid the moment you sign it . However, a springing power of attorney only becomes active in the future if a specified condition has been met. The situation could include you becoming physically or mentally incapacitated.

Can you download a POA template?

So, select the one you want carefully. Bear in mind that if you find an online POA template, you must download and print it.

Do you need to be careful when filling out a POA form?

You need to be careful when filling out a POA form to ensure you do everything correctly. Below are the steps you should follow.

Popular Posts:

- 1. how do i file a complaint with the ohio attorney general

- 2. who is the ithaca new york paul trivelli attorney?

- 3. what does it mean if an attorney refuses to take a case

- 4. what power of attorney is needed in tn

- 5. who appoint the attorney general of india

- 6. what is the agreement between attorney and client

- 7. how to follow up on an unpaid invoice, attorney client

- 8. how to address former attorney general

- 9. who is cas deputy attorney general

- 10. how to be a tax attorney