How to write a power of attorney letter [10+ best examples]?

If you want to create a power of attorney yourself, you can find templates online or pay a lawyer for professional help. Either way, here are the steps that you need to follow: Choose a reliable agent. Select the power of attorney type. Identify the duration of the POA.

How do you apply for power of attorney?

Ordinary Power Of Attorney – The most basic Power of Attorney is referred to as an Ordinary Power of Attorney. It is also often referred to as a General Power of Attorney. This type of legal form gives the agent you decide the power to make all decisions on your behalf, including the legal, financial, business, and health.

How to fill out a power of attorney?

Download - http://powerofattorneyform.com/durable.htmHomepage - http://powerofattorneyform.comA legal instrument that allows a person, typically referred to ...

What are general powers of attorney?

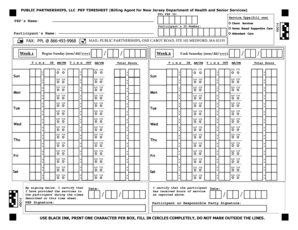

If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. You can download a Form 2848 from IRS.gov or access the file in the image below. It’s just two pages but can be confusing if you’re filling it out for the first time. Here's what you need to know.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Can I do Power of Attorney myself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

How do I fill out a durable power of attorney in Florida?

How to Fill Out a Florida DPOA FormStep 1: Designate an agent. First, choose someone you trust to be your agent. ... Step 2: Grant authority. ... Step 3: Ensure your form is durable. ... Step 4: Sign and date the form. ... Signing on Behalf of the Principal. ... Revoking a Durable Power of Attorney in Florida.

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Does a power of attorney need to be recorded in Florida?

Your agent must keep records. Under the new law, agents must keep records of all receipts, disbursements, and transactions made on behalf of the principal.

How long is a power of attorney good for in Florida?

One question we often get is, “When does a power of attorney expire?” The answers largely depends on how the power of attorney is drafted. But as a general rule, a durable power of attorney does not have a fixed expiration date.Dec 6, 2019

How do I get a medical power of attorney in Florida?

To become the medical power of attorney (Health Care Surrogate) or to appoint a person to become your medical power of attorney in Florida, you must complete a Florida Medical Power of Attorney Form, also commonly referred to as the “Florida Designation of Health Care Surrogate.” This form will have you choose your ...

What is a power of attorney?

If you need someone to make decisions for you regarding business, healthcare, real estate, or legal matters, you should create a power of attorney. It is a legal document that allows the agent to make decisions for the principal in the case of mental or physical incapacitation. Solve My Problem. Get Started.

When is a POA effective?

A durable POA is effective immediately after signing and remains valid even if the principal becomes incapacitated. A limited POA is effective for a specific purpose and ends as soon as the purpose is achieved.

How to get a document notarized?

Compose and Sign the Document and Get It Notarized. Write the document yourself or hire a lawyer to do it for you. Once the document is complete, both the principal and the agent need to sign the document. After signing, get it notarized by the notary public to make it official.

What is a POA in real estate?

General POA —The principal delegates all legal, business, healthcare, and real estate powers to the agent. Durable POA —With this agreement, the principal hands over the power for a longer period. The agreement immediately becomes effective and stays in effect even if the principal becomes mentally or physically incapacitated.

What is a springing POA?

Springing POA —The agreement becomes effective if a trigger event or incident takes place. Limited POA —The agent has powers over specific matters and for a limited period. Financial POA —The agent has responsibility for the principal’s financial matters.

What is the advantage of DoNotPay?

Using DoNotPay comes with plenty of advantages, the main one being that you can resolve just about anything in a matter of clicks. It doesn’t get any easier than that!

What is a 2848 form?

Form 2848 allows taxpayers to name someone to represent them before the IRS. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. You can download a Form 2848 from IRS.gov or access the file in the image below.

What is line 3 on a 1040?

Line 3 – Acts authorized: These are the acts you, the representative, are being authorized to perform. If you’re simply filing a return for a parent, you can list “Income” under “Description of Matter.”. Write 1040 for the tax form number if you’re filing a basic tax return for your parent.

What to do if you don't have a CAF number?

If you don’t have one, enter “none” and the IRS will assign a number to you. You should get a letter from the IRS with your CAF number, which you will need to use when you send a Form 2848 along with each year’s tax return for your parent. You can leave PTIN blank (this is a number assigned to paid tax preparers).

What does "accept payment" mean?

accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative (s) or any firm or other. entity with whom the representative (s) is (are) associated) issued by the government in respect of a federal tax liability.

Who fills out a power of attorney?

Power of attorney forms, or office of the decedent forms, can be filled out by anyone who needs the power to be granted, but if there is an issue such as death, then the person who filled out the form should be named as the primary caregiver, or agent on behalf of the decedent’s children.

What information do I need to fill out a form?

You will need to fill out a form with all of the information needed to be valid for the person who will be filling out the form, such as name, address, date of birth, social security number, and place of work, among others. You should also include copies of your driver’s license, identification cards, and a valid phone number.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

Who is Diana's representative on W-2?

Diana authorizes John to represent her in connection with her Forms 941 and W-2 for 2018. John is authorized to represent her in connection with the penalty for failure to file Forms W-2 that the revenue agent is proposing for 2018.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

Who is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.

Can I use a power of attorney other than 2848?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney. See Pub. 216, Conference and Practice Requirements, and section 601.503 (a). These alternative powers of attorney cannot, however, be recorded on the CAF unless you attach a completed Form 2848. See Line 4. Specific Use Not Recorded on the CAF, later, for more information. You are not required to sign Form 2848 when you attach it to an alternative power of attorney that you have signed, but your representative must sign the form in Part II, Declaration of Representative. See Pub. 216 and section 601.503 (b) (2).

How to fill out a power of attorney form?

The way to complete the Affidavit power of attorney form online: 1 To begin the blank, use the Fill & Sign Online button or tick the preview image of the blank. 2 The advanced tools of the editor will direct you through the editable PDF template. 3 Enter your official identification and contact details. 4 Use a check mark to indicate the answer wherever demanded. 5 Double check all the fillable fields to ensure full accuracy. 6 Use the Sign Tool to add and create your electronic signature to signNow the Affidavit power of attorney form. 7 Press Done after you fill out the document. 8 Now you'll be able to print, download, or share the document. 9 Address the Support section or contact our Support crew in the event you've got any concerns.

What is an affidavit for power of attorney?

An affidavit is a sworn written statement. A third party may require you, as the Attorney-in-Fact, to sign an affidavit stating that you are validly exercising your duties under the Power of Attorney. If you want to use the Power of Attorney, you do need to sign the affidavit if so requested by the third party.

What is an affidavit in law?

An affidavit is a written statement that is made under oath. For example.

Popular Posts:

- 1. the attorney who plays god pdf

- 2. how much of back pay does attorney get in ss disability case

- 3. who was kyle rittenhouse's attorney

- 4. how to request client files from attorney in california

- 5. attorney general eric schneiderman how to avoid federal imigration laws

- 6. what are you authorized to do with power of attorney after someone passes away

- 7. what can the attorney general do about illegal police actions

- 8. how to check where attorney is licensed

- 9. do you have to have a lawyer when u do a power of attorney

- 10. how long is attorney review in illinois