If you are importing for your own personal account, fill in your full name. If the Power of Attorney is for a partnership, fill in the full, legal names of each partner (if more space is required, attach a rider listing the names. If you attach a rider, so indicate on the Power of Attorney in the appropriate item).

How to complete customs power of attorney?

· A Power of Attorney or POA is a legal form or document that is used by an individual to allow another person to represent or make decisions on their behalf. The decisions are usually financial or health-related, but not limited to just those two. The POA is usually between two people, the principal (person setting up the Power of Attorney) and ...

How to establish a power of attorney?

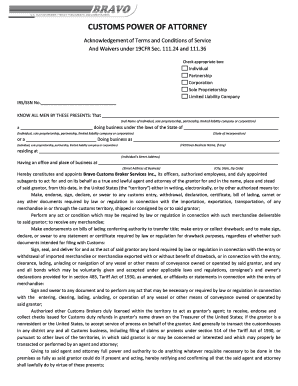

Instructions to Complete Customs Power of Attorney Form. Please complete this two page form as follows and email the completed form to us at [email protected]. You may also fax to us at 770-852-6879. PAGE ONE. Check the box that applies to your company; either individual, corporation/LLC, partnership or sole proprietorship.

How to complete the power of attorney form?

Instructions for Completing the Customs Power of Attorney . 1. Check the appropriate block indicating the type of organization – Individual, Partnership, Corporation, Sole Proprietor, LLC 2. Enter the company’s Federal Tax ID or IRS number in the indicated field a. Individuals will fill in their social security number b.

What is the form for power of attorney?

· For a document to establish Power of Attorney for customs business to be considered valid, the signed version must include: The importer’s US tax reporting number; The importer’s status (corporation, partnership, sole proprietor, individual); and; Standard Power of Attorney terms, limited or unlimited. Things to Keep in Mind

What is an import POA?

Customs and Importing in the US: POA In Shipping A power of attorney (POA) is a legal document used in shipping to grant a customs broker the authority to process Customs clearance on your behalf. A signed POA is necessary in order to clear your goods through US Customs.

Does POA have to be on CBP Form 5291?

POWER OF ATTORNEY INSTRUCTIONS This Power of Attorney is limited to US Customs matters only. Attached is a blank Power of Attorney form in the preferred format, Customs Form 5291. Please follow the instructions carefully.

What is Power of Attorney documentation for UPS?

A Power of Attorney (POA) authorizes UPS to act on the shipper's behalf for completion of one or both of the following documents: Shipper's Export Declaration or Certificate of Origin.

How do you validate a power of attorney?

Validating the Power of AttorneyTo the greatest extent possible, have POA's completed in person so the grantor's unexpired government issued photo identification (driver's license, passport, etc.) ... Check applicable web sites to verify the POA grantor's business and registration with the State authority.More items...•

What is an importer of record?

What is an Importer of Record? The party responsible for ensuring that imported goods comply with all customs and legal requirements of the country of import. This is usually the owner of the goods, but may also be a designated individual or customs broker.

When was the MSC minimum security criteria last updated?

In May 2019, CBP updated the MSC with new and strengthened criteria to address the current global supply chain environment and the threats it faces today.

What document must be completed for all international UPS shipments?

You must file an International Shipper Agreement with UPS for each active shipper or provide a Power of Attorney with each international shipment. Both grant UPS power of attorney on your behalf for all international shipments you send with UPS. The only difference between the two forms is how UPS receives them.

Where do I put customs Form UPS?

...or put the extra customs forms in a regular envelope If you don't have one of those clear plastic sleeves, just attach the shipping label to the package, and put the other labels into a regular envelope that says "CUSTOMS" on it, and tape it the outside of the package.

What is the UPS shipper number?

Your UPS account number is a six-digit number that identifies your account, whether you have an individual or a corporate account. Assigning each account a unique figure helps UPS track invoices and payments.

What are the 3 types of power of attorney?

Different Types Of POAsSpecific Power Of Attorney. A specific power of attorney is the simplest power of attorney. ... General Power Of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ... Enduring Power Of Attorney. ... Durable Power Of Attorney.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Does power of attorney expire?

The standard power of attorney expires when the principal dies, becomes incapacitated, or revokes the power of attorney in writing. In contrast to the standard power of attorney, a springing power of attorney does not become effective until the principal becomes incapacitated.

What is POA in customs?

Establishing a POA is a necessary step in the process of importing in the United States. Whether you are using a Customs Broker, a member of your staff, or different third-party to complete your transactions with Customs, a power of attorney will be required in most cases to establish the right to make entry.

What is a broker for imports?

During the process of importing in the United States, many importers will make the decision to use a licensed Customs Broker to clear goods through customs and ensure all documentation is filed correctly. Brokers are regulated by U.S. Customs and Border Protection and are therefore authorized to assist importers in meeting the Federal requirements governing imports and exports.

How long does a POA last?

A POA issued by a partnership must be limited to a period of no more than two years from the date of execution. and must state the names of all members of the partnership. If a change of membership occurs resulting in a new firm, the POA will no longer be effective for customs business.

What does TRG mean?

TRG has broken down what it means to give someone the power of attorney when entering your goods at a U.S. port of entry to help you remain compliant with customs. During the process of importing in the United States, many importers will make the decision to use a licensed Customs Broker to clear goods through customs and ensure all documentation ...

Popular Posts:

- 1. which section on cd do attorney fees go?

- 2. what type of attorney lawyer do i need house damage

- 3. how you say this- attorney and me or attorney and i

- 4. who was the attorney assigned to defend rick brewer

- 5. when is it too late to change attorney

- 6. how to get records of my living will, attorney retired where can i find documents

- 7. what was the name of the bill that created the attorney general

- 8. what happens if county attorney pick up case

- 9. on average how much does an attorney make on a 40,000.00 settlement

- 10. what is more correct criminal lawyer or criminal defense attorney