To report payments to an attorney on Form 1099-NEC, you must obtain the attorney's TIN. You may use Form W-9, Request for Taxpayer Identification Number and Certification, to obtain the attorney's TIN. An attorney is required to promptly supply its TIN whether it is a corporation or other entity, but the attorney is not required to certify its TIN.

Full Answer

Why do attorneys get 1099?

paying that amount to a claimant's attorney is required to: • Furnish Form 1099-MISC to the claimant, reporting damages pursuant to section 6041, generally in box 3; and • Furnish Form 1099-MISC to the claimant’s attorney, reporting gross proceeds paid pursuant to section 6045(f) in box 10. For more examples and exceptions relating to payments to

When to issue a 1099?

paying that amount to a claimant's attorney is required to: • Furnish Form 1099-MISC to the claimant, reporting damages pursuant to section 6041, generally in box 3; and • Furnish Form 1099-MISC to the claimant’s attorney, reporting gross proceeds paid pursuant to section 6045(f) in box 10. For more examples and exceptions relating to payments

Do attorneys get a 1099?

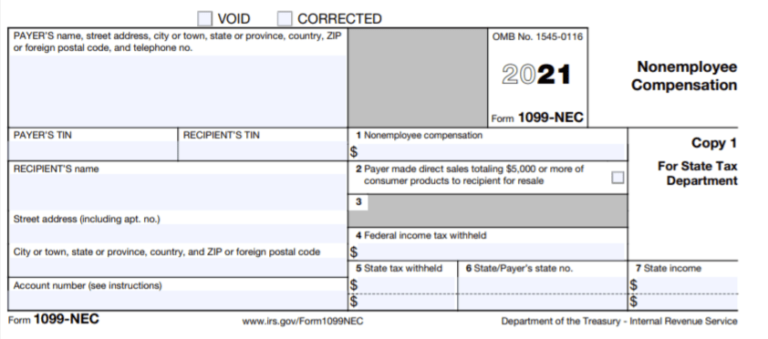

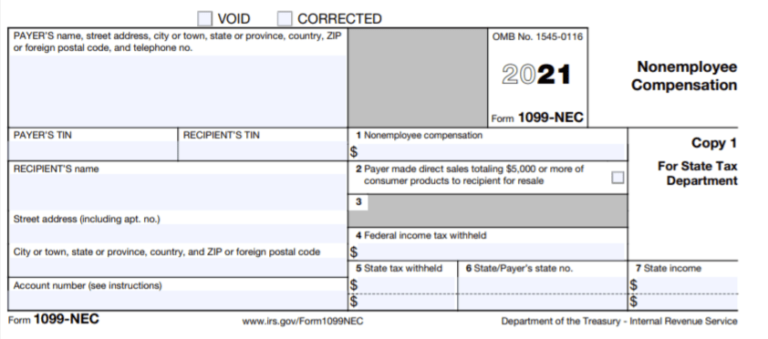

reportable in box 1 of Form 1099-NEC, under section 6041A(a)(1). Gross proceeds paid to attorneys. Under section 6045(f), report in box 10 payments that: • Are made to an attorney in the course of your trade or business in connection with legal services, but not for the attorney’s services, for example, as in a settlement agreement; •

What are the rules for 1099?

See the Example that follows. Enter the name and TIN of the payment recipient on Form 1099-MISC. For example, if the recipient is an individual beneficiary, enter the name and social security number of the individual; if the recipient is the estate, enter the name and employer identification number of the estate.

What 1099 form do I use for attorneys?

Form 1099-NECIf your business paid an attorney or a law firm $600 or more for services related to your business, then you will need to complete and file a Form 1099-NEC. Under IRS guidance, the term “attorney" includes a law firm or any other legal services provider on behalf of your business or trade.

Do you send 1099s to attorneys?

How should payments to attorneys be reported? Payments to attorneys of $600 or more will be reported on either Form 1099-MISC or Form 1099-NEC according to the following rules: Attorney fees paid in the course of your trade or business for services an attorney renders to you are reported in box 1 of Form 1099-NEC.Jan 5, 2021

Where do I put attorney fees on a 1099?

Attorneys' fees of $600 or more paid in the course of your trade or business are reportable in box 1 of Form 1099-NEC, under section 6041A(a)(1).Jan 31, 2022

Do I file 1099-Misc or 1099 NEC?

The 1099-NEC is now used to report independent contractor income. But the 1099-MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney. Although the 1099-MISC is still in use, contractor payments made in 2020 and beyond will be reported on the form 1099-NEC.Dec 9, 2021

How do I fill out a 1099 NEC?

4:537:19How to Fill Out the New Form 1099-NEC (Updated) - YouTubeYouTubeStart of suggested clipEnd of suggested clipThis is the your business name information here who to contact. Um and then on down here this isMoreThis is the your business name information here who to contact. Um and then on down here this is your employer ein and then total number of forms well how many nec's are you sending in with this 1096.

Can I hand write 1099 NEC?

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.Dec 11, 2019

Where do I file 1099 NEC?

You'll use the amount in Box 1 on your Form(s) 1099-NEC to report your self-employment income. Instead of putting this information directly on Form 1040, you'll report it on Schedule C.

Do I need to send a 1099 NEC to my accountant?

If Your Accounting Firm is Organized as a Partnership, the IRS Requires 1099s for Fees Paid. The IRS requires businesses, self-employed individuals, and not-for-profit organizations to issue Form 1099-MISC for professional service fees of $600 or more paid to accountants who are not corporations.

What does it mean to have an X in your TIN?

You may enter an “X” in this box if you were notified by the IRS twice within 3 calendar years that the payee provided an incorrect TIN. If you mark this box, the IRS will not send you any further notices about this account.

Who is Z Builders?

Z Builders is a contractor that subcontracts drywall work to Ronald Green, a sole proprietor who does business as Y Drywall. During the year, Z Builders pays Mr. Green $5,500. Z Builders

Do I need to report 1099-NEC?

Some payments do not have to be reported on Form 1099-NEC, although they may be taxable to the recipient. Payments for which a Form 1099-NEC is not required include all of the following.

What is a caution box?

CAUTIONbox alerts IRS scanning equipment to ignore the form and proceed to the next one. Your correction will not be entered into IRS records if you check the VOID box.

Do I need an account number for 1099?

The account number is required if you have multiple accounts for a recipient for whom you are filing more than one Form 1099-NEC. See part L in the 2021 General Instructions for Certain Information Returns.

What is excess golden parachute?

Enter any excess golden parachute payments. An excess parachute payment is the amount over the base amount (the average annual compensation for services includible in the individual's gross income over the most recent 5 tax years).

What is the form 8596-A?

CAUTIONand Form 8596-A, Quarterly Transmittal of Information Returns for Federal Contracts, if a contracted amount for personal services is more than $25,000. See Rev. Rul. 2003-66, which is on page 1115 of Internal Revenue

What does it mean to have an X in your TIN?

You may enter an “X” in this box if you were notified by the IRS twice within 3 calendar years that the payee provided an incorrect TIN. If you mark this box, the IRS will not send you any further notices about this account.

Who is Z Builders?

Z Builders is a contractor that subcontracts drywall work to Ronald Green, a sole proprietor who does business as Y Drywall. During the year, Z Builders pays Mr. Green $5,500. Z Builders

Do I need to report 1099-NEC?

Some payments do not have to be reported on Form 1099-NEC, although they may be taxable to the recipient. Payments for which a Form 1099-NEC is not required include all of the following.

What is excess golden parachute?

Enter any excess golden parachute payments. An excess parachute payment is the amount over the base amount (the average annual compensation for services includible in the individual's gross income over the most recent 5 tax years).

Do I need an account number for 1099?

The account number is required if you have multiple accounts for a recipient for whom you are filing more than one Form 1099-NEC. See part L in the 2021 General Instructions for Certain Information Returns.

What is the form 8596-A?

CAUTIONand Form 8596-A, Quarterly Transmittal of Information Returns for Federal Contracts, if a contracted amount for personal services is more than $25,000. See Rev. Rul. 2003-66, which is on page 1115 of Internal Revenue

What is a caution box?

CAUTIONbox alerts IRS scanning equipment to ignore the form and proceed to the next one. Your correction will not be entered into IRS records if you check the VOID box.

What is a caution box?

CAUTIONbox alerts IRS scanning equipment to ignore the form and proceed to the next one. Your correction will not be entered into IRS records if you check the VOID box.

Do I need to furnish a 1099 NEC?

If you are required to file Form 1099-NEC, you must furnish a statement to the recipient. For more information about the requirement to furnish a statement to each recipient, and truncation, see part M in the 2020 General Instructions for Certain Information Returns.

What is the form 8596-A?

CAUTIONand Form 8596-A, Quarterly Transmittal of Information Returns for Federal Contracts, if a contracted amount for personal services is more than $25,000. See Rev. Rul. 2003-66, which is on page 1115 of Internal Revenue

What does it mean to have an X in your TIN?

You may enter an “X” in this box if you were notified by the IRS twice within 3 calendar years that the payee provided an incorrect TIN. If you mark this box, the IRS will not send you any further notices about this account.

What box is backup withholding?

Enter backup withholding. For example, persons who have not furnished their TINs to you are subject to withholding on payments required to be reported in box 1. For more information on backup withholding, including the rate, see part N in the 2020 General Instructions for Certain Information Returns.

What is a 1099-MISC?

Check the box if you are a U.S. payer that is reporting on Form (s) 1099 (including reporting payments on this Form 1099-MISC) as part of satisfying your requirement to report with respect to a U.S. account for the purposes of chapter 4 of the Internal Revenue Code, as described in Regulations section 1.1471-4 (d) (2) (iii) (A). In addition, check the box if you are a foreign financial institution (FFI) reporting payments to a U.S. account pursuant to an election described in Regulations section 1.1471-4 (d) (5) (i) (A). Finally, check the box if you are an FFI making the election described in Regulations section 1.1471-4 (d) (5) (i) (A) and are reporting a U.S. account for chapter 4 purposes to which you made no payments during the year that are reportable on any applicable Form 1099 (or are reporting a U.S. account to which you made payments during the year that do not reach the applicable reporting threshold for any applicable Form 1099).

When to report 1099-MISC?

. Trade or business reporting only. Report on Form 1099-MISC only when payments are made in the course of your trade or business.

Do you report attorney fees on 1099?

Are not reportable by you in box 1 of Form 1099-NEC. Generally, you are not required to report the claimant's attorney's fees. For example, an insurance company pays a claimant's attorney $100,000 to settle a claim. The insurance company reports the payment as gross proceeds of $100,000 in box 10.

What does it mean to have an X in your TIN?

You may enter an "X" in this box if you were notified by the IRS twice within 3 calendar years that the payee provided an incorrect TIN . If you mark this box, the IRS will not send you any further notices about this account.

Do you report death benefits on 1099-MISC?

Death benefits from nonqualified deferred compensation plans or section 457 plans paid to the estate or beneficiary of a deceased employee are reportable on Form 1099-MISC. Do not report these death benefits on Form 1099-R. However, if the benefits are from a qualified plan, report them on Form 1099-R.

Why do lawyers send 1099s?

Copies go to state tax authorities, which are useful in collecting state tax revenues. Lawyers receive and send more Forms 1099 than most people, in part due to tax laws that single them out. Lawyers make good audit subjects because they often handle client funds. They also tend to have significant income.

Who must file a 1099?

Lawyers must issue Forms 1099 to expert witnesses, jury consultants , investigators, and even co-counsel where services are performed and the payment is $600 or more. A notable exception from the normal $600 rule is payments to corporations.

Do 1099s match Social Security?

IRS Forms 1099 match income and Social Security numbers. [1] . Most people pay attention to these forms at tax time, but lawyers and clients alike should pay attention to them the rest of the year as well. Failing to report a Form 1099 is guaranteed to give you an IRS tax notice to pay up. These little forms are a major source ...

Do attorneys have to report 1099?

The tax code requires companies making payments to attorneys to report the payments to the IRS on a Form 1099. Each person engaged in business and making a payment of $600 or more for services must report it on a Form 1099. The rule is cumulative, so whereas one payment of $500 would not trigger the rule, two payments of $500 to a single payee ...

Do you need a 1099 for slip and fall?

Given that such payments for compensatory damages are generally tax-free to the injured person, no Form 1099 is required.

Do lawyers have to issue 1099s?

Lawyers are not always required to issue Forms 1099, especially to clients. Nevertheless, the IRS is unlikely to criticize anyone for issuing more of the ubiquitous little forms. In fact, in the IRS’s view, the more Forms 1099 the better.

What is a 1099 NEC?

However in 2020, the IRS brought back Form 1099-NEC, Nonemployee Compensation, to report nonemployee compensation. Business owners used to report nonemployee compensation on Form 1099-NEC until 1982.

When is the 1099 due?

Form 1099-MISC has a due date of March 31, 2021 if you file electronically. Send Copy B of Form 1099-MISC to the recipient no later than February 1, 2021. To steer clear of late-filing penalties, file Form 1099-MISC on time.

Is 1099-NEC a replacement for 1099-MISC?

Form 1099-NEC is not a replacement for Form 1099-MISC. Form 1099-NEC only replaces the use of Form 1099-MISC for reporting independent contractor payments. You may need to file both Forms 1099-MISC and 1099-NEC.

What is a 1099 NEC?

1099-NEC is the version of Form 1099 you use to tell the Internal Revenue Service whenever you’ve paid an independent contractor (or other self-employed person) $600 or more in compensation. (That’s $600 or more over the course of the entire year.)

How many copies of 1099 are there?

How to file a 1099 form. There are two copies of Form 1099: Copy A and Copy B. If you hire an independent contractor, you must report what you pay them on Copy A, and submit it to the IRS. You must report the same information on Copy B, and send it to the contractor.

When do I need to send a 1099 to a contractor?

If you’re a contractor, it’s your client’s responsibility to send you a completed copy of the Form 1099-NEC by January 31, 2021. If you haven’t received Copy B of a 1099 from your client by the deadline, and you believe you should have, make sure you request it. You will need it to file your income taxes in April.

Do I need a 1099 for 2020?

Editor’s note: 1099 forms are changing for 2020. If you are a contractor or hired a contractor, you will now need to use Form 1099-NEC. Read everything you need to know about this change in our guide! If you’re getting started as a freelancer or your small business is contracting outside help, you’ve probably heard of IRS Form 1099.

What is an independent contractor?

Independent contractor definition. An independent contractor is anyone you hire on a contract basis to complete a particular project or assignment. By definition, an independent contractor is not an employee. Common examples include graphic designers, web developers, copywriters, and social media consultants.

Do I need to file a 1099 for freelance work?

If you hire a freelancer through a third-party service, you may not be required to submit a 1099 for them. For instance, if you hire a freelancer through Upwork, Upwork is actually the one doing the hiring, so you don’t need to submit a 1099. These details vary from one third-party hiring service to another.

Do I need to file a 1099 for an independent contractor?

It’s rare, but sometimes an independent contractor will be registered as a C corporation or S corporation. You don’t need to file Form 1099 for a contractor registered as a corporation. You can see whether a contractor is incorporated based on the information on their Form W-9.

How to complete a 1099 NEC?

In order to accurately complete a 1099-NEC, or a 1099-MISC, you will need information usually found on the worker’s W-9. All non-employee workers should provide you a W-9 when starting their work with your business. Here’s what you need: 1 The appropriate forms: Form 1099-NEC – Form 1099-MISC 2 The legal name of the contractor (NEC) or non-employee worker (MISC). 3 Their business name (if it’s different from the contractor’s name). 4 The federal tax classification of the contractor, so you will know whether you need to issue a 1099-NEC, or a 1099-MISC. 5 Current and accurate mailing addresses. 6 Tax Identification Number (EIN) or Social Security number. 7 The total amount of funds paid to the contractor for the calendar year

What form do I need to get a W-9?

All non-employee workers should provide you a W-9 when starting their work with your business. Here’s what you need: The appropriate forms: Form 1099-NEC – Form 1099-MISC. The legal name of the contractor (NEC) or non-employee worker (MISC). Their business name (if it’s different from the contractor’s name).

How many boxes are there on a 1099?

Once you’ve entered the above information into the 1099, you can populate any of the 17 boxes that apply. Here’s a rundown with instructions for what each box is for: Box 1 – Rents – This is used to report rent paid to a property owner. Rent paid to a real estate agent or property manager will not have to be reported.

When do I need to file 1099-MISC 2021?

1099-MISC. For 2021, you are required to furnish the Form 1099-MISC to the payee by February 1 , and file with the IRS by March 1 (March 31 if filing electronically).

Do I need to send 1099 to independent contractor?

Here’s a handy guide to everything you need to know about Forms 1099-MISC/NEC. If you’ve paid an independent contractor for goods or services during the year, you will most likely need to send them a 1099- NEC while also reporting their income to the IRS at the beginning of next year. There are other non-employee workers who are not contractors, ...

What is excluded from a health care plan?

Flexible spending accounts and employer-provided health care coverage are excluded. This mainly pertains to any payments made directly to a health care provider for services not covered by an insurance plan, but be sure to check with the IRS for specifics.

Do I need to issue a 1099 to a contractor?

There is also a $600.00 threshold that needs to be surpassed, so you won’t have to issue a 1099 to a contractor that has been paid less than that amount during the year.

What is a 1099 NEC?

Its original version reads, “Payer made direct sales totaling $5,000 or more of consumer products to the recipient for resale.” This refers to relationships between a vendor and a retailer.

How many places are on a 1099 NEC?

Your 1099-NEC form includes 15 places to enter information. Frustratingly, only seven of them are numbered, you don’t have to enter information on all of them, and some of them don’t apply to the 1099-NEC specifically. It’s cheaper for the IRS to make one general form and change just the letter designation than to design each form individually.

Where is the checkbox on a 1099?

This checkbox sits near the center, on the left-hand side of the central dividing line on your 1099 form. FATCA stands for Foreign Account Tax Compliance Act. It only applies to 1099-INT income in situations with significant balances in foreign bank accounts.

What is Box 4 for state taxes?

This is the same as Box 4, only for money withheld toward the payee’s state tax responsibility. It includes two lines for situations where the contractor did work for your company in two different states and you withheld state tax in each.

What Is A 1099-Nec?

- While there are a variety of 1099 forms, the newest one is 1099-NEC. It’s used to report payments to contractors and service providers who are not employees at your company and do not have taxes withheld. Before, these payments were reported using a 1099-MISC. Because this form is provided to both the contractor and the IRS, it allows the government to track the amount of tax …

When Is A 1099-Misc Required Instead of A 1099-Nec?

- While there are exceptions to every rule, you will need to send a 1099-MISC if you’ve paid: 1. At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest 2. At least $600 for: 2.1. Services performed by someone who is not an employee 2.2. Rents 2.3. Prizes and awards 2.4. Other income payments 2.5. Medical and health care payments 2.6. Crop insurance …

What’s The Filing Deadline For A 1099?

- 1099-NEC You are required to furnish Form 1099-NEC to the payee and file with the IRS by January 30 in 2022. 1099-MISC For 2022, you are required to furnish the Form 1099-MISC to the payee by January 30, and file with the IRS by March 1 (March 31 if filing electronically).

Popular Posts:

- 1. what happens when closing attorney doesn't do title search nc

- 2. what grounds do you have to turn in an attorney to the

- 3. power of attorney who can witness

- 4. what happens if attorney general gets fired

- 5. who is florida attorney general

- 6. what does the federal attorney general control all federal courts

- 7. franklin county prosecuting attorney columbus, oh who oversees the office

- 8. how to write special power of attorney

- 9. how does an attorney collect a contingency fee?

- 10. what pocs meand in attorney firm audit