What is US customs power of attorney?

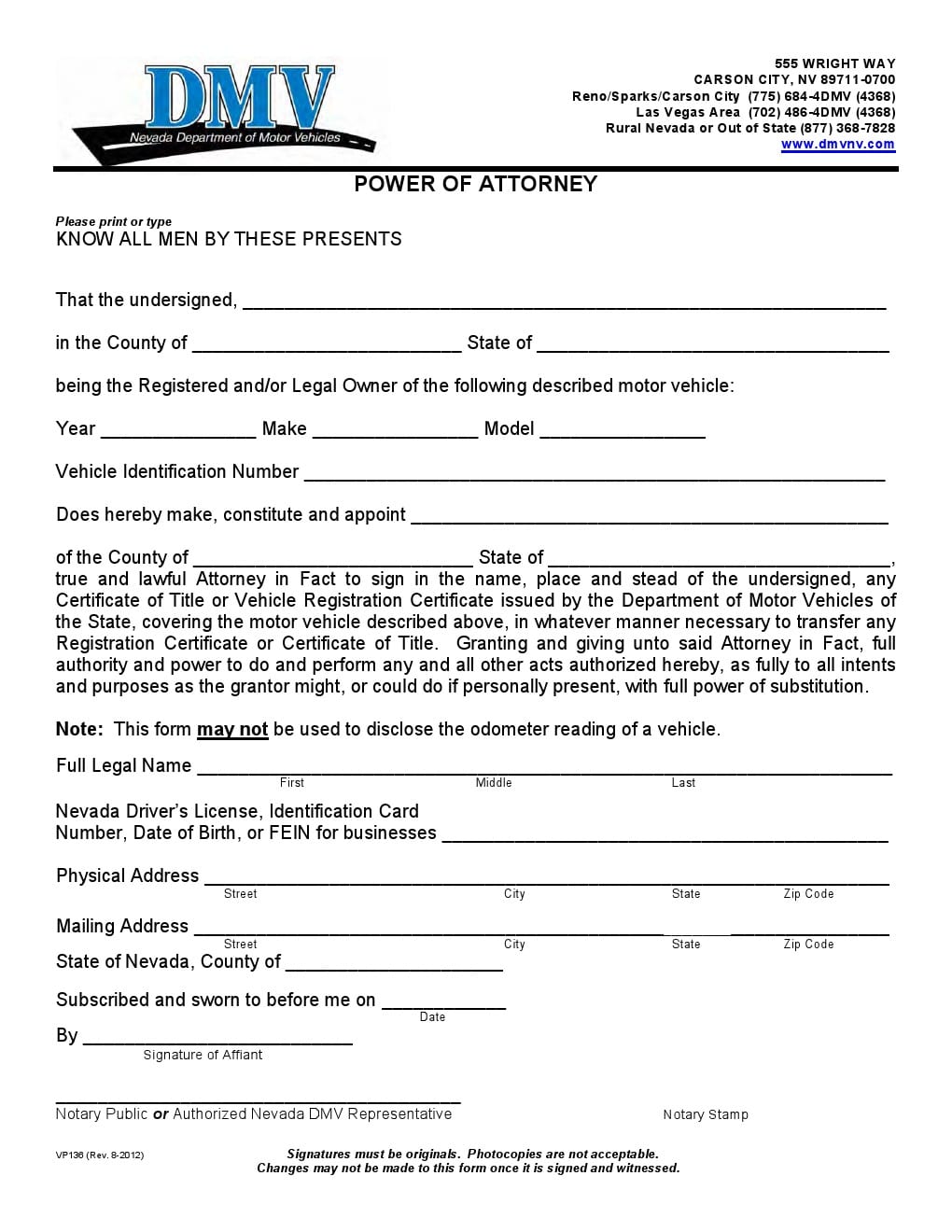

Customs and Importing in the US: POA In Shipping A power of attorney (POA) is a legal document used in shipping to grant a customs broker the authority to process Customs clearance on your behalf. A signed POA is necessary in order to clear your goods through US Customs.

What is a Customs Form 5291?

§ 141.32 Form for power of attorney. Customs Form 5291 may be used for giving power of attorney to transact Customs business.

How do I fill out US Customs and Border Protection Form?

2:226:13How to fill out US Customs Forms | Arriving in USA in 2021 - YouTubeYouTubeStart of suggested clipEnd of suggested clipForm first of all you have to complete the front of the document. Before you start filling out theMoreForm first of all you have to complete the front of the document. Before you start filling out the form keep in mind that only one form is allowed per family member.

How do I fill out a CBP Form 7533?

How to Fill Out CBP Form 7533?Bill of lading/the marks and numbers/the address of the consignee written on the packages;Car number and the initials;Number and gross weight (in kilos or pounds) of the packages and the complete description of the goods;Name of the consignee.

How to fill out a power of attorney?

Instructions to Complete Customs Power of Attorney Form 1 Check the box that applies to your company; either individual, corporation/LLC, partnership or sole proprietorship 2 Insert your Federal EIN number on the line provided. If an individual please use your Social Security Number here 3 Insert your company name on the line that begins “Know All Men by these Presents that …….” 4 Insert the name of the State under whose laws you are doing business in the space provided 5 Show your full physical address (not PO Box) on the lines provided

Do you need to notarize a witness?

Have a witness sign the form – this does not need to be notarized

Who can sign a power of attorney?

Partnerships - The Power of Attorney may be executed by any member of the partnership. (Section 141.39(a)(I), CR). If the executor is not a general partner, the partnership must certify that the executor is authorized to sign the Power of Attorney under the terms of the partnership agreement.

How long does a power of attorney last?

of this power of attorney is a partnership, the said power shall in no case have any lorce or effect in the United States after the expiration 2 years from the dates of its execution); Appointment as Forwarding Agent Grantor authorizes the above Grantee to acl within the territory as lawful agent and sign or endorse

What is not a customs business?

CBP has declared that "customs business" does not include: (I) marine transactions, (2) the in-bond movement or transportation of merchandise, and, (3) foreign trade zone admission. (Section 171 App. C(II)(C), CR). Further. those activities not involving transactions directly with CBP, such as arranging for freight, performing messenger services, etc., are also not within the definition of "customs business." Additionally, CBP has taken the position that making an Importer Security Filing (ISF) is not "customs business." Nonetheless, if an importer designates an agent to make the required ISF, the agent must be empowered with a valid Power of Attorney. The grant of authority under the NCBF AA recommended Power of Attorney form is broad enough to include authority to file the ISF on behalf of the Principal. Regardless, brokers and forwarders should examine their existing Powers of Attorney in order to ensure sufficient breadth.

What is a power of attorney for LLC?

Limited Liability Corporations - The Power of Attorney should state the names of all members of the LLC that have the authority to execute the Power of Attorney on behalf of the LLC. In addition, if the signator is not a named member, documentation must be provided certifying the signator is authorized to sign the Power of Attorney under the terms of the LLC Agreement.

What is 141.41 surety on customs bonds?

141.41 Surety on Customs bonds, Powers of attorney to sign as surety on Customs bonds are subject to the requirements set forth in part 113 of this chapter. [T.O. 73-175, 38 FR 17447, July 2,1973, as amended by T.O. 74-227, 39 FR 32023, Sept. 4, 1974) § 141.42 Protests. Powers of attorney to file protests are subject to the re- quirements set forth in §174.3 of this chapter.

Do brokers need to fill out Power of Attorney?

Conclusion Sound business practice requires that brokers and/or forwarders provide detailed written instructions for the execution of the Power of Attorney and to fill in as much information as possible on the form prior to sending it to the principal; this will facilitate prompt and correct execution and return. The Power of Attorney should be inspected upon reyeipt to insure completeness. The broker should immediately return the Power of Attorney to the grantor for correction of material deficiencies and/or for re-execution. The retention of Powers of Attorney

Can a power of attorney be used with a CBP?

Using a Power of Attorney with CBP infurtherance of any other customs business activity. whether or not signed or filed by the preparer. However. "customs business" does not include the mere electronic transmission of data received for transmission to CBP and does not include a corporate compliance activity.

How to verify a power of attorney?

Here are some ways the broker can validate a Power of Attorney: 1 To the greatest extent possible, have POA’s completed in person so the grantor’s unexpired government issued photo identification (driver’s license, passport, etc.) can be reviewed. 2 Check applicable web sites to verify the POA grantor’s business and registration with the State authority. 3 If the principal uses a trade or fictitious name in doing business, confirm that the name appears on the POA. 4 Verify that the importer’s name, importer’s number and Employer Identification Number (also known as the Federal Tax Identification Number) on the POA match what is in ACE. 5 Verify the importer’s address is a “brick and mortar” location on a public mapping program, and not simply a “postal box” or undeveloped parcel of land. 6 Dial the provided phone landline number for authentication. 7 Cross-check the provided information through a third party entity, ie: credit report, DUN’s number, or similar business identifying entity. 8 Access the client’s website for depth of content versus only a surface containing a landing page. 9 Check whether the POA grantor is named as a sanctioned or restricted person or entity by the U.S. Government. See the Bureau of Industry and Security’s Export Enforcement ( https://www.bis.doc.gov/index.php/oee ).

What is required to enter into a POA?

In addition to security, the broker’s own professional business interest and continuing obligation to demonstrate “reason able care” require verification of the POA grantor’s identity and legal authority (position in a company or partnership) to enter into a POA .

What is COAC recommendation 010045?

Within Commercial Customs Operations Advisory Committee's (COAC) recommendation 010045, it is suggested that to verify the authenticity of information provided by the importer to the broker, the broker could review publicly available open source information regarding the importer’s business and as appropriate.

Can a broker validate a power of attorney?

Here are some ways the broker can validate a Power of Attorney: To the greatest extent possible, have POA’s completed in person so the grantor’s unexpired government issued photo identification (driver’s license, passport, etc.) can be reviewed.

Popular Posts:

- 1. who is the attorney from erin brockovich marrried to

- 2. what type of attorney do i need to sue my employer

- 3. how many assistant attorney generals are there in albany

- 4. attorney florida procedure in deciding who to represent

- 5. how to find an inexpensive bankruptcy attorney

- 6. who can represent a borrower before the small business administration power of attorney

- 7. what is unethical for a nc attorney

- 8. if the person who has the power of attorney is a convicted felon is the will valid

- 9. what do you need to do to invoke the durable power of attorney in wisconsin

- 10. google how to file a substitution of attorney when there is no opposing counsel