How can I set up a power of attorney?

May 02, 2022 · In California, you must use the form created by the state for your POA. You can find financial POAs in California Probate Code Section 4401, called a Uniform Statutory Form Power of Attorney. This is used to create general or limited POAs.

How to establish a power of attorney?

Jun 09, 2014 · A power of attorney is a legal document that gives someone the power to act on behalf of someone else. In California, the person executing the document is referred to as the “principal” and the person chosen to act on the principal’s behalf is referred to as the “agent” or “attorney-in-fact.”

How do you make a power of attorney?

Tax Power of Attorney California Form – Adobe PDF. The California tax power of attorney form (Form 3520) is used to allow someone else (mostly accountants) to handle another’s State income tax filing. For all federal filings, a U.S. citizen will need to download and complete, in its entirety, the IRS 2848 form.

How do you get a durable power of attorney?

- Enter your California employer payroll tax account number (if applicable) , federal employer identification number, owner or corporation name, corporate identification number, business name/doing business as (DBA), mailing address, business phone and fax number(s), and business location if different than the mailing address. II.

Does a power of attorney need to be recorded in California?

How do I submit a CA power of attorney?

- Choose the correct form. ...

- Fill out the form correctly. ...

- Sign the form. ...

- Provide supporting documentation, if necessary, such as: ...

- Submit the form. ...

- After you submit.

How much does a power of attorney cost in California?

Does a California power of attorney need to be notarized?

Where do I send Form 3520?

How do I get power of attorney for elderly parent in California?

- Talk to Your Parent. Your parent must be mentally competent to make his or her own decisions. ...

- Gather the paperwork. ...

- Fill out the paperwork (Do not sign yet!) ...

- Meet with a Notary to Sign. ...

- File the Form Appropriately.

What are the 3 types of power of attorney?

- Specific Power of Attorney. A specific power of attorney is the simplest power of attorney. ...

- General Power of Attorney. A general power of attorney is used to give a very broad term of use to the attorney. ...

- Enduring Power of Attorney. ...

- Durable Power of Attorney.

What three decisions Cannot be made by a legal power of attorney?

What is the difference between power of attorney and lasting power of attorney?

How long does a power of attorney last in California?

Can a California notary public notarize a power of attorney?

Who signs a power of attorney in California?

Does California have a power of attorney?

California makes it easy to access and create a power of attorney document. The California Probate Code offers a form that complies with California law. In addition, the California Office of the Attorney General website provides a standard power of attorney for health care form.

How to fill out a power of attorney?

Name the parties. When filling out either form, the first step will be two identify each party to the power of attorney. First, you will include the principal's name, address, and contact information. Next, you will need to include the name of the agent or agents that were chosen.

How to get conservatorship in California?

Seek conservatorship if necessary. In order to set up a conservatorship, you must complete a petition and file it with the appropriate court in California . Someone must then provide notice to the proposed "conservatee," the person currently incapacitated, and their relatives.

How many witnesses do you need to sign a power of attorney in California?

In California, a power of attorney must either be acknowledged in front of a notary or signed by two witnesses.

What to do before you execute a power of attorney?

Before you execute a power of attorney, talk with those close to you about your reasons for wanting to do so. It may be that you have a physical illness or injury, or that you want to think ahead in case you ever become incapacitated.

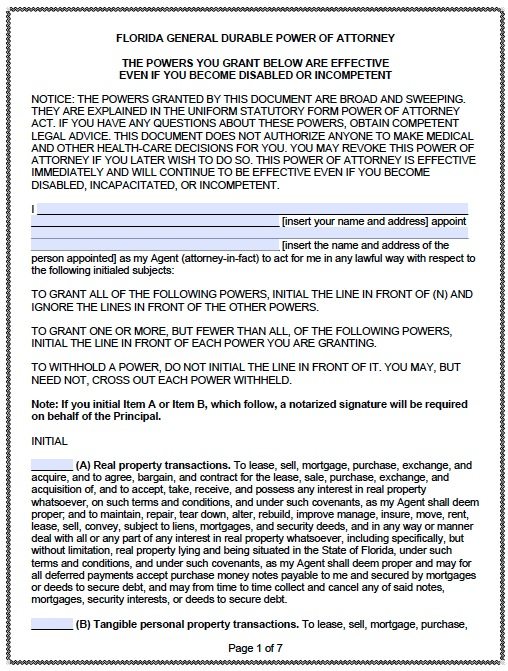

What is a durable power of attorney?

In California, the first type of power of attorney is a durable power of attorney. A durable power of attorney allows you to act on behalf of another person for all day-to-day financial decision making. This is the most flexible and permissive form of a power of attorney.

When does a durable power of attorney become effective?

A durable power of attorney can become effective whenever the principal so chooses. You can make it go into effect immediately or you can choose a time to make the power of attorney effective. A durable power of attorney terminates upon the death of the principal, or when the principal cancels it.

What is a power of attorney in California?

A power of attorney allows someone else to handle financial or healthcare matters on your behalf, and California has specific rules about types and requirements.

What is a POA in California?

The California healthcare POA is found in Section 4701 of the Probate Code and is called an advanced healthcare directive. You can also work with an attorney or an online service to create and execute your POA. If you are unsure about which form to use or how to complete and execute it, legal assistance is a good idea.

What is a POA?

A power of attorney (POA) gives someone you name the authority to handle legal or financial matters for you under specific circumstances. When you create a POA, you are called the principal, and the person you choose to act for you is called your attorney-in-fact or your agent.

What is a general POA?

General POA. This is the broadest kind of POA and gives your agent the right to handle a wide variety of financial matters for you. Limited POA. This is sometimes called a specific POA. This is a very narrow POA that gives your agent the authority to act for you only in specific situations you list in the document.

What is a durable POA?

In addition to the types of matters the POA covers, when the POA will become effective can also vary. Durable POA. A general or limited POA can be durable, which means it goes into effect when you sign it and remains in effect until you destroy or revoke it. Springing POA.

Who must sign a POA?

The principal must also have the legal capacity to enter into a contract. A general or limited POA must be signed by the principal and two witnesses or a notary. If the POA gives your agent the right to handle real estate transactions, the document must be notarized so that it can be recorded with your county.

Can a POA be notarized?

If the POA gives your agent the right to handle real estate transactions, the document must be notarized so that it can be recorded with your county. The agent listed in the POA cannot be a witness to the document. The principal and two witnesses must sign a healthcare POA.

What Types of Power of Attorneys Are Available in California?

You can make several different types of POAs in California. In particular, many estate plans include two POAs that are effective even if you become incapacitated:

What Are the Legal Requirements of a Financial POA in California?

For your POA to be valid in California, it must meet certain requirements.

Steps for Making a Financial Power of Attorney in California

California offers a statutory form (a form drafted by the state legislature) with blanks that you can fill out to create your POA. For a more user-friendly experience, you can try a software program like WillMaker, which guides you through a series of questions to arrive at a POA that meets your specific aims and is valid in your state.

Who Can Be Named an Agent (Attorney-in-Fact) in California?

Legally speaking, you can name any competent adult to serve as your agent. But you'll want to take into account certain practical considerations, such as the person's trustworthiness and geographical location. For more on choosing agents, see What Is a Power of Attorney.

When Does My Durable Financial POA Take Effect?

Your POA should say when it takes effect. If you used California's statutory POA form, it will say, " UNLESS YOU DIRECT OTHERWISE ABOVE, THIS POWER OF ATTORNEY IS EFFECTIVE IMMEDIATELY AND WILL CONTINUE UNTIL IT IS REVOKED." The POA takes effect as soon as you've signed and notarized it.

When Does My Financial Power of Attorney End?

Any power of attorney automatically ends at your death. It also ends if:

Length of POA

Generally, a POA lasts for 6 years. To extend the POA for an additional 6 years, you must submit a new POA 3 .

Ending (revoking) your POA

Anyone on the POA declaration can revoke the POA at any time (such as the individual, business, or representative).

Tax Professionals and MyFTB

If a representative has a tax professional MyFTB 12 account, they will have online access 13 to the individual or business account information once the POA is approved. Taxpayers or tax professionals can request full online account access for a tax professional when a POA declaration is submitted.

What are the Different Types of Power of Attorneys?

There is a generally four different types of powers of attorney documents recognized in California. A Durable Power of Attorney, a General Power of Attorney, a Limited Power of Attorney, and a Medical Power of Attorney.

What is Required to Ensure the Power of Attorney is Valid?

How a power of attorney is set up is crucial if the legal instrument is to operate properly. In order to ensure that the document is valid and that the agent actually possesses all of the power you want to give, certain formalities must be satisfied.

What if my power of attorney is ignored?

Some banks or other financial institutions refuse to recognize the authority of an agent pursuant to a power of attorney. The reason is that banks may be reluctant to acknowledge a power of attorney for fear of a lawsuit if it turns out the power of attorney is not legitimate.

Are the requirements the same for revoking a power of attorney?

Revocation of a power of attorney should also be in writing and notarized. That way, there will be no dispute that the revocation is valid. There is no specific language required, but a written revocation should include your name, the statement that you are of “sound mind,” and that you wish to revoke the existing power of attorney.

What is a power of attorney form?

The California tax power of attorney form (Form 3520) is used to allow someone else (mostly accountants) to handle another’s State income tax filing. For all federal filings, a U.S. citizen will need to download and complete, in its entirety, the IRS 2848 form. It should be noted that the individual being represented is responsible for any inaccuracies and is held accountable despite the representative’s…

What is a durable power of attorney in California?

The California durable power of attorney allows a person to authorize someone else to handle monetary decisions on their behalf. The agreement will provide clarity in what tasks the agent will be able to undertake while clearly defining the durable nature of the legal document; that is, the fact that the powers granted to the agent will remain effective even if the principal becomes disabled…

How many types of power of attorney are there in California?

Types of Power of Attorney. In the state of California, there are four different types of Power of Attorney. In this case, a person can act in place of another individual to fulfill a particular duty. On completion of the specified responsibility, the Power of Attorney becomes void. A person can act in place of another for financial decision making.

What is a power of attorney?

A Power of Attorney is a written document in which a person, also known as the Principal, appoints another person, also known as the Agent, to act on his or her behalf. This appointment is mainly done with respect to private affairs, business and other court-ordered matters. The Power of Attorney expires with the death of the taxpayer (Principal) ...

When does a power of attorney expire?

The Power of Attorney expires with the death of the taxpayer (Principal) or if the representative (Agent) revokes it. People normally opt for a Power of Attorney for medical or financial reasons.

Can a power of attorney be used in place of another?

A person can act in place of another for financial decision making. This type of Power of Attorney remains valid even if the Principal becomes incapacitated. General Power of Attorney. A General Power of Attorney is similar to a Durable Power of Attorney, however, the former stands void if the Principal becomes incapacitated.

Is a Power of Attorney valid if the principal is incapacitated?

This type of Power of Attorney remains valid even if the Principal becomes incapacitated. A General Power of Attorney is similar to a Durable Power of Attorney, however, the former stands void if the Principal becomes incapacitated. In such a Power of Attorney, the Agent is authorized to take all the medical decisions for the Principal.

Length of Poa

Rights and Authorizations

- A POA declaration gives a representative the right to: 1. Talk to us about your account 2. Receive and review your confidential account information 3. Represent you in FTB matters 4. Request copies of information we receive from the IRS 5. Remove another representative from the POA declaration 6. Revoke (end) the POA If your POA declaration was fil...

Ending (Revoking) Your Poa

- Anyone on the POA declaration can revoke the POAat any time (such as the individual, business, or representative).

Tax Professionals and MyFTB

- If a representative has a tax professional MyFTB12 account, they will have online access13to the individual or business account information once the POA is approved. Taxpayers or tax professionals can request full online account access for a tax professional when a POA declaration is submitted.

Popular Posts:

- 1. how many years has cohen been trump's attorney

- 2. how many attorney generals have gone to jail

- 3. how much does a lawyer charge for a durable power of attorney?

- 4. who played district attorney on tonights angie tribeca

- 5. how do you make a server on ace attorney online

- 6. how to reduce attorney fee award to judgment

- 7. reasons why the attorney should switch to an electronic database

- 8. how to address writing a letter as holder of power of attorney

- 9. which attorney general for ebay

- 10. what is the salary of the district attorney stephen zappala of allegheny county