Complete VA Form 21-4142, Authorization to Disclose Information to the Department of Veterans Affairs (VA) and VA For 21-4142a, General Release for Medical Provider Information to the Department of Veterans Affairs (VA); submit completed forms with your claim and VA will attempt to obtain your records through our Private Medical Records contract.

Do I need a power of attorney in Virginia?

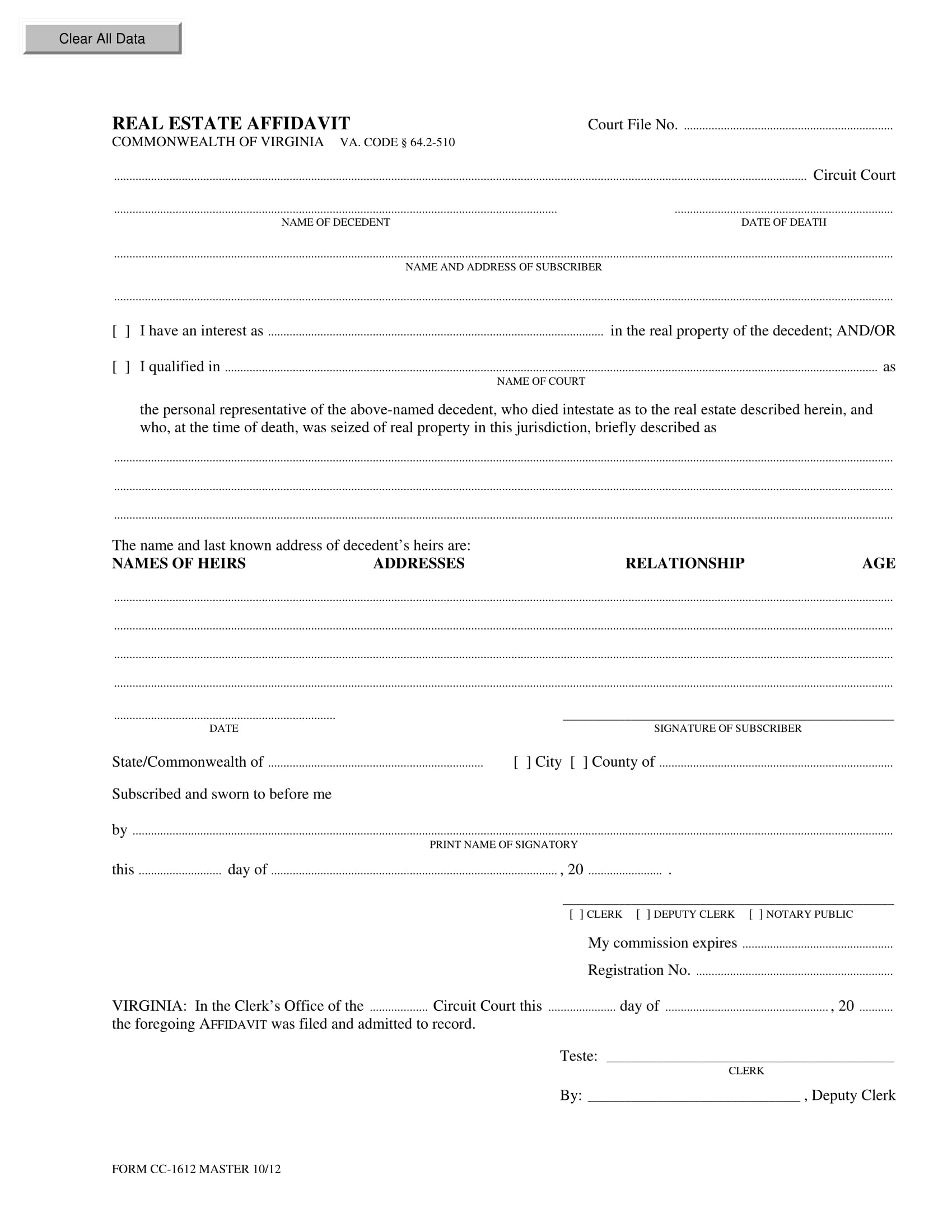

Steps for Making a Financial Power of Attorney in Virginia 1. Create the POA Using Software or an Attorney ... If you gave your agent the power to conduct real estate transactions, you should also file a copy of your POA in the land records office (a division of the circuit court clerk's office in Virginia) in the county where you own real ...

How to establish a power of attorney?

Mar 17, 2022 · Get VA Form 10-0137, VA Advance Directive: Durable Power of Attorney for Health Care and Living Will. Use this VA form to name specific people to make health care decisions for you, and to let VA health care providers know your wishes for medical, mental health, long-term, and other types of health care. About VA Form 10-0137 | Veterans Affairs

How to complete the power of attorney form?

Virginia Power of Attorney Forms. Virginia Power of Attorney Forms grants a resident to appoint an individual to handle financial, medical, tax filing, or motor vehicle-related matters on their behalf. Under statute 64.2-1602, all power of attorney forms are considered “durable” which means that the representative’s authority will continue to be effective even if the person being ...

How to write a power of attorney?

omitted some power or discretion, some tax period, some form or some jurisdiction, I hereby grant to my attorney-in-fact the power to amend the Internal Revenue Service form power of attorney (presently Form 2848 or Form 2848-D) in my name; ___ 8. Safe-Deposit Boxes. To have access at any time or times to any safe-deposit

Do you need a lawyer for power of attorney Virginia?

If you had a power of attorney prepared while you were living in another state or country and you have now moved to Virginia, that document may or may not be legal under Virginia law. To be sure the document will be valid in Virginia, you should have an attorney review it for you or have a new one written.

How much does a power of attorney cost in Virginia?

between $150 and $200 per documentIf an attorney creates a power of attorney for you, the cost can vary greatly in Virginia. Many attorneys will charge between $150 and $200 per document. Many estate planning attorneys also offer estate planning packages that include a will, a trust, an advance directive, and a power of attorney.Feb 1, 2022

How do I get power of attorney?

Procedure for Power of Attorney in IndiaDraft the Power of attorney whether special or general, by a documentation lawyer or through a website.Submit the power of attorney with the Sub-Registrar.Attach the supporting documents with the power of attorney.Attest the power of attorney before the Registrar.More items...

Does power of attorney need to be notarized?

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

How long does it take to get power of attorney?

It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Does power of attorney need to be registered?

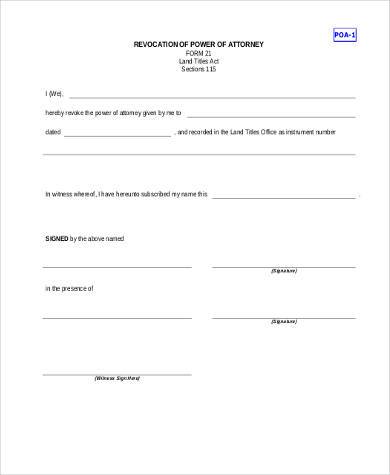

Power of Attorney: Registration: In many cases, a general or specific power of attorney need not be registered. The question of registration arises only if a power is given for the sale of immovable properties. The Indian Registration Act does not make a power of attorney compulsorily registerable.

What is the best power of attorney to have?

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.Mar 19, 2019

What is POA form?

Fill in the oval or select the checkbox on your return to authorize Virginia Tax to speak with your preparer for the specific tax year being filed. Personal Representative.

What is an executor of an estate?

Executor or Administrator of an Estate. A Letter of Qualification from the court of proper jurisdiction on file naming the executor/administrator and giving authority over the deceased taxpayer's tax matters. An executor or administrator of an estate can also be appointed by the Last Will and Testament of the deceased.

What is a CPA?

An authorized tax professional (CPA, enrolled agent, tax preparer, or payroll service provider) needs to discuss routine issues like a return that was filed or a payment that was made by the tax professional on your behalf.

What is an authorized employee?

An authorized employee or officer of your business needs to discuss routine issues like a return that was filed or a payment that was made by your business. A fiduciary (trustee, receiver, or guardian) acts as an authorized agent because a fiduciary already stands in the position of the taxpayer.

What is a PAR 101?

The PAR 101 is a legal document. For the tax matters you list on the form, your representative will be able to receive and inspect your confidential tax information and take the same actions you can, including consenting to extend the time to assess tax or executing consents that agree to a tax adjustment.

When to use this form

Use VA Form 10-0137 to give specific people permission to make health care decisions for you, and to let VA health care providers know your wishes for medical, mental health, long-term, and other types of care.

Helpful links related to VA Form 10-0137

Read about your basic rights and responsibilities when you receive care at a VA health facility or live in a VA community center.

Durable Power of Attorney Virginia Form – Adobe PDF

The Virginia durable power of attorney form, otherwise known as a financial power of attorney form, enables a principal to choose a representative who will have the authority to manage their finances.

General Power of Attorney Virginia Form – Adobe PDF

The Virginia general power of attorney form is a legal instrument that allows a person to select someone else, referred to as an “agent,” to handle all facets of their finances on their behalf. The agent is permitted to use these unrestricted powers as long as the person designating authority, known as the “principal,” is coherent.

Limited Power of Attorney Virginia Form – Adobe PDF

The Virginia limited power of attorney form is used to select an agent to handle certain financial actions or decisions as described by the principal. The form can be made to grant restricted access to one’s personal affairs such as collecting mail, handling a real estate transaction, or paying bills on the principal’s behalf.

Medical Power of Attorney Virginia Form – Adobe PDF

The Virginia medical power of attorney form is a health care plan consisting of two parts. The first section, the Living Will, will be used to specify the conditions under which the principal does or does not consent to the various critical life-saving medical treatments.

Minor (Child) Power of Attorney Form Virginia – PDF

The Virginia minor child power of attorney form is a document that grants temporary guardianship rights to a Virginia resident. A parent or legal guardian may fill out the power of attorney form if they anticipate a situation wherein they will be unable to provide the attention necessary to care for their child.

Real Estate Power of Attorney Virginia Form – PDF – Word

The Virginia real estate power of attorney, once signed by an agent and the principal, provides the former party with the ability to represent the latter in the transfer and maintenance of real property in the State of Virginia.

Tax Power of Attorney Virginia – Form PAR 101- Adobe PDF

The Virginia tax power of attorney form, also known as Form PAR 101, allows an individual to select another person to file their taxes with the Department of Taxation. The appropriate person to appoint for this position is a Certified Public Accountant (CPA) or Tax Attorney due to their knowledge in the field.

What is the meaning of power of attorney?

The meaning and effect of a power of attorney is determined by the law of the jurisdiction indicated in the power of attorney and, in the absence of an indication of jurisdiction, by the law of the jurisdiction in which the power of attorney was executed.

What does "agent" mean in a power of attorney?

For the purposes of this chapter, unless the context requires otherwise: "Agent" means a person granted authority to act for a principal under a power of attorney, whether denominated an agent, attorney-in-fact, or otherwise.

Power of Attorney and Declaration of Representative

- The agent you name in your POA has wide-ranging authority to manage your affairs on your behalf, so it's important to choose someone you trust, such as a family member or close friend. The agent must act in your best interest. It's a good idea to first talk with the person you want to …

Form R-7 - Application For Enrollment as Virginia Authorized Agent

Acceptable Alternative Forms of Authorization

Account Authorization For deceased Taxpayers

- Use this form to: 1. authorize a person to discuss designated tax matters with Virginia Tax and receive correspondence on your behalf 2. revoke a prior power of attorney authorization The PAR 101 is a legal document. For the tax matters you list on the form, your representative will be able to receive and inspect your confidential tax information and take the same actions you can, …

Popular Posts:

- 1. what documents to gather before meeting with attorney regarding mortgage fraud and financial audit

- 2. how to beat ace attorney

- 3. how to select real estate attorney

- 4. how to reply email to attorney

- 5. set up a call with the attorney(s) who want or wants

- 6. how to dress attorney general's office internship

- 7. what else cound an attorney need to prove esa animal

- 8. no living relatve how do power of attorney

- 9. illinois power of attorney form pdf

- 10. who decides if you do not have a health care power of attorney