How do I create a power of attorney?

Oct 01, 2021 · How to Execute a California POA. A California POA can only be created by a principal who is 18 years of age or older. The principal must also have the legal capacity to enter into a contract. A general or limited POA must be signed by …

How to establish a power of attorney?

You can get a blank Power of Attorney form from: a stationery store or other store that sells pre-printed legal forms. your estate planning lawyer, or. a written copy of the correct language for Probate Code, § 4401, may be found at a law library, public library or on the Internet under the California Probate Code.

What does it cost to get a power of attorney?

Use one of the following methods to file form FTB 3520-PIT: For faster processing, submit electronically. Go to ftb.ca.gov, log in to MyFTB, and select File a Power of Attorney. For more information, go to ftb.ca.gov/poa. Mail form FTB 3520-PIT separately from the tax return(s) or other correspondence to the following address: Mail POA/TIA Unit

How do you get a durable power of attorney?

Dec 29, 2020 · Generally, power of attorney documents are described by 1) the time they take effect, and 2) the powers they grant or limits thereon. In California, a power of attorney can be made a springing power of attorney or an immediate power of attorney. An immediate power of attorney becomes effective when signed.

How do you get a power of attorney in California?

power of attorney. submit a power of attorney....To establish a power of attorney relationship, you must fill out and submit the correct FTB form.Choose the correct form. ... Fill out the form correctly. ... Sign the form. ... Provide supporting documentation, if necessary, such as: ... Submit the form. ... After you submit.Sep 23, 2021

Does a power of attorney need to be recorded in California?

Powers of attorney concerning real property must be acknowledged (notarized). There is no statutory requirement that the power of attorney be recorded with the County Recorder in the county where the real property is located.

How do you get power of attorney for a parent in California?

How to Get a Power of Attorney for a Sick Parent in CaliforniaTalk to Your Parent. Your parent must be mentally competent to make his or her own decisions. ... Gather the paperwork. ... Fill out the paperwork (Do not sign yet!) ... Meet with a Notary to Sign. ... File the Form Appropriately.May 24, 2019

Does a power of attorney in California need to be notarized?

Your power of attorney must be notarized. Your power of attorney must explicitly note that it remains in effect if you are incapacitated if you want it to be a durable power of attorney.Sep 19, 2020

How much is a power of attorney in California?

A power of attorney can be created without legal assistance and almost free of charge. In fact, one can find a free POA form online and simply print it and fill it out. One can also have a POA created online for as little as $35.

Can I do power of attorney myself?

Some types of power of attorney also give the attorney the legal power to make a decision on behalf of someone else such as where they should live or whether they should see a doctor. In order to make a power of attorney, you must be capable of making decisions for yourself.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can family members witness a power of attorney?

An attorney's signature must also be witnessed by someone aged 18 or older but can't be the donor. Attorney's can witness each other's signature, and your certificate provider can be a witness for the donor and attorneys.Aug 26, 2021

How long is a power of attorney valid in California?

Code §4129. Typically, a power of attorney goes into effect when signed and ends once the principal becomes incapacitated. However, a durable power of attorney continues even when the principal becomes incapacitated, is rendered unconscious, or otherwise incapable of communicating their desires.Dec 29, 2020

Do you have to register a power of attorney?

In order for a Lasting Power of Attorney to be valid and be used by the Attorney it must be registered. With a Property and Affairs Lasting Power of Attorney, once it has been successfully registered it can be used straight away.

How do you activate a power of attorney?

Your LPA needs to be registered by the Court of Protection before it can be activated. You have two options, you can either register the Lasting Power of Attorney as soon as it's in place and signed by you and your attorney, or leave it to be registered at a later date.Apr 16, 2021

How to fill out a power of attorney?

Name the parties. When filling out either form, the first step will be two identify each party to the power of attorney. First, you will include the principal's name, address, and contact information. Next, you will need to include the name of the agent or agents that were chosen.

How to grant a power in California?

Using the California Probate Code form, you can grant powers by simply initialing next to the powers already laid out. In order to withhold powers, simply avoid initialing next to that power. The subjects included in the form are: real property transactions; tangible personal property transactions; stock and bond transactions; commodity and option transactions; banking and other financial institution transactions; business operating transactions; insurance and annuity transactions; estate, trust, and other beneficiary transactions; claims and litigation; personal and family maintenance; benefits from social security, medicare, medicaid, or other governmental programs, or civil or military service; retirement plan transactions; and tax matters.

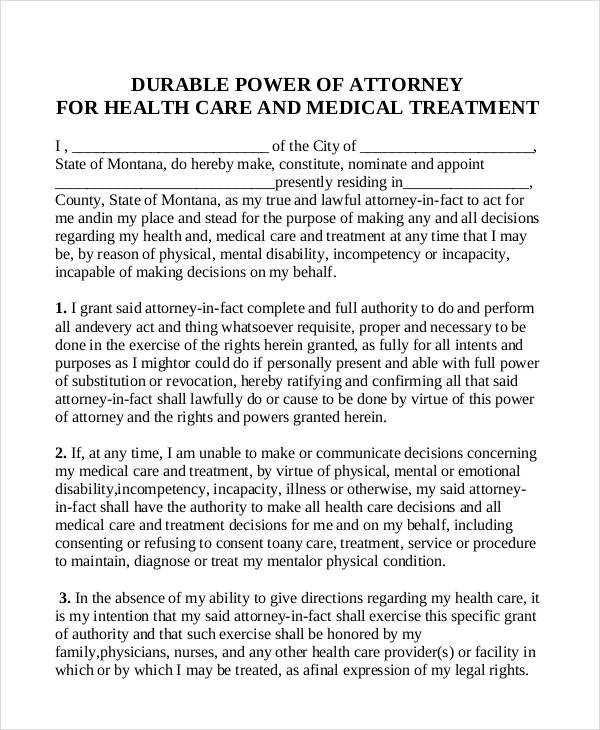

What is a durable power of attorney?

In California, the first type of power of attorney is a durable power of attorney. A durable power of attorney allows you to act on behalf of another person for all day-to-day financial decision making. This is the most flexible and permissive form of a power of attorney.

How to get conservatorship in California?

Seek conservatorship if necessary. In order to set up a conservatorship, you must complete a petition and file it with the appropriate court in California . Someone must then provide notice to the proposed "conservatee," the person currently incapacitated, and their relatives.

Can a power of attorney be signed by two witnesses?

In California, a power of attorney must either be acknowledged in front of a notary or signed by two witnesses. While either method of validation will work, consider doing both. By signing in front of a notary, you expel any doubt as to the validity of the principal's signature.

When does a durable power of attorney become effective?

A durable power of attorney can become effective whenever the principal so chooses. You can make it go into effect immediately or you can choose a time to make the power of attorney effective. A durable power of attorney terminates upon the death of the principal, or when the principal cancels it.

Who can sign a power of attorney?

Direct the principal to sign the power of attorney. The power of attorney can be signed by the principal or by someone else acting on behalf of the principal , in the principal' s presence, and in the principal's name.

What is a power of attorney in California?

A power of attorney allows someone else to handle financial or healthcare matters on your behalf, and California has specific rules about types and requirements.

How old do you have to be to get a POA in California?

A California POA can only be created by a principal who is 18 years of age or older. The principal must also have the legal capacity to enter into a contract. A general or limited POA must be signed by the principal and two witnesses or a notary.

What is a POA?

A power of attorney (POA) gives someone you name the authority to handle legal or financial matters for you under specific circumstances. When you create a POA, you are called the principal, and the person you choose to act for you is called your attorney-in-fact or your agent.

How to complete a POA?

Keep the form in a safe place. Give a copy to your agent. For healthcare POAs, be sure to give a copy to your healthcare provider. Complet ing a POA gives you the peace of mind that someone can handle things for you if you are unable to do so. Ensure your loved ones and property are protected START MY ESTATE PLAN.

What is a general POA?

General POA. This is the broadest kind of POA and gives your agent the right to handle a wide variety of financial matters for you. Limited POA. This is sometimes called a specific POA. This is a very narrow POA that gives your agent the authority to act for you only in specific situations you list in the document.

What is a durable POA?

In addition to the types of matters the POA covers, when the POA will become effective can also vary. Durable POA. A general or limited POA can be durable, which means it goes into effect when you sign it and remains in effect until you destroy or revoke it. Springing POA.

What is a springing POA?

Springing POA. A general or limited POA can be written so that it takes effect only at a certain time or under certain conditions (so it "springs" into action only at that time). For example, you could create it so that it takes effect only if you are incapacitated or so that it is effective for one month.

What is a power of attorney?

A Power of Attorney lets you authorize someone to handle a specific task, like signing documents for you while you are away. For example, your agent can sign sale documents or contracts for the purchase of a house, or to sell your car. Or, your Power of Attorney can authorize your agent to handle on-going tasks.

How long does a power of attorney last?

Or, your Power of Attorney can be durable. This means it will last either until you cancel it or until you die.

What can an agent do?

Here are examples of tasks you can have your agent do: make bank deposits, withdrawals or other transactions. trade stocks and bonds. pay your bills. buy or sell property. hire people to take care of you. file your tax returns. arrange the distribution of retirement benefits.

Can an agent be a witness?

An agent cannot be a witness. If you want the Power of Attorney to be durable, it must say either: "This Power of Attorney shall not be affected by subsequent incapacity of the principal", or. "This Power of Attorney shall become effective upon the incapacity of the principal", or similar words that show you want the document to be valid ...

Can a notary sign a power of attorney?

You must sign the Power of Attorney. You can ask someone to sign for you, but you have to watch him or her do it. The document must be acknowledged by a notary public or signed by at least 2 adult witnesses. An agent cannot be a witness. If you want the Power of Attorney to be durable, it must say either:

What form do you need to sign a POA?

The fiduciary must sign, date, and enter their title on form FTB 3520-PIT, in order for the POA Declaration to be valid. If you are signing on behalf of a fiduciary, you must attach legal documentation indicating you have this authorization.

When does a POA expire?

However, if the POA Declaration was originally established with a durable power of attorney before January 1, 2018, then the POA Declaration will not be terminated. If such a durable power of attorney or letter of conservatorship was filed on or after January 1, 2018, then the POA Declaration will expire at the six year expiration and a new form FTB 3520-PIT will need to be filed to extend the relationship.

What is the FTB 3520-PIT form?

Use form FTB 3520-PIT to authorize an individual to represent you in any matter before FTB, and to request, receive and inspect your confidential tax information. Information that FTB may release includes, but is not limited to estimated payments, notices, account history or compliance status. FTB may release information by phone, in person, in writing, or online via MyFTB.

What is a fiduciary in tax?

A fiduciary stands in the position of an individual and acts as the individual, not as a representative. To authorize an individual to receive confidential tax information on behalf of the individual, estate, or trust, the fiduciary must file form FTB 3520-PIT, and include supporting documents establishing the fiduciary’s authority, such as a certificate of trustee (as provided by Probate Code section 15603), court order, governing instrument, or letters issued by a court (as provided by Probate Code sections 2310 or 8405). If federal Form 56, Notice Concerning Fiduciary Relationship, is required to be filed with the IRS, attach a copy to form FTB 3520-PIT, with supporting documents.

Do you need a FEIN for a POA?

A FEIN is required for estates or trusts and an SSN is required for deceased individuals. If this POA Declaration is for a grantor trust and the IRS did not provide a FEIN, provide the individual’s SSN.

What is a power of attorney in California?

In California, a power of attorney can be made a springing power of attorney or an immediate power of attorney. An immediate power of attorney becomes effective when signed.

What is a power of attorney?

A power of attorney is a legal document that grants the holder (called the agent) legal authority to act on behalf of another person (called the principal). Importantly, a principal may grant power of attorney to an agent giving just a few powers, or a great deal of powers. Power of attorney is important especially when a person becomes ...

Who is Ferdeza Zekiri?

Ferdeza Zekiri is an attorney at Talkov Law in San Diego. The focus of her practice is real estate law and trusts, probate & estate law in California. She can be reached at (858) 800-3300 or [email protected]

Is a springing power of attorney durable?

Prob. Code §4124. A springing power of attorney is considered a durable power of attorney because it becomes effective and lasts through a principal’s incapacity. Generally, there are three power grants for a power of attorney: 1.

Durable Power of Attorney California Form – PDF – Word

The California durable power of attorney allows a person to authorize someone else to handle monetary decisions on their behalf.

General Power of Attorney California Form – Adobe PDF

The California general power of attorney form serves the same function as a general durable power of attorney form only the powers granted to the agent become voided if the person being represented becomes incapacitated (mentally or physically).

Guardianship Power of Attorney California Form – Adobe PDF

The California guardianship power of attorney form is used to nominate a short-term guardian for one or more minor children. The form empowers the guardian with parental rights to care for the child (ren) and make decisions regarding their health care and education.

Limited Power of Attorney California Form – Adobe PDF

The California limited power of attorney form, otherwise known as a “specific” power of attorney, allows a resident of the state to designate an agent to take care of a specific financial matter on their behalf. The matter can be as small as picking up a car to as big as selling or buying real estate. Most of the time, when the task for which…

Medical Power of Attorney California Form – Adobe PDF

The California medical power of attorney, also known as an “Advance Directive”, is used to represent another’s health care decisions in a situation where a person may not be able to represent themselves.

Real Estate Power of Attorney California Form – PDF – Word

The California real estate power of attorney form is a template with which individuals can name an attorney-in-fact to handle certain real estate matters.

Tax Power of Attorney California Form – Adobe PDF

The California tax power of attorney form (Form 3520) is used to allow someone else (mostly accountants) to handle another’s State income tax filing. For all federal filings, a U.S. citizen will need to download and complete, in its entirety, the IRS 2848 form.

What is a power of attorney?

A Power of Attorney is a written document in which a person, also known as the Principal, appoints another person, also known as the Agent, to act on his or her behalf. This appointment is mainly done with respect to private affairs, business and other court-ordered matters. The Power of Attorney expires with the death of the taxpayer (Principal) ...

When does a power of attorney expire?

The Power of Attorney expires with the death of the taxpayer (Principal) or if the representative (Agent) revokes it. People normally opt for a Power of Attorney for medical or financial reasons.

Popular Posts:

- 1. who appoints the attorney general of texas

- 2. so what? hannity using cohen as an attorney?

- 3. how to file for power of attorney of an adult in ar

- 4. how does one sign over power of attorney in the state of washington?

- 5. what can attorney say in lawsuit against former client for unpaid fees california

- 6. chapter 13 - why do you have to submit tax returns to your attorney

- 7. why was william barr chosen for attorney general

- 8. what to bring to a attorney for a will

- 9. what to do if attorney withdraws midcase and dont return amy money

- 10. how do i contact the district attorney