Become Power of Attorney for a Medicare Beneficiary on Social Security If you want to be the representative payee for someone on Social Security, go to the local office. At the Social Security office, submit a letter from the recipient’s doctor that states the need for a representative payee. Also, you’ll need to have proof of identity.

Full Answer

Does Social Security recognize a power of attorney?

May 15, 2006 · POA’s are given so that the designated “attorney” can transact business for the person giving the POA. In some cases a person holding a beneficiary's POA may try to use it as authority to negotiate the beneficiary's Social Security or SSI checks.

Can I use a power of attorney for Social Security?

The steps to becoming a representative payee is as follows: Fill out (or least review) SSA 11 Request to be Selected as Payee form. Schedule a meeting with your local Social Security office. Wait on the review process performed by the SSA.

How do I become a Social Security Attorney?

Aug 08, 2021 · Become Power of Attorney for a Medicare Beneficiary on Social Security. If you want to be the representative payee for someone on Social Security, go to the local office. At the Social Security office, submit a letter from the recipient’s doctor that states the need for a representative payee. Also, you’ll need to have proof of identity.

How to find the Best Social Security lawyer?

Jun 23, 2019 · They will ask you to fill out an SSA-11 form, show proof of identity, and provide your SS number. This must be done in person and not online or by mail. Having a power of attorney drawn up is important for many people who are close to retirement age.

How do I send power of attorney to Social Security?

If you decide to have a representative, you must sign and submit a written statement to us appointing him or her to represent you in your dealings with Social Security. You may use Form SSA-1696 (Appointment of Representative) for this purpose. Send the completed form to your local Social Security office.

Does SSA accept power of attorney?

The Treasury Department does not recognize power of attorney for negotiating federal payments, including Social Security or SSI checks. This means, if you have power of attorney for someone who is incapable of managing his or her own benefits, you must still apply to serve as his or her payee.

What is a SSA 623 form?

Form SSA-623 requires the representative payee to account for all benefit funds issued within a particularly time period. The SSA sends notices for this form to be completed on an intermittent schedule.

What happens to Social Security when someone passes away?

What happens if the deceased received monthly benefits? If the deceased was receiving Social Security benefits, you must return the benefit received for the month of death and any later months. For example, if the person died in July, you must return the benefits paid in August.

What is the monthly amount for Social Security disability?

Social Security disability payments are modest At the beginning of 2019, Social Security paid an average monthly disability benefit of about $1,234 to all disabled workers.

Can I be my own payee for Social Security?

Can I be my own payee? Yes. To be your own payee, you need to show Social Security that you are physically and mentally able to manage your money.

What is SSA 820 form?

Social Security uses the Work Activity Report form to learn more about the work activity of a disability applicant or beneficiary. If you are applying for disability benefits, the information you provide will help us decide if you can receive benefits.

What is a SSA 561 form?

If you applied for Social Security or Supplemental Security Income (SSI) disability benefits and were denied for medical reasons, you may request an appeal online. Appeal Medical Decision. If you do not wish to appeal a medical decision online, you can use the Form SSA-561, Request for Reconsideration.

Who is the number holder on form SSA 11?

Complete all of the information, including your Social Security Number. If you are filing your claim on someone else's Social Security record, this person is the “number holder” and we need his or her information to process your claim.

When someone dies when do they get their last Social Security check?

Let us know if a person receiving Social Security benefits dies. We can't pay benefits for the month of death. That means if the person died in July, the check received in August (which is payment for July) must be returned.

Who gets the $250 Social Security death benefit?

Who gets a Social Security death benefit? Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump-sum death payment.

What is the maximum earnings for Social Security in 2021?

Maximum Taxable Earnings Each YearYearAmount2018$128,4002019$132,9002020$137,7002021$142,8004 more rows

How to approach Social Security Administration?

One way to approach the Social Security Administration is with a court-appointed guardianship. This is an expensive, time-consuming process — but agencies such as the SSA are required to deal with a beneficiary’s court appointed guardian. First, you’ll have to hire an attorney to file a petition for a guardianship hearing.

How to become a representative payee?

The steps to becoming a representative payee is as follows: 1 Fill out (or least review) SSA 11 Request to be Selected as Payee form. 2 Schedule a meeting with your local Social Security office. 3 Wait on the review process performed by the SSA.

What is the second option for Social Security?

The second option is applying to become a representative payee. This program is specific to the Social Security Administration, and it allows an individual to manage the Social Security payments of a beneficiary who is incapable of managing his or her own Social Security.

What is a representative payee report?

Understanding Your Responsibility a a Representative Payee Report. The SSA requires that a representative payee file an annual accounting called the Representative Payee Report. This report details what you, as the representative payee, have done with the beneficiary’s funds during the previous year.

What is a statutory guardian?

A statutory guardian. A voluntary conservator. A private, for-profit institution with custody and is licensed under State law; A friend without custody, but who shows strong concern for the beneficiary’s well-being, including persons with power of attorney;

How to become a power of attorney for Medicare?

If you want to be the representative payee for someone on Social Security, go to the local office. At the Social Security office, submit a letter from the recipient’s doctor that states the need for a representative payee. Also, you’ll need to have proof of identity.

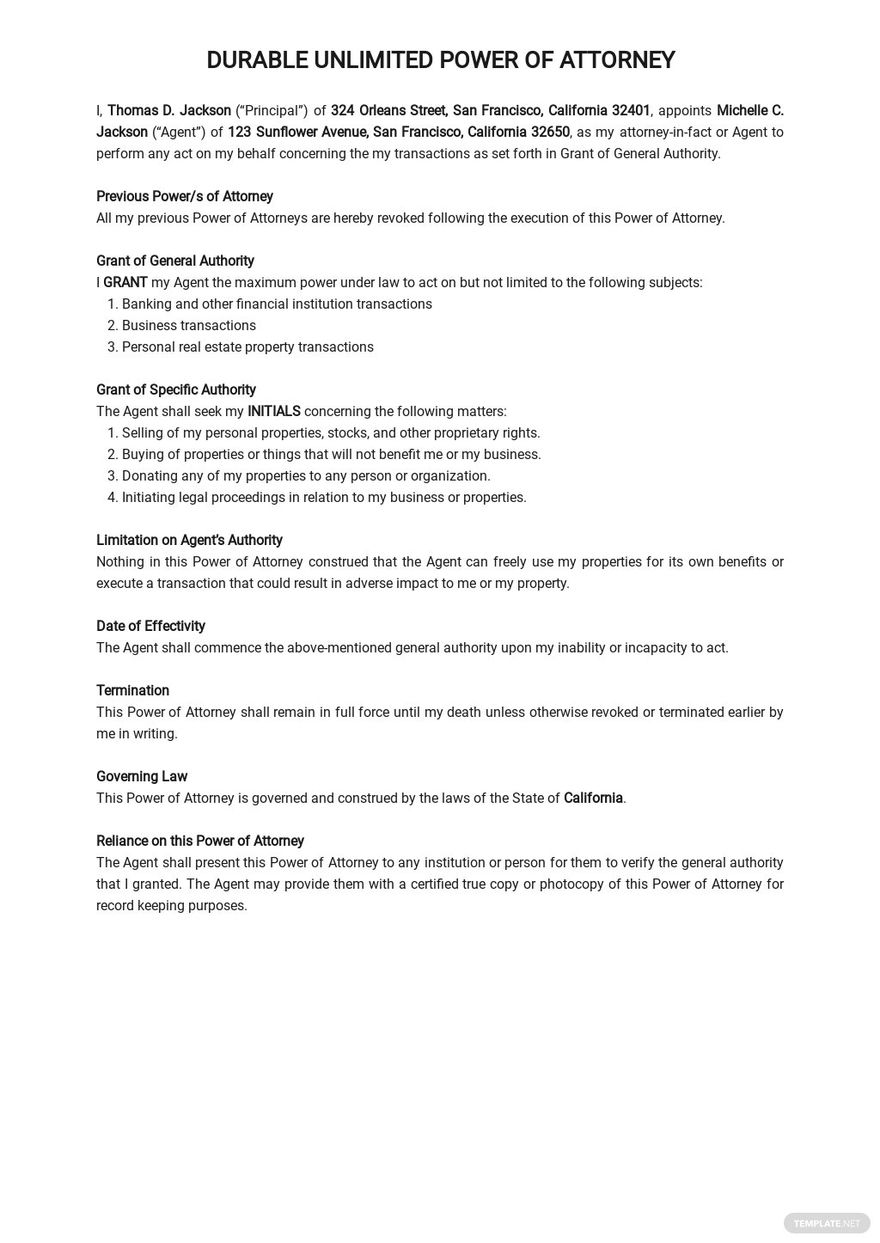

What is a durable power of attorney?

Durable Power of Attorney gives financial legal authority to an agent when the principal is either capable or incapable. Conventional Power of Attorney is granted to the agent when the principal is unfit.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Do you need an advanced directive?

You need an “ advanced directive ” to make medical choices. But, medical choices are different than Medicare or Social Security changes. There are different forms for various changes or decisions you would want to make on behalf of another. Let’s take a look at what you’ll need.

Can a power of attorney be notarized?

Springing Power of Attorney only occurs when the document is signed, and it stays in effect throughout the principal’s life. An attorney can notarize any documents in your state. Each state has different rules.

Can a power of attorney make medical decisions?

Standard power of attorney allows you to handle most of the finances; but, it doesn’t allow you to make health care choices. Yet, making healthcare decisions is necessary when if they become incapable. You need an “ advanced directive ” to make medical choices. But, medical choices are different than Medicare or Social Security changes.

What is a power of attorney?

In very simple terms, a power of attorney is a legally binding document that allows you as the principal to appoint another person as your agent. Your agent then has the power to make decisions on your behalf. In your power of attorney, you can establish the extent of representation you wish to allow your agent to have.

Why is a power of attorney important?

Having a power of attorney drawn up is important for many people who are close to retirement age. If you are concerned about what will happen to your 401K or IRA annuities if you become incapacitated, a power of attorney will allow your loved ones to manage those financial matters.

What is a power of attorney?

Power of attorney is a legal process where one individual grants a third party the authority to transact certain business for that individual. It does not lessen the rights of the individual and does not usually grant the third party the right to manage the individual's assets.

What is a beneficiary in Social Security?

A beneficiary is a person who receives Social Security and/or Supplemental Security Income (SSI) payments. Social Security and SSI are two different programs. we administer both. Who Needs a Representative Payee? The law requires most minor children and all legally incompetent adults to have payees.

What is a representative payee?

A representative payee is a person or an organization. We appoint a payee to receive the Social Security or SSI benefits for anyone who can’t manage or direct the management of his or her benefits. . A payee’s main duties are to use the benefits to pay for the current and future needs of the beneficiary, and properly save any benefits not needed ...

Does the Treasury recognize power of attorney?

The Treasury Department does not recognize power of attorney for negotiating federal payments, including Social Security or SSI checks. This means, if you have power of attorney for someone who is incapable of managing his or her own benefits, you must still apply to serve as his or her payee.

Can a payee sign a document other than Social Security?

A payee cannot : Sign legal documents, other than Social Security documents, for a beneficiary. Have legal authority over earned income, pensions, or any income from sources other than Social Security or SSI.

Is a power of attorney the same as a payee?

Being an authorized representative, having power of attorney, or a joint bank account with the beneficiary is not the same as being a payee. These arrangements do not give legal authority to negotiate and manage a beneficiary's Social Security and/or SSI benefits. In order to be a payee, you must apply for and be appointed by Social Security.

Popular Posts:

- 1. who is the attorney general of maine

- 2. what is it called when an attorney doesn't get paid until he wins case

- 3. va commonwealth attorney what is

- 4. what is continuing of education attorney

- 5. who will pay if you are hit by a bus -law -lawyer -attorney -legal

- 6. what kind of attorney do i need for credit card debt

- 7. how to contact wisconsin attorney general office

- 8. what is p.a. after attorney

- 9. how much does a civil defense attorney cost

- 10. where can i get medical power of attorney in arizona