Write the following in the endorsement area:

- “Pay to the order of” followed by the name of the individual who you wish to have the money

- Sign your name underneath

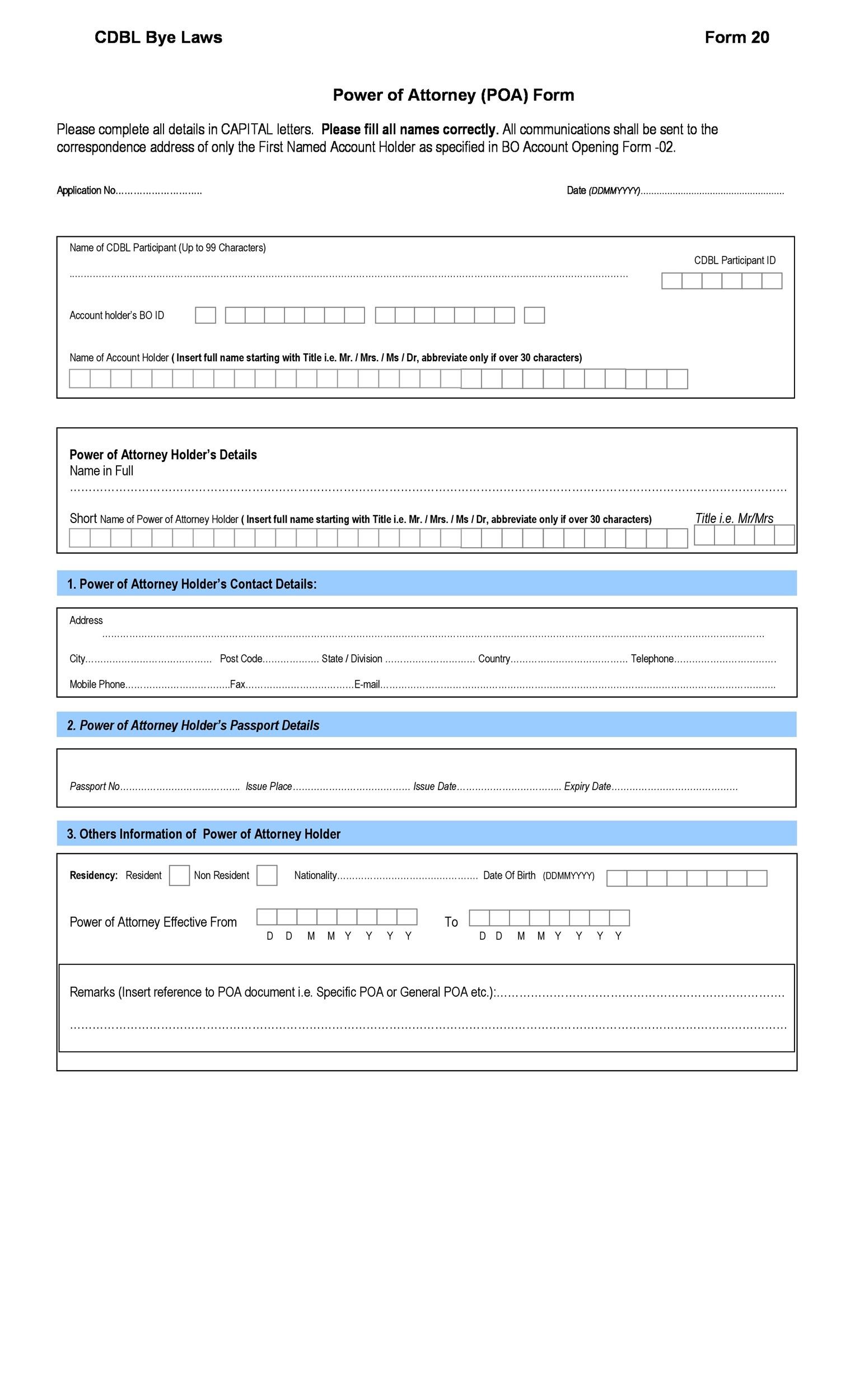

How do you write a check with power of attorney?

If you need to sign a check for her, the usual procedure is to write her name on the top line and then add your name and title underneath, Mr. Rubenstein says. For example, you would write your mother's name on the main line. Underneath it, you would write: "By (insert your own name), as attorney in fact."

How do I endorse a check to someone?

Write “Pay to the Order of” and the third party's name below your signature. It's important to write the name of the person that you are signing the check over to in the endorsement area under your signature. This signals to the bank that you are endorsing the transfer of ownership for the check.

How do you endorse a check print or signature?

To endorse a check, you simply turn it over and sign your name on the back. Most checks give you a space on the back for your endorsement. You'll see a few blank lines and an "x" that indicates where you should sign your name.

Can I deposit a check that is not in my name?

Call your bank and explain that you intend to deposit a check that has been made payable to someone else. Ask what you need to have them write on the back of the check, and be sure to ask if you both need to be present to deposit it.

What do I write on the back of a check to deposit?

For Deposit Only—Restrictive Endorsement Write: For Deposit Only to Account Number XXXXXXXXXX. Sign your name below that, but still within the endorsement area of the check.

How do I endorse a check to someone else without recourse?

Qualified Endorsement You qualify the check by writing the words “without recourse” in the endorsement area. Qualified endorsements typically absolve the endorser from the responsibility of payment if, for any reason, the check is not honored.

Who signs the endorsement on a check?

Who Endorses a Check? The person receiving the check is the one that needs to endorse the check. For instance, if the front of the check on the "Pay to the Order of" line says, "Jane Doe" then Jane Doe is the one who should be endorsing the check.

What happens if I endorse a check incorrectly?

What happens if I endorse a check incorrectly? It also won't be accepted by the bank. Also, if the amount written in the box is correct but the amount written in words is wrong, you will need to void the check and write another one.

Can I deposit someone else's check for them?

You can deposit a check for someone else as long as it has the payee's signature and includes the phrase “for deposit only.”

Who signs the endorsement on a check?

Who Endorses a Check? The person receiving the check is the one that needs to endorse the check. For instance, if the front of the check on the "Pay to the Order of" line says, "Jane Doe" then Jane Doe is the one who should be endorsing the check.

Where do I go to endorse a check?

First, take a look at the payee line on the front of the check, which will specify who needs to endorse the check. The payee line is located near the top of the check, next to the words “Pay to the order of.” If your name is the only one on the payee line, you're the only person who needs to endorse it.

What is the purpose of endorsing a check?

The answer I was given is that a check is a legal document (a promise to pay). In order to get your money from the bank, you need to sign the check over to them. By endorsing the check you are attesting to the fact that you have transferred said document to them and they can draw on that account.

How to endorse a check on behalf of a client?

The proper way to endorse a check on behalf of a client begins with the retainer agreement . The retainer must include a revocable power of attorney clause and must fully disclose the effect of the power of attorney (NYSB Op. 760). If these two requirements are met, then the attorney has the right to endorse a check on behalf of the client—but only as an agent of the client.

Is it wrong to sign a client's name on a settlement check?

In conclusion, the common expediency of signing a client’s name to the back of a settlement check is incorrect. While your bank may be willing to overlook this practice, it is still wrong. I suggest that in any case where a settlement check is anticipated that the body of your retainer include a disclosure statement regarding the effect of the power of attorney the client is signing and that the physical revocable power of attorney form be made a part of the retainer as a stand-alone schedule which will remain with the retainer agreement yet can be copied for the purpose of depositing checks. 3

Does a retainer have to include a power of attorney clause?

The retainer must include a revocable power of attorney clause and must fully disclose the effect of the power of attorney (NYSB Op. 760). If these two requirements are met, then the attorney has the right to endorse a check on behalf of the client—but only as an agent of the client.

What is a Power of Attorney?

This means that another individual (normally referred to as the agent) is required to make certain decisions for them. Being designated someone 's power of attorney could require you to make life-impacting decisions on their behalf.

When can a power of attorney be invoked?

It is often assumed that power of attorney is only invoked when an individual can no longer make their own decisions, but that isn't actually the case. Individuals with power of attorney privileges can perform certain duties for another individual, based on the documentation at the heart of this relationship.

Can individual B sign a check as POA?

In this case, individual B has two ways they can endorse a check as POA. The writers at Aging Care say that they can sign the check as "A, signed by B under POA", or they can sign as "B, Power of Attorney for A," says the team at Citizen's Bank.

Can a POA be signed by B?

In this case, individual B has two ways they can endorse a check as POA. The writers at Aging Care say that they can sign the check as "A, signed by B under POA", or they can sign as "B, Power of Attorney for A," says the team at Citizen's Bank. Either one of these explains the situation to all relevant parties and covers the legal requirements set forth in the power of attorney agreement.

Can you sign a check when you are a power of attorney?

You can sign a bank check when you are the power of attorney.

Can a power of attorney sign a check for another person?

Someone appointed with power of attorney can in fact sign a check for another individual, as long as the POA agreement grants them the right to execute these financial transactions. The document that was created and signed as the power of attorney agreement was enacted will detail all of the specific cases in which the agent is able to sign in ...

How to endorse a check?

You endorse a check by signing the back of it. On most checks there is a box at the top containing a stack of at least three lines that has the heading “Endorse Here,” and another, larger box beneath it with the heading "Do Not Write, Stamp, or Sign Below This Line." You should endorse the check in the top box. 3

Why do banks require you to endorse checks?

First, though, a general word of warning about check fraud. The reason why banks require you to endorse checks is in order to prevent fraud. Signing the back of a check helps to confirm your identity. 2

What Is a Blank Endorsement?

A blank endorsement consists simply of the signature of the person to whom the check is made out on its back side. This makes the check negotiable tender for anyone holding it, not just the endorser, so it is not a very safe from of endorsement. That said, it is the most common form.

What Is a Restrictive Endorsement?

A restrictive endorsement includes not only the signature of the endorser but also the words “For Deposit Only” and the bank account number in which it is to be deposited. This prevents anyone else cashing or depositing the check.

Why do you wait until the last possible moment to endorse your check?

Wait until the last possible moment to endorse your check, so that it cannot be intercepted before it is processed. Doing this helps to guard against check fraud.

How to sign a check made out to someone else?

You first write “Pay to the order of” followed by the name of the person you wish to have the funds. Then you sign your below that. A number of banks will no longer accept such an endorsement, so make sure in advance that your bank will. And even if it will, it may require you to be present for identification purposes when your third party cashes or deposits the check.

Why do you sign the back of a check?

Different types of checks require different types of endorsement, but most involve signing the back of a check to prove that you are the legal owner of the funds it represents.

What does it mean when a check says endorse?

Every check has an area on the back that reads “Endorse Check Here.” This is where you will sign your name as it appears on the front of the check. Understanding how to properly endorse a check will create a smoother and more positive experience when signing over a check to someone else.

How to cash a third party check?

2. Confirm the Person/Entity Will Accept a Signed-Over Check. Make sure to touch base with your choice recipient of the signed-over check and confirm that they are willing to accept the check.

How to sign a check over to a third party?

The following steps detail the process of signing over a check to a third party: 1. Plan Before Endorsing a Check to Someone Else. You’ll need to designate who you’d like to sign your check over to. This could be another person, group of people, or a company.

Do you have to sign a check over to a bank?

The person or entity that you choose to sign the check over to will need to ensure that their bank will accept the check, as a bank is not obligated to do so. This should be confirmed before the check is endorsed to avoid causing confusion with multiple signatures.

Who to give check to when cashed?

Give the Check to the Third Party to be Cashed. The check is now ready to be deposited by your designated third party. It is a good idea to accompany the third party to the bank when the check is deposited to provide proof of identification.

Can a third party accept a check?

Because the check is currently payable to you, you’ll need to ensure that the third party and their bank can accept a signed-over check, also known as a “third-party check,” and endorse the check by signing the back of it.

What happens if you don't check a POA?

This means if you don't check anything, the agent won't have any powers.

How to sign a power of attorney?

To sign as a power of attorney, start by signing the principal's full legal name. If you're dealing with a financial account, sign their name the same way it's listed on the account. Next, write the word "by" on the line below the principal's name and sign your own name.

What does POA mean?

When someone gives you power of attorney (POA) in the United States, it means you have the authority to access their financial accounts and sign financial or legal documents on their behalf. POA is given using a legal POA document that has been drafted and executed according to your state's law.

How to tell if you need to notarize a document?

If you're using a form or template, look to see if there is space at the bottom for witness signatures or a notary seal. This will tell you whether you need to have the document notarized, or bring additional witnesses.

What does it mean to be an attorney in fact?

When the document goes into effect, you become that person's attorney in fact, which means you act as their agent. Generally, to sign documents in this capacity, you will sign the principal's name first, then your name with the designation "attorney in fact" or "power of attorney.". Steps.

When does a POA go into effect?

Your POA agreement should specify exactly when the POA will go into effect, how long it will last, and what duties and powers the agent has under the agreement. Some POA agreements go into effect when signed, while others are designed to go into effect only when a specified event happens.

Who can help with POA?

An attorney who specializes in trusts and estates can assist you if you need a POA for reasons not covered in the basic form. For example, in many states a basic POA document won't allow the agent to act on the principal's behalf in real estate transactions.

3 attorney answers

Endorse the back of the check with his name as it appears on check followed by: "by (your name), attorney in fact for (his name). ". Then you endorse your name and deposit into your checking account. Legally that should work.

Forrest Nolan Welmaker Jr

First, try going to the bank upon which the funds are drawn. If the employer's bank is Wells Fargo (by example), then go there and bring the original, signed and notarized POA. You might -- maybe -- have better luck in that instance. Second, if that doesn't work, see if your friend can contact the employer to explain...

Stuart A. Lautin

You do not need a power of attorney to cash the check. He simply has to endorse them and give them to you.

Popular Posts:

- 1. what happens if the owner of the state dies and the power of attorney dies

- 2. who has to file limited power of attorney

- 3. power of attorney how many simultaneous

- 4. reasons why you would get 2 pieces of mail from an attorney

- 5. how does power of attorney of a child affect parental rights

- 6. a defense attorney who knew of the location of the murder weapon

- 7. who is the attorney general for ft myers

- 8. local attorney from newport, vt. who is being disciplined

- 9. what to put on inmate letter from attorney

- 10. attorney general dana chosen why