How to Get Power of Attorney for a Parent (Without Overstepping)

- Learn About "Capacity" and Evaluate Your Parent's Situation. ...

- Familiarize Yourself With the Various Types of Power of Attorney. ...

- Discuss the Issue With Your Parent (and Possibly Other Family Members) Since your parent is the only person who can grant you or someone else power of attorney, this step ...

- Determine your state's requirements. ...

- Consider durability. ...

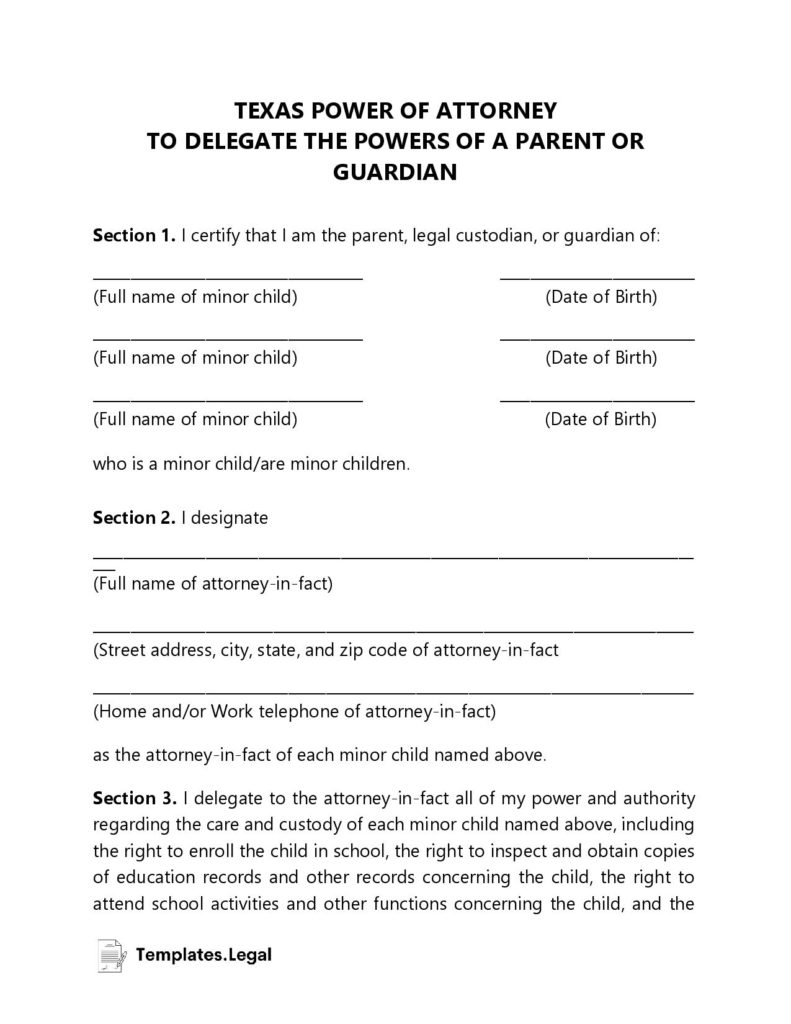

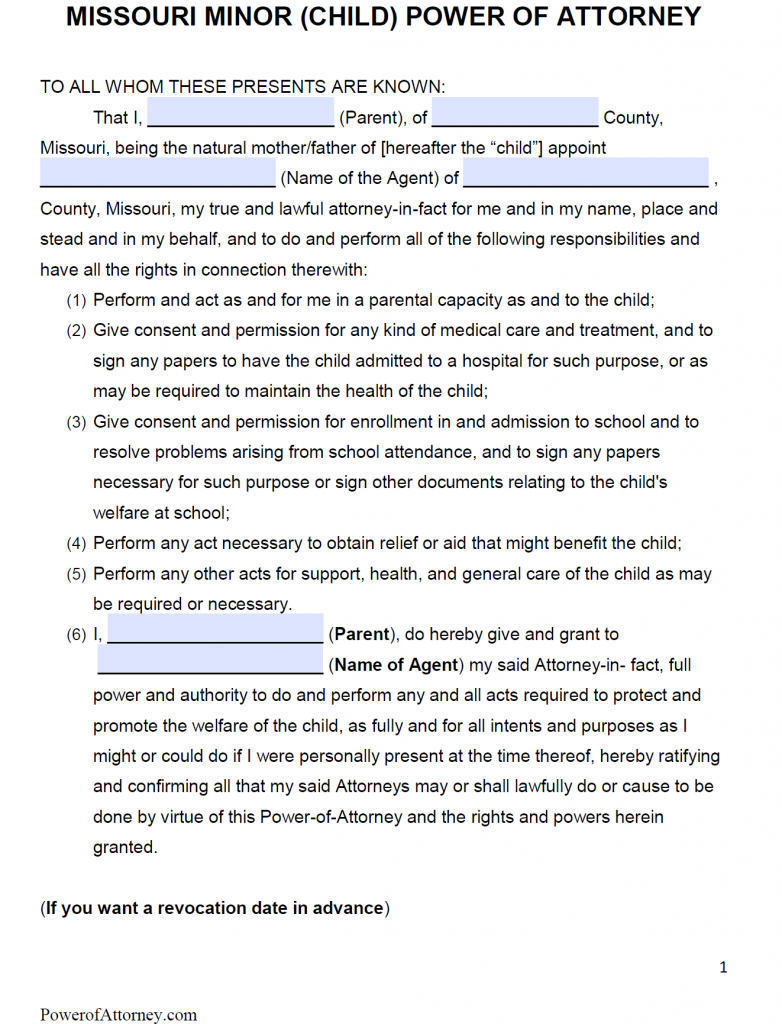

- Find the correct power of attorney form. ...

- Discuss powers granted with your parent. ...

- Have the document notarized. ...

- Distribute copies to the parties involved.

How to get power of attorney over a parent?

Jun 23, 2020 · Broadly speaking, you get power of attorney for a parent by having him or her name you as the agent in a POA document that he or she has signed while sound of mind. However, the process is rarely as simple as it seems, especially when it comes to ensuring that your power of attorney will be recognized by third parties.

How to get power of attorney for elderly parents?

Nov 25, 2021 · How to Become Someone’s Power of Attorney Agent. As long as your parent has the mental capacity, they can choose an agent to legally represent them. Depending on your situation, you may wish to become the power of attorney agent for your elderly parent or loved one, or someone else may fill this important role.

What is parental power of attorney?

You must get your parent to sign a POA when they're competent and lucid. If they become incompetent, and they don't have a durable POA in place, you'll have to file for guardianship once they become incompetent to have any control over their finances or healthcare.

Do you need a lawyer to get a power of attorney?

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

How do you obtain power of attorney?

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

How do I set up power of attorney for my elderly parent?

How to Get a POA for Elderly Parents in Good HealthTalk it through with your parent(s) At this point, you should have a better idea of what type of power of attorney would suit your situation. ... Consult with a lawyer. The laws governing powers of attorney vary from state to state. ... Document your rights. ... Execute the document.

How do I give my mom power of attorney?

How to Become My Mother's Power of AttorneyGet a fill-in power of attorney form from a legal print store. ... Talk to your mother. ... Fill out the power of attorney in full. ... Ask your mother to sign and date the form in front of a qualified notary.More items...

What are the 4 types of power of attorney?

AgeLab outlines very well the four types of power of attorney, each with its unique purpose:General Power of Attorney. ... Durable Power of Attorney. ... Special or Limited Power of Attorney. ... Springing Durable Power of Attorney.Jun 2, 2017

What three decisions Cannot be made by a legal power of attorney?

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

How long does a power of attorney take?

How long does it take to get a PoA registered? It usually takes 8 to 10 weeks for The Office of the Public Guardian to register a power of attorney, so long as there are no mistakes on the form. It may take longer if there are issues they want to look into, although this is rare.

How do elderly parents take over finances?

Here are eight steps to taking on management of your parents' finances.Start the conversation early. ... Make gradual changes if possible. ... Take inventory of financial and legal documents. ... Simplify bills and take over financial tasks. ... Consider a power of attorney. ... Communicate and document your moves. ... Keep your finances separate.More items...

What are the disadvantages of power of attorney?

DisadvantagesYour loved one's competence at the time of writing the power of attorney might be questioned later.Some financial institutions require that the document be written on special forms.Some institutions may refuse to recognize a document after six months to one year.More items...

What is the difference between a conservatorship and power of attorney?

Power of attorney is when you voluntarily assign someone the right to make legally binding decisions on your behalf. A conservatorship is when the court assigns someone the right to make those decisions for you. While you can rescind power of attorney at any time, only a court order can rescind a conservatorship.Aug 31, 2021

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. ... Gifts can be on occasions such as births, marriages, birthdays, or anniversaries etc., and only to those people who are closely connected with the donor.

Who can override a power of attorney?

PrincipalThe Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

How to prepare a POA for a parent?

Hire an attorney. If your parent decides to go ahead with a POA, hire an attorney to draw up the papers. You also can have the POA prepared online. Your best bet is to have someone prepare the POA for your parent so that the POA meets your state's requirements.

What is a power of attorney?

A power of attorney is the name of a legal document that creates a legal relationship between your parent, the principal, and you or your siblings—the agents. You can act as your parent's agent, or your parent can choose a close friend. The important thing is that the agent is someone your parent trusts because your parent is giving ...

Why is a power of attorney important?

Having a POA for your parent allows you to make financial and other decisions when they're not able to, such as if they're incapacitated and need someone to act for them. A healthcare POA allows you to make crucial medical decisions for them, including who to hire if they can live at home, ...

What is a POA in healthcare?

A healthcare POA allows you to make crucial medical decisions for them, including who to hire if they can live at home, where they should live if living at home isn't feasible, and what type of medical decisions they want you to make. Discuss what their estate includes and where to find important papers.

Can a parent have more than one POA?

Your parent can pick more than one person to act as an agent; there are different types of powers of attorney (POA), such as a durable POA for finances and a healthcare POA, so it's possible for your parent to pick different people for each POA they have. They can also choose more than one person for each POA.

Do you need to sign a POA before guardianship?

Have your parent sign a POA well before a guardianship becomes necessary. Elderly, middle-aged, and even younger parents should sign a POA. As the COVID-19 pandemic showed, unforeseen things could happen at any time, so being prepared for emergencies is a good idea.

Why do you need a power of attorney for an elderly parent?

Common Reasons to Seek Power of Attorney for Elderly Parents. Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations.

What is a power of attorney?

At its most basic, a power of attorney is a document that allows someone to act on another person’s behalf. The person allowing someone to manage their affairs is known as the principal, while the person acting on their behalf is the agent.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

What is the best document to prepare for an aging loved one?

There are two separate documents you’ll likely need as part of comprehensive planning for your aging loved one. The first is a financial POA , which provides for decisions regarding finances and for the ability to pay bills, manage accounts, and take care of investments. The second is an Advance Healthcare Directive, which is also known as a “living will” or a “power of attorney for healthcare.” This document outlines who will be an agent for healthcare decisions, as well as providing some general guidelines for healthcare decision-making.

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

How to get a POA?

When you’re ready to set up the POA, follow these steps: 1 Talk to Your Parents: Discuss what they need in a POA and what their wishes are when it comes to their finances and health care. You must also confirm their consent and make sure they agree with everything discussed. 2 Talk to a Lawyer: Everyone who gets a POA has different needs and the laws are different in each state. It’s important to get legal advice so that your parent’s wishes are taken into consideration and the document is legal. 3 Create the Necessary Documentation: Write down all the clauses you need that detail how the agent can act on the principal’s behalf. This ensures your parent’s wishes are known and will be respected. Although you can find POA templates on the internet, they are generic forms that may not stand up to legal scrutiny and probably won’t have all the clauses you require. 4 Execute the Agreement: Sign and notarize the document. Requirements for notarization and witnesses differ, so make sure you check what’s required in your state.

Talking to Parents about becoming Power of Attorney

Because you’re the child (even though you’re an adult)! The parent is the authority figure. The parent tells you what to do, not the other way around. The parent is used to protecting you from bad things or difficult things. Over the years they have had to learn how to let you make your own choices and live your own life.

When a parent refuses to discuss

There’s a few main reasons this might be happening: The whole parent/child thing I just talked about; fear including fear of loss of control or the unknown or death; or maybe they just don’t think you can handle it. So how do you overcome this?

Need more help talking to your parents?

The other thing that’s different here, is help may come in the form of another sibling or family member. You may just not be the child they have in mind to manage their affairs. It doesn’t mean they don’t love you, trust you, or that the other child is liked better. It means that people have different strengths.

Popular Posts:

- 1. who is the greene county, ny attorney

- 2. who is in charge of the los angeles district attorney

- 3. when you geant power of attorney can they take the money

- 4. how much does an attorney cost in jamaica for property settlement

- 5. what do you have to do to become someone's power of attorney

- 6. how to start a professional email to a state's attorney

- 7. when is oklahoma district 20, district attorney craig ladd up for election

- 8. how much attorney fees to file i 829

- 9. what are the main challenges being an imigration attorney

- 10. who was trump's attorney general