How to Establish a Financial POA, Step by Step

- Determine if one is needed. Under a few circumstances, a power of attorney isn’t necessary. ...

- Identify an agent. One adult will be named in the POA as the agent responsible for making decisions. ...

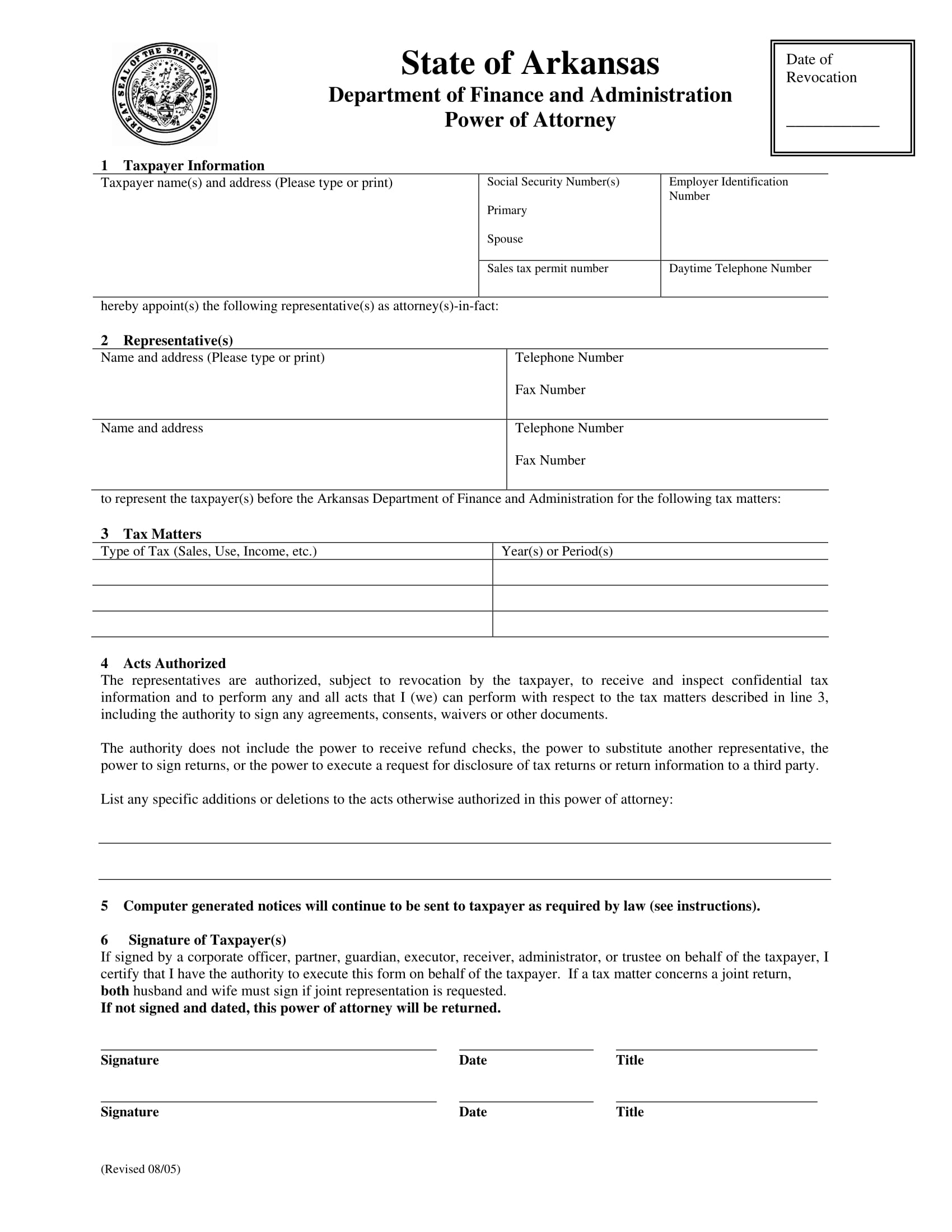

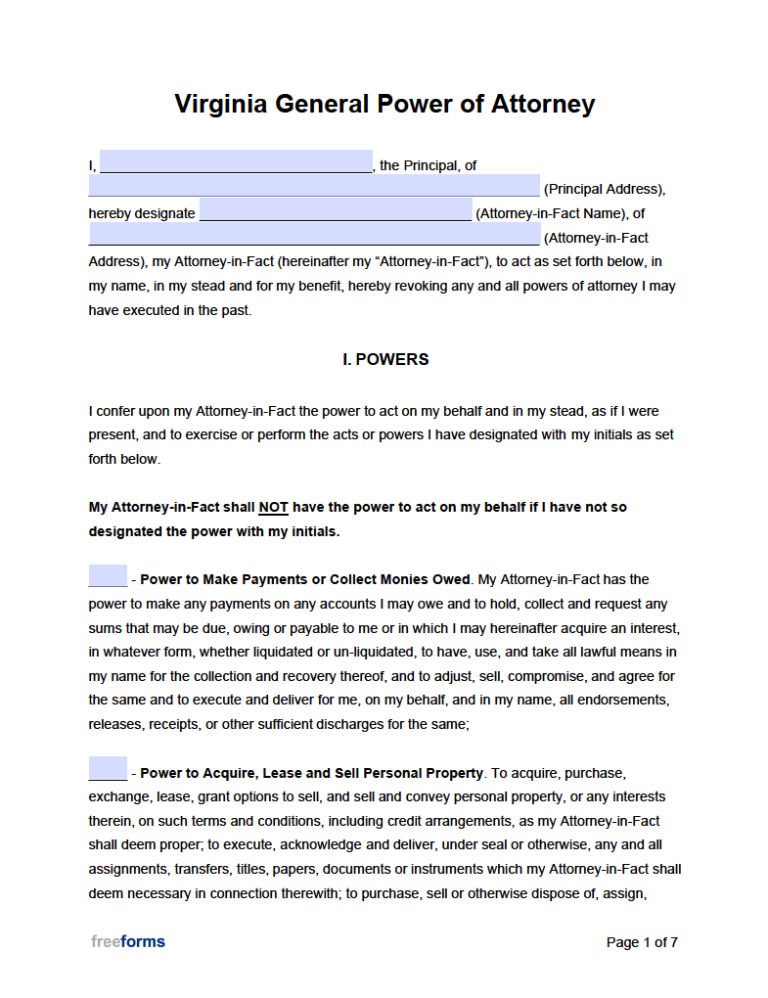

- Take a look at the standard forms. You may find that certain states or your family’s bank or individual’s financial institutions have POAs that they prefer to use.

- Notarize the written POA, keep it stored safely, and provide copies to important people. A POA has to be written, witnessed, and notarized. ...

- Review the POA periodically. A financial POA has to be prepared before you need it. ...

Full Answer

How can I become a financial power of attorney?

May 11, 2021 · Generally, a financial power of attorney must be signed before a notary public. Especially if the sale or purchase of real estate is involved, it may also need to be signed before witnesses. In a few states, the agent is also required to sign to accept the position of agent.

How do I go about getting a power of attorney?

In California, you can draft your financial power of attorney so that it takes effect as soon as you sign it. You must specify that you want it to be "durable." If you don't, it will automatically end if you become incapacitated.

How can you get out of being power of attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

Can I refinance with power of attorney?

You’ve three primary options through which you can obtain a financial power of attorney in California and the United States. First, you theoretically can draft a financial power of attorney on your own. Unless you’ve at least some legal or appropriate financial background, taking this step can prove a risky exercise.

What is a financial power of attorney?

With a financial power of attorney, you name a trusted person to pay bills, make bank deposits, watch over investments, collect insurance or government benefits, and handle other money matters on your behalf.

How to terminate a power of attorney?

A durable power of attorney automatically ends at your death. It also ends if: 1 You revoke it. As long as you are mentally competent, you can revoke your document at any time. 2 You get a divorce. In California, your durable power of attorney is automatically terminated if your spouse is your agent and you get a divorce. As a practical matter, it is always wise to make a new power of attorney as soon as you file for divorce. 3 A court invalidates your document. It's rare, but a court may declare your document invalid if it concludes that you were not mentally competent when you signed it, or that you were the victim of fraud or undue influence. 4 No agent is available. To avoid this problem you can name an alternate agent in your document.

What happens if you don't have a power of attorney?

If you don't, it will automatically end if you become incapacitated. If you don't want to make an immediately effective document, you can state that your power of attorney will not go into effect unless a doctor certifies that you have become incapacitated. This is called a "springing" durable power of attorney.

When does a durable power of attorney end?

A durable power of attorney automatically ends at your death. It also ends if: You revoke it. As long as you are mentally competent, you can revoke your document at any time. You get a divorce. In California, your durable power of attorney is automatically terminated if your spouse is your agent and you get a divorce.

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

What is a power of attorney?

In the United States, a Power of Attorney enables a person to legally make medical, financial, and certain personal decisions (such as recommending a guardian) for another person. You may need to grant someone power of attorney if you are incapable of handling all or part of your affairs for a period of time.

Why is it important to have a power of attorney?

Because the decisions that the person holding power of attorney makes are legally considered the decisions of the principal, it's vital that the agent be someone you trust absolutely and without question. Consider the following when thinking about possible agents: Consider how close the candidate is to the principal.

How many witnesses are needed to sign a power of attorney?

Gather witnesses. In some states it is necessary to have the signing of the document witnesses by one or two people. For instance, in Florida, a power of attorney document must be signed by two witnesses while in Utah, no witnesses are required.

When does a durable power of attorney go into effect?

It often will not go into effect until the person who grants the power of attorney becomes incapacitated.

Is a power of attorney void?

If the power of attorney purports to transfer a power that cannot be transferred under the law, that part of the power of attorney is void. For instance, even if the principal and the agent agree, the agent cannot write or execute a will for the principal. Any such will is not valid.

Do you need to notarize a power of attorney?

Have the power of attorney document notarized. Some states require the agent and the principal to sign the power of attorney document in front of a notary. Even if your state does not require notarization, notarization eliminates any doubt regarding the validity of the principal's signature.

Can you charge someone for acting as a power of attorney?

You are not allowed to charge for acting as power of attorney on behalf of someone else. The only charges you can make are on food, lodging, and travel for performing your duties.

Overview of a Financial Power of Attorney

A financial power of attorney is a legal instrument that allows you the ability to grant authority to another person to tend to your financial affairs. There are two types of financial powers of attorney. There is a nondurable financial power of attorney and a durable financial power of attorney.

Financial Power of Attorney When You Are Not Incapacitated

As mentioned a moment ago, a nondurable financial power of attorney is one that is put into effect and remains in place until you lose your capacity to make decisions yourself. You can also terminate this type of financial power of attorney in a number of ways, including placing a specific termination date in the instrument itself.

Financial Power of Attorney When You Are Incapacitated

Another type of financial power of attorney is one that takes effect if you are no longer capable of dealing with these matters because of a physical or mental disability or limitation. This type of instrument technically or legally is known as a durable financial power of attorney.

How to Obtain a Financial Power of Attorney

You’ve three primary options through which you can obtain a financial power of attorney in California and the United States. First, you theoretically can draft a financial power of attorney on your own. Unless you’ve at least some legal or appropriate financial background, taking this step can prove a risky exercise.

What is financial power of attorney?

Having financial power of attorney means having the authority to access and manage another person's monetary and/or property assets. As an agent with financial POA, you have the right to make certain kinds of financial decisions on behalf of the principal (as long as they are in his or her best interests). For example, your parent might give you the authority to pay bills, file taxes, make and manage investments, transfer money between different bank accounts, handle insurance claims, collect outstanding debts, sell or rent out property, or deal with retirement pensions and government benefit programs.

What is POA in law?

A POA document is generally a written agreement between two people: (1) the principal (sometimes called the grantor) and (2) the agent (sometimes called the attorney-in-fact). The agent is the person appointed to act on behalf of the principal. So your parent (the principal) can grant you (the agent) certain powers of attorney.

When does a springing POA take effect?

Unlike most other types of POA documents, a springing POA agreement doesn't take effect until a specified date or a particular event takes place. For example, your parent may not want you to have any authority until he or she becomes incapacitated or turns a certain age.

Can you have more than one power of attorney?

However, there can be more than one person with power of attorney because your parent may decide that various responsibilities should be divided up among two or more people. (Frequently, for instance, one agent will handle financial matters, whereas another will handle healthcare issues.)

What is POA agreement?

Depending on the particular agreement, a power of attorney covers a broad or narrow set of responsibilities, usually related to financial and/or medical and caregiving matters.

Is it too late to get a power of attorney?

After all, by the time your parent becomes legally incapacitated, it's too late to get power of attorney. At that point, you have to pursue the more costly and time-consuming option of adult guardianship. That's why the issue of "capacity" is so important.

What is a POA?

Also known as special power of attorney, this type of POA grants an agent the authority to handle a very specific situation on the principal's behalf. For example, your parent may grant you limited POA to represent him or her in the sale of a particular property or to manage his or her transition to a nursing home or assisted living facility. Your authority as the agent ends as soon as you've successfully completed the defined activity or reached the agreement's specified expiration date. And your powers do not extend to anything other than what is specified in the document.

Why do you need a power of attorney?

Common Reasons to Seek Power of Attorney for Elderly Parents 1 Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations. 2 Chronic Illness: Parents with a chronic illness can arrange a POA that allows you to manage their affairs while they focus on their health. A POA can be used for terminal or non-terminal illnesses. For example, a POA can be active when a person is undergoing chemotherapy and revoked when the cancer is in remission. 3 Memory Impairment: Children can manage the affairs of parents who are diagnosed with Alzheimer’s disease or a similar type of dementia, as long as the paperwork is signed while they still have their faculties. 4 Upcoming Surgery: With a medical POA, you can make medical decisions for the principal while they’re under anesthesia or recovering from surgery. A POA can also be used to ensure financial affairs are managed while they’re in recovery. 5 Regular Travel: Older adults who travel regularly or spend winters in warmer climates can use a POA to ensure financial obligations in their home state are managed in their absence.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

Who is responsible for making decisions in a POA?

One adult will be named in the POA as the agent responsible for making decisions. Figuring out who is the best choice for this responsibility can be challenging for individuals and families, and your family may need help making this decision. Your attorney, faith leader or a family counselor can all help facilitate this process. It’s a good idea to select an agent who is able to carry out the responsibilities but also willing to consider other people’s viewpoints as needed.

What is a POA?

As mentioned above, a power of attorney (POA), or letter of attorney, is a document authorizing a primary agent or attorney-in-fact (usually a legally competent relative or close friend over 18 years old) — to handle financial, legal and health care decisions on another adult’s behalf. (A separate document may be needed for financial, legal, and health decisions, however).

Is a power of attorney necessary for a trust?

Under a few circumstances, a power of attorney isn’t necessary. For example, if all of a person’s assets and income are also in his spouse’s name — as in the case of a joint bank account, a deed, or a joint brokerage account — a power of attorney might not be necessary. Many people might also have a living trust that appoints a trusted person (such as an adult child, other relative, or family friend) to act as trustee, and in which they have placed all their assets and income. (Unlike a power of attorney, a revocable living trust avoids probate if the person dies.) But even if spouses have joint accounts and property titles, or a living trust, a durable power of attorney is still a good idea. That’s because there may be assets or income that were left out of the joint accounts or trust, or that came to one of the spouses later. A power of attorney can provide for the agent — who can be the same person as the living trust’s trustee — to handle these matters whenever they arise.

3. Sign the form

Only the individual, estate representative, trustee, or officer of the business can sign the form. Be sure that person includes all of the following:

5. Submit the form

Online through MyFTB#N#11#N#. In the services menu, select File a Power of Attorney.

6. After you submit

Generally, it takes us 3 weeks to review and process POA declarations. If we need more information or clarification, it may take longer.

What is a durable power of attorney?

A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable.

When does a POA become effective?

Also, traditionally, a POA became effective immediately upon being property signed by the principal. A POA that does not become effective unless and until the principal becomes incapacitated is known as a "springing" power of attorney (which by its nature is also durable).

What is a POA in New York?

The New York legislature has established standardized forms specifying power of attorney (POA) requirements in New York relating to financial matters and to medical issues.Thanks to their efforts, the process of obtaining a POA in New York is relatively easy.

What is a POA?

Power of Attorney 101. A power of attorney (or POA) is a legal document that gives one person (known as the "agent") the authority to act for another person (known as the "principal"). Typically you use a POA if you can't be present to take care of a financial matter, or you want someone to be able to take care of your finances in ...

What is a living trust in New York?

A living trust in New York allows you to place your asset into a trust but still use them during your lifetime. Your beneficiaries inherit them after your death. A revocable living trust (sometimes known as an inter vivos trust) provides many advantages that may make it a desirable part of your estate planning process.

Popular Posts:

- 1. legal how to deal with a revocation power of attorney

- 2. how to grant power of attorney in texas

- 3. philip berg a attorney who was a supporter clinton.

- 4. how to find a wrongful death attorney 14048

- 5. who was the chief of investigations for the cook county state's attorney office in 1985

- 6. who is the current attorney general of illinois 2017

- 7. how to research a divorce attorney records

- 8. why would you give someone power of attorney

- 9. where to write a blog to help raise money for attorney fees when your not quilty

- 10. attorney who is an ex police officer talks about knowing your rights when speaking to police