How to Get Power of Attorney for a Parent (Without Overstepping)

- Understand What the Law Allows (and Doesn't Allow)

- Create a contract in order to get paid for personal services provided to the principal.

- Vote in place of the principal.

- Create or alter the principal's will.

- Name someone else as the agent on behalf of the principal.

- Take over the principal's guardianship of someone else.

- Give eyewitness testimony in place of the principal.

- Do anything that is not in the principal's best interests.

- Talk it through with your parent(s) At this point, you should have a better idea of what type of power of attorney would suit your situation. ...

- Consult with a lawyer. The laws governing powers of attorney vary from state to state. ...

- Document your rights. ...

- Execute the document.

How do you obtain power of attorney over a parent?

- Healthcare agent — the agent should be a person of trust that will make the same kind of decisions about your parent’s health as he or she would

- HIPAA — the POA should include a HIPAA release effective immediately

- End of Life Decisions — POA should include a living will/advanced directive concerning end of life decisions

- Organ donation

When should you get power of attorney for a parent?

You can get power of attorney for your parent when they can understand what they're doing. You can start in whatever order you want, but generally, your discussion with your parent should include the following: Find out if they have an estate plan. Approach this topic in a caring, sincere manner, otherwise, a skeptical parent may think you're ...

How to get power of attorney over a parent?

- Find out if they have an estate plan. ...

- Explain why a power of attorney is important. ...

- Discuss what their estate includes and where to find important papers. ...

- When should they sign a power of attorney? ...

- What is guardianship? ...

- Don't force your parent to sign a power of attorney. ...

- Hire an attorney. ...

- What if they already have a POA? ...

How do I get power of attorny for a parent who?

How to Get Power of Attorney for a Parent (Without Overstepping)

- Learn About "Capacity" and Evaluate Your Parent's Situation. ...

- Familiarize Yourself With the Various Types of Power of Attorney. ...

- Discuss the Issue With Your Parent (and Possibly Other Family Members) Since your parent is the only person who can grant you or someone else power of attorney, this step ...

How can I take over my parents finances legally?

Here are eight steps to taking on management of your parents' finances.Start the conversation early. ... Make gradual changes if possible. ... Take inventory of financial and legal documents. ... Simplify bills and take over financial tasks. ... Consider a power of attorney. ... Communicate and document your moves. ... Keep your finances separate.More items...

Should I have power of attorney for my parents?

It's vital to set up durable power of attorney for an elderly parent who has dementia before they experience significant cognitive decline, since it can be complicated to execute legal documents once a senior is deemed mentally incapacitated.

What is the best power of attorney to have?

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.

What three decisions Cannot be made by a legal power of attorney?

Are there any decisions I could not give an attorney power to decide? You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself – for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

Can you get power of attorney for someone with dementia?

The power of attorney document allows a person with dementia (called the principal) to name another individual (called an attorney-in-fact or agent), usually a spouse, domestic partner, trusted family member or friend, to make financial and other decisions when the person with dementia is no longer able.

Can I write a power of attorney myself?

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

Does power of attorney need to be notarized?

Registration of power of attorney is optional In India, where the 'Registration Act, 1908', is in force, the Power of Attorney should be authenticated by a Sub-Registrar only, otherwise it must be properly notarized by the notary especially where in case power to sell land is granted to the agent.

What are the 3 power of attorney?

Generally speaking, there are three main types of POA: Ordinary power of attorney. Lasting power of attorney. Enduring power of attorney.

How do I get power of attorney over my elderly parent?

The first step to getting power of attorney over an elderly parent is to research powers of attorney, understand how these documents work in your s...

What are the four types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes in...

Can I get a power of attorney if my parent has dementia?

No, if your parent already has cognitive impairment, they can’t legally sign the documents required to set up a power of attorney. This is one reas...

What are the disadvantages of a power of attorney?

The biggest drawback to a power of attorney is that an agent may act in a way that the principal would disapprove of. This may be unintentional if...

Is power of attorney responsible for nursing home bills?

As your parent’s power of attorney, you’re responsible for ensuring their nursing home bills are paid for through their assets and income. However,...

Why do you need a power of attorney for an elderly parent?

Common Reasons to Seek Power of Attorney for Elderly Parents. Financial Difficulties: A POA allows you to pay the bills and manage the finances for parents who are having difficulty staying on top of their financial obligations.

What is a power of attorney?

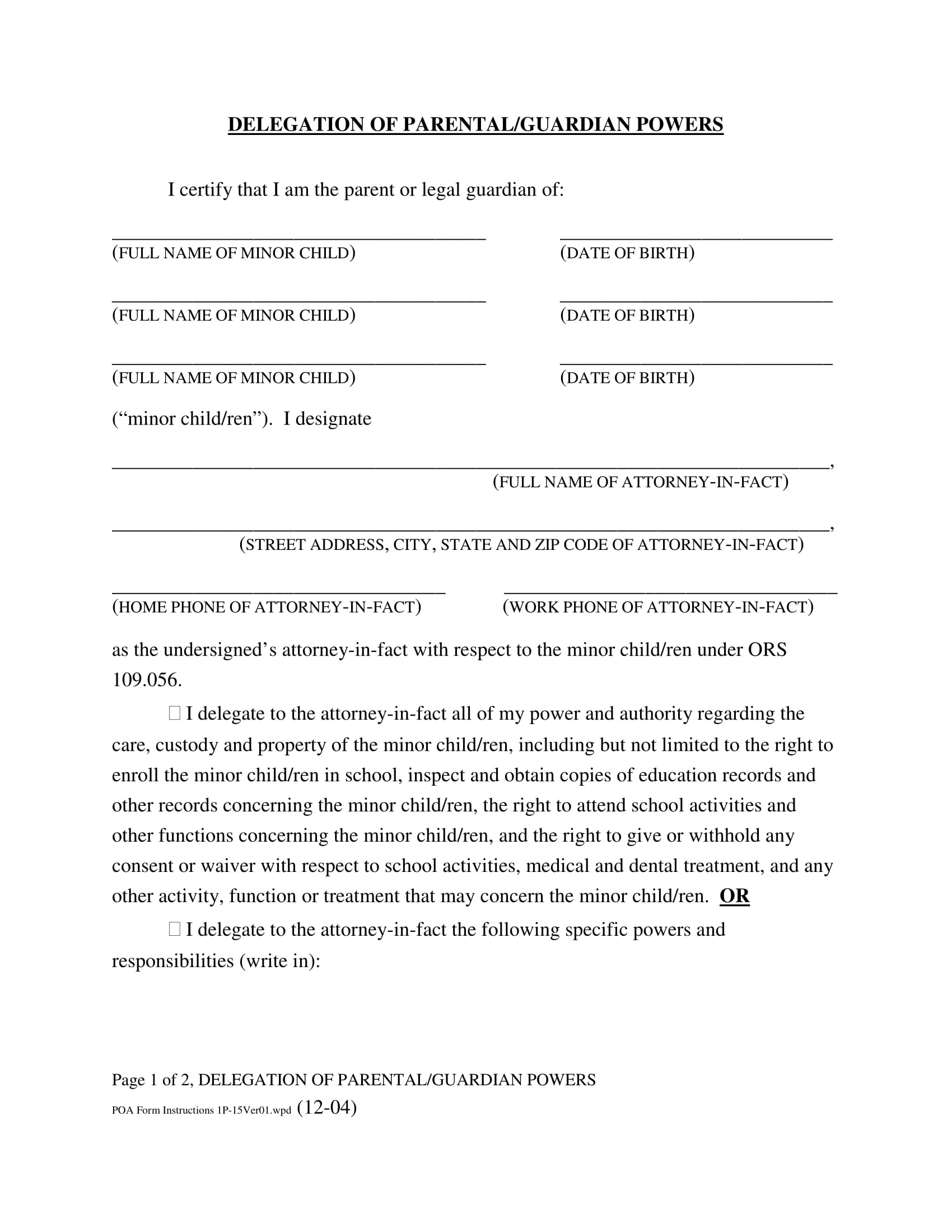

At its most basic, a power of attorney is a document that allows someone to act on another person’s behalf. The person allowing someone to manage their affairs is known as the principal, while the person acting on their behalf is the agent.

What are the different types of power of attorney?

The four types of power of attorney are limited, general, durable and springing durable. Limited and general POAs end when the principal becomes incapacitated, so they’re not often used by older adults when planning for the end of life. A durable POA lasts even after a person becomes incapacitated, so is more commonly used by seniors.

What is a POA in 2021?

Last Updated: July 16, 2021. A power of attorney (POA) can be an important element of planning for your elderly parent’s future. It allows another person to take action on your parent’s behalf, ensuring bills get paid and medical decisions can be made in the unfortunate circumstance that your elderly parent is unable to do those things on their own ...

What is the best document to prepare for an aging loved one?

There are two separate documents you’ll likely need as part of comprehensive planning for your aging loved one. The first is a financial POA , which provides for decisions regarding finances and for the ability to pay bills, manage accounts, and take care of investments. The second is an Advance Healthcare Directive, which is also known as a “living will” or a “power of attorney for healthcare.” This document outlines who will be an agent for healthcare decisions, as well as providing some general guidelines for healthcare decision-making.

How many witnesses do you need to sign a letter of attorney?

A notary public or attorney must witness your loved one signing the letter of attorney, and in some states, you’ll need two witnesses. The chosen agent must be over 18 and fully competent, meaning they understand the implications of their decision. When filling out the form, the parent must specify exactly which powers are transferring to the agent.

How to get a POA?

When you’re ready to set up the POA, follow these steps: 1 Talk to Your Parents: Discuss what they need in a POA and what their wishes are when it comes to their finances and health care. You must also confirm their consent and make sure they agree with everything discussed. 2 Talk to a Lawyer: Everyone who gets a POA has different needs and the laws are different in each state. It’s important to get legal advice so that your parent’s wishes are taken into consideration and the document is legal. 3 Create the Necessary Documentation: Write down all the clauses you need that detail how the agent can act on the principal’s behalf. This ensures your parent’s wishes are known and will be respected. Although you can find POA templates on the internet, they are generic forms that may not stand up to legal scrutiny and probably won’t have all the clauses you require. 4 Execute the Agreement: Sign and notarize the document. Requirements for notarization and witnesses differ, so make sure you check what’s required in your state.

What happens if your parents don't grant power of attorney?

For instance, your mom could be unable to make IRA withdrawals from your dad’s retirement account, or worse. “Just recently, a client’s husband fell ill from a brain tumor.

What does a power of attorney do?

With a specific power of attorney, they may give their financial adviser the authority to handle their investment accounts and give you control over their day-to-day finances, such as ensuring that their bills get paid using the money in their accounts .

What to do if your parents don't have a notary?

If your parents aren’t able to go to a notary, you could hire a mobile notary service to come to their home; an Internet search should turn up several local options.

What does "springing power of attorney" mean?

It may make sense to give that person what’s known as “springing power of attorney,” which means the agreement will only take effect if a physician deems your parent to be incapacitated or incompetent.

What happens if one parent becomes incapacitated?

If one becomes incapacitated, the other can continue to manage the household’s finances. But each of your parents should list a back-up person on their power of attorney forms, in case both become incapacitated. 2. Your parent is single or married to someone who isn’t mentally competent to exercise power of attorney.

What should a parent do if they are mentally competent?

Your parent is mentally competent, but wants help with routine money-management tasks, like paying bills or dealing with financial institutions. The helper should have a narrow power of attorney agreement, limiting the stand-in’s authority to such chores.

Can a parent give a financial advisor a power of attorney?

For example, your parents might grant one individual the power to make all their financial decisions through a general power of attorney, or just certain decisions, through a specific power of attorney. With a specific power of attorney, they may give their financial adviser the authority to handle their investment accounts ...

What is a power of attorney?

A power of attorney is a document, signed by a competent adult called “the principal,” that grants a trusted individual the power to make decisions on their behalf if the principal is unable to. The person designated to act in the principal’s best interest is called “the agent.”.

Why do seniors need a power of attorney?

Here are a few reasons seniors may feel it’s time to set up a power of attorney: Financial responsibilities. If your aging relative has a hard time staying on top of financial obligations, or is in danger of overspending their savings, it may be time to establish a financial power of attorney.

What is a POA in medical terms?

A medical POA only goes into effect when a senior is deemed incapacitated. The agent named is responsible for ensuring health providers follow instructions from the senior’s medical power of attorney documents. They also have authority over: Medical treatment. Surgical procedures.

What is a POA in retirement?

A power of attorney ensures that a senior’s wishes will be respected in case of emergency. Planned travel. Sometimes, a POA is established out of convenience, rather than medical necessity. If seniors are traveling in retirement, they may want someone at home able to cash incoming checks and handle bills.

What is a POA?

A power of attorney (POA) is one way to ensure that no matter what happens down the road, your loved one’s wishes will be prioritized. A POA is one of the most important documents for elderly parents and grandparents, but it’s one that many families haven’t prepared.

When does a springing power of attorney go into effect?

Springing power of attorney. A springing power of attorney is executed in advance, but doesn’t go into effect until a senior receives a declaration of incapacity. Seniors who want to maintain autonomy as long as possible may prefer a springing power of attorney.

How to get a POA?

A general POA, sometimes called a financial power of attorney, gives an agent power to: 1 Sign documents on the senior’s behalf 2 Open or close bank accounts and withdraw funds 3 Buy and sell property, real estate, and assets 4 Trade and sell stock 5 Pay bills and cash checks on the principal’s behalf 6 Enter contracts for utilities and services like housekeeping or home health

What is a power of attorney?

Power of attorney allows you to make decisions on your parent’s behalf when they no longer can do so for themselves. This legal document allows you to allocate funds and determine which medical treatments your parent receives, as well as other rights.

What happens to a durable power of attorney?

A durable power of attorney would follow the steps outlined in the intro. When both parties sign the document, the durable POA goes into effect for you to act on behalf of your parent. The only way this legal right would end is if your parent passes away, you pass away, or one or both parties revokes it in writing.

What is POA in financial management?

As you probably guessed, a financial POA relates to you managing a senior’s finances going forward. This doesn’t necessarily mean you assume their financial burden, but rather, you make decisions about how your senior parent’s financial assets are handled.

What do seniors make decisions about?

They made decisions about what you ate for breakfast, what time you went to bed, and what you wore to school, along with a myriad of other day to day decisions. Well, those days have long since passed and now, as seniors, your parents may struggle with or even be unable to make important decisions for their health and well being.

Is a POA durable?

Non-Durable Power Of Attorney. As the name suggests, a non-durable POA is not as long-lasting. Should your parent become incapacitated from injury, illness, or disease, then your rights as power of attorney significantly lessen.

Does a power of attorney cover all the legal requirements?

For one, it may not cover certain legal requirements of your state. For another, it may not cover the details that are appropriate for your situation. It is better to seek legal advice when it comes to drawing up a power of attorney to ensure everything is covered properly.

Can a power of attorney be granted to a person who is incapacitated?

It’s important to mention that power of attorney cannot be granted to you unless a person has a sound mind. This would exclude those who are incapacitated. Step 2: This means you’ll have to see a judge to get conservatorship, which is a form of adult guardianship.

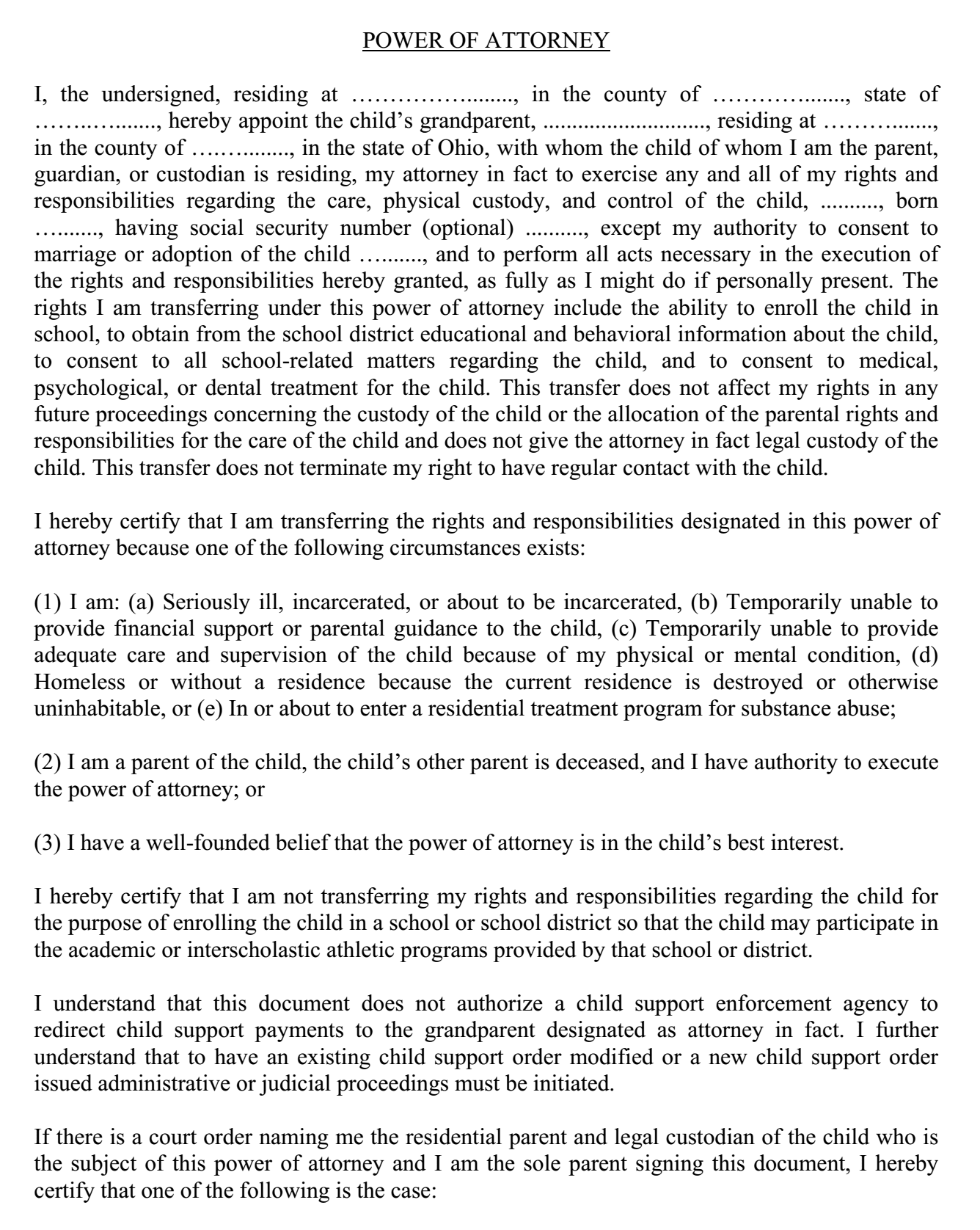

How long can you give someone a power of attorney?

You can give someone POA for as little as one day to as long as 24 months (2 years). We explain POA here.

What happens if you don't have a POA?

If the other parent is not involved in the child's life, you can do a POA appointing whomever you want in your absence. However, understand that parent could return and try to seek custody of the child. That may mean a court gets involved.

What to do if your child's other parent has the right to time with your child?

If the child's other parent has the right to time with the child, they might be able to argue that they should have custody and that you should not give POA to a non-parent.

Can a parent sign a power of attorney for a child?

Before 6/11/20, state law allowed a parent to sign a power of attorney allowing another person to make medical decisions only for their child.

Can you get authorization from your child's school?

Your child's school or doctor might have their own authorization form to allow other people to access your children's records, pick your child up from school, or get care for your child. Ask about those things and fill them out for your child to make sure you have covered everything.

Can you take back a POA?

You can revoke (take back) the POA at any time before the POA expires (ends). You should do this in writing and give a copy to anyone who has a copy of the POA to make sure everyone knows it is no longer valid. (good).

What is a POA for a parent?

A POA is a legal document that hands control over various areas of the principal’s life to an agent. Medical decisions are regulated by healthcare powers of attorney, while the principal’s monetary affairs come under ...

What is a POA in a relationship?

A power of attorney (POA) can solve that problem.

What is a durable POA?

Durable POA. A durable POA hands control of the principal’s finances to the agent from the moment of signing until the principal passes away. It remains in force after the principal has been declared incapacitated and is, therefore, the most appropriate form of POA in dementia cases.

What is a limited POA?

Limited POA. A limited POA is used to limit the agent’s power to: Specific financial tasks. A limited time. In the case of a parent with dementia, it is not the best option. General POA. General POAs cover all aspects of the principal’s finances but terminate when the principal is declared incapacitated.

What to do if your parent is incapacitated?

In case your parent is already incapacitated, your only recourse may be to approach the local court for help. Your parent’s case will be reviewed by a judge who may award a conservatorship, allowing the conservator to make financial decisions on the patient’s behalf.

Can a POA be springing?

Springing POA. If the principal wants the POA to only come into effect after they have been declared incapacitated, a springing POA may be an option. The issue may be that the progress of dementia is not easily predictable, so the criteria for declaring incapacity would have to be set out clearly. Durable POA.

Can a notary notarize POA?

If their incapacity is not picked up beforehand, a notary will refuse to notarize a POA if the principal isn’t capable of understanding what they are signing. In most states, the absence of notarization on a POA will render it invalid.

Popular Posts:

- 1. how to obtain a court appointed attorney in virginia

- 2. collection of attorney fees in united states when party is from a different country

- 3. what percentage of a med malpractice claim in indiana can an attorney charge

- 4. attorney how to prep a client for physch deposition workers comp

- 5. what federal prison was mike hernandez,jr, san antonio attorney at law in?

- 6. who is the attorney general of the is

- 7. if your power of attorney is in jail what happens?

- 8. who do you want to date: quarterback or attorney

- 9. work comp attorneys who file appeals after another attorney lost your case in arizona.

- 10. why are florida attorney home addresses unpublished?