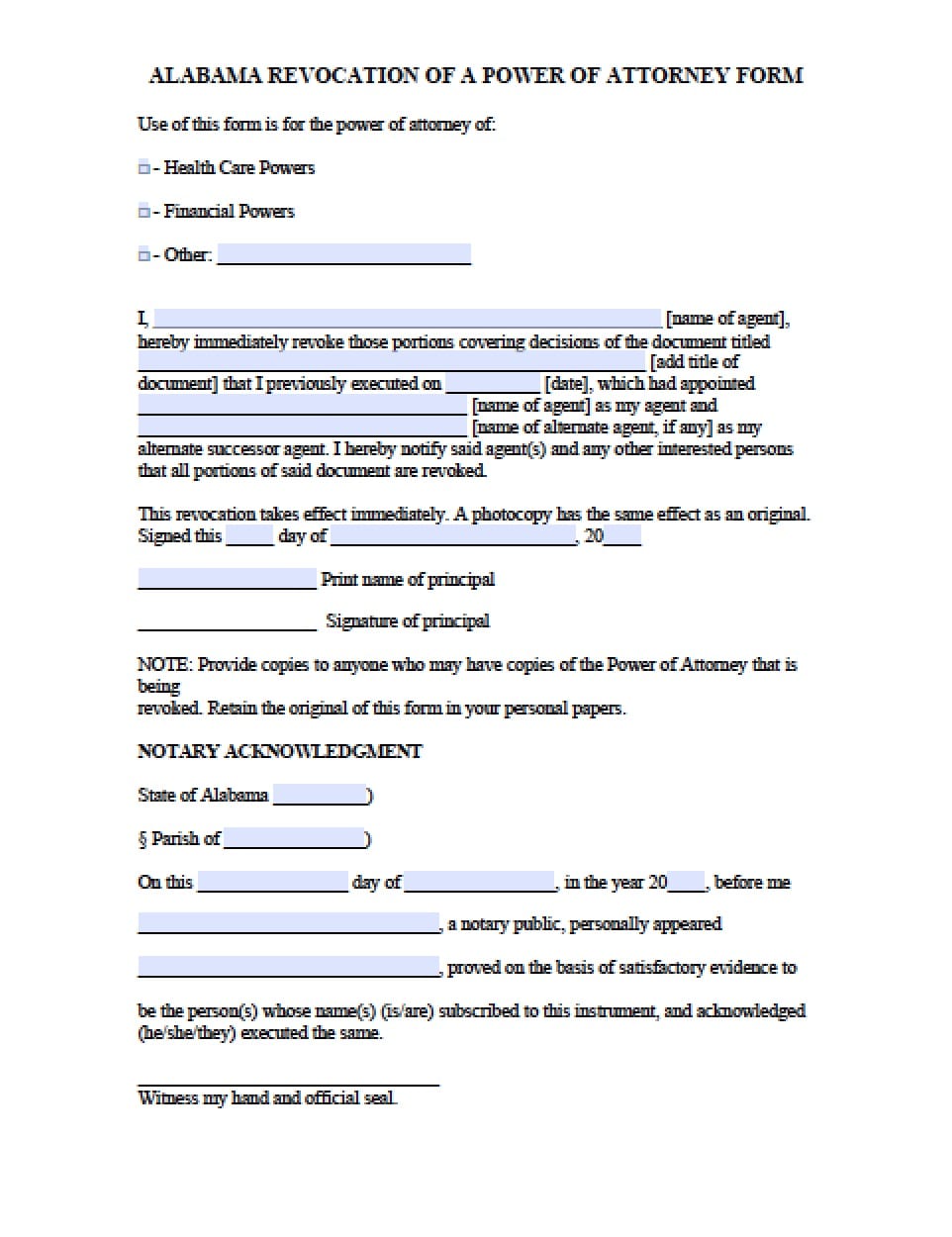

To change some of the details in your power of attorney or appoint new attorneys, you’ll have to cancel the existing documents and fill out new forms for a new power of attorney. Fill out the legal paperwork. Fill out a formal revocation form to cancel any existing powers of attorney.

Full Answer

How do I get a power of attorney in North Carolina?

A. A power of attorney must always be signed in front of a notary public. If you wish, it can be recorded at the county register of deeds office in North Carolina where it is to be used. When a power of attorney is used to transfer land or to do business on behalf of a person who has become incapacitated, it must be recorded.

What is a limited power of attorney in North Carolina?

May 17, 2018 · A Statutory Short Form Power of Attorney has been created by the North Carolina legislature. The form may be found in the North Carolina General Statutes, Chapter 32C , at Section 32C-3-301. Although the law states that POAs created before the new law are still effective, it would be a good idea to create a new one using the current form.

How to amend a durable power of attorney?

Talk to the person (s) you want to name as your agent (s) to be sure they understand their potential responsibilities and are willing to act on your behalf. 2. Prepare a new power of attorney. When you know what you want to change, create a new power of attorney.

What is a medical power of attorney in North Carolina?

Dec 31, 2020 · Power of Attorney Policy. The Power of Attorney Policy document describes in detail the policy of the Department of Revenue relating to powers of attorney. For information about how to submit a power of attorney, please visit the Department's power of attorney page.

Can you change a power of attorney?

The PoA can only be amended by you, the granter, if you are capable of making and understanding this decision. Examples of amendments that can be made are: Removing power(s) from the PoA. Add an attorney, this could either be a joint or a substitute attorney.

Does a power of attorney have to be filed with the court in NC?

A. A power of attorney must always be signed in front of a notary public. If you wish, it can be recorded at the county register of deeds office in North Carolina where it is to be used. ... As a general rule, however, a power of attorney does not need to be recorded in North Carolina in order to be effective.

Do I need a lawyer for power of attorney in NC?

Do you need help creating or modifying a power of attorney in North Carolina? You need to seek legal representation to make sure your document satisfies all legal requirements.

What is an amendment to a power of attorney?

A power of attorney grant may be amended to expand an agent's ability to act on behalf of the principal, to limit the agent's influence, or to change agents entirely. Amending a durable power of attorney is subject to state law, and the standards can vary.

How long is a power of attorney good for in NC?

§ 32C-1-109. (a) A power of attorney is effective when executed unless the principal provides in the power of attorney that it becomes effective at a future date or upon the occurrence of a future event or contingency.

Does North Carolina recognize out of state power of attorney?

Key Changes Under the NC Uniform Power of Attorney Act The new law completely replaces the prior power of attorney laws, thus there are many changes. ... Out-of-state Powers of Attorney will be interpreted under the laws stated in the document, or if not stated, then under the laws of the state in which they were signed.

Can a power of attorney transfer money to themselves?

Attorneys can even make payments to themselves. However, as with all other payments they must be in the best interests of the donor. ... Gifts can be on occasions such as births, marriages, birthdays, or anniversaries etc., and only to those people who are closely connected with the donor.

Who can override a power of attorney?

The Principal can override either type of POA whenever they want. However, other relatives may be concerned that the Agent (in most cases a close family member like a parent, child, sibling, or spouse) is abusing their rights and responsibilities by neglecting or exploiting their loved one.Nov 3, 2019

How long does a power of attorney last?

Another important thing to note here is that a PoA remains valid only till the life of the principal. Within their lifetime also, one can revoke the PoA. An SPA gets revokes on its own as soon as the specific transaction for which it was executed is completed.Nov 12, 2021

Which power of attorney is valid after death?

Durable power of attorneyBoth durable and nondurable powers of attorney expire after the death of the principal. Durable power of attorney, however, lasts if the person you are authorized to represent is alive but becomes incapacitated. For example, a parent diagnosed with dementia may assign durable power of attorney to an adult child.

How do I revoke a power of attorney?

It is also possible to make a Deed of Partial Revocation, which would allow you to remove an attorney without revoking the whole document. You would be able to cancel a Power of Attorney document or issue a Deed of Partial Revocation for as long as you had the mental capacity to legally do so.

Can general power of attorney be revoked?

Although a PoA is something when granted is of an irrevocable nature, if there is gross mismanagement on part of the agent, if the agent breaches the terms of the contract or if the agent acts beyond the scope of the powers, then the PoA can be revoked.May 30, 2019

Can you amend an LPA?

Amending a LPA document. Once you have sent off a complete LPA form to the Office of the Public Guardian, you cannot make any amendments. ... If you need to change the LPA after it has been registered, you will need to complete a brand new form and pay the cost of a registration fee, so this is best avoided.Sep 23, 2016

Can an executor of an estate give power of attorney to someone else?

Can an executor appoint another executor? If they are unable to act temporarily, for example, they live abroad; it is possible to give a Power of Attorney to another person to act on their behalf. The executor can delegate the functions he/she has to carry out to the attorney.

Does a will need to be recorded in NC?

Technically, you do not need to file your will with the court while you are still living. ... Once a person dies, their family or the will executor will likely try to locate the will immediately.Jan 20, 2017

What Is A Power of Attorney?

The power of attorney grants authority to an individual to represent a taxpayer before the Department of Revenue and to receive and inspect confide...

How Do I Execute A Power of Attorney?

A power of attorney is executed by completing Form GEN-58. This form is available on the Department's website and can be obtained by calling the De...

Is A Separate Power of Attorney Required For Bankruptcy Matters Involving State Taxes?

Yes. A power of attorney for bankruptcy matters is executed by filing Form GEN-58B. This form is available on the Department's website and can be o...

What Tax Periods and Types of Tax Can I Include on The Power of Attorney?

1. You must designate a specific tax type or more than one tax type (individual income, withholding, sales & use, corporate & franchise, etc.). You...

How Do I Revoke A Power of Attorney I Previously Filed With The Department?

1. If you want to revoke an existing power of attorney and name a new representative, file form GEN-58 naming a new representative. This automatica...

How Long Is The Power of Attorney in Effect?

The power of attorney is in effect until the Department receives actual notice of revocation. If you would like to revoke a power of attorney, plea...

Am I Required to File Form Gen-58, Or Can I File Federal Form 2848, Power of Attorney and Declaration of Representative, Or Another Alternative form?

1. The Department prefers that Form GEN-58 be filed. However, federal Form 2848 or another alternative form may be filed in lieu of Form GEN-58, pr...

What is a power of attorney in North Carolina?

The North Carolina legislature has created a Health Care Power of Attorney form. In addition to the general authority that is granted, there are specific provisions related to particular types of healthcare decisions, including nutrition, mental health, and organ donation.

Why is it important to have a last will?

You know having a last will is important—it protects your family and provides for your final wishes. Now that you're finally sitting down to write that will, be on the lookout for these common but easy-to-avoid mistakes.

What is a power of attorney?

A power of attorney is a legal document that gives one person, called the "agent," the power to take certain actions on behalf of another person, called the "principal.".

Who determines incapacity?

If not stated, or if the person designated can't or refuses to make the decision, incapacity will be determined by either two individuals who are physicians or licensed psychologists who have examined the principal; or by a lawyer, judge, or "an appropriate government official.".

What is a POA in healthcare?

A healthcare POA gives your agent the power to make medical treatment decisions for you, but only if you are physically or mentally incapable of making your own decisions. By its very nature, a healthcare POA is both durable and springing.

What does POA mean in estate planning?

When you create a power of attorney, or POA, you give someone else legal authority to act on your behalf and manage your financial affairs. They are common estate planning tools, but they have other uses as well, such as authorizing someone to handle a specific transaction in your absence.

How to change your agent?

Changing your agent may mean you want to also change the types of transactions you want your agent to handle. Talk to the person (s) you want to name as your agent (s) to be sure they understand their potential responsibilities and are willing to act on your behalf. 2. Prepare a new power of attorney. When you know what you want to change, create ...

Can you change the scope of authority of a POA?

Changing a Power of Attorney. After creating a POA, you may need to make changes to it. Whether you change your mind about the person to whom you gave the authority, called the agent, or you want to change the scope of authority granted under the form, you can revoke the existing document and create a new one. 1.

What is a power of attorney?

The power of attorney authorizes the representative specified to perform any and all acts the taxpayer can perform unless otherwise noted in Section 4, Acts Authorized, on the Power of Attorney, Form GEN-58.

Can I file for bankruptcy with a power of attorney?

Yes. A power of attorney for bankruptcy matters is executed by filing Form GEN-58B. This form is available on the Department's website and can be obtained by calling the Department's Forms Line at telephone number 1-877-252-3052 (toll-free).

Can I file Form 58 in lieu of Form 58?

The Department prefers that Form GEN-58 be filed. However, federal Form 2848 or another alternative form may be filed in lieu of Form GEN-58, provided the form includes all pertinent information requested on Form GEN-58 and specifies that a taxpayer is authorizing the Department to discuss North Carolina State tax matters with the named representative (s).

How to accept an appointment as an agent under a power of attorney?

Except as otherwise provided in the power of attorney, a person accepts appointment as an agent under a power of attorney by exercising authority or performing duties as an agent or by any other assertion or conduct indicating acceptance. (2017-153, s. 1.)

Can a power of attorney petition the court for authority to do an act described in G.S. 32C-

Except as provided in subsection (b) of this section, an agent under a power of attorney that does not expressly grant the agent the authority to do an act described in G.S. 32C-2-201(a) may petition the court for authority to do the act described in G.S. 32C-2-201(a) that is reasonable under the circumstances.

How to cancel a power of attorney?

How to cancel or change your power of attorney 1 Fill out the legal paperwork. Fill out a formal revocation form to cancel any existing powers of attorney. You’ll need a revocation form template specific to your state. 2 Advise your attorneys that their powers have been revoked. To avoid any problems, make sure that all your attorneys have a copy stating your wishes to revoke their powers of attorney. You can mail in your revocation form or a copy of the new power of attorney documentation. 3 Destroy old documents. Once you have canceled a power of attorney, collect any copies of the document from your files, family members and your attorneys and shred them. Keep a copy of your new form for your records.

What is a POA?

Power of attorney (POA) is a valid and legal document and once signed, the person appointed power of attorney has the legal right to make financial, medical or legal decisions on your behalf. Following just a few steps could help you keep these documents up to date with your needs.

Where is Katia Iervasi?

Katia Iervasi is a staff writer who hails from Australia and now calls New York home. Her writing and analysis has been featured on sites like Forbes, Best Company and Financial Advisor around the world. Armed with a BA in Communication and a journalistic eye for detail, she navigates insurance and finance topics for Finder, so you can splash your cash smartly (and be a pro when the subject pops up at dinner parties).

What is a power of attorney in North Carolina?

A North Carolina medical power of attorney has a two-pronged effect; it can be used to appoint a health care representative, and it can list the types of medical treatment and attention one wishes to receive in certain life-threatening circumstances.

What is a gen 58?

The North Carolina tax power of attorney form , also known as the GEN-58, is a document that allows a resident to choose someone else to handle their tax filing with the Department of Revenue. The principal has the option of selecting specific tax matters that they would like their account (attorney-in-fact) to complete for them or they can grant them the authority to do everything…

What is a power of attorney?

A power of attorney grants the attorney-in-fact authority over specific areas of the principal’s life, such as finances, health care, taxes, etc. Some of these forms are temporary, giving the attorney-in-fact control over one or more specific tasks until that task is complete.

James Paul Tinsley

The recording in the Chancery Clerks office may not be required for validity, but I recommend that they be recorded since the recording fee in this district is only $10.00. By doing this you give notice to the world of the existence of the POA. But like Jon said earlier, you need to do a brand new POA to avoid confusion and future headaches.

Jon H Powell

Do a completely new power of attorney. Any attempt to "amend" a power of attorney will only create questions and confusion.#N#The legal secretary is NOT correct. A power of attorney does NOT have to be filed with the Chancery Clerk to be valid...

Steven M Zelinger

Not sure about the registration question in MS, but I would say that you should execute a new POA with the change so there is never any confusion. See a lawyer however.

Popular Posts:

- 1. what does the constitution say about firing the attorney general

- 2. what would attorney general due if employer didn't provide personnel file in 5 days

- 3. what is the name of a court appointed attorney

- 4. when can an attorney seekin appellate

- 5. what is the limit of control in colorado general power of attorney form

- 6. can i use esquire when referring to a deceased attorney?

- 7. how successfull is an attorney in supressing statements

- 8. what should i expect from my attorney

- 9. charitnan-attorney when attorneys and clients conspire pdf

- 10. how much attorney charge for green card interview?