Is QuickBooks for lawyers right for your firm?

However, according to Clio’s 2021 Legal Trends Report, solo practitioners typically spend two-thirds of their day on non-billable tasks like accounting. Efficient, accurate accounting processes are important to help your firm succeed. The right accounting software—like QuickBooks for lawyers—can help.

How do I link a check to a bill in QuickBooks?

The Accounts Payable account is created by default by QuickBooks you can directly create a check for the deposit and then enter the bill given by your vendor. From there you can link the check to the bill.

How do I select a client in quick-books online?

Click in the box and start typing the first few letters of the client, and Quick- Books will start narrowing the list for you. After you choose the client, a pop-up box will appear if you have unbilled time/costs for the client (see Figure 10.13).

How do I Bill a client with all the available time?

The Choose Billable Time and Costs box will appear, and you will see all the time you have available to bill your client (see Figure 10.14). Click the Select All button to add all of the time, or you can select particular time entries, and leave others unchecked.

See more

Do lawyers use QuickBooks?

QuickBooks is a popular accounting platform that many solo lawyers and small to medium-sized law firms use.

How do I set up billing in QuickBooks?

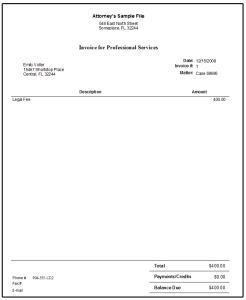

From the QuickBooks Home screen or the Customer menu, select Create Invoices.On the Customer: Job drop-down, select a customer or customer job. The available Estimates window appears.Choose the estimate you want to include in the invoice. ... When the invoice appears, edit the information as needed.Select Save & Close.

What is PCLaw?

PCLaw is a law practice management software program designed for Windows desktop. Billing and Accounting. Its focus is on the billing and accounting side of your practice. You can manage vendor payments and business expenses as well as write and print checks from bank or trust accounts.

How do I set up a trust account in QuickBooks?

Here's how to create a trust account in QuickBooks Online:Click the Gear icon at the top and select Chart of Accounts.Select the New tab at the upper right corner.For Account type. Select Other Current Liabilities.Select Trust Accounts under Detail Type.Type in your desired name under Name.Click Save.

How do I enter a payment account in QuickBooks?

Go to your QuickBooks integration app. Click on Payment Methods. Here you can link each payment method to a specific ledger account in QuickBooks. Click Save when you are done.

How do I enable payments in QuickBooks?

Step 1: Turn on online paymentsGo to Settings, then select Payments.Select Connect QuickBooks Payments. Note: Payments will automatically turn on if it's already connected to your QuickBooks Online account. If not, you'll be redirected to Account and Settings in QuickBooks Online to complete the connection.

Who owns PCLaw?

“Dedicated to you in the past, here for you now, committed to you in the future.” PCLaw | Time Matters™ LLC, a joint venture between LexisNexis® and LEAP Legal Software, is a global provider of practice management software solutions for law firms.

What is the latest version of PCLaw?

PCLaw 16.1 continues to build on the enhancements released in PCLaw 16.0. It also builds on the technology refresh introduced in version 15 by migrating the core database to Microsoft SQL Server.

Is PCLaw web based?

PCLaw is Windows-based, and cannot run on a Mac computer. However, certain Virtual Desktop solutions, such as Uptime Practice, enable you to run PCLaw in cloud desktop from your Mac computer.

Can QuickBooks be used for trust accounting?

Complex Setup. QuickBooks is not designed to manage a firm's trust account, and so you must be intimately familiar with both the software and your state bar rules and regulations in order to manipulate QuickBooks into working for your firm's trust account.

How do you record a trust payment?

0:544:30How to Record Trust Transactions - YouTubeYouTubeStart of suggested clipEnd of suggested clipAccount from the drop-down box and then select new transaction on the top right in this newMoreAccount from the drop-down box and then select new transaction on the top right in this new transaction window type in the amount that you are depositing into your clients trust account in the amount.

What does trust account mean?

A trust account is a legal arrangement in which the grantor allows a third party, the trustee, to manage assets on behalf of the beneficiaries of the trust. A trust can provide legal protection for your assets and make sure those assets are distributed according to your wishes.

How to set up a retainer account?

I can guide you how to do it. Here's how to create a retainer account: Go to the Accounting menu. Choose the Chart of Accounts tab. Click the New button.

Can you use retainer service every time you pay a lawyer?

Once completed, you can use the retainer service item every time you pay your lawyer. You can record it as a bill, create a check or an expense transaction. You can always get back into this post if you have other questions about tracking your expense transactions. I'm just a few clicks away. 0.

How to add a matter to a client?

In the Customer: Job List, right click on your Client to add a Matter for an existing Client and select Add Job. In the Job Name field, name your Matter on the New Job screen. In the New Job window, click on the tab titled Payment Settings and set your appropriate Price Level.

What is a general retainer in QuickBooks?

In your QuickBooks chart of accounts, a General Retainer represents monies paid by a client for a service that has not yet been rendered but that is allowed by state regulations and the Client Retainer Agreement and you intend to deposit them in your Operating Bank Account. It is critical to check with the Bar Association in your state to see if they allow General Retainers. If so, you can setup a double sided service item (see below). Every item will now point to a Suspense general Retainer account for both income as well as expense. Typically it is not necessary to have more than one General Retainer account and not likely a good idea.

What is reimbursed client cost?

Reimbursed Client Costs are expenses to be billed to a client but that are paid from the Firm Operating Bank Account. You will need to setup a double sided service item for each expense that is provided by your law firm and paid by your law firm. Each item should point to Reimbursed Client Costs for both income as well as expense. We recommend you set up separate Reimbursed Client Cost items for any items to be billed to a client at a different rate than is to be paid to a vendor. Using these items will help you accurately bill clients if you are billing within your QuickBooks. We do not recommend using multiple Advanced Client Cost accounts and it is certainly not necessary.

Can you set up single income accounts in QuickBooks?

You can also set up single income accounts and then use items to report and track on various kinds of income. Our recommendation is to separate your income accounting in your QuickBooks chart of accounts because it is much easier to see information you want to view. For every type of income in your income accounts, ...

Can a law firm have more than one matter per client?

In the event your law firm has an individual Matter Per Client, it may be wise for you to set up the Matters as Customers without using Jobs. If your law firm generally has in excess of one Matter per Client, it is recommended that you use Jobs. Whatever you decide you must be consistent.

Can a lawyer's trust account be overdraft?

Be certain that your bank gets this set up as an Interest on Lawyer’s Trust Account so the interest will be handled properly. Check your state regulations, however in the majority of states the account is not allowed to have ATM accessibility or automatic overdraft protections in place.

Can you track a soft cost in QuickBooks?

QuickBooks currently does not have the ability to track as well as charge clients for any Soft Costs incurred. A soft cost is a cost you need to charge a client for, however you do not actually write them a check for the cost. This might include something like photo copies for faxes. We recommend you setup a single sided service item for every soft cost. The service item should point to an expense account being used for the cost, i.e. lease for copier expense. If you point it to the expense account, using the item reduces total expense.

How to report unbilled time in QuickBooks?

This way you have a list of everyone that needs to be invoiced. From the Main Menu, click Reports and choose Jobs, Time & Mileage.

How to add additional costs to invoices?

Add any additional costs to the invoices. Print or e-mail the invoices. If you have a trust or escrow account you may want to transfer the funds and apply the transfers to the invoices before you print out the invoices. Run any billing reports you want. Take a coffee break because you are done.

How to print all invoices at once?

You can print the invoice now or wait and print all of the invoices at once. To print or e-mail now, just click the Print or Email box at the top of the invo ice. To save and print (or e-mail) all of your invoices at one time, make sure the Print Later (or Email Later) box is selected (see Figure 10.17).

What are automatic late fees?

Some small businesses apply late fees or finance charges on overdue invoices to encourage their customers to pay on time. QuickBooks Online can automatically calculate late fees. And add them to overdue invoices as a line below Product / Service.

How do I set up late fees?

To set up your default automatic late fees in QuickBooks Online you must be logged in as the Primary Administrator or Company Administrator. Go to:

What is a grace period?

The grace period is the amount of time you give your customers to pay without incurring late fees or interest. A grace period can be used in addition to your net terms.

Can I edit the name for how a late fee appears on my invoice?

You can customize how your late fees appear on your invoices when setting up your late fee preferences. Once the preferences are saved, you can edit the name for how a late fee appears on your invoice. Here's how:

What income account are late fees tied to?

When you turn on late fees, QuickBooks Online automatically creates an income account to track the amount of fees you’ve collected for reporting purposes. The account is set up as an “Other Income” account type and is named “Late fee income”.

Popular Posts:

- 1. what happens when an attorney misses a statute

- 2. i have an attorney email what happens if i cancel att

- 3. what is a reasonable attorney hourly fee in florida?

- 4. why would an attorney depose his client?

- 5. how to hire a game board patent attorney

- 6. what can we expect from new attorney general

- 7. what an inhouse attorney can do?

- 8. how to use a power of attorney in sc

- 9. when is there an exception to attorney client privilege

- 10. what office in canada that is equal to the attorney general's office in the usa?