The tax return (or electronic filing authorization) should be signed in the following manner: “(Taxpayer name), by (attorney-in-fact name) under authority of the attached power of attorney.”

What is the tax form for power of attorney?

Mar 14, 2021 · A taxpayer who has a power of attorney (POA) can also sign returns on behalf of someone else, although care should be taken that the POA clearly authorizes the person to sign tax returns. Unless these exceptions apply, the Form 8879 must be signed by the taxpayer and spouse if applicable.

How to remove power of attorney IRS?

The person signing on behalf of the taxpayer must include a copy of the power of attorney paperwork with the return. A taxpayer may give permission for somebody else, usually his tax agent, to sign a return on his behalf. While it is possible to give an agent power of attorney in dealing with tax officials, the ability to sign a return usually only applies if the taxpayer if …

What is business power of attorney?

Jul 18, 2021 · Power of Attorney must be authorized with your signature. Here’s how to do it: Authorize in your online account - Certain tax professionals can submit a Power of Attorney authorization request to your online account. There you can review, electronically sign and manage authorizations.

Who must sign tax return?

Jun 01, 2019 · If your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes the representative to sign your return. To do this, you can use Form 2848. You would include a copy of the form 2848 if you are filing a paper version. If efiling, you would attach the form 2848 to the form 8453.

How do I sign a tax return for someone else?

When someone can sign for you If the spouse can't sign because of injury or disease and tells the taxpayer to sign for him or her, the taxpayer can sign the spouse's name on the return followed by the words “By (your name), Husband (or Wife).” A dated statement must be attached to the return.

Does the IRS recognize power of attorney?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney.Sep 2, 2021

Does the IRS accept durable power of attorney?

The IRS will accept a durable power of attorney when the document authorizes the named decision-maker to handle tax matters. But, the authorized agent will be required to execute IRS Form 2848 and file an affidavit before being recognized by the IRS.Jan 19, 2016

Does the IRS accept electronic signatures on power of attorney?

As long as you can create a Secure Access account and follow authentication procedures, you may submit a Form 2848 or 8821 with an image of an electronic signature.

How long is a power of attorney Good for IRS?

After it's filed with the IRS, the representative can act as you in the eyes of the IRS. The POA stays in effect until you or your representative withdraws the authorization. After seven years, if you haven't already ended the authorization, the IRS will automatically end it.

How long does it take for the IRS to process a power of attorney?

To reduce processing time, the IRS added resources from multiple sites other than the three CAF units to assist in processing. During the past year, the average time the IRS took to process a POA fluctuated from 22 days to over 70 days and is currently 29 days.Jan 19, 2022

What is the IRS power of attorney form?

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.Mar 2, 2022

Where do you fax IRS power of attorney?

Power of Attorney - Form 2848THEN use this address...Fax number*Internal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268901-546-4115Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404801-620-42492 more rows

What is the difference between IRS form 8821 and 2848?

Use: Form 2848, Power of Attorney and Declaration of Representative PDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information Authorization PDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.Aug 26, 2021

Does the IRS accept scanned signatures on 1040?

The IRS will accept images of signatures (scanned or photographed) including common file types supported by Microsoft 365 such as tiff, jpg, jpeg, pdf, Microsoft Office suite or Zip.Sep 15, 2021

How do I submit an electronic signature?

Open the email with a request to digitally sign your document.Click the link. ... Agree to electronic signing. ... Click each sign tag and follow the instructions to add your electronic signature where required to sign or initial.Adopt a signature to save your signature information.Confirm your signature by clicking FINISH.

Can form 1040 be signed electronically?

Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).Jan 13, 2022

What is the power of attorney for tax returns?

The rules relating to power of attorney with regard to tax returns are contained within Title 26 of the Code of Federal Regulations. The specific section is 1.6012-1 (a) (5). The IRS explains how those regulations work in Publication 947, which discusses the roles of tax agents both in signing tax returns and representing clients in dealings with tax officials.

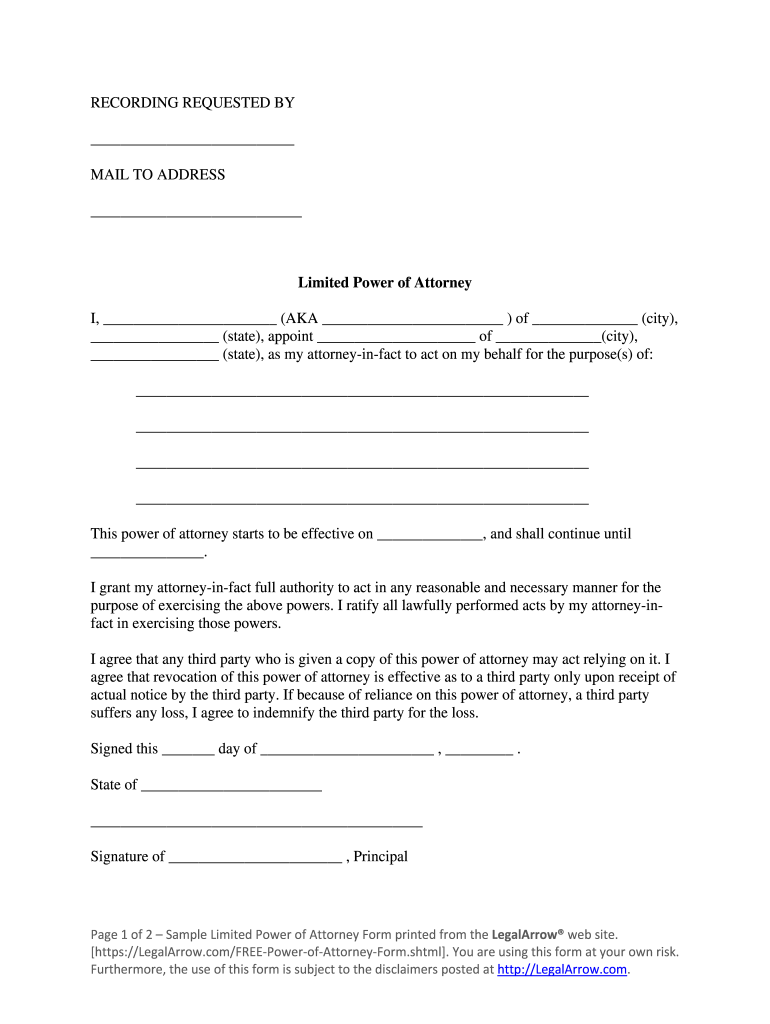

What is a power of attorney?

As a general legal principle, a power of attorney is a document signed by an individual which gives somebody else the ability to act on his behalf in a legal context. The person given the ability is referred to as having "power of attorney.". Despite the name, this person does not have to be a qualified lawyer.

Can a spouse sign a joint return without a power of attorney?

Joint Returns. In the event of a couple making a joint return, one spouse is allowed to sign on behalf of the other, without the need for a formal power of attorney. This only applies in cases of disease and illness.

What is a power of attorney?

Power of Attorney. You have the right to represent yourself before the IRS. You may also authorize someone to represent you before the IRS in connection with a federal tax matter. This authorization is called Power of Attorney.

How long does a power of attorney stay in effect?

Power of Attorney stays in effect until you revoke the authorization or your representative withdraws it. When you revoke Power of Attorney, your representative will no longer receive your confidential tax information or represent you before the IRS for the matters and periods listed in the authorization.

How to authorize a third party to file taxes?

There are different types of third party authorizations: 1 Power of Attorney - Allow someone to represent you in tax matters before the IRS. Your representative must be an individual authorized to practice before the IRS. 2 Tax Information Authorization - Appoint anyone to review and/or receive your confidential tax information for the type of tax and years/periods you determine. 3 Third Party Designee - Designate a person on your tax form to discuss that specific tax return and year with the IRS. 4 Oral Disclosure - Authorize the IRS to disclose your tax information to a person you bring into a phone conversation or meeting with us about a specific tax issue.

What is a tax information authorization?

A Tax Information Authorization lets you: Appoint a designee to review and/or receive your confidential information verbally or in writing for the tax matters and years/periods you specify. Disclose your tax information for a purpose other than resolving a tax matter.

What is an oral disclosure?

Oral Disclosure. If you bring another person into a phone conversation or an interview with the IRS, you can grant authorization for the IRS to disclose your confidential tax information to that third party. An oral authorization is limited to the conversation in which you provide the authorization.

What is a low income clinic?

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and may be able to help you. LITCs represent eligible taxpayers before the IRS and in court. To locate a clinic near you, use the Taxpayer Advocate Service LITC Finder, check Publication 4134, Low Income Taxpayer Clinic List PDF, or call 800-829-3676.

What is a POA on a tax return?

Form 8453 has a specific box to check if you are attaching a POA indicating that the individual has authority to sign the tax return: Form 2848, Power of Attorney and Declaration of Representative (or POA that states the agent is granted authority to sign the return)

When is a power of attorney terminated?

A power of attorney is generally terminated if you become incapacitated or in- competent. The power of attorney can continue, however, in the case of your incapacity or incompetency if you authorize this on line 5a “Other acts authorized” of the Form 2848. Does this mean I should also add words like these to Line 5a:

What is Form 2848?

Form 2848 is the IRS’s own version of a POA. Form 8453 is needed whenever mailing a paper document related to an e-filed return. Of course, I would prefer to use Method (1).

How long do you have to file 1040?

3) Complete line 3; income, 1040, 2018-2020. You are allowed prospective years but I don't recommend more than 3 years.

What is a power of attorney?

A power of attorney is a legal document that gives someone the authority to sign documents and conduct transactions on another person’s behalf. A person who holds a power of attorney is sometimes called an attorney-in-fact.

Who is responsible for managing a power of attorney?

A person who acts under a power of attorney is a fiduciary . A fiduciary is someone who is responsible for managing some or all of another person’s affairs. The fiduciary has a duty to act prudently and in a way that is fair to the person whose affairs he or she is managing.

Who is Jane Haskins?

Jane Haskins is a freelance writer who practiced law for 20 years. Jane has litigated a wide variety of business dispute….

Can a power of attorney be used for business?

Don't exceed your authority. A power of attorney document may give you broad power to transact business, or your powers may be more limited. Make sure you understand what you are and aren’t allowed to do as attorney-in-fact, and consult a lawyer if you need clarification. You could face civil or criminal penalties for unauthorized transactions.

How to get a power of attorney for IRS?

An IRS power of attorney allows tax pros to: 1 Research your IRS account to help you understand a notice, verify your good standing at the IRS, or uncover any compliance issues that you need to address. 2 Get copied on any notices the IRS sends you – which allows your tax pro to reach out to you if there’s anything you need to do about the notice. 3 Respond to an IRS notice or inquiry for you. 4 Set up agreements with the IRS for you, like monthly payment plans for taxes you owe or agreements on audit findings. 5 Represent you and advocate for you with the IRS. Common examples are when taxpayers need to argue the legitimacy of a deduction in an audit, contest a collection matter, or request penalty relief. 6 Deal with the IRS Taxpayer Advocate Service. 7 Appeal a dispute with the IRS.

What is a POA?

So we’ll get this part out of the way: A power of attorney (POA) is an authorization for someone to act on your behalf. What that actually means for you and your taxes: You can authorize your tax pro to deal with the IRS for you.

What is a third party authorization?

This authorization is called the third-party designee. It’s a person you name in the Third Party Designee area of your return. This authorization isn’t a POA.

What is the form 8821?

If you want someone to receive information related to the return (like IRS notices, IRS records, etc.), but you don’t want them to be able to advocate on your behalf, you can use the Form 8821, Tax Information Authorization. This form isn’t limited to licensed tax professionals.

How long does a POA stay in effect?

The POA stays in effect until you or your representative withdraws the authorization. After seven years, if you haven’t already ended the authorization, the IRS will automatically end it.

Can a power of attorney represent you?

Not just anyone can represent you. You can authorize specific family members to act on your behalf. But the most likely use of a power of attorney is to authorize a licensed tax professional to deal with the IRS for you. Licensed tax professionals are usually CPAs, enrolled agents, and attorneys.

How to sign a power of attorney?

To sign as a power of attorney, start by signing the principal's full legal name. If you're dealing with a financial account, sign their name the same way it's listed on the account. Next, write the word "by" on the line below the principal's name and sign your own name.

When does a POA go into effect?

Your POA agreement should specify exactly when the POA will go into effect, how long it will last, and what duties and powers the agent has under the agreement. Some POA agreements go into effect when signed, while others are designed to go into effect only when a specified event happens.

What does POA mean?

When someone gives you power of attorney (POA) in the United States, it means you have the authority to access their financial accounts and sign financial or legal documents on their behalf. POA is given using a legal POA document that has been drafted and executed according to your state's law.

What does it mean to be an attorney in fact?

When the document goes into effect, you become that person's attorney in fact, which means you act as their agent. Generally, to sign documents in this capacity, you will sign the principal's name first, then your name with the designation "attorney in fact" or "power of attorney.". Steps.

What happens if you don't check anything?

This means if you don't check anything, the agent won't have any powers. For other forms or templates, you simply list the powers the agent has. Execute your POA agreement. A POA agreement, to be valid, must be signed by both the agent and the principal.

Who is Jennifer Mueller?

Jennifer Mueller is an in-house legal expert at wikiHow . Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006. This article has been viewed 109,911 times.

Can you get conservatorship if you are incapacitated?

If this is the case, you need to file a petition in your local court for a "conservatorship," or adult guardianship.

Popular Posts:

- 1. find attorney who defends medical fraud

- 2. living will form

- 3. how to obtain n a jail a state attorney for veteran in broward county fl

- 4. what is poer of attorney

- 5. in florida how much does it cost to have an attorney prepare a codocil to a will

- 6. why would the coconino county attorney hold my car until the criminal case is done

- 7. what is role of nys attorney for child

- 8. what can cannot do with a financial power of attorney

- 9. how long after a civil trial can a party sue for their attorney fees

- 10. what is the legal theory that imposes the rules of attorney ethics on paralegals?