New York probate fees explained – court and attorney fees

| Value of Estate or Subject Matter | Fee Rate |

| Less than $ 10,000 | $ 45.00 |

| 10,000 but under 20,000 | 75.00 |

| 20,000 but under 50,000 | 215.00 |

| 50,000 but under 100,000 | 280.00 |

Full Answer

How much do lawyers charge for probate?

Jul 29, 2019 · FLAT FEE. 32%. 32 %. Nearly a third of readers said the estate paid a flat fee for a lawyer’s estate administration services. If you’re serving as an executor, personal representative, trustee, or administrator of an estate, you might need a lawyer’s help with some part of the process. The good news is that estate funds will almost always pay for that help.

Do lawyer fees have to be paid before a probate?

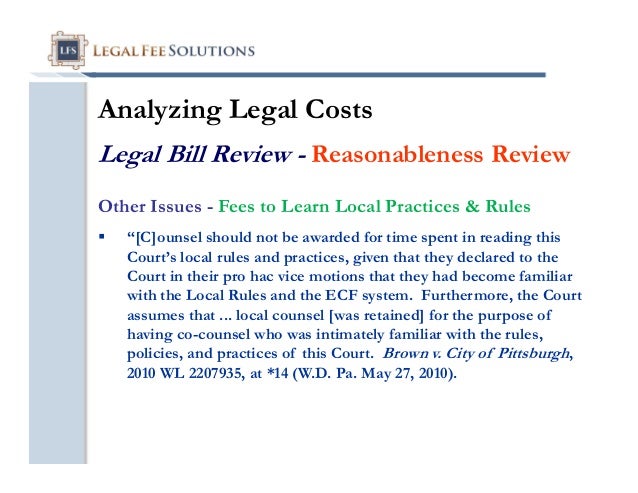

Kinds of Fee Arrangements. Lawyers usually use one of three methods to charge for probate work: by the hour, a flat fee, or a percentage of the value of the estate assets. Your lawyer may let you pick how you pay—for example, $250/hour or a $1,500 flat fee for handling a …

How much do lawyers charge to settle an estate?

Executors can also be reimbursed a fair fee for the job they do as a representative of an estate. State laws dictate how much an Executor can charge (usually a max of 3 - 5 percent of the estate value). Other Fees There may be other miscellaneous fees related to probate. Some of these could include: Appraisal Fees. Postage Fees. Business Valuation Fees. Notary Fees. Storage …

Can You probate an estate without a lawyer?

4% of the first 100,000 of the gross value of the probate estate; 3% of the next $100,000; 2% of the next $800,000; 1% of the next $9 million; ½% of the next 15 million "a reasonable amount" of anything over $25 million; A probate estate with a gross value of $500,000 would generate $13,000 in legal fees.

How does a probate lawyer get paid?

Lawyers usually use one of three methods to charge for probate work: by the hour, a flat fee, or a percentage of the value of the estate assets. Your lawyer may let you pick how you pay—for example, $250/hour or a $1,500 flat fee for handling a routine probate case.

How much should you pay for probate?

How much does professional help with the probate process cost? The fees for probate and estate administration can vary widely depending on who does it, whether that be a solicitor, probate specialists or a bank. The cost for these range between 2.5 to 5% of the value of the estate.

How much does a solicitor charge to be an executor?

Some probate specialists and solicitors charge an hourly rate, while others charge a fee that's a percentage of the value of the estate. This fee is usually calculated as between 1% to 5% of the value of the estate, plus VAT.

Do I need to send death certificate for probate?

You'll need a copy of the death certificate for each of the deceased's assets (eg, each bank account, credit card, mortgage etc), so before you can start probate, you'll need to register the death.Jan 26, 2022

How much does a probate lawyer charge?

Small town rates may be as low as $150/hour; in a city, a rate of less than $200/hour would be unusual. Big firms generally charge higher rates than sole practitioners or small firms, unless a small firm is made up solely of hot-shot specialists.

How long does a lawyer bill?

Many lawyers bill in minimum increments of six minutes (one-tenth of an hour). So, if your lawyer (or a legal assistant) spends two minutes on a phone call on behalf of the estate, you'll be billed for six minutes.

What are the drawbacks of probate?

Perhaps one of the biggest drawbacks to probate is the cost . And the more it costs, the less inheritance your beneficiaries will receive. Total cost can widely vary, depending on a number of factors including: But there are some things you can count on being fairly consistent in the probate process.

How long does probate take?

Probate can take anywhere from a few months to several years to fully complete. For most estates of average size, the process will range from six months to two years. If an estate is especially large, if any heirs contest anything, or if beneficiaries cannot be found, things will take longer.

Do you have to pay probate fees out of your estate?

And in some states, you’re actually required to do so by law (although most states do not mandate this). A probate lawyer's fees (and most other costs of probate) are paid out of the estate, so your family will not need to worry about who pays probate fees, and they won’t have to cough up any money out of pocket.

Do probate attorneys charge hourly?

At the end of the day, that’s money that could be going to your beneficiaries. Probate lawyer fees can vary - lawyers can charge hourly or a flat rate.

What is surety bond?

Surety Bonds offer insurance that protect the estate against anything questionably done by a representative throughout the process. If a bond is required, the amount is typically determined by the estimated size of the estate. Executors can charge a fee to be reimbursed for most expenses they incur.

What is the billing method for probate?

Another popular billing method is the flat fee. An attorney who's done a lot of probates knows about how long the work takes, and charging a lump sum means the attorney doesn't have to keep careful records of how the lawyers and paralegals spend their time. Some attorneys also find that clients are more relaxed and comfortable dealing with the attorney when they know the meter isn't always running.

What are some examples of real estate fees?

Some examples include court filing fee, postage, publication of legal notices in the newspaper, property appraisals, and recording fee for real estate deeds.

Do lawyers collect percentage of estate value?

In a few states, lawyers are authorized by law to collect a percentage of the value of the estate as their fee. They're not required to do so—you are free to negotiate an hourly rate or flat fee with them. But many prefer it because it usually pays so well in relation to the amount of work actually required.

Do you have to get a fee agreement for an estate attorney?

When you hire an attorney on behalf of the estate, get a fee agreement in writing. It's required by law in some states, and it's a good idea no matter where you are.

What happens if you don't have an estate plan?

Your loved ones will be faced with probating some or all of your assets if you don't have an estate plan and haven't taken steps to avoid the process. The overall cost of probate can vary depending on the type and the value of the estate's property. In general, the greater the value, the more probate will cost.

Do estates require an attorney?

An attorney can also ask for "extraordinary fees" for services rendered above and beyond those that are deemed to be basic probate duties. 5 . Not all estates require an attorney, however.

What are miscellaneous fees?

Miscellaneous Fees. Miscellaneous fees can range from the cost of postage to insuring and storing personal property, shipping personal property, and more. And this doesn't include any estate and income taxes that might be due and payable during the course of the probate administration. Taxes can further deplete an estate.

What is accounting fee?

Accounting fees can include the preparation and filing of estate tax returns if the estate is taxable at the state or federal level. 5 Sometimes the attorney for the estate will prepare and file these returns.

What is an affidavit procedure?

Affidavit Procedure. This option does not involve probate courts, attorneys, or related fees at all. This option can only be used if the decedent’s value of probate assets is $100,000 or less, and it excludes any property interest from their spouse or partner.

Does Washington state require attorneys to accept estate taxes?

Depending on the estate’s value and the type of property included in it, these fees can get pretty steep. Still, states cannot legally require attorneys to accept these fees.

What is flat fee probate?

Flat Fees. Flat fees are fixed charges for specific tasks. It’s not uncommon for probate attorneys in Washington to negotiate a flat fee for things like filing documents. It’s also a good way for them to charge for the entire process without having to track everything they do down to the minute.

Can you get reimbursed for probate expenses?

If you paid any probate expenses, then you are eligible to get reimbursed. This is uncommon since the estate covers probate expenses, but it does happen from time to time. When this happens, reimbursement is handled through courts, and it has to be requested by the executor or administrator.

Is your lawyer charging too much?

Julie Ann Garber is a vice president at BMO Harris Wealth management, a CFP, and has 25 years of experience as a lawyer and trust officer. Julie Ann has been quoted in The New York Times, the New York Post, Consumer Reports, Insurance News Net Magazine, and many other publications.

Your Initial Meeting

Most estate planning attorneys don't charge a fee for the initial meeting, but this is by no means a universal rule. Don't be surprised if the attorney does charge a small fee for sitting down with you for the first time. It can go either way.

The Estate Planning Flat Fee

A set dollar amount typically covers the initial meeting—if you end up retaining the attorney's services—as well as preparation of basic documents, review of documents, and signing of documents.

Standard Hourly Rates

A flat fee is a composite of the attorney's standard hourly rate and how many hours he thinks he'll have to invest in your case to resolve it. Ask what that hourly rate is, and find out how much you'll be charged for the services of other attorneys and paralegals in the firm.

Meet by Telephone First

It's common these days to handle a significant amount of business by telephone. Consider setting up telephone interviews with at least two estate planning attorneys before meeting in person. This will save your time and the attorney's time...if she's willing.

Ask for Details

Ask an attorney who's going to charge you more than another exactly why his fee is so much higher. Some attorneys are in the business of selling estate plans in bulk, while others are truly interested in giving you a high-quality estate plan and becoming your advisor for life.

Trust Your Gut

Your goal shouldn't necessarily be to find the cheapest attorney. Think about how comfortable you feel with each, because you'll have to be open and honest when discussing the most intimate details of your personal life and finances with this individual. Sometimes you have to go with your instincts.

What is Probate?

In basic terms, probate is a legal process supervised by the court, during which the estate is distributed to the beneficiaries of a deceased person. Probate takes place after a person’s death. The probate process may include the following steps:

Probate Process. How to Probate a Will?

The process to probate a Will in California, similar to most other states in the United States, seems overwhelming, yet it’s meant for individuals to be able to do it and even though hiring a probate attorney may save you countless headaches, hiring an attorney is not required.

Fees Associated with Probate Attorneys

An attorney will take payment for probate following one of these three different fee structures: hourly rate, fixed fee, or a percentage of the estate’s value.

Probate Cost and Attorney Fees for California and other states

Now that you a general idea of how probate attorney fees break down, let’s examine other costs accrued throughout the probate process.

Popular Posts:

- 1. who is the state attorney for live oak fl

- 2. how old must you be to witness a power of attorney

- 3. when may an unlicensed attorney in fact

- 4. power of attorney vs guardianship for child

- 5. what los angeles attorney will sue walmart

- 6. california when must attorney report addiction

- 7. when to tell someone to deal with your attorney

- 8. where to get entry level attorney job

- 9. how does a pa attorney gain access to another state court jurisdiction?

- 10. who is running district attorney for coweta county ga