Mortgage fees you might have to pay

- Application fee ($100): Some lenders charge a small fee when you submit your application. ...

- Attorney fee ($150 to $500): In some states, you bring your own attorney to the closing table; in other states, you don’t. ...

- Flood certification ($5 to $10): This tells the lender if the home is in a flood zone.

How much do real estate attorneys make per closing?

Feb 15, 2018 · Closing attorney fees vary greatly from one state to another, and can reach $1,000 - $2,000 depending on the complexity of the transaction. Some attorneys charge a flat fee, while others will charge an hourly rate, usually $100 - $300. You can compare real estate attorneys capable of helping you with the closing process on WalletHub.

How much should a lawyer charge for a closing?

May 18, 2013 · When you make application for a mortgage, federal law requires that the closing fees, including the bank’s attorney fees, be disclosed to you up front. Banks are diligent in this disclosure. However, what they disclose, on the document called the Good Faith Estimate, is not exactly the attorney’s fee, but the maximum the bank will allow the ...

Which states require attorneys for real estate closings?

Jul 06, 2020 · Closing costs on a mortgage loan usually equal 3 – 6% of your total loan balance. Appraisal fees, attorney’s fees and inspection fees are examples of common closing costs. The specific closing costs you’ll pay depend on the type of …

How much does Quicken Loans charge for closing costs?

A South Carolina real estate closing attorney typically charges a flat fee for conducting the closing. In most cases, the fee is several hundred dollars, and in some situations, it may be over $1,000. Many real estate clients only see the real estate closing attorney at the closing itself and may wonder why these fees are in place.

Can attorney fees be negotiated when buying a house?

the purchase price – always negotiable. the transferring attorney – charged at a standard rate based on the purchase price of the property, but slightly negotiable. the bond attorney – charged at a standard rate based on the purchase price of the property, but slightly negotiable.Nov 11, 2019

What fee is paid directly to the lender at closing?

Discount points: Discount points are fees paid directly to the lender by the buyer at closing in exchange for a reduced interest rate. This is also called “buying down the rate.” One point costs 1% of your mortgage amount (or $1,000 for every $100,000).Nov 15, 2021

How do you calculate closing costs?

To calculate your closing costs, most lenders recommend estimating your closing fees to be between one percent and five percent of the home purchase price. If you're purchasing your house for $300,000, you can estimate your total closing costs to be between $3,000 and $15,000.Feb 25, 2022

Are closing costs tax deductible?

Typically, the only closing costs that are tax deductible are payments toward mortgage interest – buying points – or property taxes. Other closing costs are not. These include: Abstract fees.Feb 23, 2022

Which of the following closing cost fees is commonly charged on a loan?

Common closing fees or charges may include: Appraisal fees. Tax service provider fees. Title insurance.Sep 8, 2020

Can closing costs be rolled into mortgage?

In simple terms, yes – you can roll closing costs into your mortgage, but not all lenders allow you to and the rules can vary depending on the type of mortgage you're getting. If you choose to roll your closing costs into your mortgage, you'll have to pay interest on those costs over the life of your loan.

What Are Closing Costs?

Closing costs are processing fees you pay to your lender. Lenders charge these fees in exchange for creating and servicing your loan. Closing costs...

How Much Are Closing Costs?

Closing costs can make up about 3% – 6% of the price of the home. This means that if you take out a mortgage worth $200,000, you can expect closing...

Who Pays Closing Costs?

Both buyers and sellers pay closing costs. However, the buyer usually pays most of them. You can negotiate with a seller to help cover closing cost...

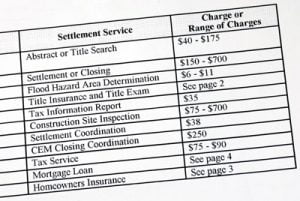

What’s Included In Closing Costs?

Not every buyer will pay the same amount in closing costs. Some costs are lender requirements, some are government requirements and others are opti...

Popular Posts:

- 1. second medical power of attorney when patient is incapacitated

- 2. when is vote on attorney general barr

- 3. how to get a medical power of attorney in pa

- 4. real estate attorney orlando what does it mean

- 5. how to give someone power of attorney to sell a car in tn

- 6. who can draft power of attorney

- 7. how much does an attorney cost per hour

- 8. kentucky cities who hires the city attorney

- 9. how to fine out before death who is power of attorney

- 10. case on long island where attorney was removed from case for driving clients children