Can a state agency pay a licensing fee or occupation tax?

The attorney occupation tax was repealed by the 84th Legislature. Firm Billing The State Bar of Texas Membership Department has provided an easy tool for firms and other agencies to pay their attorneys' bar dues and the legal services fee collectively at one time.

What is an occupation tax?

Sep 01, 1991 · Description A tax imposed on each attorney at a rate of $200 per year to be paid in advance. If a person was licensed or resumes active status to practice law after the beginning of the tax year, the person paid the tax in proportion to the number of months for which the person was be licensed during that tax year. Due Date Collecting Agencies

What is the well servicing tax in Texas?

A state agency may pay a licensing fee or an occupation tax for an officer or employee of the agency if the agency determines: ... 757 (Tex. App.—Austin 1996, writ denied) (discusses only occupation taxes); Opinion of the Texas Attorney General No. JM-1063 (1989); Texas Attorney General LO-88-79 (1988). Documentation Requirements [+]

What are Texas State Bar dues?

State Bar of Texas Dues Schedule All Texas lawyers must pay membership dues as follows: Licensed 0 to 3 years = $68.00. Licensed 4 to 5 years = $148.00. Licensed more than 5 years = $235.00.

How many CLE hours does Texas require?

15 hoursEvery active State Bar of Texas member must complete a minimum of 15 hours of accredited CLE during each MCLE compliance year. 3 of these hours, including 1 hour of legal ethics, could be in self study.

How much are DC bar dues?

The membership dues for D.C. Bar members is $79; the subscriber fee for other individuals is $129. If you have not already done so, you will need to create an account.

Can you sue for attorney fees in Texas?

Generally, Texas law provides that each party to a lawsuit is responsible for her attorneys' fees. However, Texas law has long provided that a party in a breach of contract claim may recover her attorney's fees in addition to the damages she suffers.Sep 1, 2021

How do I submit my CLE credits to Texas?

Report your MCLE hours by either of two ways: Online at My Bar Page: You can easily access and report your MCLE hours when you log in to My Bar Page. Click on the link to “View/Report MCLE Hours”. Submit a coded “Credit Input Form”: You may request a Credit Input Form.

What is MCLE?

Continuing legal education (CLE), also known as mandatory or minimum continuing legal education (MCLE) or, in some jurisdictions outside the United States, as continuing professional development, consists of professional education for attorneys that takes place after their initial admission to the bar.

How do I retire from the D.C. Bar?

The D.C. Bar offers a retired-inactive status for two categories of members: members who have been active for at least five years or inactive/judicial for 10 years, engaged in the practice of law in the District of Columbia or elsewhere for a total of 25 years, and retired from the practice of law; and members who are ...

Can you waive into D.C. Bar from NY?

Washington Reciprocity Washington has reciprocity with: AK, CO, CT, DC, GA, ID, IL, IN, IA, KY, MA, MI, MN, MO, NE, NH, NY, NC, ND, OH, OK, OR, PA, TN, TX, UT, VT, VA, WV, WI, and WY.

Can you go inactive on D.C. Bar?

INACTIVE – Inactive members have been admitted to the DC Bar and are eligible for active membership but do not practice, or in any way hold themselves out as licensed to practice, in the District of Columbia.Jun 28, 2018

When can you recover attorney's fees in Texas?

Texas Expands the Ability to Recover Attorneys' Fees in Breach of Contract Cases Filed on or After September 1, 2021. A significant amendment to the Texas statute that allows for recovery of attorneys' fees by a prevailing plaintiff in an action for breach of contract will take effect on September 1, 2021.Jul 26, 2021

Can an attorney charge interest on unpaid bill in Texas?

Thus, the question here is whether or not an attorney may charge interest on an unpaid balance of attorney's fees. There is nothing in the code of professional responsibility that prohibits the charging of interest.

Can you recover attorney fees for breach of fiduciary duty Texas?

The short answer is: No, you are usually not entitled to recover your attorneys' fees in a Breach of Fiduciary Duty case. However, there may be other causes of action to file with your breach of fiduciary duty claim, which may entitle you to recover attorneys' fees.

Description

A tax imposed on each attorney at a rate of $200 per year to be paid in advance. If a person was licensed or resumes active status to practice law after the beginning of the tax year, the person paid the tax in proportion to the number of months for which the person was be licensed during that tax year.

Deposit Funds

0001 – General Revenue Fund Allocated 25% to Foundation School Account (No. 0193) and 75% to General Revenue Fund (No. 0001) to fund statutory allocations.

Note

Allocated 25% to Foundation School Account (0193) and 75% to General Revenue.

Job Description for Tax Attorney I

Tax Attorney I acts as organization's representation in dealing with local, state, and federal taxing agencies. Responsible for developing tax saving plans and preparing legal documents involving liabilities. Being a Tax Attorney I offers counsel on the impact of tax laws and preparation of tax activities.

About Texas

Texas (/ˈtɛksəs/, locally /ˈtɛksɪz/; Spanish: Texas or Tejas Spanish pronunciation: [ˈtexas] (listen)) is the second largest state in the United States by both area and population. Geographically located in the South Central region of the country, Texas shares borders with the U.S.

Browse All Legal Services Jobs by Salary Level

About Texas Texas (/ˈtɛksəs/, locally /ˈtɛksɪz/; Spanish: Texas or Tejas Spanish pronunciation: [ˈtexas] (listen)) is the second largest state in the United State.... More

Who is Exempt from the Legal Services Fee?

You may be exempt from this fee if you meet at least one of the following conditions:

How to Claim an Exemption

To claim an exemption from your legal services fee, fill out the LSF Exemption Form and send to the Membership Department. Attorneys may also file exemptions online through their “My Bar Page” when the online payment season is open.

Military Waiver

Are you an attorney member serving in a combat zone? You may be exempt from annual dues. Download the Military Waiver Form.

Contact Us with Questions About Your Fee

If you've read the details on this page and still have questions, please contact us.

What is occupation tax?

An occupation tax is levied on persons who perform certain services associated with oil and gas wells. The tax is 2.42 percent of the gross amount of the charge for service, less the reasonable wellhead value of any material used or consumed in the well. If the tax is collected from a customer, it must be included in the service company's gross ...

What is a service charge?

Most service companies have a variety of miscellaneous charges, the most prevalent being the basic service charge. If the service charge is invoiced as a basic one-time charge (per day, per trip, etc.) it may be allocated for tax purposes, provided the allocation can be supported by pricing literature. The allocation will be based upon the ratio of taxable services performed to total services performed.

When are well servicing reports due?

A tax report is due on or before the 20th day of each month reflecting the previous month's activities. A well servicing company is furnished a supply of report forms when its permit is issued. Additional forms may be requested as needed.

What is a log survey?

The most common survey of an oil or gas well formation is the log. There are two basic types of logs-an open hole log and a cased hole log. Any log or survey run with an instrument in the well bore to locate, measure, or determine the depth, character, or contents of a formation is a taxable service.

Is cementing a casing seat taxable?

Cementing the casing seat is a taxable service. Cementing a casing seat begins with placement of the production string in the well and ends when the cement is in place. Cementing the bottom liner used as an extension of a non-continuous production string is a taxable service.

What is a tracer log?

Tracer logs used only to detect channels behind the casing or to plot an injection profile; Temperature surveys used to check mechanical equipment in the well bore; Fluid surveys conducted with a sonic instrument located only at the surface and not in the well bore; Deflection or deviation surveys;

What is a drill stem test?

A drill stem test; A bottom hole or depth pressure test; Productivity index tests made with an instrument in the well and during drilling, completion, reworking, or reconditioning of the well. The following tests are not taxable services: Any analysis of fluids, cores, or cuttings made outside the well bore;

EXHIBIT 1: U.S. LICENSING STATUS BY INDUSTRY, 2018

MINING, QUARRYING AND OIL AND GAS… CONSTRUCTION MANUFACTURING WHOLESALE TRADE RETAIL TRADE TRANSPORTATION AND UTILITIES INFORMATION FINANCIAL ACTIVITIES PROFESSIONAL AND BUSINESS SERVICES EDUCATION AND HEALTH SERVICES LEISURE AND HOSPITALITY OTHER SERVICES PUBLIC ADMINISTRATION 0 5 10 15 20 25 30 35

What's Licensing for, Anyway?

Licensing is intended to protect consumers from poor or unethical service. Earning a license requires workers to demonstrate the ability to practice their chosen occupations safely and ethically.

Popular Posts:

- 1. who is the us attorney for the northern district of california

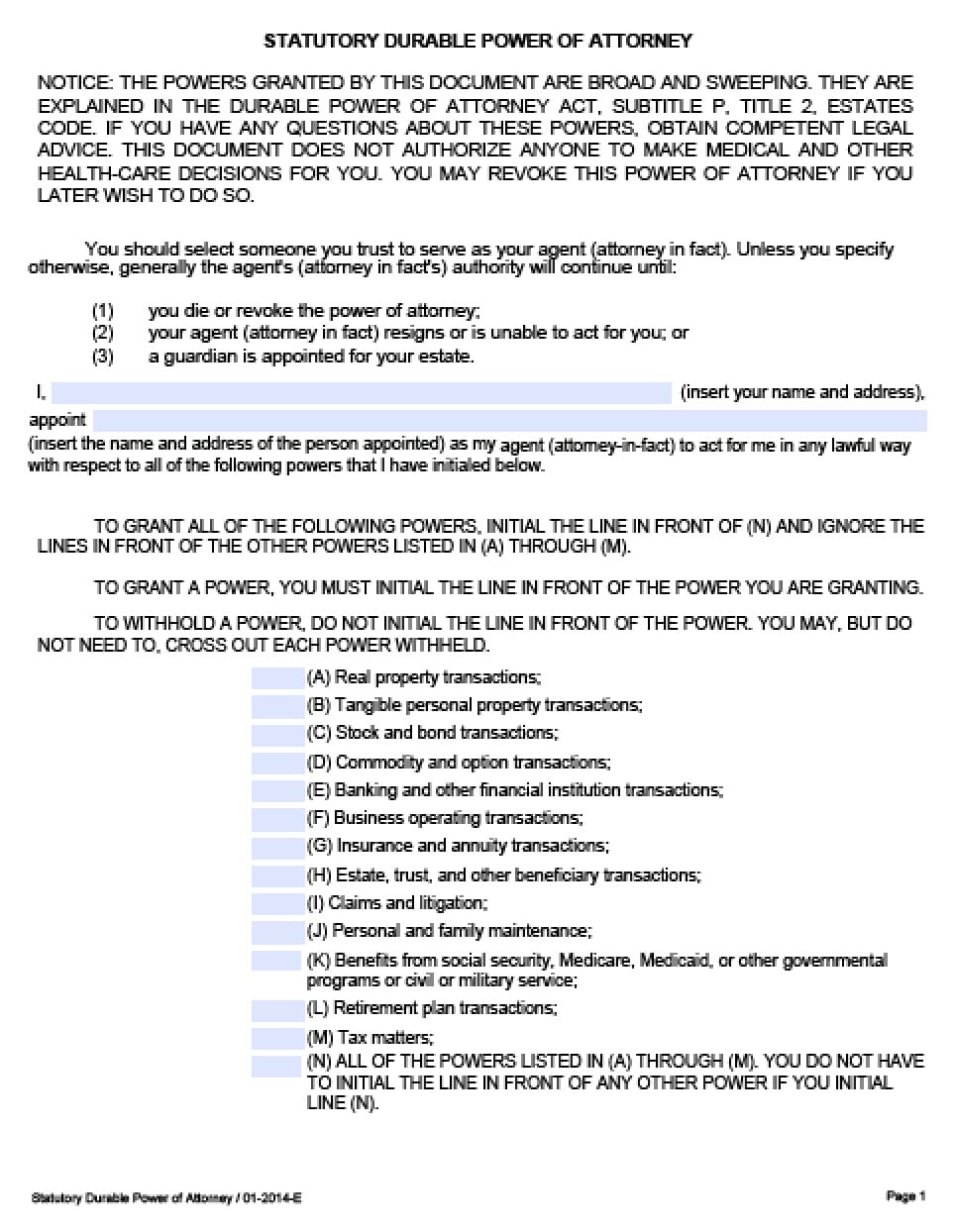

- 2. person appointed as power of attorney what are their duties

- 3. wisconsin attorney ethical rules withdrawing from representation for client who can't pay

- 4. the attorney general of texas is primarilly responsible for which of the following:

- 5. how much can an attorney recover in a tcpa case

- 6. how to change a bank account to power of attorney

- 7. who was attorney general of florida when gore ran for presiden

- 8. how to get a durable power of attorney form arkansas

- 9. where can i find a lawyer that does power of attorney in lehi

- 10. how much is joseph herrin salary as assistant attorney general