How much does it cost to register a deed in Florida?

Mar 07, 2022 · If you have any concerns about what you need to include in a quit claim deed to make it valid, you could hire an attorney to draft the deed for you. A typical fee will be $200 to $300 for the preparation of the deed by an experienced attorney. Quitclaim Deed FAQs How does a quit claim deed work in Florida?

How much does a lawyer charge to prepare a quitclaim deed?

Jul 24, 2017 · If you're thinking about buying property in Florida, or are having difficulty in the buying or selling process, we can help. Our attorneys have handled real estate matters for a variety of clients, from first-time home buyers to purchases grossing multiple millions of dollars. Call our office today at (727) 397-5571 to schedule a consultation ...

Do I need an attorney to prepare a Florida Quit Claim Deed?

How much does a quitclaim deed cost in Florida? A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk’s office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

How much does a real estate attorney cost?

Aug 07, 2020 · Real estate lawyers typically charge a flat fee, which ranges from $750 to $1,250, Reischer said. Although there shouldn’t be any hidden fees, Romer said there are always carve-outs and exceptions.

How much does a deed transfer cost in Florida?

The tax rate for documents that transfer an interest in real property is $. 70 per $100 (or portion thereof) of the total consideration paid, or to be paid, for the transfer. An exception is Miami-Dade County, where the rate is $. 60 per $100 (or portion thereof) when the property is a single-family residence.

How much does a real estate attorney charge?

Fixed hourly rate: A real estate attorney who charges an hourly rate may charge $150 – $350 per hour, but this can vary a lot depending on how experienced the attorney is and what area you're in.Mar 7, 2022

Can an out of state attorney prepare a Florida deed?

An attorney licensed to practice law in a state other than Florida may establish an interstate practice in Florida only if the attorney follows the guidelines of The Florida Bar v. Savitt, 363 So. 2d 559 (Fla.

What type of lawyer handles deeds?

A property lawyer can research all requirements, negotiate, draft the deed, and represent you in court if necessary. A lawyer can also help sellers decide the best type of deed transfer to perform depending on the circumstances of the sale.Mar 31, 2021

Do you need an attorney to buy a house in Florida?

Unlike some states, Florida does not require that buyers involve a lawyer in the house-buying transaction. Even if it's not required, you might decide to engage a lawyer in special situations, for example if you are purchasing a house jointly with others and need help structuring your co-buyer agreement.Nov 20, 2020

What is a lowball offer?

A lowball offer refers to an offer that is far less than the seller's asking price or is deliberately too low, as a means of starting negotiations. To lowball also means to throw out a purposely lower than reasonable number to see how the seller will react.

How do I transfer a deed in Florida?

A person filing a deed for transfer of Florida real estate ownership must do so through the county comptroller's office where the property is located. There is a small fee for filing and a document stamp tax, which is an excise tax on legal documents delivered, executed or recorded in the state.Dec 23, 2021

Can a paralegal prepare a living trust?

Only Registered Legal Document Assistants or an Attorney can legally accept money from the public to prepare legal documents.May 26, 2020

Can I waive into Florida Bar?

Florida's Bar Association does not have “reciprocity” with any other state bar association. Reciprocity means that two state bar associations have agreed that lawyers in state A can practice in state B, and vice-versa, without taking another bar exam as long as they meet the other state's admission requirements.Jul 26, 2017

When should I hire a real estate attorney?

A Lawyer for Real Estate will make sure that the seller has clear and transferable ownership right over the property that he or she is selling. There should be no pending litigation on the property and the title should be transferable.

What is an attorney called?

A lawyer (also called attorney, counsel, or counselor) is a licensed professional who advises and represents others in legal matters. Today's lawyer can be young or old, male or female. Nearly one-third of all lawyers are under thirty-five years old.Sep 10, 2019

What does an estate lawyer do?

An estate lawyer is a legal professional who assists people in planning their affairs to ensure the administration of their estate goes smoothly. Estate lawyers ensure that a client has documented their wishes so that they may be carried out after their death, including through wills and trusts.

How long does it take to get a lawyer to buy a house?

Buying a home, land, or commercial real estate is a complex process that can take weeks or even months to complete.

What is the primary function of a real estate lawyer?

The primary function of a real estate lawyer is to make the transaction as easy as possible while ensuring your interests are protected. Mistakes in the purchasing process may cause delays, add unforeseen costs, and expose you to legal liability in the future.

How much does a quitclaim deed cost in Florida?

A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk’s office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

How much does it cost to record a deed in Broward County?

Recording charges are $10.00 for the first page and $8.50 for each additional page of the same document. For pages over 14″ in length or over 8 ½ in width, add $8.50 for each additional 14″ in length or 8 1/2 ” in width, or portion thereof.

Where to find Recorder of deeds in Broward County?

Find GIS Maps, Land Records, Property Records, and Tax Records related to Broward County Recorder of Deeds. Find 2 Recorders Of Deeds within 43.2 miles of Broward County Recorder of Deeds. Find 25 external resources related to Broward County Recorder of Deeds.

Where can I get a copy of a deed in Fort Lauderdale?

maintains a searchable database of recorded documents, including deeds, at our offices at the Broward County Governmental Center, 115 S. Andrews Ave., Fort Lauderdale. You can also view an index and images of recorded deeds online. provides certified copies of deeds and other recorded legal documents. processes requests to change names on a deed.

When did Broward County Florida start keeping records?

Use our online records search to view a comprehensive listing of documents recorded into the Official Records of Broward County, Florida between January 1, 1978 and the present.

How to return a property in Broward County?

Self-addressed, stamped envelope for the return of your recorded document (s). Your search of the Official Record must be by property owner.

Where do you record deeds in Broward County?

IMPORTANT: Deeds related to Broward County properties must be recorded with the Broward County Records Division in downtown Fort Lauderdale. Click here to visit their website.

How much does an attorney charge per hour?

While most attorneys charge a flat rate, some will charge by the hour, with hourly rates ranging from $150 to $350, according to Thumbtack.

What is the difference between a realtor and a real estate agent?

A real estate agent, or realtor, is tasked with marketing a property for sale or finding a property for a buyer, Romer said, while an attorney is enlisted to ensure someone’s legal rights are protected during a home sale. Real estate agents are paid based on commission , while attorneys are paid a separate legal fee that is typically a flat rate, he said.

Do you need a real estate attorney to close a house?

Some states require a real estate attorney for closing, while others don’t. In states that don’t require an attorney, it’s still a good idea to consider hiring one to help make sure everything is in good order. How much does a real estate attorney cost may factor into your decision-making given how many costs are associated with closing on a house .

How much does a quit claim deed cost in Florida?

A quick claim deed in Orange County, Florida, costs $10 for the first page, $8.50 for every page after that and $1 for each name after the first four names. Palm Beach County, Florida, assesses the exact same fees.

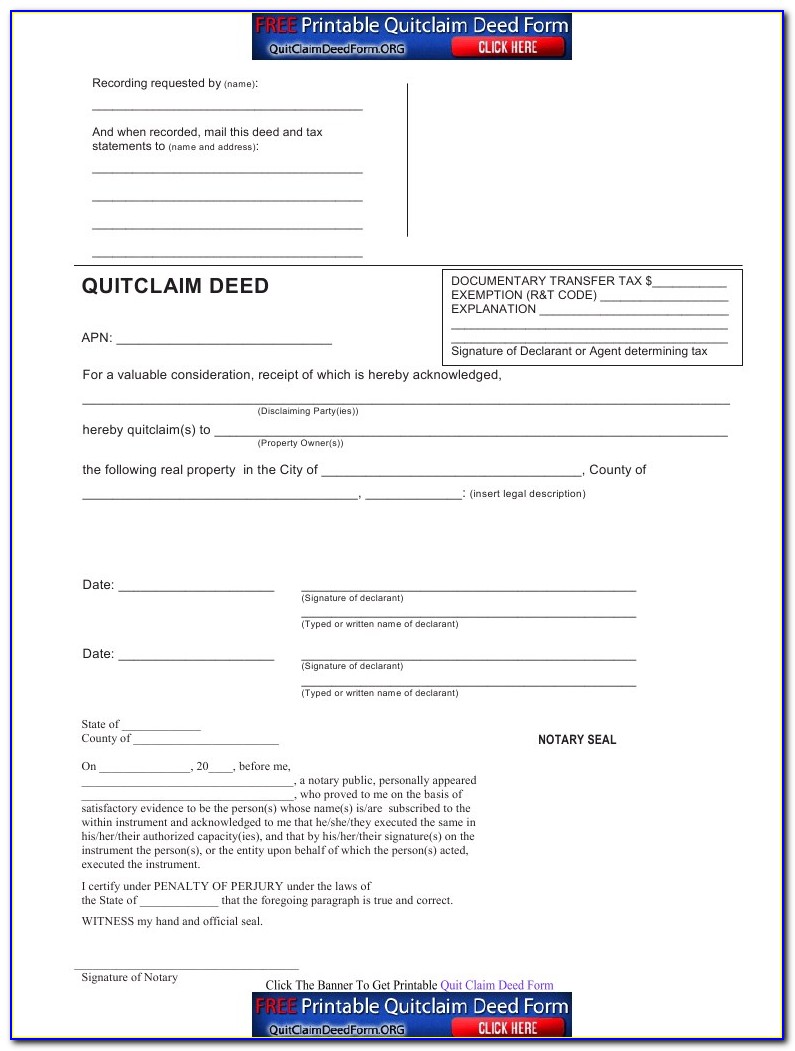

What is a quitclaim deed in Florida?

A Florida quitclaim deed is a legal document that is used to transfer ownership of a piece of real estate from one person to another. This type of deed is also used to correct the misspelling of an owner's name and to remove a joint owner who no longer has any interest in the property. There is a cost to transfer a deed to another person, ...

What is included in a quit claim deed?

Each deed includes the grantor (the person giving the property), and the grantee (the person receiving the property).

Who is the first party on a deed?

In some cases, the deed refers to the grantor as the first party and the grantee as the second party. While the deed will change who is listed as the property owner, it does not offer any buyer protection or any guarantees that the title is clear.

Can you transfer a deed to another person?

There is a cost to transfer a deed to another person, as well as to remove an individual from an existing deed, and it is good practice to know these fees before beginning the process.

Can a real estate agent help you get a quit claim deed?

Even some real estate agents can also help you obtain a quit claim deed form. Each form requires the property appraiser’s parcel identification number, information on the individual preparing the form and information on the grantor and grantee.

How long does it take to transfer a lady bird deed?

For starters, if you wanted to apply for Medicaid, an applicant cannot transfer property within five years of the application, but in the case of a Lady Bird deed, you can retain control of your property and it may not count as an asset for Medicaid eligibility in some states.

What is a lady bird deed?

A Lady Bird deed is a way to transfer your ownership to someone else outside of probate while still retaining your life inside your home. But unlike a regular estate, this type of deed allows you to have the power to retain control of your property throughout your life, including the rights to profit from and sell at any time you wish. ...

What are the advantages of Lady Bird Deed?

The advantages of a Lady Bird deed. You will be able to avoid any probate for your home after death. You maintain the right to use and profit from your property during your lifetime. You can also sell at any time without the approval of the beneficiaries. You will not have to “gift” your home, which may be subjected to the federal gift tax.

Can you pass a Lady Bird deed to multiple heirs?

If your goal was to pass the property onto multiple heirs after death, then this deed may cause disputes, according to Mika Meyers. If this is the case, then a living trust may need to be considered. Those who own multiple properties may find it harder to amend a Lady Bird deed as compared to one trust. The property deed is a countable asset ...

Is a property deed countable for Medicaid?

The property deed is a countable asset for Medicaid purposes unless it is exempt. There will be no control after death unless it was conveyed to a trust. In some cases, ReneeWoodLaw.com mentions those who are unfamiliar with them may misclassify them. Advertising Disclosure: This content may include referral links.

Who signs a deed in Florida?

For an example, in Florida a grantor must sign the deed before a notary and two witnesses — who also sign in the notary’s presence. As you can see, a state and the counties will have specific requirements for the deed, which can include formatting, return addresses, the name of the deed preparer, and so forth. Step 5.

How to get a copy of a deed to a house?

Retrieve your original deed. If you’ve misplaced your original deed, get a certified copy from the recorder of deeds in the county where the property is located. You’ll need to know the full name on the deed, the year the home was last bought, and its address. Expect to pay a fee for a copy of the deed.

What is warranty deed?

The general warranty deed promises that no unmentioned lienholders exist who might have claims to the property; it means the owner is free to sell the home . Warranty deeds are used in “arm’s length” transactions — between people who don’t know each other apart from the real estate deal.

What is a quitclaim deed?

Quitclaim deeds are cost-effective tools for transferring interests in real property when there is no need for researched guarantees. Always consider potential tax implications before you decide to transfer real estate, including tax on the deed transfer itself.

What to do before transferring a warranty deed?

So, before transferring a general warranty deed, the owner has to resolve all mortgages, tax liens, judgment liens and other relevant debts and encumbrances. If you are transferring property under a general warranty or similar deed, it’s wise to seek professional assistance.

Can you transfer a house into a trust?

Another possible workaround is transferring the house into a trust. Be clear on what your mortgage company will allow that without accelerating the mortgage due date. And look out for quitclaims from strangers. If you receive a home by accepting a quitclaim deed, know that your title could have defects.

Do I need to sign a deed before a notary?

Sign the deed before a notary. As the grantor, you’ll need to sign the deed with a notary public, who will change a small fee. In some states the grantee may not need to sign, but the deed must be delivered to the grantee, and the grantee must accept the deed, or it’s not valid.

How much does a lawyer charge to prepare a quit claim deed?

Rates vary by state and law office but typically fall in the range of $200 to $400 per hour. Title companies routinely prepare quitclaim deeds in many states.

How much does it cost to sign a quitclaim deed?

Depending where you are, notaries charge between $2 and $20 per signature, but mortgage closings and real estate transactions will cost you more. After getting the quitclaim notarized, you must record the deed with the county records office and pay a small recording fee, which varies by county. There is also a transfer tax known as a deed stamp. Many states charge transfer tax as a percentage of the purchase price specified in the deed. You pay this deed stamp to the county recorder.

What is a quit claim deed?

A quitclaim deed lets you gift or sell your property to another person quickly and easily because it transfers legal ownership without making guarantees about the title. Costs vary depending on whether you prepare the quitclaim deed yourself or hire a professional, such as an attorney or title company to do it for you.

Can you use quitclaims on a family deed?

The owner does not promise that there are no claims against his title to the property. For this reason, quitclaims are typically used to transfer property within a family.

Popular Posts:

- 1. what year does ace attorney take place

- 2. a durable power of attorney terminates when: new york

- 3. new york bar attorney when is sworn cermony

- 4. how ask for a raise doc review attorney

- 5. how long does an attorney have to provide proof of damages in pennsylvania

- 6. what needs to happen to go through probate when you have power of attorney?

- 7. why won't the attorney call back

- 8. how long to hear back from a complaint tot he attorney general nys

- 9. what is good cause for an attorney to withdraw

- 10. how to find out if someone is an attorney