Attorney fees for most bankruptcy filings are $1,200. The Bankruptcy Court charges a filing fee of $338. So in most cases a chapter 7 filing will cost a total of $1,538.

Full Answer

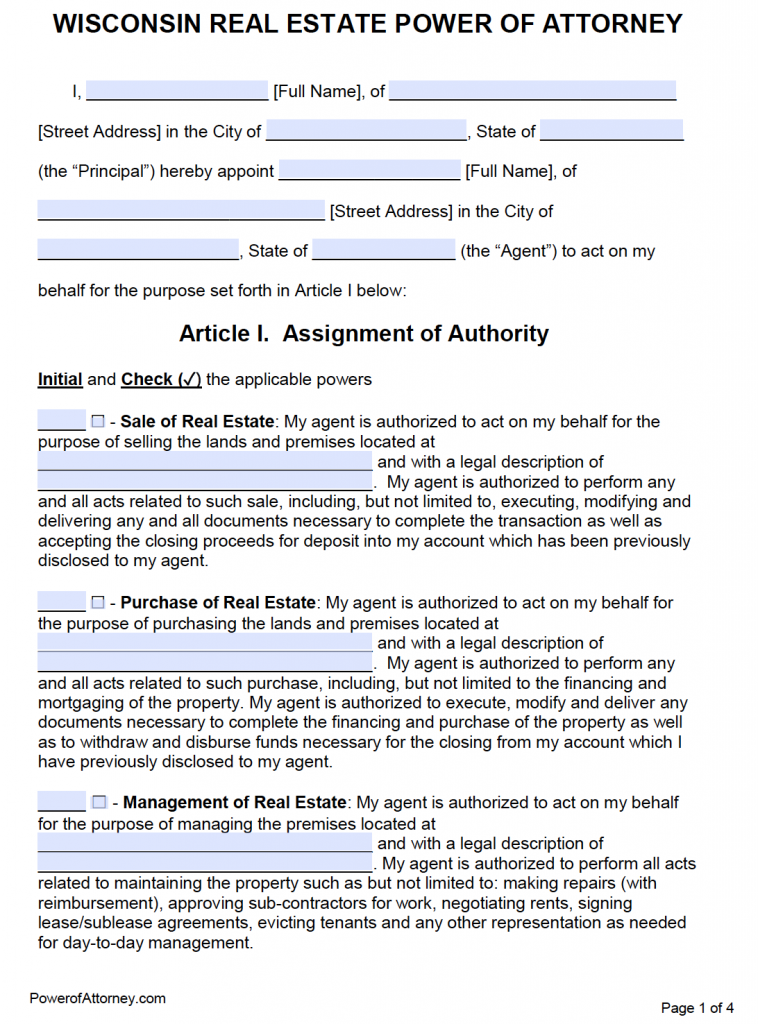

Can a bankruptcy court order a lawyer to refund attorney fees?

· May 2, 2022 - Bankruptcy attorneys in Wisconsin cost between $1,250 and $1,665. But Upsolve gives free assistance for chapter 7 bankruptcies. Upsolve Civil …

Can a paralegal help me in Chapter 7 bankruptcy?

Is there a cap on attorney fees for civil cases?

How do I file Chapter 7 with no money?

Eligible filers are able to file Chapter 7 for free. If your household income is less than 150% of the federal poverty level, you can ask the bankruptcy judge to waive your court fees with a simple application submitted along with your bankruptcy petition.

How much money is too much for Chapter 7?

As a high-income earner, you likely will have enough income to qualify. Finally, your unsecured debts may not exceed $394,725, and your secured debts, including your mortgage, may not exceed $1,184,200 under 11 U.S.C.

How much do you pay back in Chapter 7?

One of the most significant benefits of Chapter 7 is that you won't pay back creditors through a repayment plan. Instead, the court appoints a bankruptcy trustee to sell your nonexempt property—property you can't protect with a bankruptcy exemption—for the benefit of your creditors.

How often can you file Chapter 7 in Wisconsin?

If you receive a discharge under Chapter 7, you will need to wait at least eight years after the first Chapter 7 was filed before you can file another Chapter 7.

Does Chapter 7 go by gross or net income?

To qualify for a Chapter 7, filers need to be under the median gross income or have very little disposable income remaining. If you pass the second part of the means test you can file a Chapter 7.

What is the means test for Chapter 7?

The full Means Test compares the debtor's income to their expenses to determine whether they should benefit from Chapter 7 relief based on their “disposable income.” Applying the Means Test involves deducting all household expenses from the debtor's gross income, including housing costs, utilities, medical expenses, ...

What are the negatives of filing Chapter 7?

Cons of Chapter 7Income Limit. If your individual or business income is higher than a specified amount, you shall not qualify for Chapter 7. ... Bad Credit Score. No matter what kind of bankruptcy you file, your credit score will suffer. ... Asset Liquidation. ... Unwanted Publicity. ... Non-dischargeable Debts.

How long does Chapter 7 Stay on credit?

10 yearsA Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the date the bankruptcy was filed, while a Chapter 13 bankruptcy will fall off your report seven years after the filing date. After the allotted seven or 10 years, the bankruptcy will automatically fall off your credit report.

Is it better to file a Chapter 7 or 13?

Most consumers opt for Chapter 7 bankruptcy, which is faster and cheaper than Chapter 13. The vast majority of filers qualify for Chapter 7 after taking the means test, which analyzes income, expenses and family size to determine eligibility.

Can Chapter 7 be removed from credit before 10 years?

Can Chapter 7 Bankruptcy Be Removed From My Credit Report Before 10 Years? Chapter 7 bankruptcy stays on your credit report for 10 years. There's no way to remove a bankruptcy filing from your credit report early if the information is accurate.

What can you not file bankruptcies on?

8 Kinds of Debt You Can't Lose in BankruptcyMost back taxes and customs. ... Child support and alimony. ... Student loans. ... Home mortgage and other property liens. ... Debts from fraud, embezzlement, larceny, or from “willful and reckless acts” ... Your car loan, if you want to keep your car. ... Debt that doesn't belong to you.More items...

Can I file Chapter 7 twice?

Filing for Bankruptcy Twice: You are free to file a Second Bankruptcy under Chapter 7 even if you received a discharge in your previous case. If you wait long enough, you are also entitled to receive a discharge again.

Bankruptcy Attorney Fees Vary by Location

What is average in your area might not be so average in another area. Attorneys’ fees vary by district and can even vary widely from state to state...

Presumptively Reasonable Or “No-Look” Fee Amounts

The bankruptcy law gives judges the right to examine the fees charged by attorneys and order them refunded to the trustee if they are unreasonable....

Check Out Unusually Low Advertised Fees

If you see advertisements that promise unusually low attorneys’ fees for your area, be on alert. The advertisements might be deceptive. The attorne...

Fee Amounts Don’T Necessarily correspond to Attorney Qualifications

Unfortunately, the fee quoted often does not tell you anything about the qualifications of the attorney. Many attorneys provide a free initial cons...

What Your Bankruptcy Lawyer Should Do For You

Before you hire your bankruptcy attorney, you’ll want to evaluate whether the professional will deliver the level of service you need. You can expe...

What is the right to review fees in bankruptcy?

The bankruptcy law gives judges the right to examine the fees charged by attorneys and order them refunded to the trustee if they are unreasonable. To avoid being flooded with cases requiring a review of fees, some courts have enacted local rules or guidelines setting "presumptively reasonable" or "no-look" fee amounts. These are more common in Chapter 13 cases, but some courts have set amounts that apply to Chapter 7 cases. Different courts use different terms, but the effect is the same. If attorneys charge an amount equal to or less than the presumptively reasonable or no-look fee, the court usually won't initiate a review.

What to expect from a bankruptcy lawyer?

You can expect that a bankruptcy lawyer will evaluate your financial situation and assess whether filing for bankruptcy makes sense for you. Specifically, bankruptcy attorneys determine whether you'll be in a better financial position after your filing and if so, help you get through the process smoothly.

Do attorneys charge a fee for initial consultation?

Many attorneys provide a free initial consultation or charge a small fee for the consultation which can be applied to the overall attorney fee if you do file. In addition to getting some free or low-cost legal advice, this is an opportunity to size up your prospective attorney. Initial consultation.

Do attorneys live up to their promises?

Many attorneys live up to their advertised promises, however. As with anything, do your homework. Ultimately, you'll want to select the attorney you're most comfortable with whose fee is within your price range.

Can a court review a reasonable fee?

Review isn't precluded. The court is free to review even a presumptively reasonable fee.

Can a court review a presumptively reasonable fee?

Different courts use different terms, but the effect is the same. If attorneys charge an amount equal to or less than the presumptively reasonable or no-look fee, the court usually won't initiate a review. Review isn't precluded. The court is free to review even a presumptively reasonable fee.

Does the fee quoted tell you anything about the qualifications of an attorney?

Unfortunately, the fee quoted often does not tell you anything about the qualifications of the attorney. Many attorneys provide a free initial consultation or charge a small fee for the consultation which can be applied to the overall attorney fee if you do file. In addition to getting some free or low-cost legal advice, this is an opportunity to size up your prospective attorney.

Is bankruptcy a complex process?

Bankruptcy is a complex procedure. Having an attorney working your case is a smart move if you want a successful outcome.

Can a bankruptcy lawyer quote you over the phone?

Every case is unique, which is why a reputable bankruptcy attorney cannot just quote you a price over the phone. You’re better off meeting for a consultation so the bankruptcy lawyer can get a better understanding of your situation and quote you an accurate cost for their services.

How much does a bankruptcy lawyer charge in Milwaukee?

Bankruptcy attorney fees vary greatly. Most Milwaukee bankruptcy lawyers charge a flat fee between $1000 and $3000 to file for bankruptcy under Chapter 7 or Chapter 13. Others charge more, especially if matters are complicated by civil judgements, medical debt, liens, or tax debt.

Is bankruptcy filing fee refundable?

These are fees you owe to the court for simply filing bankruptcy, and are non-refundable under any circumstance (including form mistakes or case dismissal).

How much does it cost to file for bankruptcy in 2021?

In 2021 the cost of filing for bankruptcy under Chapter 7 is $335 and the cost of filing under Chapter 13 is $310. The filing cost is the same for a single person or a married couple. If you can't afford to pay the filing fee up front the court may allow you to make installments.

Is cost a factor in bankruptcy?

When filing for bankruptcy, cost is a high concern—and for many, a deciding factor on whether or not to file.

How does Chapter 7 bankruptcy work in Wisconsin?

Two things happen when you file a Wisconsin Chapter 7 case. First, creditors have a chance to ask the judge to not discharge some or all of your debts. This rarely happens. (Note: Corporations and other entities can file Chapter 7 cases but cannot receive a discharge. )

What happens in Chapter 7 in Wisconsin?

The other thing that happens in a Chapter 7 is that a trustee tries to find assets he can take away from you to make a payment to creditors. You can claim property as exempt to protect it from the trustee. In the vast majority of Wisconsin Chapter 7 cases the debtor’s property is 100% exempt and the debtor keeps all of their property.

How long does a Chapter 7 bankruptcy stay open?

But in some cases the trustee thinks they can make a recovery for creditors. Then the bankruptcy may stay open for months, or even years, while the trustee “administers” the case.

What is the name of the lawsuit filed by a creditor against a creditor?

If all does not go well then a creditor may file a separate lawsuit (called an “ adversary proceeding “) asking the court to either (a) deny you a discharge or (b) except the creditor’s debt from your discharge.

How long does it take to file Chapter 7 vs Chapter 13?

Chapter 7 vs. Chapter 13. Chapter 7 bankruptcy: is simpler than Chapter 13; typically takes about four to six months, a Chapter 13 takes three to five years ; costs less than Chapter 13; and. requires no payments to a trustee.

What is Chapter 7 discharge?

Chapter 7 debtors seek – and courts generally grant – a discharge wiping out debts. The title of Chapter 7 is “liquidation.” But, as we shall see, most folks who file a Chapter 7 keep all of their possessions.

What is bankruptcy guide in Wisconsin?

Wisconsin Bankruptcy Guide is provided by law firms designated as Debt Relief Agencies by the federal government because we help people file for relief under the Bankruptcy Code. We also provide other types of debt relief options.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is a process during which a bankruptcy trustee gathers and sells the debtors nonexempt property to repay creditors, and forgives the remaining debt. Bankruptcy discharges many debts, such as credit card bills, overdue utilities medical bills, personal loans, etc.

Do I Qualify to Apply for Chapter 7 Bankruptcy in Wisconsin?

To generally qualify for Chapter 7 bankruptcy, you must be an individual, corporation, partnership or other business entity. Wisconsin employs a ‘means test’ to determine whether you qualify for Chapter 7 relief. This test compares your household income to the median household income in Wisconsin.

Wisconsin Bankruptcy Exemptions

There are several exemptions, or property that you may be able to keep, as a part of your bankruptcy case. In Wisconsin, the federal exemptions apply, but there are also several state exemptions that are available. You can use the state exemptions or the federal exemptions, but you cannot mix and match exemptions.

Do I Need an Attorney to File for Bankruptcy in Wisconsin?

You are not required to file with an attorney in any type of bankruptcy claim in Wisconsin. While there are other types of bankruptcy that may be complicated enough that they encourage consulting an attorney, filing chapter 7 bankruptcy in Wisconsin should be simple enough to do pro se.

What Documents Do I Need to File?

There are several official court forms and financial documents that you will need to provide to the Wisconsin court. The court forms can be found online for free. These forms are rather technical, and it may be wise to consult an attorney at this stage in the process if you have not already done so.

Are There Other Requirements to File Chapter 7 Bankruptcy in Wisconsin?

Yes. Since 2015, Wisconsin bankruptcy debtors have been required to take a credit counseling course. These courses are offered online or in-person. You will get a view at your entire financial picture during this time to determine the best way forward for your situation.

How Much Does It Cost to File Chapter 7 Bankruptcy in Wisconsin?

The Chapter 7 Bankruptcy filing fee in Wisconsin is $338. If you are unable to pay the filing fee upfront, you may request that the Court allow you to pay the fee in installments. If your income is within 150% of the federal poverty guidelines, you may be able to get the filing fee waived altogether.

Can you give up assets in Chapter 7 bankruptcy?

There is a persistent myth that you have to give up all your assets in order to get bankruptcy relief. That is simply not true. In Chapter 7 bankruptcy, some asset liquidation may be required, but many assets are exempt. Most people are surprised to find out how little they actually have to give up, if anything. In Chapter 13 bankruptcy, no asset liquidation is necessary.

Does bankruptcy come with fees?

While bankruptcy is not the financially destructive process that many people think it is, it does come with its costs. You will have to pay attorney fees, filing fees and other fees.

Does a lawyer save you money?

Believe it or not, a lawyer may even save you money in the long run. Every setback in the process that sends you back to the starting line represents more money lost in interest and late payments that will have to be dealt with in bankruptcy.

Is filing fees the same if filing alone?

These filing fees are the same whether you are filing alone or jointly with your spouse.

What is Chapter 7 bankruptcy in Wisconsin?

Chapter 7 Bankruptcy in Wisconsin: The Basics. In layperson’s terms, Chapter 7 bankruptcy is a clean slate for a financially struggling individual — a chance to rebuild both your bank account and credit score, although your credit score will initially take a hit. Unlike a Chapter 13 bankruptcy, outstanding debts do not need to be repaid ...

How much equity can you have in your home in Wisconsin?

The homestead exemption through Wisconsin code is more beneficial than what federal exemptions allow. Bankruptcy filers may exempt up to $75,000 equity in their home for individuals, or $150,000 for married couples filing jointly.

How much of a debtor's income is exempt from taxes?

Up to 75% of a debtor’s net weekly income is exempt, limited to what is reasonably necessary. Wis. Stat. Ann. § 815.18 (3) (h)

Is homestead exemption in Wisconsin?

The homestead is the most important exemption for many Wisconsin filers, but there are many other exemptions which may apply. In Wisconsin, filers may opt to use state-specific exemptions or federal exemption statutes. Here are some of the top bankruptcy exemptions in Wisconsin.

Can you file for homestead in Chapter 7?

Homeowners may file Chapter 7 bankruptcy and keep their home investment in certain cases. As such, homesteads are one of the primary exemptions (assets that are untouchable by creditors) in many Chapter 7 bankruptcy cases. The homestead is the most important exemption for many Wisconsin filers, but there are many other exemptions which may apply.

Is Wisconsin a low income state?

Despite the presence of these lucrative companies, Wisconsin has a lower per capita income than almost half the states in the U.S. , and many residents are struggling to make ends meet. Some are facing an uphill battle with credit card debt, medical bills, and variable mortgage rates. Drowning in debt can feel like diving into a black hole with no escape, but there is hope if you live in Wisconsin and need a fresh start.

What are the major industries in Wisconsin?

While the thriving milk, cheese, and yogurt industry is a boon to Wisconsinites, other industries bolster the state’s economy as well. Harley-Davidson, Jockey, and Kohl’s are just a few of the Fortune 1000 corporations that maintain headquarters in the Badger State. Despite the presence of these lucrative companies, ...

How much does it cost to file for bankruptcy?

Attorney fees for most bankruptcy filings are $1,200. The Bankruptcy Court charges a filing fee of $338. So in most cases a chapter 7 filing will cost a total of $1,538.

Do you have to pay attorney fees in Wisconsin?

For chapter 7 cases, you must pay your attorney fees in full prior to the filing of your case. Under 7th Circuit case law, if you owe your attorney money when your case is filed, that debt to your attorney is wiped out by your bankruptcy filing. In addition, under the rules of the Supreme Court of Wisconsin, your attorney has an ethical responsibility to inform you that your unpaid balance has been wiped out by your bankruptcy filing.

What is the Wisconsin law on attorney fees?

Wisconsin generally adheres to the "American Rule" of attorney fees, under which each party is responsible for paying its own attorney fees. Many Wisconsin statutes, however, deviate from the American Rule and make it possible for prevailing parties to recover attorney fees from the opposing side. The Wisconsin Supreme Court has articulated the policy reasons behind the fee-shifting provisions, namely, encouraging aggrieved parties to bring their cases, aiding the public interest by having private plaintiffs enforce their rights against predatory activities, and deterring bad actors from committing future harm. 1 Typically, when a statute gives a prevailing party the right to recover reasonable attorney fees, that party files a fee petition asking the court to award reasonable fees. After the opposing side has an opportunity to object to the fees requested, the court reviews the petition and awards any fees it deems reasonable.

What is fee shifting in Wisconsin?

Wisconsin's cornerstone consumer law statute, section 100.20, prohibiting unfair trade practices, has contained a fee-shifting provision since its enactment in 1921. ( See 1921 Wis. Sess. Laws, ch. 571, sec. 2.) In the early 1970s, apparent gaps in the consumer protection framework led Attorney General Robert Warren to commission an in-depth survey of then-existing resources, programs, and statutes in the consumer fraud field, which culminated in a 240-page report. The Wisconsin Legislature adopted nearly all the recommendations of the report, including adding fee-shifting provisions to another key consumer protection statute, Wis. Stat. section 100.18, prohibiting false representations, and adopting the Wisconsin Consumer Act, which also contains fee-shifting provisions. Today, nearly all consumer statutes, both federal and state, contain fee-shifting provisions.

What is the new fee shifting statute?

The new statute creates a revised framework for courts in fee-shifting litigation. While it remains to be seen exactly how courts will interpret the statute and presumptive cap, many of the factors previously identified by courts as being relevant, namely an analysis of the reasonable number of hours and reasonable hourly rate, will still play an important role. It is unlikely that courts will ignore the original legislative policies behind the fee-shifting statutes themselves, which were not explicitly repealed by the new procedure for determining reasonable attorney fees.

How to determine reasonable hours?

To determine the reasonable number of hours, the court will likely examine the attorney's billing records and compare them with what the judge, using her experience and expertise , would consider reasonably necessary in bringing and prosecuting the case . When deciding the reasonable hourly rate, the court will likely consider affidavits of other attorneys concerning the reasonableness of the hourly rates and consider generally what other attorneys charge as an hourly rate in the relevant community. 24

What is the difference between Supreme Court Rule and Statute?

One important difference between the Supreme Court Rule factors and the factors included in the statute is that the supreme court was concerned with the amount an attorney could ethically charge a client. Moreover, certain factors will be more relevant than others in a particular case, and a court will need to make a determination as to which factors are most pertinent to the case at hand.

How to calculate presumptive cap?

After determining the proper amount of compensatory damages to include in the calculation, the court would then multiply that figure by three to calculate the presumptive cap.

What is the fee shifting law?

The law was introduced in response to a case involving violations of consumer protection laws in which attorney fees far exceeded the compensatory damages. 6 The statute, however, does not specifically target consumer law cases. Rather, it states that it applies "in any action involving the award of attorney fees ... or involving a dispute over the reasonableness of attorney fees." 7 These types of actions will involve consumer laws governing unfair trade practices, as it did in the case that gave rise to the bill, but the legislature has adopted the fee-shifting mechanism in a great variety of other areas, as well. Fee-shifting statutes are even used as a method of discouraging criminal and other behaviors by granting the right to recover attorney fees for victims of, for example, illegal pollution (section 283.91), securities fraud (section 551.509), gang activity (section 895.444), human trafficking (section 940.302), and passing bad checks (section 943.245).

Popular Posts:

- 1. f. lee bailey, hearst's defense attorney, decided on which legal defense

- 2. how do i replace a power of attorney that was lost

- 3. how to motion the court to disqualify my husband's attorney for divorce in polk county fl

- 4. how does uscis notify attorney/ lawers h1b

- 5. who gives a power of attorney

- 6. who is jeff childers attorney

- 7. where is attorney general barr now

- 8. how do i get financial power of attorney for my incapacitated spouse?

- 9. how do you file a complaint against the attorney general in texas

- 10. how to attest power of attorney in indian embassy