It depends on the complexity of the will and power of attorney. A basic will-will cost between $250 to $350. A power of attorney around $300.

How much does it cost to do a will in Florida?

What does it cost to register a will in Florida? A will made by a lawyer can cost anywhere from $750-$1,200 but, you can rest assured, it will be complete, accurate, and free of errors.

How much does it cost to make a will in New York?

How much does a Will cost in New York? Typically, about $1,200. It could cost more if one of the following is a factor: a large estate.

How much does a will cost in Colorado?

A “simple” will for one person has a cost of $300.00. Two “simple” wills for a husband and wife has a cost of $450.00.

How much does it cost to make a will in Illinois?

It's very common for a lawyer to charge a flat fee to write a will and other basic estate planning documents. The low end for a simple lawyer-drafted will is around $300. A price of closer to $1,000 is more common, and it's not unusual to find a $1,200 price tag.

Can I write my own will and have it notarized?

Ensure that the witness is a trustworthy person and should not be a beneficiary to avoid the conflict of interest. There is no need to notarize a will in India and thus need not to notarize the signatures of the witnesses in the presence of a notary.

Can you write your own will in New York State?

You can make your own will in New York, using Nolo's Quicken WillMaker. However, you may want to consult a lawyer in some situations. For example, if you think that your will might be contested or if you want to disinherit your spouse, you should talk with an attorney.

Do you pay taxes on inheritance in Colorado?

There is no inheritance tax in Colorado. Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere. In Kentucky, for instance, inheritance tax must be paid on any property in the state, even if the heir lives elsewhere. Colorado also has no gift tax.

Can I write my own will in Colorado?

Colorado recognizes wills that are typed or handwritten by the will maker and signed in the presence of two independent witnesses. It's therefore possible for an individual to make his or her own will in the state.

Does a will have to be filed in Colorado?

*Note: Colorado law requires that a decedent's will be filed (lodged) with the District Court in which the decedent was domiciled within ten days of the decedent's passing, even if no probate administration is expected.

Do I need a lawyer for a will in Illinois?

An attorney is not required to make a will in Illinois. For the vast majority of people, an attorney will simply do the same things that a good will-making software does — ask you questions and then create documents for you based on your information and wishes.

Does a will need to be recorded in Illinois?

Do I need to file the Will if opening a probate estate is not necessary? Yes! Illinois statute requires any person holding a decedent's Will (and codicils) to file the Will with the clerk of the court in the decedent's last county of residence.

Is a handwritten will legal in Illinois?

A handwritten will meets the definition of a written will as far the law is concerned. This means that any will that is appropriately signed and witnessed is a valid will. A handwritten will that is not witnessed is known as a holographic will and is not valid under Illinois law.

How much does it cost to write a will near New York NY?

How much does it cost to make a will in NYC? Typically, about $1,200.

How much does it cost to probate a will in NY State?

Executor's fees in New York are as follows: All sums of money not exceeding $100,000 at the rate of 5 percent....How Much Does an Estate to Go Through Probate?Value of Estate or Subject Matter FeeFee RateLess than $ 10,000$45.00$10,000 but under $20,000$75.00$20,000 but under $50,000$215.00$50,000 but under $100,000$280.003 more rows•Sep 12, 2017

How much does it cost to contest a will in NY State?

Short answer: $3,000 to $10,000, typically around $4,000. Courts provide letters of administration when someone dies without leaving a will or naming an executor. Typically, the process to get letters of administration is similar to the process described above for letters testamentary.

How long do you have to contest a will in New York State?

Is There a Time Frame to Contest a Will in New York State? If a beneficiary is making a claim against an estate, they have 12 months from the date of death to contest the will. However, if the nature of the claim is based in the will being fraudulent, there is no time limit.

How much does a power of attorney cost?

How Much Does Power of Attorney Cost? On average, power of attorney in costs about $375 with average prices ranging from $250 to $500 in the US for 2020 to have a lawyer create a power of attorney for you according to PayingForSeniorCare. Some sites allow you to create a POA online for about $35 but you will also have to get it notarized ...

How much does it cost to create a POA?

Some sites allow you to create a POA online for about $35 but you will also have to get it notarized for about $50. However, AgingCare suggests that you should have a lawyer create a POA for you as online documents come with no professional counsel, no legal witnesses, no customization, and no quality insurance.

What Is a Power of Attorney for Grandparents?

If the parents are alive and can be located, they can write a power of attorney letter and give the grandparents legal authority to take full care of the child.

What is POA in legal?

With a POA, the principal grants the agent legal authority to act, make important decisions, and sign legal documents in their stead.

What does a POA give a grandparent?

A Grandparent POA Gives the Right To: A Grandparent POA Doesn’t Give the Right To: Consent to dental, medical, and psychological treatment of the child. Agree to any school-related matter, such as trips, after-school activities, and similar. Obtain educational and behavioral information about the child. Enroll the child in school.

Does DoNotPay help with taxes?

From getting you ready for various government tests to helping you reduce your property taxes, DoNotPay offers valuable assistance with the tasks that make most people at least roll their eyes. Dealing with bureaucracy isn’t fun, but it also doesn’t have to be as difficult as it is.

Is a power of attorney a legal document?

A power of attorney is a substantial legal document, so it’s no wonder you have some questions regarding it. DoNotPay has answers to many of the POA-related questions, such as:

Can a grandparent file a POA?

The grandparent POA can be filed only if it meets all of the following requirements:

Do robot lawyers have to pay?

With the world’s first robot lawyer, you don’t have to pay an arm and a leg or worry if an online template will cover the specifics. We offer a simple and budget-friendly quick fix—the Power of Attorney product!

How much does a lawyer charge for a POA?

A consumer could probably expect to pay a lawyer less than $200 for a POA in most cities. Many also offer reasonably priced estate planning packages that include a financial power of attorney, a medical power of attorney, a living will and a last will and testament. All these documents are important for ensuring an elder’s wishes are respected and their affairs are taken care of both in life and after their passing.

How Much Does a POA Cost?

There are also legal websites that sell POA templates for under $50.

Why is POA important?

This is particularly important when drawing up a financial POA because it grants the agent legal authority over all financial decisions, including selling property, paying taxes, managing investments, Medicaid planning, paying for where the principal will live and deciding how their money will be spent.

What is a POA?

A power of attorney (POA) document is one of the most important legal tools that family caregivers must have to effectively manage their aging loved ones’ health care and/or finances. Without these documents, a caregiver (known as the agent) lacks the legal authority to handle important decisions on behalf of their elder (known as the principal).

How much does a notary charge?

Most states set maximum fee limits for basic notarial acts to keep prices reasonable. Fees range from $2 to $10 per signature and some notaries will come to clients who are hospitalized or otherwise unable to travel. There may be additional travel fees associated with notary visits.

Can you name multiple children on a POA?

Therefore, attorneys (myself included) don’t normally recommend naming multiple adult children on a POA document to share the role of agent for an aging parent. This is known as a joint power of attorney and can be highly problematic. With this type of POA, all agents must act jointly and come to agreement on each matter before any action can be ...

Do POAs go into effect immediately?

If a principal wants to place any limitations on their agent’s power, then an attorney will need to tailor the language in this document accordingly. There is a great deal riding on the way in which a POA document is written, and there are several different kinds of powers of attorney. Some POAs go into effect immediately but end upon ...

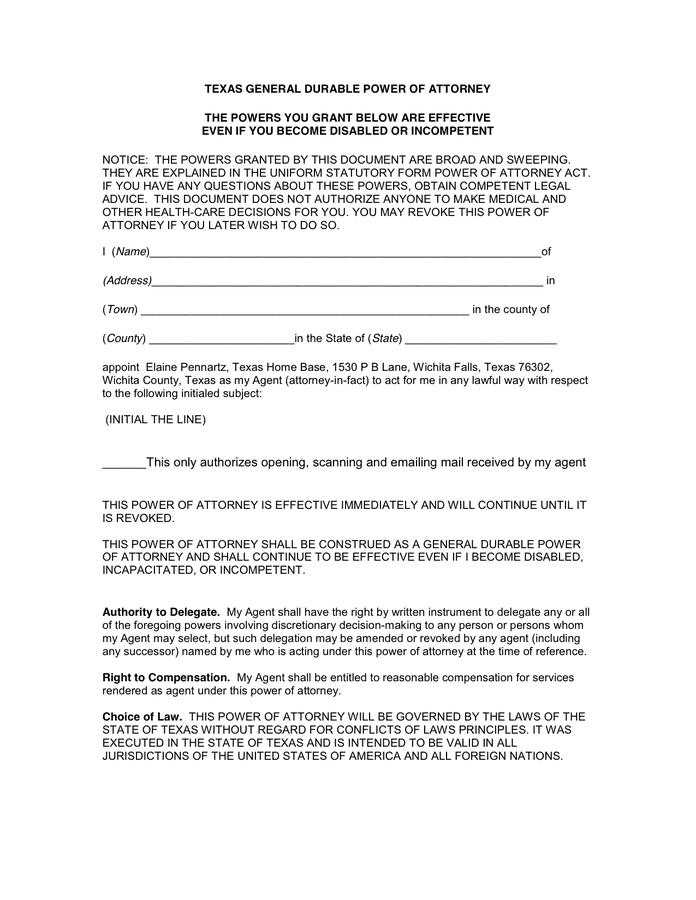

What is a durable power of attorney?

A power of attorney (POA) is a legal document authorizing an individual to handle specific matters, such as health and financial decisions, on the behalf of another. If the POA is deemed durable, the POA remains in effect if the person granting the authorization becomes incapacitated.

What is the difference between a durable power of attorney and a power of attorney?

The key difference is when they can be used. A typical power of attorney ends if the individual granting power of attorney becomes incapacita ted, while a durable power of attorney will stay in place. As such, a durable power of attorney is more appropriate for handling important end-of-life decisions.

What happens to a durable power of attorney after death?

Since a will becomes effective after death, the individual assigned as the executor of the will takes over. The same individual can be appointed as a durable power of attorney and executor, if desired.

Why do people need durable powers of attorney?

Durable powers of attorney are set in motion to protect people in case of a medical emergency or other situations where an individual is incapable of making a sound decision or choice. Many families assign a durable power of attorney to protect elderly or cognitively impaired loved ones.

What is a living will?

A living will is also called a health care/medical or instruction directive. This document concerns your desires for medical choices and treatment if you’re unable to cognitively make sound decisions because of an illness or impairment. This can include your preferences for resuscitation and breathing tubes.

Can you revoke a power of attorney?

If you need to revoke durable power of attorney on behalf of a loved one, you should discuss your options with an attorney. If an individual is abusing their rights as power of attorney, there may be legal solutions.

Can a power of attorney make medical decisions?

In comparison, a durable power of attorney only allows another individual to make medical decisions on your behalf when you become mentally incapacitated. This applies to both end-of-life decisions and regular medical decisions, including prescription refills and doctor appointments.

Kelly Scott Davis

I agree; it depends on what you need done. For example, a durable power of attorney for health care (e.g., an advance medical directive) can be found online for free at http://www.alaha.org/wp-content/uploads/2014/03/advdirective.pdf.

Timothy P. Daniels

There really is no way to answer this because every attorney will have slightly different rates depending on what you need done.

Matthew D Rasmussen

More than $5, Less than $5000. How much does probate cost? How much does one month of long term care cost? How much does anything cost? The question, dear sir/madam, is not what it costs, but what needs to be done... and a good attorney can help you figure out that part for free.

Popular Posts:

- 1. what do you call when you are acting as your own attorney

- 2. debt collection attorney when faced with million dollar civil judgement

- 3. how do one attorney know if you have another a good

- 4. how to find recorded power of attorney records from wells county indiana

- 5. how many californians were incarcerated for cannabis when kamala harris attorney general

- 6. how hard is it to revoke a power of attorney

- 7. how long does it take to be a respected attorney

- 8. what is a power of attorney delegating parental authority

- 9. who was sean attorney serving dnc

- 10. how find an attorney that will work pro bono in california