How much is the average cost of legal malpractice insurance? The average annual cost of legal malpractice insurance for a new attorney is around $500. For an experienced attorney practicing in a high risk legal area can expect to pay as much as $6,000 a year with several years of retroactive coverage.

What is the average cost of lawyer's malpractice insurance?

Just as in the medical profession, the rates that attorney's are subject to vary from State to State and the area of practice. The average cost of legal malpractice insurance can range from $5,000 to $8,000 with members of the bar who focus primarily on divorce, real-estate, and personal injury subject to rates at the higher end of the spectrum.

How much will your legal malpractice insurance cost?

The minimum malpractice insurance limit is $100,000 per claim/$300,000 annual agg-regate. This means that the insurer will pay a maximum of $100,000 for defense and indemnity costs for any one claim made against your firm, and a maximum of $300,000 for all claims made against your firm during the policy year.

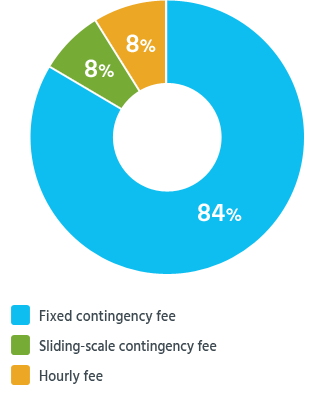

How much will my medical malpractice attorney charge?

The law states that medical malpractice lawyers can charge the following percentages, which apply based upon the gross recovery made in a particular medical malpractice case: (i) 30% of the first $250,000.00 recovered; (ii) 25% of the next $500,000.00 recovered; (iii) 20% of the next $250,000.00 recovered; (iv) 15% of the next $250,000.00 recovered; and (v) 10% of all sums recovered over $1,250,000.00.

Does malpractice insurance cover legal fees?

Yes. Your medical professional liability insurance policy will cover the legal expenses when defending you against claims of malpractice. If it does not, you have a very weak policy and should look into a better option right away.

How Much does Malpractice Insurance Cost Lawyers?

How Much Does Malpractice Insurance Cost in Different Professions?

How Much does Malpractice Insurance Cost Physician Assistants?

What is malpractice insurance?

See 1 more

How much is malpractice insurance in the US?

The average cost of Medical Malpractice Insurance is $7,500 annually. However, there many types of doctors and countless insurance variables. Keep this in mind when searching for coverage. Surgeons pay between $30,000 and $50,000 a year.

Does NY require legal malpractice insurance?

For example, New York does not require that a lawyer carry malpractice insurance. Oregon is the only state in the US to require legal malpractice coverage. Many jurisdictions in other countries require a lawyer to have an insurance policy before they are allowed to practice.

Is legal malpractice insurance required in Florida?

In the state of Florida, attorneys are not required to carry malpractice insurance, but they must report whether they have such coverage each year when they register. There are no exact numbers regarding how many attorneys are practicing without insurance.

What is professional liability insurance coverage?

Professional liability insurance is a type of business insurance that provides coverage for professionals and businesses to protect against claims of negligence from clients or customers. Professional liability insurance typically covers negligence, copyright infringement, personal injury, and more.

Is legal malpractice insurance required in NJ?

Requires all attorneys engaged in private practice of law in New Jersey be covered by legal malpractice liability insurance.

Does Georgia require malpractice insurance for lawyers?

In the state of Georgia, lawyers are not required to carry insurance. As lawyers who represent victims of legal malpractice, The Linley Jones Firm, P.C. continues to fight for a rule that would require lawyers to carry insurance, that is, mandatory professional liability insurance.

What is the minimum malpractice insurance in Florida?

There actually is a law in Florida (see 458.320, F.S.) that says doctors must carry $100,000 in malpractice insurance in order to practice medicine at all, and in order to have hospital staff privileges (they see patients in hospitals and not just in their offices) they must have at least $250,000 in malpractice ...

Does California require malpractice insurance for lawyers?

Although many non-lawyers, and even some lawyers, in California believe liability insurance already is mandatory for lawyers, it is not. Rather, California's Rules of Professional Conduct merely require that any lawyer who does not have insurance disclose that fact to his or her clients. See Rule 1.4.

Are Missouri attorneys required to have malpractice insurance?

Missouri does not require attorneys to carry malpractice insurance.

Is professional liability insurance the same as malpractice insurance?

Malpractice insurance is another name for professional liability insurance for legal or medical professionals. No matter what it's called, professional liability policies offer coverage if you make a mistake in your professional service. If a client sues you, these coverages will help pay for your legal defense.

What are not covered in professional liability?

Claims not covered by general liability insurance that are covered by professional liability insurance include negligence, misrepresentation, violation of good faith and fair dealing, and inaccurate advice.

What happens if you don't have professional liability insurance?

Fines and Jail Time: Lacking certain types of coverage, including workers' compensation and even professional liability coverage, violates state laws and, in many instances, is considered a felony. As a result, you may face hefty fines and could spend time in jail.

Does California require malpractice insurance for lawyers?

Although many non-lawyers, and even some lawyers, in California believe liability insurance already is mandatory for lawyers, it is not. Rather, California's Rules of Professional Conduct merely require that any lawyer who does not have insurance disclose that fact to his or her clients. See Rule 1.4.

Is legal malpractice insurance required in Illinois?

Illinois does not require that attorneys carry malpractice insurance. However, in 2018 Illinois Supreme Court moved to encourage law firms to carry malpractice insurance by amending Rule 756.

How Much Does Legal Malpractice Insurance Cost? (2022 Rates)

The average legal malpractice insurance cost is $2,500-$3,500 a year for an attorney with 5+ years of experience. A new attorney can be as little as $500 a year.

Highest Malpractice Insurance by Specialty

Gallagher Healthcare is a specialty niche of Arthur J. Gallagher & Co., one of the largest insurance brokerages in the world. We understand the importance of crafting tailored solutions to address your unique needs.

How Much Does Medical Malpractice Insurance Cost? (2022 Rates)

The average annual cost of malpractice insurance across all medical professions is $7,500. Medical personnel should expect to pay between $4,000 and $12,000 a year for malpractice coverage.

The Current Cost of Medical Malpractice Insurance - Physicians Thrive

What Is Malpractice Insurance? Malpractice insurance protects physicians when their patients make malpractice claims and file lawsuits against them.. Also referred to as Medical Professional Liability Insurance, it’s a way to protect you when patients suffer bodily injury or harm.Patients can file suits for everything from medication and surgical mistakes to misdiagnoses.

How Much does Malpractice Insurance Cost Lawyers?from bravopolicy.com

Malpractice insurance for lawyers: Although most states don’t require lawyers to have malpractice insurance, at least 26 states require lawyers to notify their clients in writing if they don’t have it. Common reasons for clients to sue their lawyer include misfiling paperwork, missing deadlines, inadequate investigation, or failure to follow instructions. Attorneys in higher risk fields, such as class action work and intellectual property pay more.

How Much does Malpractice Insurance Cost Physician Assistants?from bravopolicy.com

Physician Assistants: In some states, physician assistants work closely with a supervising doctor, and in some states they have a lot of freedom and are just a step short of being a doctor. Either way, PA’s need malpractice insurance because anyone can make a mistake and mistakes in this field can severely impact someone’s health.

What is malpractice insurance?from bravopolicy.com

Last Updated: July 12, 2021. Malpractice insurance is a type of professional liability insurance. Malpractice insurance most often applies to healthcare workers and lawyers. This type of insurance protects you if you are sued to have made any mistakes that harm a client or a patient.

How Much does Malpractice Insurance Cost Lawyers?

Malpractice insurance for lawyers: Although most states don’t require lawyers to have malpractice insurance, at least 26 states require lawyers to notify their clients in writing if they don’t have it. Common reasons for clients to sue their lawyer include misfiling paperwork, missing deadlines, inadequate investigation, or failure to follow instructions. Attorneys in higher risk fields, such as class action work and intellectual property pay more.

How Much Does Malpractice Insurance Cost in Different Professions?

Liberty Mutual- Are You Overpaying For Home Insurance? Save 10% When You Buy Online.

How Much does Malpractice Insurance Cost Physician Assistants?

Physician Assistants: In some states, physician assistants work closely with a supervising doctor, and in some states they have a lot of freedom and are just a step short of being a doctor. Either way, PA’s need malpractice insurance because anyone can make a mistake and mistakes in this field can severely impact someone’s health.

What is malpractice insurance?

Last Updated: July 12, 2021. Malpractice insurance is a type of professional liability insurance. Malpractice insurance most often applies to healthcare workers and lawyers. This type of insurance protects you if you are sued to have made any mistakes that harm a client or a patient.

Why do lawyers need professional liability insurance?

Buying lawyers professional liability insurance is a crucial part of managing the risk of malpractice claims. If sued, the policy would kick in to cover both the defense costs and any settlement monies awarded to the wronged party.

How long does a law firm have to keep increasing their insurance premiums?

Usually, insurers will keep increasing rates over the first five years. Once a law firm has been with the same insurer for five to six years, the carrier will consider it a mature law firm and stop increasing its premium on a yearly basis.

What is the data used to determine the premium rate for lawyers?

When underwriters seek to establish premium rates for lawyers professional liability insurance, it’s a data-led process that relies heavily on historical claims data that each insurer has collected over the course of many years and continues to collect. This claims data is analyzed according to two major principles, the frequency and the severity of losses.

What are some risk management practices for law firms?

Some of the things that go into accessing risk management practices for law firms include the firm’s client selection process, whether they use any type of scheduling or conflicts-checking tools or software, whether it is in the practice of sending engagement and disengagement letters, and if the firm has recently sued clients for unpaid fees, for example.

Why is it important to investigate before starting a law firm?

If you’re starting your law firm or looking to grow your practice and want to see if you could add different specialties to your practice, it would be a good idea to investigate before doing so in order to identify which areas of practice tend to be of a higher risk than others.

Can insurance companies access your law firm?

Insurers will certainly access your law firm to see what you have been doing in terms of risk management and prevention before determining your premium. Here are some best practices that can go a long way in terms of improving these processes within your law firm.

Does my lawyer's premium go up?

While it’s true that your premium will go up as your law firm adds new lawyers, it’s not an exponential increase usually. This means that while your premium might double if you go from one lawyer to two lawyers, it’s not going to triple or quadruple with each lawyer that’s being added to your roster.

How much is malpractice insurance deductible?

Nearly all firms whose malpractice insurance premium is below $10,000 have a de-ductible of $1,000, $2,500, or $5,000 per claim , because insurers won’t offer them anything greater. Within this range, each higher deductible will reduce the premium by 1% – 3%, i.e., raising it from $1,000 to $5,000 will reduce the premium by about 5%.

How much does a sole practitioner pay for a policy?

Most sole practitioners will pay $500 – $1,000 for their first policy. A 2-atty. firm will pay slightly less than double that; a 3-atty. firm, slightly less than triple that, etc. Premiums are 25% – 50% higher in NYC, NJ, Miami-area, LA-area, and San Francisco-area; up to 35% lower in rural areas.

How do insurers calculate step rating?

The number of years each lawyer has been with a firm (not his/her total years in practice) – insurers use “step rating” to calculate premiums, whereby a lawyer’s pre-mium is lower in his first year with a firm (step 1), when he has fewer cases, and rises in each of the next four years steps (2 – 5), as his cases from the previous years develop , and he takes on additional cases, both of which increase his malpractice claims risk (a claim generally isn’t filed for 1 – 4 years after an atty. makes an error). (See Prior Acts coverage below.)

How long does it take for a lawyer to mature?

After five years with a firm (some insurers use six or seven years), a lawyer is consid-ered to be “mature”, as the malpractice claims risk of his new and developing cases is offset by the statute of limitations tolling on his older, closed cases.

What is firm size?

Firm size – the number of lawyers in a firm, and whether each one works full-time or part-time. Note: all of the placements shown above are for full-time attorneys, which most insurers define as working more than 26 hours/week. Part-time attorneys generally pay lower premiums.

Does prior acts coverage apply to malpractice insurance?

Prior acts coverage doesn’t apply when you buy your first malpractice policy, , i.e., the policy won’t cover any work that you did before the policy inception date. However, if you renew the policy a year later, it will cover work that you did back to the inception date of your first policy, i.e., one year ago.

Does a firm pay a higher premium if a lawyer is sued?

Malpractice Claims – a firm will pay a higher premium if any of its lawyers has recently been sued for malpractice; how much higher depends on the number of claims, and the total dollars its insurer paid out to resolve them.

How much does an attorney insurance cost?

The average costs for most attorneys for a fully rated policy should be $1,200 to $2,500 per year assuming minimal limits. Attorneys that practice in the higher risk areas can expect to pay around $3,000 to $10,000 per year. All of this can also vary by state and location in the state based on the carriers past claims experience in that state.

Why do lawyers go without malpractice insurance?

Lawyers that choose to go without malpractice insurance believe that because they work for a small firm and maintain close relationships with their regular clients, that they are immune to claims. Other attorneys believe that the chances of them facing a claim aren’t great enough for them to purchase a lawyers liability malpractice insurance policy.

Do attorneys pay the same for a clean record?

Even with having a “clean” record no two attorneys are going to pay the same for their coverage. Even though the firm is insured as an entity, the cost generally is on a per-attorney basis. The key factors affecting cost are the following: claims history. areas of practice.

How much is deductible for malpractice insurance?

As far as deductibles go, malpractice policies can have deductibles ranging from $0 to $15,000. The higher the coverage limit, the larger the deductible will be on average. Policies with higher deductibles also tend to have lower monthly premiums. Overall though, deductibles only have around a 3%-6% effect on premiums.

What Does Legal Malpractice Insurance Cover?

Legal malpractice insurance is meant to cover any errors or omissions that arise in the context of you practicing the law. Every policy will be different, but the typical legal professional liability policy will offer coverage for

How much does cyber liability insurance cost?

The typical cost of a cyber liability policy is around $140 a month, or approximately $1,600 a year. About a third of small firms pay less than $1,000 a year for malpractice insurance and another third pay between $1,000 to $2,000 a year for cyber liability insurance. Only about 20% of firms pay more than $3,000 a year for a cyber liability policy.

What is the limit for a professional liability policy?

Proliability policies have a standard coverage limit of $1 million but some policies have up to a $5 million coverage limit. The main downside of Proliability is that they do not offer other kinds of policies except for professional liability. Their professional liability policies also do not include cyber liability coverage. On the other hand, Proliability will offer premium discounts for members of professional organizations.

What are the two types of coverage limits for malpractice insurance?

There are two major types of coverage limits for malpractice policies: claim expenses within limits (CEIL) and claim expenses outside the limits (CEOL).

How much does EPLI cost?

EPLI insurance cost depends on your total number of employees and your insurance claim history. Most businesses pay between $800 to $3,000 per year for EPLI insurance. This is the average cost for a law firm with between 5 to 20 employees.

What is loss and expense deductible?

Loss & Expense deductibles are specifically for settlement payments and for claiming expenses such as legal fees. The firm must first pay all expenses and settlements from the deductible before insurance will step in and handle the rest.

How long does an Indiana medical malpractice claim take?

That keeps our costs down, so we can pass the savings on to you. Find out how affordable legal malpractice insurance in Indiana can be. Get your free quote today, and find out why small firms and solo practitioners in Indiana trust Mainstreet Legal Malpractice Insurance to keep them covered. Call Us Today For A Free Quote (800) 817-6333 (800 ...

How much does malpractice insurance cost?

Feb 14, 2022 · The higher your policy limit is, the higher the premium will be. Most smaller firms would purchase a $1 million limit. However, this limit may not be adequate for your firm, as the cost to defend and the cost of any settlements are combined under the limit. The typical maximum limit is $10 million.

Who is covered by the Indiana medical malpractice Act?

The common reasons for legal malpractice claims in Kansas are administrative errors such as missing a filing date, lost paperwork, or even typographical errors. To help you stay protected from such incidents, Daniels-Head Insurance Agency provides attorney professional liability insurance offerings for your firm.

What are the medical malpractice laws in Indiana?

Legal malpractice insurance cost depends on a number of factors. The first of which is the type of law practiced: criminal and insurance lawyers have the lowest premiums, while securities placement, class action, and intellectual property attorneys’ premiums are higher. Premium costs start at $79 per month and can reach $500 per month.

Does Indiana require malpractice insurance?

1. Does the Law Require You to Carry Malpractice Insurance in Indiana? Indiana law requires physicians to obtain a minimal amount of insurance coverage to qualify for the state liability reforms.

Why is malpractice coverage so expensive?

Lawsuits against doctors are just one of several factors that have driven up the cost of malpractice insurance, specialists say. Lately, the more important factors appear to be the declining investment earnings of insurance companies and the changing nature of competition in the industry.Feb 22, 2005

What factors are thought to contribute to rising costs in healthcare and malpractice insurance rates?

A Journal of the American Medical Association (JAMA) study found five factors that affect the cost of healthcare: a growing population, aging seniors, disease prevalence or incidence, medical service utilization, and service price and intensity.

How is malpractice insurance distributed?

In the United States, most legal malpractice insurance is distributed, or offered for sale, through agency relationships. This means that the company a purchaser deals with is often not the actual insurer or “carrier” itself, but rather someone representing the insurer as an agent or contracted seller. For example, Protexure Insurance Agency Inc. is a Managing General Underwriter for Crum & Forster, which is the actual insurer or carrier offering coverage through the Protexure Lawyers program. Each layer of the distribution chain can add to your ultimate out-of-pocket cost.

What factors do insurance companies consider when setting a price?

These factors include claims history, practice management choices, industry rating structures, choices about limits and deductibles, and your particular insurance coverage history .

How does premium affect insurance?

When it comes to insurance, premium is directly correlated to the limits and policy additions you select (i.e. the “amount” of insurance purchased). The lower the policy limit you choose, the lower the premium will be. The chosen deductible will also impact the premium, but in an inverse relationship: the higher the deductible, the lower the premium will be.

What is the first firm characteristic that impacts premium price?

The principle is simple: the more attorneys in the firm, the more matters and clients the firm can handle; more work equals more risk; and more risk equals higher price. All else being equal then, a solo attorney is less expensive to insure than a two-attorney firm.

Why do claims made insurance companies review applications?

Because claims-made insurance is taking on the risk of work you have done in the past, if you have carried insurance continuously and without any gap throughout your preceding years of practice, for any yearly renewal, an underwriter reviewing your application can feel more comfortable that another underwriter before them has assessed the risks of the work you already performed in those prior years. This is true even when the coverage has come from more than one carrier. This translates into better premium pricing for the purchaser, because they can more accurately calculate the risk you pose to them.

Do lawyers consider loss history when determining premium price?

As with any type of insurance, lawyer s malpractice insurance underwriters consider an applicant’s loss history when determining premium price. If you experience a costly claim that leads to a large payout by your carrier, you may very well see an increase in your premium going forward--and most carriers do have some specified loss threshold at which they will not renew a firm or offer terms on a new application.

How much does medical malpractice insurance cost?

The average annual cost of malpractice insurance across all medical professions is $7,500. However, there are many types of professionals doing healthcare work. On the high end, surgeons typically pay between $30,000 to $50,000 a year for malpractice insurance, but that could go higher for riskier forms of surgery.

What factors affect the medical malpractice insurance cost?

The cost of medical malpractice insurance varies because of all the factors that go into calculating premiums. These include:

Who needs medical malpractice insurance?

Any medical professional working in the United States must have medical malpractice coverage, including:

How much does medical malpractice insurance cost by different healthcare specialties?

Almost all healthcare specialities need malpractice insurance coverage. Different specialties are exposed to different levels of risks, and thus their medical malpractice insurance costs are also different. Below are the average medical malpractice insurance costs for different healthcare specialties based on our research:

What is medical malpractice insurance?

Medical malpractice insurance, often referred to as medical professional liability coverage, is designed to protect physicians, nurses, pharmacists, and other medical professionals working in the healthcare industry.

What does medical malpractice insurance cover?

Medical malpractice policies provide liability coverage to medical professionals found to be negligent in doing their job. It also covers legal costs when doctors, nurses, and others are sued even when found not to be negligent. Medical malpractice insurance pays for:

What else do I need to know about medical malpractice insurance before buying it?

You will be asked to choose one of two types of malpractice insurance policies:

How Much does Malpractice Insurance Cost Lawyers?

Malpractice insurance for lawyers: Although most states don’t require lawyers to have malpractice insurance, at least 26 states require lawyers to notify their clients in writing if they don’t have it. Common reasons for clients to sue their lawyer include misfiling paperwork, missing deadlines, inadequate investigation, or failure to follow instructions. Attorneys in higher risk fields, such as class action work and intellectual property pay more.

How Much Does Malpractice Insurance Cost in Different Professions?

Liberty Mutual- Are You Overpaying For Home Insurance? Save 10% When You Buy Online.

How Much does Malpractice Insurance Cost Physician Assistants?

Physician Assistants: In some states, physician assistants work closely with a supervising doctor, and in some states they have a lot of freedom and are just a step short of being a doctor. Either way, PA’s need malpractice insurance because anyone can make a mistake and mistakes in this field can severely impact someone’s health.

What is malpractice insurance?

Last Updated: July 12, 2021. Malpractice insurance is a type of professional liability insurance. Malpractice insurance most often applies to healthcare workers and lawyers. This type of insurance protects you if you are sued to have made any mistakes that harm a client or a patient.

I. Legal Malpractice Insurance Cost – Fast Facts

- Most sole practitioners will pay $500 – $1,000 for their first policy. A 2-atty. firm will pay slightly less than double that; a 3-atty. firm, slightly less than triple that, etc. Premiums are 25%...

- The premium is based mainly on your firm’s atty. count, practice areas, policy limits, and county/state.

- Most sole practitioners will pay $500 – $1,000 for their first policy. A 2-atty. firm will pay slightly less than double that; a 3-atty. firm, slightly less than triple that, etc. Premiums are 25%...

- The premium is based mainly on your firm’s atty. count, practice areas, policy limits, and county/state.

- Criminal defense lawyers pay the least, then immigration; family and business; bankruptcy and employment; PI, real estate, and trusts-estates, and patent, securities, and class action lawyers, who...

- The minimum policy limits are $100,000 per claim/$300,000 annual aggregate, followed by $250,000/$500,000, which costs about 35% more, and then $500,000/$1,000,000, $1,000,000…

III. Legal Malpractice Insurance Cost – Factors That Affect Your Premium

- Here are the primary factors that legal malpractice insurers use to calculate a firm’s annual premium: Firm size– the number of lawyers in a firm, and whether each one works full-time or part-time. Note: all of the placements shown above are for full-time attorneys, which most insurers define as working more than 26 hours/week. Part-time attorneys generally pay lower pr…

IV. Legal Malpractice Insurance Cost – Learn More Or Request Quotes

- To learn more about legal malpractice insurance, visit these pages: Legal Malpractice Insurance FAQs – Coverage, Limits, Cost, etc. Legal Malpractice Insurance Policy Legal Malpractice Insurers

- If you have any questions, contact our principal broker, Curt Cooper at (202) 802-6415 or ccooper “at” lawyersinsurer.com.

- To learn more about legal malpractice insurance, visit these pages: Legal Malpractice Insurance FAQs – Coverage, Limits, Cost, etc. Legal Malpractice Insurance Policy Legal Malpractice Insurers

- If you have any questions, contact our principal broker, Curt Cooper at (202) 802-6415 or ccooper “at” lawyersinsurer.com.

- To get the best terms on your firm’s malpractice insurance, fill out our on-line application, or download, complete, and return our one-page premium estimate form: Online: Family Law Online Applica...

Further Reading

- Understanding Your Legal Malpractice Insurance Policy Part I: Claims-Made v Occurrence Coverage

- Understanding Your Legal Malpractice Insurance Policy, Part II: Claims-Made Policy Coverage Triggers

- Understanding Your Legal Malpractice Insurance Policy, Part III: Claims-Made Policy Coverage Gaps

- Understanding Your Legal Malpractice Insurance Policy, Part IV: Avoiding Claims-Made Policy Coverage Gaps

Popular Posts:

- 1. do i need to hire an attorney when buying a house

- 2. should i sign a power of attorney for my ea to communicate with the irs when i am not audited?

- 3. when attorney client privilege applies

- 4. what is the process for filing a complaint against an attorney in florida

- 5. where is ace attorney 7

- 6. what is attorney grief

- 7. how to make a will in florida without attorney

- 8. who was michelle carter's attorney

- 9. who is andrea irwin attorney

- 10. illegal apartment nj attorney fees who pays