The federal application fee (filing fee for IRS Form 1023) is generally under $1,000. Attorneys’ fees can vary depending on the firm you select and the complexity of your nonprofit organization. For example, a small poverty organization would be on the low end, and a hospital would be on the high end.

How much does it cost to start a 501 (c) (3) nonprofit?

For example, if your lawyer charges a flat fee of $2,000 to form your nonprofit and file for 501(c)(3) exemption, your nonprofit may be able to pay over a few months, rather than all of it up front. It may be frustrating that a lawyer won't represent your nonprofit for free, but keep in mind the amount of time a lawyer will be spending on your legal issue, and that the lawyer is also …

How much do attorney fees cost?

Jan 09, 2020 · Primarily, the cost of forming a nonprofit depends on the nonprofit organization’s complexity. On average, the entire process (from state filing, binder documents, federal application for exemption, all the way to completion) can run upwards of $3,000. The “upwards” here refers to the complexity of the organization.

Should your nonprofit hire a lawyer?

The typical investment to set up a 501(c)(3) nonprofit organization involves startup costs and annual costs: First Year Costs. The federal application fee (filing fee for IRS Form 1023) is generally under $1,000. You will also have professional fees to help you: $2,000 – $4,000 in attorney and CPA fees

How much does it cost to start a nonprofit organization in Nevada?

Feb 18, 2012 · Prices vary from market to market, but I as well as other attorneys I know generally charge more to set up a nonprofit than we do for a traditional corporation or LLC because filling out the Form 1023 can be very time consuming and if not done correctly can derail your approval for nonprofit tax exempt status by the IRS or potentially result in nonapproval.

How much does it cost to form a nonprofit?

The filing fee for nonprofit articles of incorporation is $30. All of these forms contain instructions. You will also need to file a Statement of Information (Form SI-100 or Form SI-CID) within 90 days of filing the Articles of Incorporation.

How much does it cost to make a 501c3?

IRS Form 1023 The fee is $600 (as of 2021) regardless of what income your organization projects. Be sure that your paperwork is filled out correctly, as the fee is nonrefundable. If you're hoping to find a 501(c)(3) fee waiver, don't waste your time.May 17, 2021

What are the 3 types of non profits?

There Are Three Main Types of Charitable Organizations Most organizations are eligible to become one of the three main categories, including public charities, private foundations and private operating foundations.Jun 4, 2018

Can you start a nonprofit with no money?

One way of starting a nonprofit without money is by using a fiscal sponsorship. A fiscal sponsor is an already existing 501(c)(3) corporation that will take a new organization “under its wing" while the new company starts up. The sponsored organization (you) does not need to be a formal corporation.Aug 13, 2021

The Nonprofit Filing Process

The process for establishing a nonprofit differs from that of for-profit entities. With for-profits, you set up the entity with the state, then let the federal government know the entity’s tax election (for LLCs). For-profit entities do not have to apply for exemptions.

Nonprofit Status

Generally speaking, it takes between 9-15 months to acquire nonprofit status. In some cases, we’ve received it at our firm in as little as 3 months, but this is not the norm. The length of time the entire process takes varies depending on the time of year and what’s happening in the government, among other factors.

Nonprofits & Business Licenses

Nonprofits are still required to have business licenses. There are, however, exclusions and exemptions available — but you have to apply for them. They don’t happen automatically. The regulations and exemptions applicable to nonprofits also vary from state to state.

Nonprofits & Tax ID Numbers

All nonprofits are still required to have federal tax identification numbers. In the case of nonprofits, the tax ID will be its EIN. The nonprofit will need this number when it files taxes. And yes, nonprofits have to file taxes (except churches).

How much does it cost to file a 1023?

The federal application fee (filing fee for IRS Form 1023) is generally under $1,000. You will also have professional fees to help you: $2,000 – $4,000 in attorney and CPA fees. 40 hours of your time working with the attorney and CPA.

Can you donate to a charity with a donor advised fund?

With a donor-advised fund, you can donate money and get a tax deduction in that year. Your account will grow over time as you make donations each year. Then when you are ready, you can direct (“advise”) the foundation regarding which charity you want the money to be donated to.

Is it safe to use a donor advised fund?

If you decide to use a donor-advised fund, your money will be safest and the rates are usually best if you pick a large, regional fund in your community. Examples of reputable foundations who offer donor-advised fund services include

Joel Jay Kofsky

During law school we had a clinic to provide free assistance in the formation of 501 (c) (3) corps.#N#You may want to contact a local law school.#N#www.PhillyInjuryLawyer.com

Jeremiah Kent Jarmin

Prices vary from market to market, but I as well as other attorneys I know generally charge more to set up a nonprofit than we do for a traditional corporation or LLC because filling out the Form 1023 can be very time consuming and if not done correctly can derail your approval for nonprofit tax exempt status by the IRS or potentially result in nonapproval....

How to become a 501c3?

To recap what we talked over, forming a 501 (c) (3) involves four steps: 1 drafting, editing, and filing articles of incorporation; 2 drafting and editing bylaws, with new board members then voting in favor of the bylaws in a duly authorized meeting; 3 applying for an Employer Identification Number (EIN); and 4 drafting, reviewing, and editing the IRS non-exempt status application, known as IRS Form 1023, as well as all the supporting materials IRS Form 1023 requires.

What is the IRS Form 1023?

drafting, reviewing, and editing the IRS non-exempt status application, known as IRS Form 1023, as well as all the supporting materials IRS Form 1023 requires. By far, the most difficult and time-consuming of the four steps is the IRS Form 1023. You should definitely review the form immediately, so you can gain a sense of the level ...

Who is liable for a nonprofit's debt?

Under the law, creditors and courts are limited to the assets of the nonprofit organization. The founders, directors, members, and employees are not personally liable for the nonprofit’s debts. There are exceptions. A person cannot use the corporation to shield illegal or irresponsible acts on his/her part. Also, directors have a fiduciary responsibility; if they do not perform their jobs in the nonprofit’s best interests, and the nonprofit is harmed, they can be held liable.

Is a 501c3 a nonprofit?

Organizations that qualify as public charities under Internal Revenue Code 501 (c) (3) are eligible to be completely exempt from payment of corporate income tax. Once exempt from this tax, the nonprofit will usually be exempt from similar state and local taxes.

What is a nonprofit organization?

A nonprofit organization is subject to laws and regulations, including its own articles of incorporation and bylaws. A nonprofit is required to have a Board of Directors, who in turn determine policies.

Is a 501c3 tax deductible?

Even better: if an organization has obtained 501 (c) (3) tax exempt status, an individual’s or company’s charitable contributions to this entity are tax-deductible.

Is a nonprofit organization open to public inspection?

A nonprofit is dedicated to the public interest, therefore its finances are open to public inspection. The public may obtain copies of a nonprofit organization’s state and federal filings to learn about salaries and other expenditures. Nonprofits must be transparent in nearly all their actions and dealings.

What is the IRS Form 1023-EZ?

Option One: IRS Form 1023-EZ – If you are NOT a church, a school, a hospital, a foreign organization, or a medical research organization, and if your total projected revenue (gross receipts) is less than $50,000 per year, then there’s a good chance you will qualify for 501c3 tax exemption using IRS Form 1023-EZ.

What is a bylaw?

Bylaws are your organization’s governing document and are necessary for filing for federal tax exempt status. — Obtain your Employee Identification Number (Federal Tax Identification Number), if needed. — Prepare IRS Form 1023-EZ or IRS Form 1023 – Application for Recognition of Exemption, including all schedules, financial projections, narratives, ...

How much does it cost to file a 1023-EZ?

IRS Form 1023-EZ is a shorter and less expensive option for startup nonprofit organizations, and the IRS User Fee is only $275 (as of March, 2018). The IRS estimates less than 20 hours of total preparation time for completing this application, as opposed to 100+ hours for completing the traditional IRS Form 1023.

How to become a nonprofit in Minnesota?

There are two stages to consider when creating a nonprofit organization in Minnesota: first, drafting and filing the legal documents required to create a nonprofit organization, and second, applying to the IRS for 501 (c) (3) status, if desired.

What are the advantages of being a 501c3?

The second and perhaps the most important advantage of being recognized as a 501 (c) (3) organization is those individuals who give you donations can get a charitable deduction on their income tax return. That’s a pretty big deal.

Do nonprofits have bylaws?

Bylaws. A nonprofit organization is also required to have Bylaws . Our laws are essentially the rules inside the organization and often cover issues like the election of directors, who can be a member of the organization, how officers are selected, the role of the president of the nonprofit, and other principles under which ...

What is an employee identification number?

An employee identification number is like a social security number for a business and must be obtained in order to hire employees, open a bank account or obtain tax exempt status. After your nonprofit is formed, one of the next steps is obtaining an employee identification number. As part of the nonprofit formation process, Semanchik Law Group will obtain an employee identification number for your nonprofit.

How to become a tax exempt organization?

To become a tax-exempt organization, your nonprofit must first file an application with the IRS. This process involves providing the government with details about your directors, the structure of your organization, and the activities that you intend to engage in. Some organization may be apply to apply for tax exemption by using the form 1023EZ while others will need to complete the full 1023 application. The full 1023 application is a fact intensive application that requires your nonprofit to prove to the IRS that you qualify for 501 (c) (3) status. The application process can be quite daunting and the IRS actually suggests that it can take a novice over 100 hours to prepare the 1032 application. Providing Inaccurate or erroneous information can cause your application to be denied. Additionally, if the application is missing important information the IRS will ask additional questions which will cause the approval of your application to be delayed significantly. At Semanchik law Group we prepare the 1023 on your behalf. Our simple and streamlined process allows us to gather information from you so we can prepare the application and you can start working on the more important aspects of running your nonprofit. We handle all of the paperwork and guides you through the process so that you have a strong and detailed 1023 application that fully reflects your nonprofit’s activities.

What are the bylaws of a nonprofit?

Bylaws are the governing rules of your nonprofit. To avoid any potential issues, it is vital that your bylaws are kept up to date and meet the requirements of the California Corporations Code. Your bylaws should also be reviewed by the board of directors periodically to determine whether they need to be updated and whether they impose unreasonable restrictions on the nonprofit that are not being met.

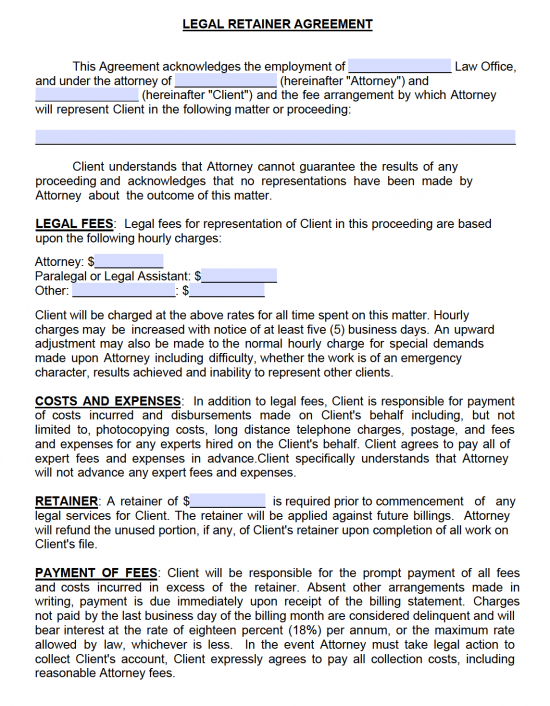

How to pay retainer fees?

Make sure that your contract includes the details of: 1 Contract – The agreement should list the total amount of any retainer deposit that you pay upfront. It should also state when you need to pay additional fees, if necessary. 2 Hourly Fee – Don't look only for the hourly rate of your lawyer on the agreement. Make sure you also see a description of the different hourly rates for each person who might contribute to your case. Ask for your payment schedule. Ask if you get a discount for early payment or if you pay penalties for late fees. 3 Contingency Fee – In a contingency case, the lawyer profits by the percentage they earn upon winning the case. The lawyer's contingency percentage and the payment-collection process should appear clearly outlined in your agreement. Sometimes, a lawyer will not collect any fees from you if they lose a contingency case, such as in personal injury disputes. In other situations, they may demand payment from their client only if they lose the case. 4 Costs of Suit – Check for clear terms to describe who pays for all of the different litigation costs involved. You should anticipate possible charges for court appearances and filing fees, hiring a private investigator, the cost of bringing in an expert witness, costs for officially serving and delivering legal documents, and travel fees.

How to avoid disagreements with your attorney?

Either way, most states require evidence of a written fee agreement when handling any disputes between clients and lawyers. You must have written evidence of what you agreed to pay for anyone to hold you accountable for what you have or have not spent.

What is contingency fee?

An attorney contingency fee is only typical in a case where you're claiming money due to circumstances like personal injury or workers' compensation. You're likely to see attorney percentage fees in these situations to average around a third of the total legal settlement fees paid to the client.

Do lawyers charge retainers?

Sometimes lawyers may charge a retainer if they find themselves in high demand. Other lawyers who work more quickly and efficiently may see no need for charging you a retainer fee. Call different lawyers in your area to see if retainers are standard practice for your particular case.

What is statutory fee?

A statutory fee is a payment determined by the court or laws which applies to your case. You'll encounter a fixed statutory fee when dealing with probate or bankruptcy, for example.

What to ask when hiring an attorney?

When hiring your attorney, ask for a detailed written estimate of any expenses or additional costs. They may itemize each expense out for you or lump their fees all together under different categories of work. Lawyers may bill you for: Advice. Research.

Main Steps to A 501

Responsibilities of Forming & Managing A Nonprofit

- Of course, there are serious responsibilities that come along with creating and running a nonprofit. These can’t be overstated, and include:

Continue The Discussion

- I hope this information is helpful to you as you begin this journey. It won’t always be easy (although I will attempt to make it as simple as possible for you!), but it will be worthwhile. I would enjoy the opportunity to be of service to you. Thank you for your time and attention. If you have any questions or concerns, please contact me. As I told you this morning, I offer anyone/everyon…

Popular Posts:

- 1. what is the opposite of a criminal defense attorney

- 2. how do you go by getting power of attorney of your own mother

- 3. what does power of attorney for health care mean

- 4. what an attorney in fact

- 5. how can i get a power of attorney for my mother

- 6. what does a traffic attorney do

- 7. is attorney fee income when in iolta or when in business account

- 8. who was the attorney from new york who was fired on friday preet

- 9. why is an attorney given little information

- 10. who plays the attorney on no good dead. the diagnosis murder episode