How much does a real estate attorney cost?

How much you’ll pay for real estate attorney fees depends on your market and how involved they are in the transaction, but they typically charge a flat rate of $800 to $1,200 per transaction. Some attorneys charge hourly, ranging from $150 to $350 per hour. If I have an attorney, do I need an agent or broker to sell my house?

How much does it cost to prepare a deed?

Property Deed Pricing

- Title Research. We determine the precise legal description of your property (map, block and lot number) and how title is held.

- Peace of Mind Review TM. We review your work for completeness and consistency.

- New property deed. Creation of the property deed for your signature.

- Filing with the county recorder's office. ...

- Expedited processing. ...

What is the standard attorney fee?

Understanding Attorneys' Fees

- No standard fee. An attorney and client will base a fee agreement on factors such as the lawyer's overhead and reputation, the type of legal problem, and the going rate ...

- Cheap isn't necessarily good. ...

- Expensive isn't necessarily best, either. ...

- A contingency fee can be a bad idea. ...

- Avoid security interests. ...

What is the average cost of a lawyer?

The average hourly attorney fee is between $300 – $400 per hour. Once the retainer has been exhausted, the client will be required to replenish the retainer back to its original amount and the attorney will again bill against the retainer for time spent on the case until the money runs out.

How much does it cost to transfer a deed in Texas?

all property deeds – $195 Any Property Deed needed to transfer real estate in Texas. Prepared by an attorney licensed in the state of Texas.

How much does it cost to transfer a deed in NY?

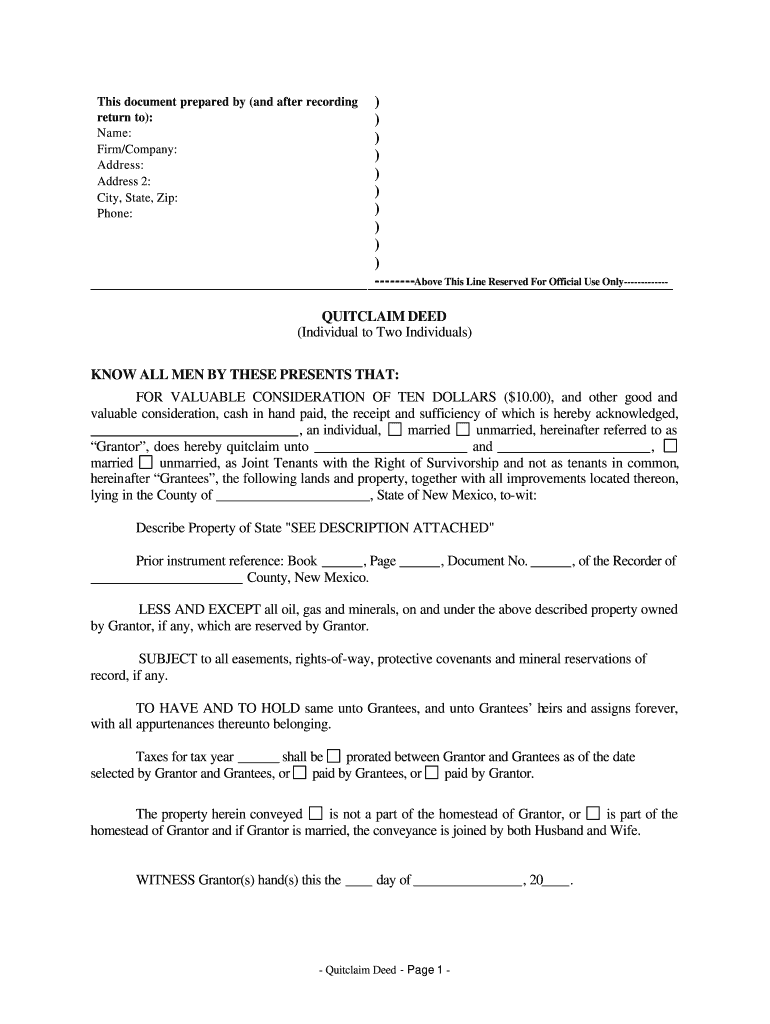

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250.

How much does it cost to add a name to a deed in Florida?

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps – recordings costs are normally less than $50.00.)

How do I transfer a deed in Illinois?

In Illinois, the real estate transfer process usually involves four steps:Locate the most recent deed to the property. ... Create the new deed. ... Sign and notarize the new deed. ... Record the deed in the Illinois land records.

Can someone sell a house if your name is on the deed?

A house cannot be sold without the consent of all owners listed on the deed. When selling a home, there are different decisions that need to be made throughout the process. Decisions such as hiring a listing agent or negotiating a price are often challenging enough without having to agree with the co-owner.

How do I transfer a deed in NY?

Checklist: Preparing and Recording Your New York Quitclaim DeedFill in the deed form.Print it out.Have the grantor(s) sign and get the signature(s) notarized.Complete a transfer tax form, Form TP-584.Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).More items...

How much does it cost for a quit claim deed in Florida?

A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk's office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

Who pays doc stamps on deed in Florida?

the sellerThe party responsible for payment of the documentary stamp tax on a sale is usually determined by the terms of the purchase agreement. However, because the seller is required to provide marketable title to the property, the seller usually pays these taxes.

How do you add someone to your deed?

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

How much does it cost to transfer title of home in Illinois?

Illinois charges you about 0.15% of your home's sale price to transfer the title to the new owner. If you sell for Illinois's median home value — $256,000 — you'd pay $384. However, your county or city may also charge their own transfer taxes.

How much is a house title transfer in Illinois?

The state of Illinois has a transfer tax that is typically paid by sellers at a rate of $0.50 per $500, or $500 per $100,000 of property value. In addition, counties may apply an additional tax of $0.25 per $500.

How much does it cost to transfer a house into your name?

It's best to have between 8 and 10% of the purchase price put aside for other purchase expenses, including bond costs and transfer duties. Transfer Duty is a government tax levied to transfer the property from the seller's name into the buyer's name.

How much does it cost to transfer a deed?

Deed transfer, when filing on your own, can cost somewhere between $30 and $150, depending on the type of deed transfer you go for and the filing fee. Hiring a professional service or a lawyer, on the other hand, can cost you over $500, and this is without the filing fee.

How to transfer a deed to a new home?

The signed document then needs to go through a process called “recording” which is where it gets filed at the county recorder’s office before being mailed back out to both parties of this transaction once completed.

What is deed transfer?

A deed transfer is a process of transferring a property’s title from one party to another. This usually takes place when an individual wants to take ownership of someone else’s belongings or if they want to remove themselves as owner entirely, but this term can also apply in instances where two businesses are exchanging assets and titles.

What to do if you choose a lawyer for a property transfer?

If you choose a lawyer, they will be able to prepare and file the appropriate documentation for your property’s transfer. Before this happens though, he or she will confirm if it would benefit anyone involved in changing the titled owner of the property. If so, then an attorney is prepared by reviewing current owners as well as getting basic information from any interested parties before establishing legal descriptions of the property in question.

Can a lawyer help you get a deed?

A lawyer will give you their costs for free so that you know ahead of time if it’s worth hiring them or not. Many people are intimidated by the process of acquiring a deed. Luckily, it is not impossible to find someone who can help you through this daunting task.

Why do you need a warranty deed?

A warranty deed provides greater protection to the new owner because the current owner makes a promise he or she legally owns, and has clear title to, the real estate. Creating property deeds with LegalZoom is fast and affordable.

When are additional taxes and fees required?

Additional taxes and fees may be required by a governmental agency when the deed is recorded if the property transfer is not exempt (i.e. not spouse to spouse, parent to child, or grandparent to grandchild transfers).

Does LegalZoom offer Quitclaim deeds in Texas?

** LegalZoom does not offer Quitclaim deeds for properties located in Virginia. Instead, warranty deeds are available. Standard.

Michael Christopher Giordano

I agree with my colleague as there are several factors which weigh into cost and timing for any project, including Deed preparation and recording. Don't forget that in addition to the lawyer's fee there will also be recording costs paid to the Recorder's office...

Robert Brian Liotta

Attorneys in your area traditionally charge between $175-$250 to prepare a deed. It is difficult to definitively predict how long it would take to render this service as it would depend upon the administrative structure of the practice office that renders the service; our office can usually have a deed prepared same day or next day at the latest.

How much does an attorney charge per hour?

Attorney fees typically range from $100 to $300 per hour based on experience and specialization. Costs start at $100 per hour for new attorneys, but standard attorney fees for an expert lawyer to handle a complex case can average $225 an hour or more.

How much does it cost to get a lawyer to write a will?

Hiring a lawyer on a flat-rate basis to create a simple will costs $300, while a will for more complex estates may be $1,200 to write.

What is retainer fee?

An attorney retainer fee can be the initial down payment toward your total bill, or it can also be a type of reservation fee to reserve an attorney exclusively for your services within a certain period of time. A retainer fee is supposed to provide a guarantee of service from the lawyer you've hired.

How to avoid disagreements with your attorney?

Avoid disagreements with your attorney about how much you owe by taking the time to review your attorney fee agreement carefully. You may also hear this document called a retainer agreement, lawyer fee agreement or representation agreement. Either way, most states require evidence of a written fee agreement when handling any disputes between clients and lawyers. You must have written evidence of what you agreed to pay for anyone to hold you accountable for what you have or have not spent.

What is contingency fee?

An attorney contingency fee is only typical in a case where you're claiming money due to circumstances like personal injury or workers' compensation. You're likely to see attorney percentage fees in these situations to average around a third of the total legal settlement fees paid to the client.

What is flat fee legal?

At first glance, flat-rate legal services seem to be a complete package deal so that you don't pay more for your case than is necessary. However, if you don't comply with every single term listed on the flat fee contract, then your attorney still has the right to bill you for additional costs that may come up in your case. For instance, a flat fee lawyer working on an uncontested divorce case may still charge you for all court appearances. Plus, they may also only offer the flat fee if you have no property issues and no child support issues either.

What happens if you lose in court?

If you lose in court, you may still have to pay for the lawyer's expenses. Many cases such as those involving child custody or criminal charges are not eligible for a contingency fee structure.

Why do attorneys charge different fees?

Some attorneys charge different amounts for different types of work, billing higher rates for more complex work and lower rates for easier tasks .

What expenses do clients have to pay for a lawyer?

Clients may also be responsible for paying some of the attorney or law firm’s expenses including: Travel expenses like transportation, food, and lodging; Mail costs, particularly for packages sent return receipt requested, certified, etc; Administrative costs like the paralegal or secretary work.

Why do lawyers need to put contracts in writing?

A written contract prevents misunderstandings because the client has a chance to review what the attorney believes to be their agreement.

What are the biggest concerns when hiring a lawyer?

Attorney fees and costs are one of the biggest concerns when hiring legal representation. Understanding how attorneys charge and determining what a good rate is can be confusing.

What are the costs of a lawsuit?

Some common legal fees and costs that are virtually inescapable include: 1 Cost of serving a lawsuit on an opposing party; 2 Cost of filing lawsuit with court; 3 Cost of filing required paperwork, like articles forming a business, with the state; 4 State or local licensing fees; 5 Trademark or copyright filing fees; and 6 Court report and space rental costs for depositions.

What factors determine if a lawyer's fees are reasonable?

Factors considered in determining whether the fees are reasonable include: The attorney’s experience and education; The typical attorney fee in the area for the same services; The complexity of the case; The attorney’s reputation; The type of fee arrangement – whether it is fixed or contingent;

What is the first step in resolving a dispute with a lawyer?

The first step to resolving these disputes is communication . If there is a disagreement, clients and attorneys should first seek to discuss it and try to reach a mutually agreeable solution. Often, small disagreements balloon merely because both the attorney and the client avoided talking to the other out of fear.

How much does a lawyer charge to prepare a quit claim deed?

Rates vary by state and law office but typically fall in the range of $200 to $400 per hour. Title companies routinely prepare quitclaim deeds in many states.

How much does it cost to sign a quitclaim deed?

Depending where you are, notaries charge between $2 and $20 per signature, but mortgage closings and real estate transactions will cost you more. After getting the quitclaim notarized, you must record the deed with the county records office and pay a small recording fee, which varies by county. There is also a transfer tax known as a deed stamp. Many states charge transfer tax as a percentage of the purchase price specified in the deed. You pay this deed stamp to the county recorder.

What is a quit claim deed?

A quitclaim deed lets you gift or sell your property to another person quickly and easily because it transfers legal ownership without making guarantees about the title. Costs vary depending on whether you prepare the quitclaim deed yourself or hire a professional, such as an attorney or title company to do it for you.

Can you use quitclaims on a family deed?

The owner does not promise that there are no claims against his title to the property. For this reason, quitclaims are typically used to transfer property within a family.

How much does an attorney charge per hour?

While most attorneys charge a flat rate, some will charge by the hour, with hourly rates ranging from $150 to $350, according to Thumbtack.

What is the difference between a realtor and a real estate agent?

A real estate agent, or realtor, is tasked with marketing a property for sale or finding a property for a buyer, Romer said, while an attorney is enlisted to ensure someone’s legal rights are protected during a home sale. Real estate agents are paid based on commission , while attorneys are paid a separate legal fee that is typically a flat rate, he said.

Do real estate attorneys help you buy a house?

Real estate attorneys may give you the peace of mind that your home purchase will go smoothly, drastically lowering the possibility that you’ll be hit with any unexpected legal problems.

Do you need a real estate attorney to close a house?

Some states require a real estate attorney for closing, while others don’t. In states that don’t require an attorney, it’s still a good idea to consider hiring one to help make sure everything is in good order. How much does a real estate attorney cost may factor into your decision-making given how many costs are associated with closing on a house .

How Much Does A Deed Transfer Cost?

- Deed transfer, when filing on your own, can cost somewhere between $30 and $150, depending on the type of deed transfer you go for and the filing fee. Hiring a professional service or a lawyer, on the other hand, can cost you over $500, and this is without the filing fee. Investopedia‘s $250 estimate is a reasonable starting point, but you’ll need ...

Deed Transfer Details

- If you choose a lawyer, they will be able to prepare and file the appropriate documentation for your property’s transfer. Before this happens though, he or she will confirm if it would benefit anyone involved in changing the titled owner of the property. If so, then an attorney is prepared by reviewing current owners as well as getting basic information from any interested parties befor…

Any Additional Expenses to Consider?

- The filing fee, not to be confused with the above-mentioned fees is an additional cost that may range anywhere from $30-$60depending on your location.

Any Way to Spend Less?

- Filing a deed transfer can be tricky, but it doesn’t hurt to talk with the local court about what you need and how they might be able to help. A lawyer will give you their costs for free so that you know ahead of time if it’s worth hiring them or not. Many people are intimidated by the process of acquiring a deed. Luckily, it is not impossible to find someone who can help you through this da…

Popular Posts:

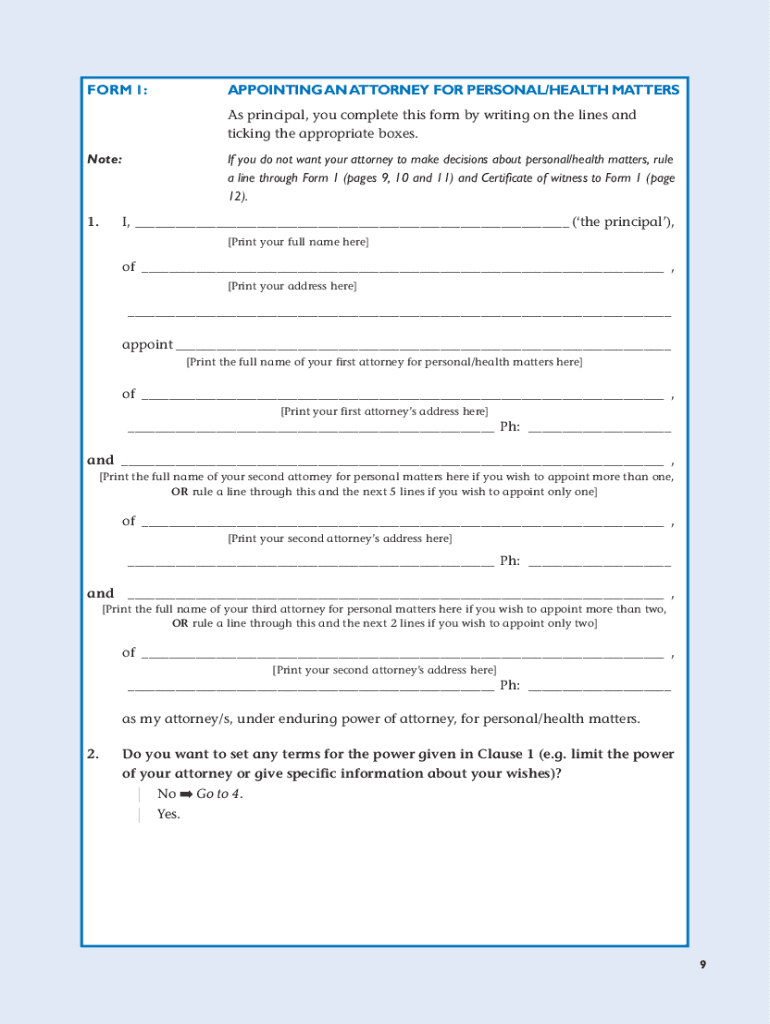

- 1. where can i obtain a durable power of attorney form

- 2. who won attorney general in nevada 2018

- 3. what can you report an attorney to the bar for

- 4. where to send georgia power of attorney

- 5. power of attorney what can go wrong

- 6. how to challenge power of attorney in indian cases

- 7. what is type of attorney fees

- 8. how to withdraw an edd power of attorney

- 9. how to look up arizona attorney general case

- 10. enforce the laws - that's what an attorney general does