How much do lawyers charge for Chapter 13 bankruptcy in New Jersey?

· Click here to see our latest payment plans. Court Costs In addition to attorney’s fees for filing your case, there are Court costs typically around $325 which are due on filing. In some cases, if you apply and the Court agrees, you may be able to pay the Court cost in four payments or even get the fee waived.

How much does a family lawyer cost in New Jersey?

· In the U.S. Bankruptcy Court for the District of New Jersey, the guideline (found in local bankruptcy rule 2016-5) for presumptive attorneys’ fees and services in all Chapter 13 cases is $3,500. The rule lists the services that this fee covers.

How do I pay my bankruptcy lawyer’s flat fee?

· To file under Chapter 7, you’ll have to pay a filing fee of $306. § 1930 (9), (a) (1). For Chapter 13, it’s $281. If you can’t pay all at once, the court may allow you to pay in installments. If you make less than 150% of the poverty line, the court may waive your fees altogether when you file under Chapter 7.

How much does Chapter 7 cost in NJ?

$306Chapter 7 comes with a filing fee of $306 and this is when you surrender your non-exempt assets. Those assets will be sold and the proceeds will be used to pay your debts. Chapter 13 comes with a filing fee of $281 and this is when you make scheduled payments on a created 5-year payment plan.

How much does it cost to file Chapter 13 bankruptcy NJ?

$313.00Court FeesItemFeeChapter 13 Petition$313.00Chapter 15 Petition$1738.00Amendments to Schedules D, E, F, G, H or List of Creditors$32.00Authorization of Direct Appeal (or Cross Appeal) From Bankruptcy Court to Court of Appeals$207.0037 more rows

Who pays the cost of bankruptcy?

So Who Actually Pays for Bankruptcies? The person who files for bankruptcy is typically the one that pays the court filing fee, which partially funds the court system and related aspects of bankruptcy cases. Individuals who earn less than 150% of the federal poverty guidelines can ask to have the fee waived.

Why should I hire a bankruptcy lawyer?

If you are considering filing for bankruptcy, you should hire an experienced bankruptcy lawyer to help you manage the process. Bankruptcy laws are incredibly complex. A lawyer will make declaring bankruptcy easier, faster, and more successful.

How do I file Chapter 7 with no money?

Eligible filers are able to file Chapter 7 for free. If your household income is less than 150% of the federal poverty level, you can ask the bankruptcy judge to waive your court fees with a simple application submitted along with your bankruptcy petition.

What are the differences between Chapter 7 and Chapter 13 bankruptcy?

With Chapter 7, those types of debts are wiped out with your filing's court approval, which can take a few months. Under Chapter 13, you need to continue making payments on those balances throughout your court-instructed repayment plan; afterwards, the unsecured debts may be discharged.

What bankruptcy clears all debt?

Chapter 7 bankruptcyChapter 7 bankruptcy is a legal debt relief tool. If you've fallen on hard times and are struggling to keep up with your debt, filing Chapter 7 can give you a fresh start. For most, this means the bankruptcy discharge wipes out all of their debt.

What can you not do after filing bankruptcies?

After you file for bankruptcy protection, your creditors can't call you, or try to collect payment from you for medical bills, credit card debts, personal loans, unsecured debts, or other types of debt.

What happens to your debts if you file for bankruptcy?

Chapter 7 Bankruptcy Money from the sale goes toward paying your creditors. The balance of what you owe is eliminated after the bankruptcy is discharged. Chapter 7 bankruptcy can't get you out of certain kinds of debts. You'll still have to pay court-ordered alimony and child support, taxes, and student loans.

How much money does a lawyer make in South Africa?

Here's how much money lawyers earn in South AfricaPrivate Practice2022 annual salary rangeAssociateR650 000 – R850 000Newly QualifiedR580 000 – R650 000PartnerR1 400 000 – R2 200 000Senior AssociateR850 000 – R1 400 0001 more row•Jan 6, 2022

Is Chapter 7 bankruptcy the quickest?

For most people, Chapter 7 Bankruptcy is the quickest, easiest, and most cost-effective choice. If you don’t own a home and don’t have too much income, Chapter 7 may be right for you. There is a range of fees, and payment plans are available as well. Click here to see our latest payment plans.

Do you have to pay for bankruptcy?

Most people who need to file for bankruptcy don’t have the money it takes to pay the fees and costs associated with filing. Payment plans are usually the answer. We do convenient monthly and bi-weekly payment plans, that fit your budget, to make paying for bankruptcy a little easier. Click here to see our latest payment plans.

How much does a bankruptcy attorney charge in New Jersey?

Bankruptcy Court for the District of New Jersey, the guideline (found in local bankruptcy rule 2016-5) for presumptive attorneys’ fees and services in all Chapter 13 cases is $3,500. The rule lists the services that this fee covers. The fees our New Jersey readers told us they paid—typically from $1,500 to $3,500— fall in line with the maximum amount recommended by the court.

How to pay a lawyer for bankruptcy?

The most common way of paying a lawyer’s flat fee in Chapter 13 bankruptcy is to make an initial down payment (or “retainer”) before the bankruptcy petition is filed, with the remainder of the fee included in your monthly payments under the repayment plan. A few bankruptcy courts set a limit on how much lawyers can ask for this up-front retainer fee.

Does Chapter 13 bankruptcy cost an hourly fee?

It’s also not surprising that none of them paid their lawyers an hour ly fee, because most bankruptcy attorneys charge a flat fee—a set amount that covers their basic services.

Can a bankruptcy attorney charge a presumptive fee?

Where bankruptcy courts have established fee guidelines, most attorneys use them to set their own fees. However, a presumptive fee isn’t an absolute maximum. Lawyers can file a detailed application to request a higher fee for cases that will require more work than usual. Also, if a case becomes more complicated than originally expected, the attorney can ask the court to approve additional fees for further services that are required.

What happens if you file for bankruptcy in New Jersey?

You should also be aware of the cost of bankruptcy itself. If you file under Chapter 7, the trustee will take control of your non-exempt assets and sell them. As a practical matter, most of our clients don't lose any of their property in chapter 7 because it's all exempt. The proceeds go to your creditors. New Jersey offers no exemption for a homestead and only $2,000 total of other exemptions. N.J.S.A. 2A:26-4. That means the trustee can go after property you own that has substantial equity. That seems overwhelming, but you’ll still come out debt-free on the other side. You may also opt for the federal exemption scheme, which protects up to $22,000 of equity in your home and varying amounts for other assets. 11 U.S.C.A. § 522. The federal exemptions will likely protect more of your property than the New Jersey exemptions, but you should discuss your options with your bankruptcy attorney to make sure you protect what’s most important to you. When the trustee has disposed of your non-exempt assets, your remaining debt will be forgiven. If you file for Chapter 13, you probably won’t have to give up any of your assets. You’ll calculate your income and your living expenses and you’ll pay the remainder to your unsecured creditors. At the end of the bankruptcy process, your remaining unsecured loans will be discharged. Remember that certain debts, such as student loans, can’t be discharged through bankruptcy.

How much does it cost to go through credit counseling before filing for bankruptcy?

Before you file for bankruptcy, you’ll have to go through a credit counseling class. § 109 (h) (1). Expect to pay about $50 for credit counseling. Credit counseling agencies are legally prohibited from turning you away if you can’t afford the fee, but you’ll have to show them evidence that you can’t pay.

Is it bad to file for bankruptcy without an attorney?

Filing pro se, or without the help of an attorney, is usually bad news for your bankruptcy case. Filing for bankruptcy requires a lot of technical knowledge even if everything goes perfectly smoothly – and it almost never will. You’ll have to file all the documents, correctly filled out and on time, you’ll need to be certain that you’re filing under the right chapter, and you’ll be responsible for preparing official answers to creditors’ complaints. It’s a lot of work and a small mistake can make a big difference in your case. Your case may even be dismissed because of an error. An experienced bankruptcy attorney has dealt with thousands of cases like yours and knows all the ins and outs of the system. She can make sure you have all your paperwork, she knows how to stand up to creditors and the trustee, and she can make sure you get the most out of your bankruptcy. Of course, an attorney isn’t free. What does it cost to hire a bankruptcy attorney? The answer depends on the attorney. You’ll have to pay reasonable compensation for the time the attorney spends on your case. If your case is routine, that won’t be as much. Your attorney will consult with you about your needs and options, fill in and file your paperwork, and represent you in front of the bankruptcy court. If adversary proceedings or a mountain of objections complicate the proceedings, the bill will be higher. Perhaps the trustee objects to your discharge or a creditor believes you have listed the wrong kind of debt or debt in the wrong amount. That sort of fight can take time and a significant amount of legal expertise. You’ll be glad to have a lawyer – you won’t be able to manage a legal battle on your own. On the other hand, that sort of legal work costs more than a simple bankruptcy filing. When you retain a bankruptcy attorney, you’ll pay just one bill to the attorney. They’ll handle the payment of the individual court fees to make sure payment is timely and in the correct amount.

Is bankruptcy free in New Jersey?

Filing for bankruptcy isn’t free, but it’s better than having creditors breathing down your neck. Without the protection of bankruptcy, creditors can get judgments against you and levy your bank accounts, seize your property, place liens on your home, and garnish your wages. If you’re a low-income debtor, you may qualify for free legal help from the state of New Jersey. For more information and to see if you qualify, check out Legal Services of New Jersey. If you’re interesting in learning more about bankruptcy or if you’ve decided to file, check out our other bankruptcy-related content and reach out to one of our experienced bankruptcy attorneys. Image credit

What are the services required to file for bankruptcy?

In considering the cost of filing bankruptcy, individual and business debtors frequently require the services of professionals to assist in their liquidation or reorganization. The most common types of professionals retained by debtors are accountants, appraisers, auctioneers, brokers, and special counsel. In a reorganization bankruptcy, such as Chapter 11 and Chapter 13, the bankruptcy court must pre-authorize a debtor’s retention of these professionals. In addition, before these professionals are paid by a debtor, the bankruptcy court must approve the professional’s fees through a process called a fee application.

Why is filing for bankruptcy important?

Filing bankruptcy is an important step for many businesses and individuals struggling with debt, law suits, foreclosures, and other issues that “trigger” their need for financial relief. For the majority of businesses and people that file bankruptcy, the debt relief they obtain in bankruptcy vastly outweighs the cost of filing bankruptcy. This is especially true where bankruptcy may be the only thing standing between a person/business and foreclosure on their real property, repossession of their car, or a turnover of their levied bank account funds.

How much does it cost to file Chapter 7?

Chapter 7 comes with a filing fee of $306 and this is when you surrender your non-exempt assets. Those assets will be sold and the proceeds will be used to pay your debts.

Is filing for bankruptcy free?

But, as is the case with many things in this world, filing for bankruptcy is not free.

Is bankruptcy attorney free?

It goes without saying that hiring a bankruptcy attorney is not free. Costs will vary though and it depends on the attorney and your case. A more routine case should be on the lower side in terms of cost. But an involved case may result in a higher bill.

Chapter 13 Bankruptcy in New Jersey

Chapter 13 Bankruptcy is a re-payment plan or re-organization of your debts. If you have above-average income or equity in a home, Chapter 13 may be right for you. Chapter 13 Bankruptcy cases are more complex than typical Chapter 7 Bankruptcy cases therefore the fees are little more costly.

Payment Plans Make Chapter 13 Bankruptcies Easier

Most people who need to file for bankruptcy don’t have the money it takes to pay the fees and costs associated with filing. Payment plans are usually the answer. We do convenient monthly and bi-weekly payment plans, that fit your budget, to make paying for bankruptcy a little easier. Click here to see our latest payment plans.

Court Costs

In addition to attorney’s fees for filing your case, there are Court costs typically around $325 which are due on filing. In some cases, if you apply and the Court agrees, you may be able to pay the Court cost in four payments or even get the fee waived. Click here to see our latest payment plans.

How Do I Come Up With The Money To Pay For The Cost To File Bankruptcy In New Jersey?

The Cost To FIle Bankruptcy In New Jersey can be daunting. Many people can stop paying their credit cards once they have made the decision to file bankruptcy. This often frees-up enough money to make payments for the attorney fee and Court costs. Other people have to rely on friends or family to give them the money.

Payment Plans

Check out our payment plans by clicking the box below. Bankruptcy hits at the least opportune times – usually when you don’t have the money to pay the legal fee and maybe when a wage garnishment, car repo, or sheriff sale is imminent. Payment plans are the answer. Click here to see our latest payment plans.

How much does a bankruptcy attorney cost?

The cost of a Chapter 7 bankruptcy attorney varies geographically but typically is between $800 and $2500.

How much does a bankruptcy lawyer charge?

Payment plans vary, but many firms allow you to retain their services for as little as $100. This won’t get your case filed but can give you some immediate relief by allowing you to refer any collection calls to your bankruptcy lawyer’s office.

Is a lawyer more involved in Chapter 13 bankruptcy than in Chapter 7?

The role of an attorney in a Chapter 13 bankruptcy is significantly more involved than his role played in a Chapter 7 bankruptcy.

Do bankruptcy attorneys charge a fee?

The good news is that the majority of bankruptcy attorney does not require the full fee before filing your case, and include the majority of their fees in the bankruptcy repayment plan.

How much does a bankruptcy lawyer cost in 2021?

as of 2021 falls somewhere in between $200 and $400 per hour. Of course, this is an estimate and will vary on a case-by-case basis. For instance, costs can be as high as $2,000 for a complicated bankruptcy case, or as low as $500 for a straight-forward filing.

What does it mean to bill a bankruptcy lawyer at an hourly rate?

Alternatively, a bankruptcy lawyer may decide to bill at an hourly rate instead. As the phrase implies, it means that a client will be charged for how much work a bankruptcy lawyer did on their case per hour. In general, bankruptcy cases typically require ...

Why do you need a bankruptcy lawyer?

There are numerous advantages to hiring a bankruptcy lawyer when filing a petition for bankruptcy . Some of those advantages may include the following: Having a legal professional present to ask questions about a case and to explain various bankruptcy laws or requirements;

What is the job of bankruptcy attorney?

Gathering, drafting, and reviewing all documents and any evidence pertaining to the bankruptcy matter.

What is the primary goal of bankruptcy?

The primary goal of bankruptcy is to restructure and manage a person’s overwhelming debts. In some cases, such as those for Chapter 7 bankruptcy, the purpose may shift to partially reducing or entirely eliminating such debts. Bankruptcy attorneys can provide a wide range of legal services to help their clients achieve these goals. Some examples of what a bankruptcy attorney does on a regular basis can include:

What are administrative expenses?

Expenses related to administrative tasks, such as photocopying, printing the filing forms for court, and the cost of mailing such forms.

What expenses should be included in a bankruptcy filing?

Expenses related to administrative tasks, such as photocopying, printing the filing forms for court, and the cost of mailing such forms. In addition, a debtor should also incorporate the expenses associated with a further dispute or issue related to a bankruptcy case.

Popular Posts:

- 1. attorney lawyer who handles wills

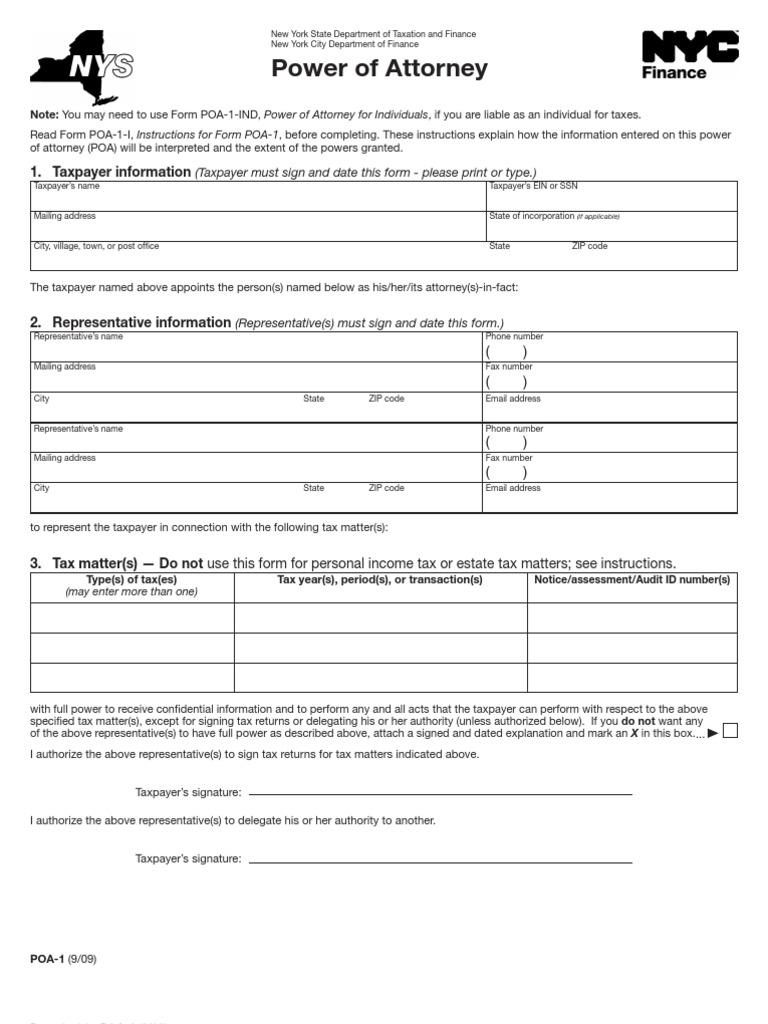

- 2. individual with power of attorney is an example of what authority

- 3. who was the defense attorney of the oj simpson trial

- 4. who is the deputy attorney general 2017

- 5. how many hours should an attorney spend on your custody modification

- 6. where do i find an attorney bar number in florida

- 7. who was the first black man in shelby county to become county attorney

- 8. attorney in philadelphia who handle rape case

- 9. how to file power of attorney in maryland

- 10. who is a good attorney cumberland county illinois for a wiil