How Much Do Pennsylvania Attorneys Charge as Estate Fees

| 00.01 | 25,000.00 | 7% | 1,750.00 | 1,750.00 |

| 25,000.01 | 50,000.00 | 6% | 1,500.00 | 3,250.00 |

| 50,000.01 | 100,000.00 | 5% | 2,500.00 | 5,750.00 |

| 100,000.01 | 200,000.00 | 4% | 4,000.00 | 9,750.00 |

| 200,000.01 | 1,000,000.00 | 3% | 24,000.00 | 33,750.00 |

Full Answer

How much should I expect to pay for a lawyer?

52 rows · Aug 17, 2021 · Lawyers work with different types of billing structures which can also affect the overall price of ...

What is the average hourly fee for an attorney?

Jul 14, 2020 · Sometimes attorneys require money down in the form of a retainer. Types of Fee Agreements Hourly Rate Legal Fees Under an hourly rate agreement, the attorney gets paid a set hourly rate for their work. Typical hourly rates range from $100 per hour in more rural areas to $300+ in more metropolitan areas.

Why do lawyers earn so much?

Apr 11, 2022 · Some lawyers charge hourly fees, which can range from $100 to $350 or more per hour. Hourly fees depend on the attorney’s specialty, experience, and amount of work a case entails. It is also common practice to charge different rates for different services.

How much will it cost to become a lawyer?

If you plan on visiting the USA and need a temporary B-1 Visa, attorney fees are typically around $400, and your filing takes five business days of processing. When renewing, extending, or changing a B-1 or B-2 Visa, attorney fees are about $400, USCIS fees are $370, and processing time takes 60 to 90 days. Spouse & Fiance Visa Cost

How much does an attorney charge per hour?

Attorney fees typically range from $100 to $300 per hour based on experience and specialization. Costs start at $100 per hour for new attorneys, but standard attorney fees for an expert lawyer to handle a complex case can average $225 an hour or more.

What is statutory fee?

A statutory fee is a payment determined by the court or laws which applies to your case. You'll encounter a fixed statutory fee when dealing with probate or bankruptcy, for example.

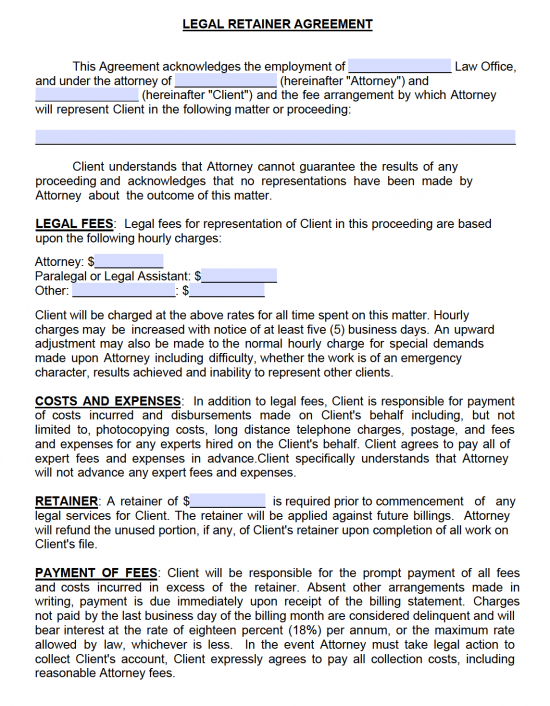

What is retainer fee?

An attorney retainer fee can be the initial down payment toward your total bill, or it can also be a type of reservation fee to reserve an attorney exclusively for your services within a certain period of time. A retainer fee is supposed to provide a guarantee of service from the lawyer you've hired.

How to avoid disagreements with your attorney?

Avoid disagreements with your attorney about how much you owe by taking the time to review your attorney fee agreement carefully. You may also hear this document called a retainer agreement, lawyer fee agreement or representation agreement. Either way, most states require evidence of a written fee agreement when handling any disputes between clients and lawyers. You must have written evidence of what you agreed to pay for anyone to hold you accountable for what you have or have not spent.

What is contingency fee?

An attorney contingency fee is only typical in a case where you're claiming money due to circumstances like personal injury or workers' compensation. You're likely to see attorney percentage fees in these situations to average around a third of the total legal settlement fees paid to the client.

What happens if you don't pay a flat fee?

However, if you don't comply with every single term listed on the flat fee contract, then your attorney still has the right to bill you for additional costs that may come up in your case. For instance, a flat fee lawyer working on an uncontested divorce case may still charge you for all court appearances.

What to ask when hiring an attorney?

When hiring your attorney, ask for a detailed written estimate of any expenses or additional costs. They may itemize each expense out for you or lump their fees all together under different categories of work. Lawyers may bill you for: Advice. Research.

Why do attorneys charge different fees?

Some attorneys charge different amounts for different types of work, billing higher rates for more complex work and lower rates for easier tasks .

What expenses do clients have to pay for a lawyer?

Clients may also be responsible for paying some of the attorney or law firm’s expenses including: Travel expenses like transportation, food, and lodging; Mail costs, particularly for packages sent return receipt requested, certified, etc; Administrative costs like the paralegal or secretary work.

Why do lawyers need to put contracts in writing?

A written contract prevents misunderstandings because the client has a chance to review what the attorney believes to be their agreement.

What are the biggest concerns when hiring a lawyer?

Attorney fees and costs are one of the biggest concerns when hiring legal representation. Understanding how attorneys charge and determining what a good rate is can be confusing.

What is flat rate legal fees?

Flat rate legal fees are when an attorney charges a flat rate for a set legal task. The fee is the same regardless of the number of hours spent or the outcome of the case. Flat rates are increasingly popular and more and more attorneys are willing to offer them to clients.

What are the costs of a lawsuit?

Some common legal fees and costs that are virtually inescapable include: 1 Cost of serving a lawsuit on an opposing party; 2 Cost of filing lawsuit with court; 3 Cost of filing required paperwork, like articles forming a business, with the state; 4 State or local licensing fees; 5 Trademark or copyright filing fees; and 6 Court report and space rental costs for depositions.

What factors determine if a lawyer's fees are reasonable?

Factors considered in determining whether the fees are reasonable include: The attorney’s experience and education; The typical attorney fee in the area for the same services; The complexity of the case; The attorney’s reputation; The type of fee arrangement – whether it is fixed or contingent;

How much does an immigration lawyer cost?

An immigration lawyer charges between $150 and $300 per hour, with a typical 30-min consultation fee of $75 to $150. Legal assistance when filing basic immigration forms costs $250 to $800, while green card assistance runs from $800 to $5,000, plus the USCIS fees of $460 to $700.

How much does it cost to get a K-1 visa?

Attorney fees for filing a K-1 Visa Petition for the fiance of a U.S. Citizen is around $725 with the USCIS fees costing $535. Typical processing time is 7 to 10 months.

How much does a green card lawyer cost?

Green Card lawyer fees range from $795 to $2,900 depending on your situation. Green Card lawyer fees for a sibling or parent of a U.S. Citizen is around $795. An employee sponsored labor certification costs $2,000 in attorney fees, $700 in USCIS filing fees, and takes 2 to 3 years to process.

What do immigration lawyers know?

Unlike the average citizen with no experience, an immigration lawyer will know exactly which forms to file and when. Also, the level of advice you'll receive is often invaluable, especially when you need to prepare for an interview or court date.

How much does an immigration attorney charge?

In most cases, an immigration attorney will charge an hourly rate of $150 to $300 per hour, whereas others will charge a set fee for the entire process. For basic immigration form filing, you can expect to pay around $250 to $1,200 in fees. Immigration attorney fees significantly range, depending on the types of services ...

Total Fees Charged by Estate Administration Lawyers

In our survey, more than a third of readers (34%) said that their lawyers received less than $2,500 in total for helping with estate administration. Total fees were between $2,500 and $5,000 for 20% of readers, while slightly more (23%) reported fees between $5,000 and $10,000.

How Lawyers Charge for Probate and Other Estate Administration Work

The total fees that estates paid for legal services were based on one of three types of fee arrangements charged by attorneys for probate and other estate administration work: hourly fees, flat fees, and fees based on a percentage of the estate’s value.

Free Consultation With Probate Lawyers

More than half (58%) of the probate attorneys in our national study reported that they offered free consultations. The typical time for these initial meetings was 30 minutes, though the overall average was higher (38 minutes).

How much does an attorney charge per hour?

While most attorneys charge a flat rate, some will charge by the hour, with hourly rates ranging from $150 to $350, according to Thumbtack.

Do you need a real estate attorney to close a house?

Some states require a real estate attorney for closing, while others don’t. In states that don’t require an attorney, it’s still a good idea to consider hiring one to help make sure everything is in good order. How much does a real estate attorney cost may factor into your decision-making given how many costs are associated with closing on a house .

Why do estate lawyers charge flat fees?

Lawyers like flat fees for several reasons. First, they can use forms that they've already written – most estate planning lawyers have a set of standard clauses that they have written for different situations, which they assemble into a will that fits a new client's wishes. It won't take a lawyer much time to put your document together, ...

How much does a lawyer charge for a will?

Depending on where you live and how complicated your family and financial circumstances are, a lawyer may charge anything from a few hundred to several thousand dollars for a will and other basic estate planning documents.

How much does a lawyer charge for a living trust?

It's rare to see a price of less than $1200 or $1500 for a trust. One caveat: After your will has been property signed and witnessed, you're done. But after a living trust is drawn up ...

How long does a lawyer keep track of their time?

Many lawyers keep track of their time in six-minute increments (one-tenth of an hour). That means that you'll never be billed for less than six minutes' of the lawyer's time, even if the lawyer spends just two minutes on the phone with you.

What is a durable power of attorney?

Durable power of attorney for finances. Advance directive (durable power of attorney for health care and living will—these may or may not be combined into one document, depending on state law) This is good advice because every adult should have these durable powers of attorney.

Does an estate planning attorney charge more than a general practitioner?

A lawyer who does nothing but estate planning will probably charge more than a general practitioner, but should also be more knowledgeable and efficient. (See details of hourly fees reported by estate planning attorneys around the country.)

Can a lawyer recommend a living trust?

(See the results of this national survey on how much lawyers charge to prepare estate planning packages .) A lawyer may also recommend a living trust, which will let your family avoid the expense and delay of probate court proceedings after your death.

How much can an attorney charge for Social Security?

The attorney and the client can agree on any fee, as long as it does not exceed $6,000 or 25% of your backpay, whichever is less. That limit on fees is a part of Social Security law, and in most cases, an attorney can't charge more than that.

What expenses do lawyers pay for Social Security?

In a typical Social Security case, an attorney will pay copying fees and postage to get records to help prove that a claimant is disabled.

What does a disability lawyer do?

A disability lawyer generally gets a quarter of your Social Security back payments, if you win. Social Security attorneys work "on contingency," which means that they collect a fee only if they win your disability claim. Whether you are applying for SSDI (Social Security disability) or SSI (Supplemental Security Income), ...

How much can a lawyer collect on Social Security backpay?

For example, if your backpay award is $20,000 , your attorney can collect $5,000 (25% of $20,000). Second, the agreement must be signed by the Social Security claimant and the attorney. If the claimant is a child, a parent should sign for the child. If the claimant is an adult with a guardian, the guardian should sign.

How much does it cost to copy a medical record?

Usually, copying and mailing costs in a case are not more than $100 - $200.

Can a disability lawyer file a fee petition?

If a disability case requires multiple hearings or an appeals to the Appeals Council or federal court, a disability lawyer is permitted to file a fee petition with SSA to request to be paid more than the $ 6,000 limit. Social Security will review the fee petition and will approve it only if it is reasonable. To learn more, read Nolo's article on ...

Do you get paid for SSDI if you have an attorney?

Even if your case goes on for years, an attorney will not get paid until it is over (and won).

Popular Posts:

- 1. how much family attorney cost

- 2. i referral a case to attorney how to get money

- 3. dc attorney who represented redskins food workers

- 4. what kind of an attorney handles lawsuits against pharmaceutical companies

- 5. when does the texas district attorney get involved in el paso county

- 6. how much should a enniment domain attorney charge

- 7. if the attorney brings the charge what will be filed

- 8. what does it mean when an attorney files for discovery

- 9. what happens to your bankruptcy wheyour attorney leaves practice

- 10. what paper do you need two physicians to sign for power of attorney