If you have an attorney assist you with closing, you’ll need to pay their fees. These vary greatly across New York. On average, an attorney's fees are around $250 per hour. If you purchase a home for over $1,000,000 in New York City, you will need to pay the New York City Mansion Tax.

How much are real estate attorney fees for closing?

Nov 07, 2018 · In the Empire State, homebuyers must cough up between 2.65% and 3.32% of their property’s purchase price to cover closing. Average closing costs in New York. Across the state, the average home sale price is between $400,000 and $500,000. If you buy a home in that price range, the average closing costs before taxes are $5,571.32. These fees pay for processing, …

How much does a real estate lawyer cost in NYC?

Jul 06, 2018 · Closing costs in New York can range from as low as 1.5% to as high as 6% of the purchase price for buyers. As for sellers, the closing costs can vary from 8% to 10% of the price. As expected, New York can be expensive. But, mistakes in the closing process can cost large amounts of money.

What is the average fee for a real estate attorney?

Dec 09, 2019 · The average real estate attorney fee for a purchase or sale transaction in NYC is $2,000 to $3,000. Lawyer fees can be as high as $5,000 for a more complex transaction and for new developments. There are also light-touch, discount …

How much are closing costs for sellers?

Jan 18, 2022 · Attorney fees: These start at $3,000 for a standard deal and can increase for a more complex transaction, such as purchases involving two units that you plan to combine. This is not an area to skimp on, so steer clear of attorneys who say they can do this for $1,500 or who don't specialize in New York City real estate closings.

How much does it cost to close on a house in NY?

Average Closing Costs in NY for Buyer Average closing costs in NY for the buyer are between 1.5% and 5% of the purchase price.Jul 6, 2018

How much do real estate attorneys charge in New York?

The typical real estate attorney based in NYC will charge anywhere from $2,000 to $3,000 for a normal purchase or sale transaction. Rates are higher for real estate lawyers based in New York City vs attorneys based in lower cost locations such as Long Island or the Hudson Valley.

What are the average New York City lawyer attorney fees?

The typical lawyer in New York charges between $122 and $485 per hour. Costs vary depending on the type of lawyer, so review our lawyer rates table to find out the average cost to hire an attorney in New York....How much do lawyers charge in New York?Practice TypeAverage Hourly RateTrusts$474Wills & Estates$33723 more rows

Why are closing costs so high in New York?

Why are NYC condo closing costs higher? It's a double whammy, condos cost more in price terms and they also have higher real estate closing costs! The reason is that when you are purchasing a condo with a mortgage you a required to pay a mortgage recording tax and typically required to purchase title insurance.Jan 3, 2022

Do you need an attorney to buy a house in NY?

If you are buying a home in New York, you will need to hire an attorney to negotiate the contract of sale and to represent you at the closing. ... You might also want to hire a buyer's agent to help you find a home to purchase and advise you when making an offer.

How much does a lawyer cost?

You can pay anywhere from $50 to thousands per hour. Smaller towns and cities generally cost less while heavily populated, urban areas are most expensive. The more complicated the case and the more experienced the attorney, the more you'll pay. Lawyer fees can range from $255 to $520 per hour.

How much is a retainer fee for a lawyer?

Overview. A retainer fee can be any denomination that the attorney requests. It may be as low as $500 or as high as $5,000 or more. Some attorneys base retainer fees on their hourly rate multiplied by the number of hours that they anticipate your case will take.

What does a real estate attorney do for a buyer?

A real estate attorney's role is to ensure the legal transfer of property from seller to buyer. These attorneys handle tasks like preparing or reviewing documents, ensuring that the title is clear and facilitating the transfer of funds.Apr 6, 2021

How much do the most expensive lawyers cost?

Topping the list of the country's most expensive lawyers is Kirkland & Ellis partner Kirk Radke. The private equity and corporate counsel bills $1,250 per hour.Oct 4, 2017

How much is closing cost?

What are closing costs? Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about 3-5% of your loan amount and are usually paid at closing.

Are closing costs negotiable?

But at this point, you may be wondering, are closing costs negotiable? The short answer is yes – when you're buying a home, you may be able to negotiate closing costs with the seller and have them cover a portion of these fees.Jun 2, 2021

Do sellers pay closing costs in NY?

Seller closing costs in NYC are between 8% to 10% of the sale price. Closing costs include a traditional 6% broker fee, combined NYC & NYS Transfer Taxes of 1.4% to 2.075%, legal fees, a building flip tax if applicable as well as building and miscellaneous fees.

Do sellers pay closing costs in NY?

Seller closing costs in NYC are between 8% to 10% of the sale price. Closing costs include a traditional 6% broker fee, combined NYC & NYS Transfer Taxes of 1.4% to 2.075%, legal fees, a building flip tax if applicable as well as building and miscellaneous fees.

Is NY An attorney state for real estate closings?

Several states have laws on the books mandating the physical presence of an attorney or other types of involvement at real estate closings, including: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New ...

How much are closing fees in NY?

Closing CostsFor the PurchaserClosing Costs for CondominiumsNYC Transfer Tax1% of price up to $500,000; or, 1.425% of price if $500,000 and over. Plus $25 administrative fee.NYS Transfer Tax$4.00 per $1,000.00 of price, or 0.4% of purchase price23 more rows

How much does a real estate attorney cost in NY?

The typical real estate attorney based in NYC will charge anywhere from $2,000 to $3,000 for a normal purchase or sale transaction. Rates are higher for real estate lawyers based in New York City vs attorneys based in lower cost locations such as Long Island or the Hudson Valley.

Do you need an attorney to buy a house in NY?

If you are buying a home in New York, you will need to hire an attorney to negotiate the contract of sale and to represent you at the closing. ... You might also want to hire a buyer's agent to help you find a home to purchase and advise you when making an offer.

Is NY An attorney state?

Are You In An Attorney State?StateAttorney State?New YorkYes - Attorney StateNorth CarolinaYes - Attorney StateNorth DakotaYes - Attorney StateOhioNo47 more rows•Jan 4, 2022

What does a real estate attorney do for a buyer?

A real estate attorney's role is to ensure the legal transfer of property from seller to buyer. These attorneys handle tasks like preparing or reviewing documents, ensuring that the title is clear and facilitating the transfer of funds.Apr 6, 2021

What is the average closing cost in New York?

Average closing costs in New York. Across the state, the average home sale price is between $400,000 and $500,000. If you buy a home in that price range, the average closing costs before taxes are $5,571.32. These fees pay for processing, appraisal and recording fees, plus title insurance, municipal searches and more.

How long does it take to get a good faith estimate of closing costs?

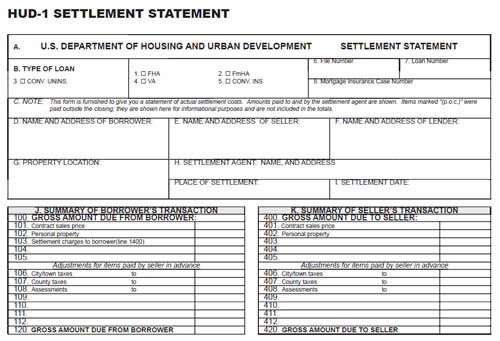

Under the Real Estate Settlement Procedures Act (RESPA), lenders are required to provide buyers with a good-faith estimate of their closing costs within three days of receiving the mortgage application. ClosingCorp. (May 2021).

What is a co-op in New York?

While closing costs for condos and homes are straightforward, co-ops are a different animal — and they make up 75% of housing in New York City. Unlike condos and houses, co-ops are owned by a corporation. If you buy an apartment inside a co-op building, you’re not actually purchasing property: You’re buying shares of the corporation.

What is the mortgage tax rate in New York City?

New York City mortgage tax — paid by borrower. Mortgage of up to $500,000: 1.80%. Mortgage of $ 500,000 or more on one - to three-family residential building: 1.925%. Mortgage on other properties of $500,000 or more: 2.80%. Miscellaneous condominium fees: Varies.

Where is Katia Iervasi?

Katia Iervasi is a staff writer who hails from Australia and now calls New York home. Her writing and analysis has been featured on sites like Forbes, Best Company and Financial Advisor around the world. Armed with a BA in Communication and a journalistic eye for detail, she navigates insurance and finance topics for Finder, so you can splash your cash smartly (and be a pro when the subject pops up at dinner parties).

Do you pay flip tax as a seller?

In other words, you’re an investor — not an owner. All of these factors affect closing costs for the buyer and the seller. As a seller, you’ll pay a flip tax, a stock transfer tax, a move-out fee and miscellaneous co-op fees, along with a slew of standard city and state fees, .

What is the average closing cost in New York?

Closing costs in New York can range from as low as 1.5% to as high as 6% of the purchase price for buyers. As for sellers, the closing costs can vary from 8% to 10% of the price. As expected, New York can be expensive.

What is closing cost?

Closing is the period during the real estate sales process where the title of the property is transferred from the seller to the buyer. Closing involves costs. Closing costs can include many of the following items: Fees the lender charges you to process and finalize your loan; Appraisal fees; Inspection fees;

How long do you have to put money in escrow before closing?

Property tax escrow: generally, your lender will require you to place a sum of money into an escrow account prior to closing to cover property taxes for at least a month so that in the event of a mortgage default, the bank can continue to pay property taxes for you.

What is loan estimate?

As explained above, the Loan Estimate is a document that includes the breakdown of the approximate payments due upon the closing of a mortgage loan. As the outline is simply an estimate, the actual closing costs could be either lower or higher at closing, but the outline is always reasonably accurate.

Is closing cost mandatory in NYC?

Certain closing costs are mandatory, including certain taxes and fees for the purchase and sale of home that NYC imposes on all properties. In addition to the fees and taxes on all property sales, there can be additional costs depending on the type of property being sold.

What is the mortgage tax rate in New York?

In New York City, the mortgage recording tax is based on the mortgage amount. If the mortgage amount is less than $500,000 on a residential property, the tax is 1.8% of the mortgage, if the mortgage is $500,000 or more than the mortgage recording tax is 1.925%.

What does an attorney do at closing?

After that, your attorney will help you calculate the amount that you will owe to the sellers at closing. Additionally, your attorney will help you determine how much you will owe to any applicable lenders, the title company, and any other third-party entities involved in the transaction (such as co-op boards).

How much does a real estate attorney charge in 2021?

June 4, 2021. The average real estate attorney fee for a purchase or sale transaction in NYC is $2,000 to $3,000. Lawyer fees can be as high as $5,000 for a more complex transaction and for new developments.

Why are real estate attorney fees so high?

Real estate attorney fees can be higher for more complex transactions that will simply take more of the lawyer’s time. For example, real estate lawyer fees could be higher for a complicated estate sale with heirs that are hard to track down and a power of attorney involved. Or the real estate attorney fees could be higher for a purchase involving ...

Can an attorney be unfamiliar with NYC real estate?

An attorney who is unfamiliar with NYC real estate may not be aware of the norms in a contract or the expected timeline for completing buyer due diligence and contract negotiation .

Can real estate lawyer fees be doubled?

Real estate lawyer fees can often be doubled when buying a new construction home in NYC. That’s because developers typically expect the buyer to pick up some of their closing costs such as NYC and NY State transfer taxes and the sponsor’s attorney fees.

Do real estate attorneys pay at closing?

Real estate attorney fees are typically taken at closing and will be part of the closing costs mentioned in your lawyer’s closing statement. Some lawyers may negotiate for half or some other portion of the fee to be paid upfront, with the remainder to be paid at closing. Some lawyers may ask for an engagement letter to be signed outlining ...

Is Hauseit LLC a real estate broker?

No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Hauseit LLC is a Licensed Real Estate Broker, licensed to do business in New York under license number 10991232340. Principal Office: 148 Lafayette Street, New York, NY 10013.

Do real estate attorneys charge hourly fees?

No. Real estate attorney fees are typically structured as a flat fee per completed transaction. You should be careful of any lawyer asking for hourly pay for a real estate deal as that’s a sure sign that the lawyer does not specialize in real estate transactions.

How much does an attorney charge for a condo?

Attorney fees: Attorney fees start at $3,000 for a standard transaction—and can go higher. Building fees: Most condo and co-op buildings charge move-in and move-out fees, which can range from a few hundred to a couple of thousand dollars each, and a managing agent and co-op attorney fee of around $1,500.

What is the largest closing cost for a seller?

At 5 to 6 percent of the sale price, a broker’s commission is by far the largest closing cost for sellers. Aside from trying to negotiate the fee down, consider working with a brokerage that rebates part of its commission to you.

How much tax is saved on a CEMA purchase?

For example, if the seller has an $800,000 balance on their mortgage, and the buyer is getting a $1,000,000 mortgage, then the mortgage tax to be saved by doing a purchase CEMA is approximately $15,400. There are usually $1,000-$2,000 in extra fees to achieve those savings.

What is a CEMA mortgage?

If you’re getting a mortgage and your seller is still paying off their own mortgage, you can ask your attorney if a Purchase Consolidation Extension and Modification Agreement, or "purchase CEMA" makes sense. This little-known mortgage maneuver involves combining the seller’s mortgage with the buyer’s mortgage and then legally modifying the terms to current rates.

How much does a broker charge for a 1 million apartment?

On a $1 million apartment, a 6 percent broker fee comes to $60,000.

What does it mean when there is an oversupply of apartments in NYC?

That said, an oversupply of apartments in high-end buildings in NYC means many developers ("sponsors") are willing to pay your transfer tax, attorneys fees and other miscellaneous fees. You’re even more likely to get a break where the developer has just a few units left to sell and they are willing to make a deal.

How much are flip taxes?

Flip taxes: Some co-op and condo buildings have flip taxes (also known as transfer fees) ranging anywhere from 1 to 2 percent of the purchase price up to 3 to 5 percent. Some buildings charge 10 percent of the seller's profit.

What is flip tax?

Flip Tax/Fee – Flip Taxes are a fee the Coops Board of Directors sets to collect money from the seller when they are leaving the association. The amount you pay could follow a few different models, either a flat fee, percentage of gross sales price, set dollar amount per share owned in the coop or a percentage of the net profit. It’s a fee that the coop uses to increase their reserves to put toward the operation of the coop.

Where do Mike and Amanda live?

Mike and Amanda own a cozy single family home in Huntington Long Island, they need to sell in order buy a larger home for their growing family. After preparing their home for selling, they hire a Realtor and list their house for sale on the Long Island MLS for $350,000. After a few weeks of being on the market they find a buyer ...

Does a transfer agent charge for a coop?

Transferring Agent Fee – This is a processing fee the Master Agent of the coop will charge in order for them to process the transfer on the coop’s end. Yes, this is in addition to the attorney fee, everyone wants to be compensated for their time.

What happens at the start of closing?

At the start of the closing process, you’ll go through an attorney review. At this point, you’ll be sitting down with the seller and their attorney while you exchange keys, funds, and the title. Because these attorneys are required, their fees are going to add in to the total cost of the home.

How much are transfer taxes in New York?

In New York, transfer taxes cost 1.8% of the sale price of a home under $500,000 or 1.4% of a home that goes over that mark. For buyers who weren’t able to cover the costs of 20% down payment, lenders might still allow you to get a mortgage but will require you to get private mortgage insurance.

How long does it take to get a home with a certification?

After you take their course and if you meet the qualifications, you’ll have six months to find a home with certification that you’re an eligible buyer. If you choose to work with a Clever Partner Agent, they’ll help you to qualify for a $1,000 rebate on your closing costs.

What to think about when buying a home?

When you buy a home, it needs constant care and investment to stay valuable and comfortable. No housing material is built to last forever and every home will need repairs and replacements from time to time.

Why is it important to choose a home?

Because there are so many additional fees that come with buying a home, it’s important that you choose a home within your budget. If you go over your budget on your mortgage, you could end up digging yourself into a hole for the next few years in closing costs.

Who pays transfer tax on $300000 mortgage?

They want to make sure that if they’re giving you a $300,000 mortgage that the home is actually worth that much. Sellers are usually responsible for paying the transfer tax on the home but in most deals, the actual cost is covered by the buyer, even though it’s the seller who submits the cost.

Does housing material last forever?

No housing material is built to last forever and every home will need repairs and replacements from time to time. You’ll be tasked with covering the costs of utilities every single month. This might seem like no big deal but if you’re moving from a small home to a larger one, the costs could be exponentially higher.

How much does an attorney charge for closing in New York?

These vary greatly across New York. On average, an attorney's fees are around $250 per hour.

How much does a home seller pay in closing costs in New York?

New York home sellers should expect to pay 1-3% of their home’s sales price in closing costs, plus both the listing and buyer’s agents’ commissions. Here, we’ll go over these expenses to help you better budget, find ways to save, and prepare for your home sale.

How much does a seller pay at closing?

Sellers will typically be on the hook for 1-3% of their home’s sales price in closing costs. But this doesn’t include the realtor commissions the seller will also pay at closing. Usually, sellers will pay 6% in commissions, which covers both the listing agent’s and the buyer’s agent’s fees. In some cases, the seller will offer to pay some ...

What are closing costs for a home sale in New York?

Closing costs for sellers in New York typically range from 1-3% of their home’s closing price, and are paid in addition to the typical 6% realtor commission ...

What is the median price of a home in New York in 2020?

As of November 2020, the median list price for New York homes is $331,459. If you sell your home for this price, you’ll need to pay between $3,315 (1%) and $9,944 (3%) in closing costs. To reiterate, this does not include realtor commission fees. You will need to pay an additional $19,888 (6%) in commission fees for a home sold at this price, ...

How much does a title search cost?

This makes sure that the seller can legally sell the property. A typical title search will cost sellers $300-$600, according to realtor.com.

How much tax do you have to pay on a home in New York?

New York state has very complex real estate tax regulations. Throughout most of the state, sellers are required to pay 0.4% of their home’s closing price. In New York City, the rate is 1% for homes sold for under $500,000 and 1.425% for properties that sell above this threshold.

Popular Posts:

- 1. how do i get help getting money for an attorney

- 2. attorney who specilaize in sec trading

- 3. what happens if an attorney witholds evidence of innocence?

- 4. who can sign a hipaa authorization and can attorney representing the client

- 5. harlan fiske stone, who became attorney general in 1924

- 6. how to contact the missouri attorney general

- 7. how to submit to the pa attorney general

- 8. how are district attorney election in louisiana

- 9. why do you want to be an attorney

- 10. when is election day for governor and attorney general in illinois