Probate attorney fees in Michigan depend on the specific details of the estate and how complicated the proceedings will be. Attorney fees in the state can cost anywhere from four to eight percent of the estate value. How to Avoid Probate in Michigan

How much does probate attorney cost?

Probate attorney fees in Michigan depend on the specific details of the estate and how complicated the proceedings will be. Attorney fees in the state can cost anywhere from four to eight percent of the estate value. How to Avoid Probate in Michigan There are a handful of ways to avoid probate in the state of Michigan.

Who pays for a probate attorney?

Probate Court Fee Tables January 2019 FEES APPLICABLE TO MULTIPLE TYPES OF CASES Type of Filing or Request1 Authority (MCL) Fee Amount2 Waivable3 Distribution Demand for Jury Trial 600.857(3) $30.00 Yes Funding Unit Motion 600.880b(1) $20.00 Yes $10 Funding Unit $10 State Court Fund Objection 600.880b(1) $20.00 Yes $10 Funding Unit

Do lawyer fees have to be paid before a probate?

Feb 01, 2018 · Attorneys are entitled to charge a reasonable fee for all work performed. Depending on the size and complexity of your loved one's estate, you can expect to incur several thousand dollars in Michigan probate attorney fees. But the money for that bill doesn't come out of the administrator's pocket. How Do Michigan Probate Attorney Fees Get Paid?

What taxes and fees are associated with probate?

But you should expect to pay most of the following common fees along the way: Filing Fee - The initial fee you’ll pay to petition the court and begin the process. Based on the estimated size of the estate to be settled. * Filing fees can generally range anywhere from $50 - $1,200.

How much does it cost to go through probate in Michigan?

In an estate of value of less than $1,000.00, $5.00 plus 1% of the amount over $500.00. In an estate of value of $1,000.00 or more, but less than $3,000.00, $25.00. In an estate of value of $3,000.00 or more, but less than $10,000.00, $25.00 plus 5/8 of 1% of the amount over $3,000.00.

How much does an attorney charge for probate?

The expenses can quickly become overwhelming. One of the costliest parts of the probate process for many families is the cost of hiring an attorney. On average, a probate attorney costs between $3500 and $7000 for simple cases.Mar 11, 2020

How much does an executor of an estate get paid in Michigan?

Executor Fees in Michigan For example, if in the last year, executor fees were typically 1.5%, then 1.5% would be considered reasonable and 3% may be unreasonable. But the court can take into account other factors such as how complicated the estate is to administer and may increase or decrease the amount from there.

How much should I pay for probate?

How much do probate services cost? Some probate specialists and solicitors charge an hourly rate, while others charge a fee that's a percentage of the value of the estate. This fee is usually calculated as between 1% to 5% of the value of the estate, plus VAT.

How much does an estate have to be worth to go to probate?

Every state has laws that spell out how much an estate would need to be worth to require the full probate process—anywhere from $10,000 to $275,000.Dec 17, 2021

How much do probate lawyers charge per hour?

Probably the most common way for probate lawyers to charge clients is to bill by the hour. Hourly rates vary depending on where you live and how experienced (and busy) the lawyer is. In a rural area, you might be billed $150/hour; in urban areas, you're more likely to see rates of $200/hour and up.

How long does an executor have to settle an estate in Michigan?

Statutes say that probate should be finished within one year, but special circumstances may cause it to go longer.

What is the normal fee for an executor of a will?

How much are executor fees? Executors can be paid a flat fee, an hourly rate, or a percentage based on the gross value of the estate. When the fees are based on the estate value, they are usually tiered — like 4% of the first $100,000 of the estate, 3% of the next $100,000, and so on.Jun 25, 2021

What is a reasonable trustee fee in Michigan?

In Wayne County, Michigan, for instance, professional trustee companies might charge a fee between 1% and 1.5% per year of the assets managed. A personal representative of an estate who is not a professional might reasonably be paid $30-$40 per hour for their time spent on behalf of the estate.Jan 25, 2018

Do I need to send death certificate for probate?

You'll need a copy of the death certificate for each of the deceased's assets (eg, each bank account, credit card, mortgage etc), so before you can start probate, you'll need to register the death.Feb 23, 2022

Do all executors have to apply for probate?

Often more than one executor is named in a will, but not all of the executors have to apply for probate. A maximum of four people can apply to the Probate Registry to prove a will and be named on the grant of probate.

Do you have to pay probate fees up front?

The probate application fee must be paid up-front. As a result solicitors are being bombarded by applicants trying to submit forms before the new fees come in.Mar 23, 2019

What is probate in Michigan?

Probate is the formal, legal process that appoints a Personal Representative (Executor) to oversee the distribution of an estate after a decedent's death. The Personal Representative is responsible for paying all taxes and debts the estate may owe, and then transferring asset ownership to the new beneficiaries and heirs. The average cost of probate in Michigan will vary based on a number of factors, including: 1 The size of the estate and how complicated it is 2 Whether or not anyone plans to contest the Will 3 What Estate Plans are valid 4 Whether or not a probate attorney is retained 5 Etc.

What is the UPC in probate?

The Uniform Probate Code (UPC) has been adopted by 18 states (including Michigan). The code tried to create a universal probate process, but it has failed to really make things any easier. The UPC dictates there are three types of probate proceedings: Informal. Unsupervised.

Who is responsible for paying all taxes and debts the estate may owe?

The Personal Representative is responsible for paying all taxes and debts the estate may owe, and then transferring asset ownership to the new beneficiaries and heirs. The average cost of probate in Michigan will vary based on a number of factors, including: The size of the estate and how complicated it is.

Is probate a reasonable compensation in Michigan?

If you use one, attorney fees. Appraisal, Land Survey and Accounting fees. Executor fees/compensation - Michigan is a reasonable compensation state.

What can a probate attorney do in Michigan?

A Michigan probate attorney can help you administer the estate. That includes: Creating an inventory of the estate's assets and debts. Establishing the value of the homes, vehicles, jewlery, and other property within the estate. Filing the appropriate paperwork and appearing in probate court.

What is the purpose of a bill of realtors?

Bills of realtors, appraisers, and other professionals hired to establish the value of estate assets. Homestead and family allowances paid to the deceased's surviving spouse and dependents. Once all those expenses are paid, the rest is distributed to the beneficiaries named in a person's will.

What happens after a loved one dies?

After a loved one's death, many personal representatives don't realize just how many bills, fees, and costs must be paid out of their family member's estate. Before the beneficiaries receive their inheritances, the probate court and your estate administration attorney will make sure the estate pays for:

What are the benefits of a deceased person?

Unpaid taxes in the deceased's name. Medical assistance benefits repayment from a special needs trust. Reasonable and necessary medical expenses from the deceased's final illness. Unpaid creditors including a mortgage, auto loan, credit cards, or other bills. Fees earned by the personal representative.

Can an estate attorney be used to pay for probate?

However, if an attorney represents the estate in another type of case, such as a wrongful death case or personal injury lawsuit, proceeds from that suit can be used to pay probate costs and attorney fees.

Do estate attorneys get money from inheritance?

It is true that attorney fees come out of the same pool of money and assets as inheritance. However, an estate administration attorney is often able to take advantage of informal probate proceedings and negotiate with creditors on behalf of the estate to make the most of those funds.

Does Michigan allow contingency fees?

Depending on the circumstances of your case, these fees will likely be paid on an hourly basis. Michigan law does not allow probate lawyers to enter into contingency fee agreements (where the amount paid is based on the value of the assets) in estate administration matters. However, if an attorney represents the estate in another type of case, ...

How long does probate take?

Probate can take anywhere from a few months to several years to fully complete. For most estates of average size, the process will range from six months to two years. If an estate is especially large, if any heirs contest anything, or if beneficiaries cannot be found, things will take longer.

What does an executor charge for?

Executors can charge a fee to be reimbursed for most expenses they incur. This can include the cost for any travel needed, to pay for tax prep, to buy any supplies, or for anything else required to settle an estate. Executors can also be reimbursed a fair fee for the job they do as a representative of an estate.

What is surety bond?

Surety Bonds offer insurance that protect the estate against anything questionably done by a representative throughout the process. If a bond is required, the amount is typically determined by the estimated size of the estate. Executors can charge a fee to be reimbursed for most expenses they incur.

What are the drawbacks of probate?

Perhaps one of the biggest drawbacks to probate is the cost . And the more it costs, the less inheritance your beneficiaries will receive. Total cost can widely vary, depending on a number of factors including: But there are some things you can count on being fairly consistent in the probate process.

Do you have to pay probate fees out of your estate?

And in some states, you’re actually required to do so by law (although most states do not mandate this). A probate lawyer's fees (and most other costs of probate) are paid out of the estate, so your family will not need to worry about who pays probate fees, and they won’t have to cough up any money out of pocket.

Do all estates need to go through probate?

Depending on how you set it up, your estate may need to go through probate so the courts can begin the process. It’s important to understand that not all estates need to go through probate. And, there are smart, strategic ways you can make probate easier or even eliminate it all together.

Do probate attorneys charge hourly?

At the end of the day, that’s money that could be going to your beneficiaries. Probate lawyer fees can vary - lawyers can charge hourly or a flat rate.

Does the Personal Representative of an Estate Need a Probate Lawyer?

Michigan law imposes substantial fiduciary duties on a person appointed by the probate court to serve as the personal representative of an estate. The laws and procedural rules that apply to probate and estate administration are complex and detailed.

How Much Do Michigan Probate Lawyers Cost?

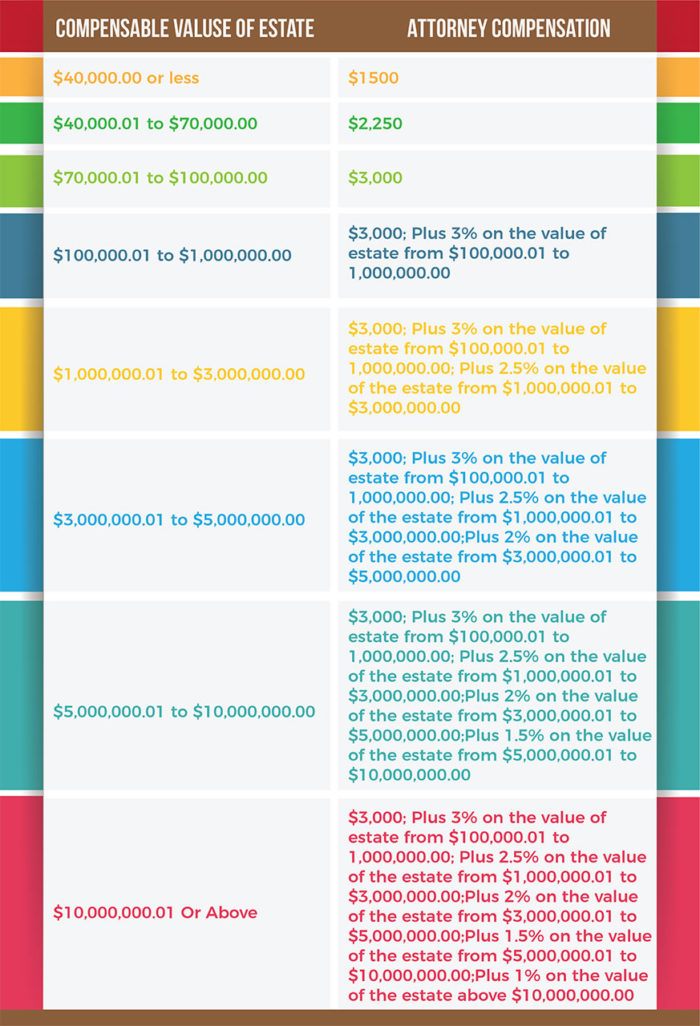

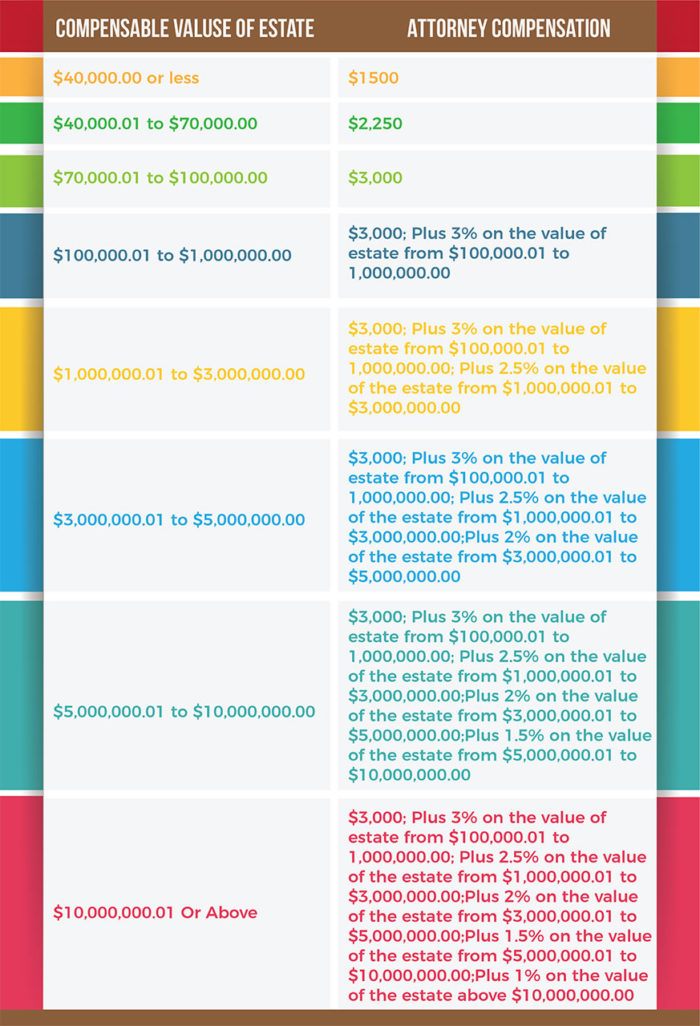

In some states, probate attorneys determine their charges based on a percentage of the assets in the estate. However, Rule 1.5 of the Michigan Professional Rules of Conduct does not permit a lawyer to charge based on the value of the assets in the estate.

Talk With Our Michigan Probate Attorneys

Our lawyers at BRMM have many years of experience assisting clients with probate administration. If you are named as the personal representative of a decedent’s estate and require assistance with estate administration and probate, we can assist throughout the entire process to ensure that all Michigan legal requirements are met.

Total Fees Charged by Estate Administration Lawyers

In our survey, more than a third of readers (34%) said that their lawyers received less than $2,500 in total for helping with estate administration. Total fees were between $2,500 and $5,000 for 20% of readers, while slightly more (23%) reported fees between $5,000 and $10,000.

How Lawyers Charge for Probate and Other Estate Administration Work

The total fees that estates paid for legal services were based on one of three types of fee arrangements charged by attorneys for probate and other estate administration work: hourly fees, flat fees, and fees based on a percentage of the estate’s value.

Free Consultation With Probate Lawyers

More than half (58%) of the probate attorneys in our national study reported that they offered free consultations. The typical time for these initial meetings was 30 minutes, though the overall average was higher (38 minutes).

How much does a probate lawyer charge?

Small town rates may be as low as $150/hour; in a city, a rate of less than $200/hour would be unusual. Big firms generally charge higher rates than sole practitioners or small firms, unless a small firm is made up solely of hot-shot specialists.

Which states allow attorneys to charge a set percentage fee?

State law allows lawyers to charge a set percentage fee in: Arkansas. Missouri. California. Montana. Florida. Wyoming. Iowa. These fees are often high under the circumstances because they are calculated based on the gross value of the probate assets, not the net value.

How long does a lawyer bill?

Many lawyers bill in minimum increments of six minutes (one-tenth of an hour). So, if your lawyer (or a legal assistant) spends two minutes on a phone call on behalf of the estate, you'll be billed for six minutes.

What expenses do you pay separately?

expenses you pay separately, such as court fees, postage, and publication of legal notices. how the lawyer's work will be described on the bills (the work done in each increment of time should be described, so you don't just get a bill for "legal services," "research" or "trial preparation")

Can a paralegal be billed at an hourly rate?

Someone who has steered many probates through the local court has probably learned all the local rules and how to prepare and file documents the way the court likes them. If your attorney employs less experienced lawyers (associates) and legal assistants (paralegals), their time should be billed at a lower hourly rate.

Do lawyers have to pay a percentage fee?

And even in those states, lawyers are not required by law to collect a percentage fee. You can and should try to negotiate an hourly rate or flat fee with the lawyer. But many lawyers prefer the "statutory fee" because it's usually very high in relation to the amount of work they have to do.

Do you have to pay a flat fee for legal work?

It can be a more relaxed experience. If you agree to pay a flat fee for legal work, make sure you understand what it does and does not cover. For example, you may still have to pay separate court filing costs, fees to record documents, or appraiser's fees.

What is the billing method for probate?

Another popular billing method is the flat fee. An attorney who's done a lot of probates knows about how long the work takes, and charging a lump sum means the attorney doesn't have to keep careful records of how the lawyers and paralegals spend their time. Some attorneys also find that clients are more relaxed and comfortable dealing with the attorney when they know the meter isn't always running.

Why are Wyoming probate fees so unreasonable?

One of the reasons these fees are so often unreasonable under the circumstances is that they are based on the gross value of the probate assets, not the actual net value. For example, if the estate contains a house worth $300,000, but there's still $100,000 left on the mortgage, the lawyer's fee is based on $300,000—not the $200,000 ...

What are some examples of real estate fees?

Some examples include court filing fee, postage, publication of legal notices in the newspaper, property appraisals, and recording fee for real estate deeds.

Do specialist attorneys charge more per hour than general practitioners?

Specialists charge more per hour than do general practitioners, but they're likely to be more efficient. If they've filed probate paperwork a hundred times in the local court, they've probably figured out how to do it quickly and in a way the court will accept.

Does probate lawyer fee come out of executor's pocket?

Remember that the estate pays the probate lawyer's fee—it doesn't come out of the executor's pocket. Of course, if you are both the executor and the only inheritor, then the fee does, in essence, come out of money that is soon to belong to you.

Do you have to get a fee agreement for an estate attorney?

When you hire an attorney on behalf of the estate, get a fee agreement in writing. It's required by law in some states, and it's a good idea no matter where you are.

Does flat fee include court filing costs?

If you are quoted a flat fee, make sure you understand what it covers. It likely won't include extra costs such as court filing costs or appraiser's fees. And if you have a complicated case—involving a will contest or an estate tax return, for example—the fee will go higher.

What is extraordinary fee in probate?

An attorney can also ask for "extraordinary fees" for services rendered above and beyond those that are deemed to be basic probate duties. 5

Why do estates of minimal value dodge probate costs?

Estates of minimal value can almost invariably dodge these costs because the probate process is not required for them by law. A simplified, streamlined process is often in place to accommodate them even when probate is required.

What happens if you don't have an estate plan?

Your loved ones will be faced with probating some or all of your assets if you don't have an estate plan and haven't taken steps to avoid the process. The overall cost of probate can vary depending on the type and the value of the estate's property. In general, the greater the value, the more probate will cost.

What is accounting fee?

Accounting fees can include the preparation and filing of estate tax returns if the estate is taxable at the state or federal level. 5 Sometimes the attorney for the estate will prepare and file these returns.

What are miscellaneous fees?

Miscellaneous Fees. Miscellaneous fees can range from the cost of postage to insuring and storing personal property, shipping personal property, and more. And this doesn't include any estate and income taxes that might be due and payable during the course of the probate administration. Taxes can further deplete an estate.

Can you waive the bond requirement in your last will and testament?

11 You can waive the bond requirement in your last will and testament, but a judge might overrule your wishes if children are involved.

Popular Posts:

- 1. how did attorney kardashian die

- 2. how to certify as elder law attorney

- 3. what happens to a medical power of attorney once married

- 4. i want to give my bankrupy attorney a bank account i didnt mentson when i filed

- 5. where is rudolph the defense attorney for the staircase murder now

- 6. deciding what you want your power of attorney to do

- 7. who holds the attorney oaths of office

- 8. when to hire an attorney submit a guest post

- 9. who can sign a customs power of attorney

- 10. what is the work of a title attorney