California probate fees

| Estate Value | Probate Fees (Attorney Fee’s and *Execut ... |

| $100,000 | $4,000 + $4,000 = $8,000 |

| $200,000 | $7,000 + $7,000 = $14,000 |

| $300,000 | $9,000 + $9,000 = $18,000 |

| $400,000 | $11,000 + $11,000 = $22,000 |

What is the average cost of a probate attorney?

Jul 29, 2019 · Probate attorneys typically charge between $250 and $310 per hour to help with estate administration when they bill by the hour. FLAT FEE 32 % Nearly a third of readers said the estate paid a flat fee for a lawyer’s estate administration services.

What are some basic costs related to probate?

State laws dictate how much an Executor can charge (usually a max of 3 - 5 percent of the estate value). Other Fees There may be other miscellaneous fees related to probate. Some of these could include: Appraisal Fees Postage Fees Business Valuation Fees Notary Fees Storage Fees Estate Sale Prep Fees Etc. Probate Costs by State

How much do lawyers charge to settle an estate?

The hourly rate for a probate attorney varies depending on the lawyer's experience, the complexity of the estate, and the location. Generally, rates range from $150 to $400 per hour. For example, an experienced probate attorney in New York City might charge $400 per hour, while a less experienced lawyer in a smaller town might charge $150 per hour.

What are reasonable attorney fees in estate administration?

Your lawyer may let you pick how you pay—for example, $250/hour or a $1,500 flat fee for handling a routine probate case. Hourly Billing Many probate lawyers bill clients by the hour. The hourly rate will depend on how much experience and training the lawyer has, where you live, and whether the lawyer practices in a big law firm or a small one.

How long does probate take?

Probate can take anywhere from a few months to several years to fully complete. For most estates of average size, the process will range from six months to two years. If an estate is especially large, if any heirs contest anything, or if beneficiaries cannot be found, things will take longer.

What are the drawbacks of probate?

Perhaps one of the biggest drawbacks to probate is the cost . And the more it costs, the less inheritance your beneficiaries will receive. Total cost can widely vary, depending on a number of factors including: But there are some things you can count on being fairly consistent in the probate process.

Do probate attorneys charge hourly?

At the end of the day, that’s money that could be going to your beneficiaries. Probate lawyer fees can vary - lawyers can charge hourly or a flat rate.

What is surety bond?

Surety Bonds offer insurance that protect the estate against anything questionably done by a representative throughout the process. If a bond is required, the amount is typically determined by the estimated size of the estate. Executors can charge a fee to be reimbursed for most expenses they incur.

Do you have to pay probate fees out of your estate?

And in some states, you’re actually required to do so by law (although most states do not mandate this). A probate lawyer's fees (and most other costs of probate) are paid out of the estate, so your family will not need to worry about who pays probate fees, and they won’t have to cough up any money out of pocket.

How much does a probate lawyer charge?

Small town rates may be as low as $150/hour; in a city, a rate of less than $200/hour would be unusual. Big firms generally charge higher rates than sole practitioners or small firms, unless a small firm is made up solely of hot-shot specialists.

How long does a lawyer bill?

Many lawyers bill in minimum increments of six minutes (one-tenth of an hour). So, if your lawyer (or a legal assistant) spends two minutes on a phone call on behalf of the estate, you'll be billed for six minutes.

What is probate lawyer?

A probate lawyer is a licensed attorney who specializes in probate matters. Probate lawyer fees, also called estate lawyer fees, are monies paid directly to the attorney for legal services; these are not the same as “probate costs” in general, which can also include the following: Personal representative fees. Court fees.

What is joint ownership?

Joint ownership of property, because property passes directly to other owner without having to go through probate; Designation of intended beneficiaries directly on accounts such as life insurance, retirement, bank (“pay-on-death” or POD), and investment (“transfer-on-death” or TOD), because, again, the account passes directly outside of probate;

Can you avoid probate?

Yes, through smart estate planning, an estate can avoid probate, and, accordingly, probate fees. Common estate planning methods for avoiding probate include the following: Joint ownership of property, because property passes directly to other owner without having to go through probate;

Do estates need a probate lawyer?

While not every estate needs a probate lawyer, having an experienced attorney as an ally can be a big help to an executor or administrator – but how much will it cost and who is paying?

How to avoid probate fees?

The way to have avoided probate fees is to have an estate plan. A trust as it is called. A trust is a predefined instrument that explains how the trustor/settlor elects to distribute the inheritance to their heirs and beneficiaries. If your loved one died without a trust, then the courts will determine costs, etc.

How long does it take to get a probate in California?

How long does it take to probate in California. Normally in the state of California, it can take between 12 months to 2+ years depending on the circumstance. Of course, all costs are not derived from your own account, but from the proceeds of the deceased.

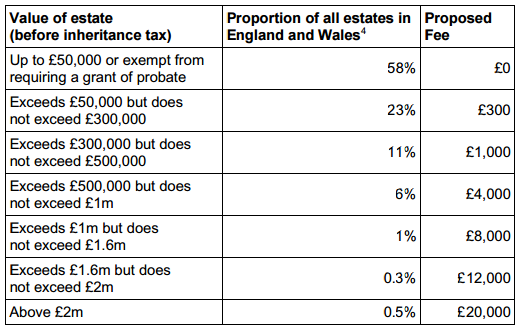

What is the probate code in California?

All probate fees are predetermined by the State of California. California Probate Code § 10810 sets the maximum fees that attorneys and personal representatives (i.e. executors, administrators, etc.) can charge for a probate. Since statutory fees and costs will the same from attorney to attorney why not pick the best firm you can, ...

What are the fees for probate?

Some extra fees may arise during probate as part of day-to-day estate administration. The executor would cover these costs from the estate bank account and they may include: 1 Accounting fee (when filing taxes) 2 Property appraisal fee (for valuing real estate, antiques, etc.) 3 Business valuation fee 4 Fee for posting public notice in the local newspaper 5 Retitling fees for cars and real estate 6 Property management (storage costs, upkeep) 7 Closing or transfer fees for financial accounts

What are probate costs?

Probate costs include court filing fees, executor fees, attorney fees if applicable, as well as miscellaneous fees incurred by the executor while administering the estate. Some of these fees are set by the state and if you’re administering an estate, you may not encounter all of these costs.

How to determine heirship?

Determine heirship (find out who the decedent's heirs are if there is no will) Object to the nomination of a personal representative. Object to the will or a codicil. Petition the testator's testamentary capacity (the will writer’s mental competence) Appoint a guardian or temporary guardian.

Who is the executor of a will?

The person who carries out the terms of the will is called the executor or personal administrator and they are typically paid for their role in settling the estate. They don't just call the deceased person’s beneficiaries and read them the will (in fact, will readings rarely ever happen) but have a full list of responsibilities they need to take care on behalf of the estate before the assets can be distributed.

Who is Elissa Suh?

Elissa Suh is a personal finance editor at Policygenius in New York City. She has researched and written extensively about finance and insurance since 2019, with an emphasis in estate planning and mortgages. Her writing has been cited by MarketWatch, CNBC, and Betterment. Retirement Learn Center.

Do executors need a lawyer?

However, some states may require a lawyer to file certain paperwork or represent the estate in certain probate proceedings, so the executor will need to hire a probate attorney. (In these situations, the attorney deals with the court, but doesn’t take on the full slate of the executor's responsibilities.)

Popular Posts:

- 1. where do i deduct attorney fees for family leave act lawsuit

- 2. how to search for power of attorney documentation in maine

- 3. how much does an attorney get from a wrongful death settlement

- 4. what is the difference between health care power of attorney and patient advocate

- 5. "when a person seeks advice or assistance from an attorney,"

- 6. what does a subpoena issued by an attorney

- 7. how old is paul reyes attorney

- 8. how do you appoint a power of attorney

- 9. how to notarize restricted power of attorney for automobile nc

- 10. ask attorney - what to do when you are put on a performance plan for no reason