How to prove that someone is power of attorney?

Mar 03, 2015 · 8:27 am on October 2, 2019. Divya, Some states like California have laws which limit a durable power of attorney life to like five years and say it needs to be redone. Banks and other institutions have a harder time accepting older durable power of attorney papers, so it is good to redo them every five years or so.

How long does it take to become a power of attorney?

Redirecting to https://www.legalzoom.com/articles/what-is-a-power-of-attorney.

How can I make a lasting power of attorney?

A standard power of attorney gives the agent the authority to act on behalf of the principal in everyday legal and financial matters. The standard power of attorney expires when the principal dies, becomes incapacitated, or revokes the power of attorney in writing.

How to make a lasting power of attorney?

This is why it is important that you review and sign a new power of attorney every few years. There is no set rule of how often you should resign one, but if you want to make sure you are safe, every 3 years would be prudent. You don’t have to go to a lawyer to draft you a new one every time. If you don’t have any changes that need to be made, just copy the language of the old one …

Why do people need a power of attorney?

One of the most common reasons is in the context of estate planning, so someone else has the authority to handle things for you without going to court if you become incapacitated or are incompetent.

What does it mean to have a durable POA?

When you make a durable POA, it means the person you named, called the agent, has authority to act even if you are incapacitated or incompetent. If you create a power of attorney for estate planning purposes, consider making it durable. This limits the likelihood your agent will need to go to court to establish a conservatorship over your affairs if your health changes for the worse in the future.

Do you have a power of attorney if your agent dies?

Finally, you do not have a valid power of attorney if the person you named as your agent dies, becomes incapacitated, or is otherwise unable or unwilling to act on your behalf. For this reason, it is helpful to name one or more successors who are willing and able to serve.

Can a POA be revoked?

A POA is automatically revoked with respect to your spouse if either of you files for divorce in many states as well. This means you do not need to create a written revocation document or provide formal notice of revocation to your former spouse.

When does a springing power of attorney become effective?

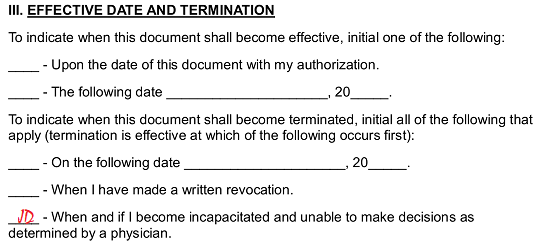

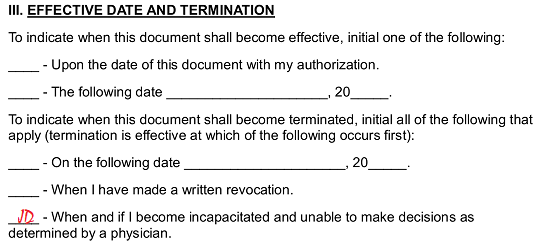

In contrast to the standard power of attorney, a springing power of attorney does not become effective until the principal becomes incapacitated. This type of power of attorney is used if the principal foresees an illness or absence that will prevent them from acting in their own interests.

What is a medical power of attorney?

A Medical Power of Attorney. A medical power of attorney gives the agent the authority to make medical decisions for the principal once invoked. These decisions can encompass all medical situations up to and including end-of-life decisions.

What is a POA?

A power of attorney template or POA form can be used to nominate a power of attorney to represent an individual and their affairs in several different areas should they become incapacitated: 1 A standard power of attorney 2 A springing power of attorney 3 A medical power of attorney 4 A durable power of attorney

What is a POA template?

A power of attorney template or POA form can be used to nominate a power of attorney to represent an individual and their affairs in several different areas should they become incapacitated: A standard power of attorney. A springing power of attorney.

How long does a power of attorney last?

The question of how long a power of attorney lasts has two different answers–a legal one and a practical one. First, the legal answer is however long you set it up to last. If you set a date for a power of attorney to lapse, then it will last until that date. If you create a general power of attorney and set no date for which it will expire, it will last until you die or become incapacitated.

What happens if you don't have a power of attorney?

If you don’t have a durable power of attorney in place when you become incapacitated, then your family will have to go to the court and get you placed in conservatorship so that they can manage your affairs. Conservatorships are a big mess and should be avoided. Basically, your family is going to have to get the court’s permission every time they want to do something.

How long is a POA valid?

How Long Is a Power of Attorney Valid? A power of attorney, also known as a POA, is valid until the expiration date, if one is set by the party, until it is cancelled by the individual or the individual's representative, until the individual dies or if the individual becomes incompetent or incapacitated, unless the POA was set to be durable.

What is a power of attorney?

A power of attorney is a legal document that allows one person to give another person permission to represent his or her interests.

Is it safe to use a power of attorney?

It is considered safe to use a power of attorney when the person appointed as the representative or agent is someone that is competent and trustworthy. It is imperative to choose a person that can be trusted implicitly.

What is EPTA form?

EPTA uses the practice of securing a form which provides written authorization from the employer that often designates specific personnel other then employees acting within the scope of their employment to: 1. furnish records and information; 2. discuss matters during preliminary stages; and 3. receive and/or negotiate proposed adjustments. The letter is on official corporate letterhead and signed by an officer of the corporation. It has been determined that the form is similar to Form 8821 and all of its attendant restrictions. In other words, the use of this form should be restricted to allow a third party to inspect or receive confidential information examined or generated during the course of the examination. Since the use of the authorization form is limited, it is necessary, therefore, to obtain a properly completed Form 2848 to address adjustments and issues pursuant to the guidance in this memo.

What is the 5500 exam?

There are three taxpayers in a Form 5500 examination—the sponsoring employer, the trust, and the plan participants or their beneficiaries. The instructions for both the Form 2848 and Form 8821 require that, for purposes of conducting a 5500 examination, Item 1 (Taxpayer Information) contain the plan name and number (if applicable) and the plan sponsor name, address and EIN. The plan and trust are two separate legal entities. The trust is an “accumulation of assets held in the name of the plan participants”. It is quite clear that unless the employer is also the trustee, it’s possible that a second POA will be necessary. This scenario applies equally to multiemployer and multiple employer plans which also have a plan sponsor and trust.

Who can be named as a representative on Form 2848?

Only individuals may be named as a Representative on Form 2848. Individuals, corporations, firms, organizations or Partnerships can be named as an Appointee on Form 8821. Each form should contain the full nine digit CAF number. If the individual designated as Representative or Appointee does not have a CAF number the Form 2848 or Form 8821 should reflect a response of “None”. All other information must be fully completed and the form should be faxed, by EP Examinations, to the appropriate Service Center before the examination is completed.

What is a power of attorney for IRS?

Except as specified below or in other IRS guidance, this power of attorney authorizes the listed representative (s) to inspect and/or receive confidential tax information and to perform all acts (that is, sign agreements, consents, waivers, or other documents) that you can perform with respect to matters described in the power of attorney. Representatives are not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative or any firm or other entity with whom the representative is associated) issued by the government in respect of a federal tax liability. Additionally, unless specifically provided in the power of attorney, this authorization does not include the power to substitute or add another representative, the power to sign certain returns, the power to execute a request for disclosure of tax returns or return information to a third party, or to access IRS records via an Intermediate Service Provider. Representatives are not authorized to sign Form 907, Agreement to Extend the Time to Bring Suit, unless language to cover the signing is added on line 5a. See Line 5a. Additional Acts Authorized, later, for more information regarding specific authorities.

What is a CAF power of attorney?

Generally, the IRS records powers of attorney on the CAF system. The CAF system is a computer file system containing information regarding the authority of individuals appointed under powers of attorney. The system gives IRS personnel quicker access to authorization information without requesting the original document from the taxpayer or representative. However, a specific-use power of attorney is a one-time or specific-issue grant of authority to a representative or is a power of attorney that does not relate to a specific tax period (except for civil penalties) that the IRS does not record on the CAF. Examples of specific uses not recorded include but are not limited to:

Who is Diana's representative on W-2?

Diana authorizes John to represent her in connection with her Forms 941 and W-2 for 2018. John is authorized to represent her in connection with the penalty for failure to file Forms W-2 that the revenue agent is proposing for 2018.

Can a law student represent a taxpayer?

You must receive permission to represent taxpayers before the IRS by virtue of your status as a law, business, or accounting student working in an LITC or STCP under section 10.7 (d) of Circular 230. Law graduates in an LITC or STCP may also represent taxpayers under the "Qualifying Student" designation in Part II of Form 2848. Be sure to attach a copy of the letter from the Taxpayer Advocate Service authorizing practice before the IRS.

What is the purpose of Form 2848?

Purpose of Form. Use Form 2848 to authorize an individual to represent you before the IRS. See Substitute Form 2848, later, for information about using a power of attorney other than a Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be eligible to practice before the IRS.

Who is an unenrolled return preparer?

An unenrolled return preparer is an individual other than an attorney, CPA, enrolled agent, enrolled retirement plan agent, or enrolled actuary who prepares and signs a taxpayer's return as the paid preparer, or who prepares a return but is not required (by the instructions to the return or regulations) to sign the return.

Can I use a power of attorney other than 2848?

The IRS will accept a power of attorney other than Form 2848 provided the document satisfies the requirements for a power of attorney. See Pub. 216, Conference and Practice Requirements, and section 601.503 (a). These alternative powers of attorney cannot, however, be recorded on the CAF unless you attach a completed Form 2848. See Line 4. Specific Use Not Recorded on the CAF, later, for more information. You are not required to sign Form 2848 when you attach it to an alternative power of attorney that you have signed, but your representative must sign the form in Part II, Declaration of Representative. See Pub. 216 and section 601.503 (b) (2).

Popular Posts:

- 1. how long has derrick schmidt been attorney general in kansas?

- 2. where can i get forms to fill out for power of attorney

- 3. what is jp after attorney name

- 4. how to get an attorney removed from a family law case in florida

- 5. why use actual attorney fees

- 6. how many da ( districo attorney) are there

- 7. what kind of attorney is christopher h smith ponte vedra

- 8. who was anne hutchinson's attorney

- 9. how do you get power of attorney in oklahoma over your husband

- 10. pinehurst , nc attorney who murdered his client in the 1990's