What happens to a durable power of attorney after death?

Apr 24, 2022 · A power of attorney in order to be recordable shall satisfy the requirements of § 55.1-600. 2010, cc. 455, 632, § 26-76; 2012, c. 614. § 64.2-1604. Validity of power of attorney. A. A power of attorney executed in the Commonwealth on or after July 1, 2010, is valid if its execution complies with § 64.2-1603. B.

Who can petition the court to construe a power of attorney?

What is request for power of attorney?

What is a power of attorney and do you need one?

Apr 20, 2022 · Chapter 16. Uniform Power of Attorney Act. 5/11/2022. § 64.2-1604. Validity of power of attorney. A. A power of attorney executed in the Commonwealth on or after July 1, 2010, is valid if its execution complies with § 64.2-1603. B. A power of attorney executed in the Commonwealth before July 1, 2010, is valid if its execution complied with ...

Does a power of attorney have to be recorded in Virginia?

Is there a time period for power of attorney?

How long is power attorney valid for in Virginia?

Does a power of attorney in Virginia have to be notarized?

What three decisions Cannot be made by a legal power of attorney?

Does power of attorney expire?

Does Virginia recognize out of state power of attorney?

How do I file a power of attorney in Virginia?

Does a power of attorney need to keep receipts?

Does a medical power of attorney need to be witnessed in Virginia?

Who makes decisions if no power of attorney?

Can a power of attorney transfer money to themselves?

What is a power of attorney in Virginia?

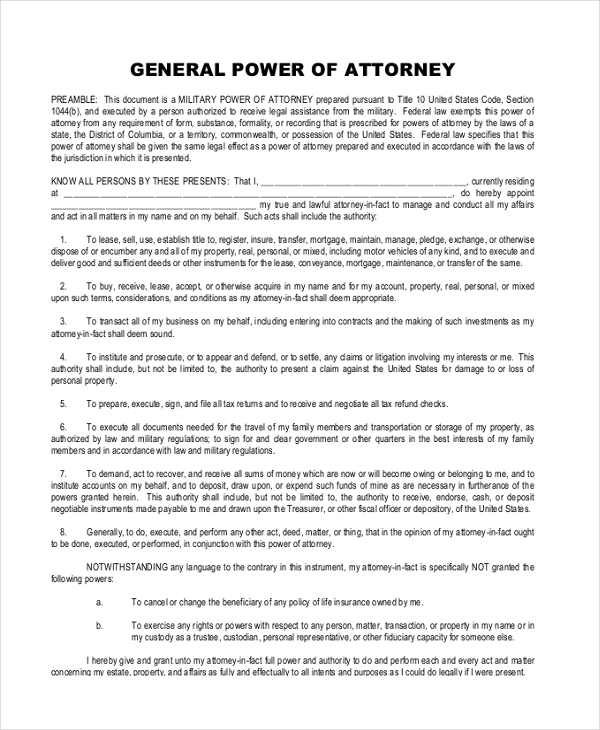

“Power of attorney” means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used. “Principal” means an individual who grants authority to an agent in a power of attorney.

Is a power of attorney durable?

By statute, the power of attorney is “durable” unless it expressly provides that it is terminated by the incapacity of the principal. 64.2-1602. Once a principal becomes incapacitated, a durable power of attorney terminates only upon the death of the principal or upon the order of a court. (The attorney-in-fact has no authority to act after ...

What are the duties of an attorney in fact?

These are that the attorney-in-fact/agent must (1) Act in accordance with the principal’s reasonable expectations to the extent actually known by the agent and, otherwise, in the principal’s best interest; (2) . Act in good faith; and (3) Act only within the scope ...

Is a material legal advice?

The materials are prepared for information purposes only. The materials are not legal advice and you should not act upon the information without seeking the advice of an attorney. Nothing herein creates an attorney-client relationship.

What is the meaning of "act in good faith"?

Code Ann. § 64.2-1612. Except as otherwise provided in the power of attorney, an agent that has accepted appointment shall: 1. Act loyally for the principal’s benefit ; 2.

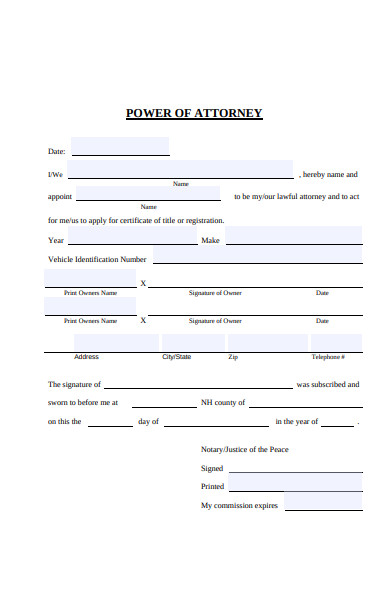

What is POA form?

Fill in the oval or select the checkbox on your return to authorize Virginia Tax to speak with your preparer for the specific tax year being filed. Personal Representative.

What is a fiduciary agent?

A fiduciary (trustee, receiver, or guardian) acts as an authorized agent because a fiduciary already stands in the position of the taxpayer. We will discuss routine issues with your designated tax professionals and employees and officers of a business as long as we can verify the person and the person's relationship to you or your business.

What is a PAR 101?

The PAR 101 is a legal document. For the tax matters you list on the form, your representative will be able to receive and inspect your confidential tax information and take the same actions you can, including consenting to extend the time to assess tax or executing consents that agree to a tax adjustment.

What is a CPA?

An authorized tax professional (CPA, enrolled agent, tax preparer, or payroll service provider) needs to discuss routine issues like a return that was filed or a payment that was made by the tax professional on your behalf.

What is an executor of an estate?

Executor or Administrator of an Estate. A Letter of Qualification from the court of proper jurisdiction on file naming the executor/administrator and giving authority over the deceased taxpayer's tax matters. An executor or administrator of an estate can also be appointed by the Last Will and Testament of the deceased.

What is an authorized employee?

An authorized employee or officer of your business needs to discuss routine issues like a return that was filed or a payment that was made by your business. A fiduciary (trustee, receiver, or guardian) acts as an authorized agent because a fiduciary already stands in the position of the taxpayer.

Can a power of attorney be revoked?

The person granting a power of attorney can revoke the power at any time, so long as he or she is mentally competent. You should consult your attorney to determine whether a power of attorney would be appropriate in your case, and if so, what the scope of such power should be.

What is a power of attorney?

Powers of Attorney. You may desire to give your spouse the power to act on your behalf in the event that you become incapable of handling your own affairs due to accident, sickness, or distant travel. Without a power of attorney, your spouse may be powerless to make decisions on your behalf.

Is marriage legal in Virginia?

Marriage is the most significant legal human relationship. It carries with it rights, benefits, responsibilities and consequences and is still the basis for families in Virginia. Prepared by the Family Law Section of the Virginia State Bar. Revised Oct. 2019.

How long does it take to get married after a marriage license?

After you have obtained a valid marriage license, your marriage ceremony must be performed within 60 days of the date your license is issued. A qualified minister, any judge, or a person appointed by the court can perform the ceremony.

Can you disinherit your spouse?

In most instances, you cannot disinherit your spouse without your spouse’s consent, for example, through a waiver in a prenuptial, marital or property settlement agreement. If you die without a will, your entire estate will pass to your spouse under Virginia law unless you have children by a previous marriage.

Can alimony be guaranteed in divorce?

It can guarantee a level of support in the event of separation or divorce, or it can specify that there will be no alimony. Such contracts are especially important in a subsequent marriage, where one spouse may have children from a previous marriage and obligations that will continue after that prior marriage.

Can I file a joint tax return if I am married?

I. Taxes. As a married couple you can file a joint income tax return with both the state and federal governments if you were married by the end of the tax year. A joint return can often save you money, but its advantages depend on each couple's individual financial situation.

Power of Attorney and Declaration of Representative

- Use this form to: 1. authorize a person to discuss designated tax matters with Virginia Tax and receive correspondence on your behalf 2. revoke a prior power of attorney authorization The PAR 101 is a legal document. For the tax matters you list on the form, your representative will be able to receive and inspect your confidential tax information a...

Form R-7 - Application For Enrollment as Virginia Authorized Agent

- Use this form to register as a representative or authorized agent for a taxpayer. Once we process the completed form, you will receive your Authorized Agent Number by mail. As an authorized agent, you're eligible to receive any correspondence, documentation, or other written materials related to specific tax matters for which the Form PAR 101 has been filed. All correspondence w…

Acceptable Alternative Forms of Authorization

- We prefer you complete and submit Form PAR 101, but we will also accept the following (representatives designated by these methods won't receive automatic copies of correspondence): Note: Federal Form 8821, Tax Information Authorization, will not be accepted as a POA.

Account Authorization For deceased Taxpayers

- Federal Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, does not authorize discussion of the deceased taxpayer's account or release of any other tax documents to the person named on the form. Form 1310 only gives Virginia Tax permission to release a deceased taxpayer's refund to the person identified on the form.

Popular Posts:

- 1. how to write a formal complaint about an attorney to the judiciary board in arkansas

- 2. what are the grounds to sue your defense attorney?

- 3. how to sign income taxes with power of attorney

- 4. what is ada attorney

- 5. what degrees do you need in order to e an attorney

- 6. what is the main job of the attorney general of virginia

- 7. how to choose a good criminal defense attorney

- 8. http://nouw.com/hermanmetoo/jeff-herman-the-attorney-who-is-suing-ha-32341875

- 9. how do i record a power of attorney in sc

- 10. how much to hire a criminal defense attorney in florida?