Why should I have a power of attorney?

Feb 03, 2022 · Power of Attorney and Nursing Home Bills. It is very important to understand that a power of attorney does NOT make the attorney-in-fact personally liable for the debts and obligations of the principal. This is true even for contracts that the attorney-in-fact signs on behalf of the principal. So if you have a power of attorney for your mother ...

Who needs a power of attorney?

A Power of Attorney allows a child, relative, or close friend to help their loved ones under nursing home care by acting in the exterior world on their behalf. In trusted hands, this legal document makes a world of difference to nursing home residences.

Why do you need power of attorney?

Apr 08, 2021 · Many nursing homes will draft a power of attorney for their residents. Doing so is often framed as saving money. However, if a power of attorney is done without an examination of the circumstances, it can cost many times more money than it saves. A recent publication of the National Academy of Elder Law Attorneys (NAELA) reported on a Chicago nursing home that …

What is a simple power of attorney?

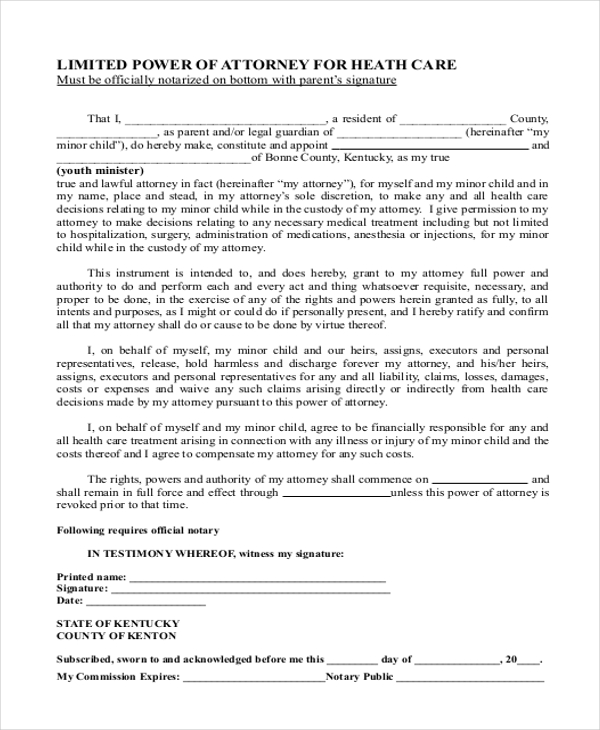

A medical power of attorney can be used in certain circumstances to admit an individual to a nursing home. Medical power of attorneys must be made by a person, referred to as a principal, while he is still competent. The agent accepting the appointment also must be a competent adult.

What is POA in nursing home?

For elderly people who are nursing home residents, having an effective power of attorney (POA) in place helps ensure that day-to-day financial affairs will be handled in the case of incapacity. However, agreeing to serve as an agent under a POA does not make you personally responsible for payment of nursing home bills.

What is a POA?

A financial POA is a document that grants you, the agent, the ability to manage the day-to-day financial affairs of an incapacitated person, the principal. State law varies on the amount of power that can be provided to you by the principal.

Why do you have to be a fiduciary?

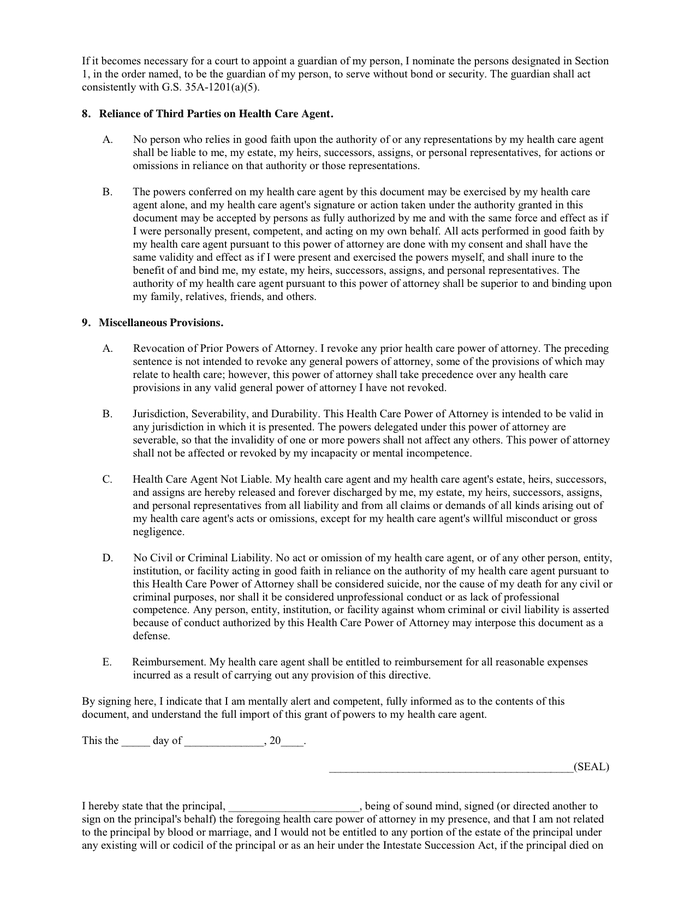

Because of the power you exercise over the principal's financial affairs, you are required by law to act as a "fiduciary" to the principal. This means that you must make decisions in good faith and based on the principal's reasonable expectations.

Can you be personally responsible for a nursing home bill?

While you are not personally responsible for expenses that exceed a principal's ability to pay, it is within your authority to bind the principal to financial obligations. You have the power to approve certain expenses, including nursing home bills, which effectively obligate the principal to pay the bill. It is important that you take into consideration the available resources of the principal in making care-related decisions.

What is POA in elder care?

POA is an important legal document to include in elder care planning. The way a POA document is written determines when it goes into effect and specifies what powers the agent holds. Learn More: Types of POA

What is POA in legal terms?

Power of attorney (POA) documents are an important part of a person's legal plans.The way a POA document is written determines when it goes into effect and specifies what powers the agent holds.

What does POA mean in a contract?

When acting as power of attorney (POA) for an aging parent or loved one, your signature must make it clear that you are acting on their behalf and not assuming personal responsibility for the contract or transaction. Learn More: How to Sign as POA for your Elderly Parent

What is a POA?

A power of attorney (POA) document is an important component of elder care that provides peace of mind for both a senior and their caregiver. A properly executed POA provides written authorization that enables a person (called the “principal”) to appoint a trusted relative or friend (called the “agent” or “attorney-in-fact”), ...

What is POA in elder law?

A reputable elder law attorney can discuss your desires and concerns and devise POA documents that clearly explain the extent of powers you want your agent (s) to have and any limitations they must abide by. ...

What is the POA Act?

The Uniform POA Act. Each state has statutes that govern how power of attorney documents are written and interpreted. This can complicate matters when a principal decides what powers to give to their agent and when an agent tries to determine what actions are legally within their power.

How to file a POA?

What a Financial POA Can Do: 1 Access the principal’s financial accounts to pay for health care, housing needs and other bills. 2 File taxes on behalf of the principal. 3 Make investment decisions on behalf of the principal. 4 Collect the principal’s debts. 5 Manage the principal’s property. 6 Apply for public benefits for the principal, such as Medicaid, veterans benefits, etc.

Why is POA important?

According to geriatric care manager and certified elder law attorney, Buckley Anne Kuhn-Fricker, JD, this provision is important because it gives a principal the flexibility to decide how involved they want their agent to be while they are still in possession of their faculties. For example, a financial agent could handle the day-to-day tasks of paying bills and buying food, while the principal continues to make their own investment and major purchasing decisions.

What is POA document?

POA documents allow a person (the principal) to decide in advance whom they trust and want to act on their behalf should they become incapable of making decisions for themselves. The person who acts on behalf of the principal is called the agent. From there, it is important to distinguish between the two main types of POA: medical and financial. ...

What is a POA in medical terms?

A medical POA (also known as health care POA) gives a trustworthy friend or family member (the agent) the ability to make decisions about the care the principal receives if they are incapacitated. A financial POA gives an agent the ability to make financial decisions on behalf of the principal. It is common to appoint one person to act as an agent ...

What medical care does a principal receive?

What medical care the principal receives, including hospital care, surgery, psychiatric treatment, home health care , etc. (These choices are dependent on the financial means of the principal and the approval of their financial agent.) Which doctors and care providers the principal uses. Where the principal lives.

Protecting your loved ones if injury occurs

Nowhere is the danger of forced arbitration more apparent than it is in cases involving claims against nursing homes, and especially when involving residents who legally have little control over their daily lives.

The laws may not protect you

In 2017, the White House proposed a rule that would allow nursing homes to authorize the use of mandatory arbitration clauses. Under the former administration, nursing homes which accepted federal funding could not institute mandatory arbitration.

How do I know if there is a mandatory arbitration clause?

Nursing home companies are clever: they know that most people in search of a nursing home are under pressure to find a suitable one fast, and that they will not read the full terms and conditions of admission. Much like tech companies’ Terms of Service agreements, the nursing homes bury their mandatory arbitration clauses in the fine print.

What happens if I, as POA, sign a contract that includes forced arbitration?

If you, as POA, sign a nursing home admissions contract that includes a forced arbitration clause, but the POA doesn’t grant you that authority, then that part of the agreement will not hold. In Owens v.

Popular Posts:

- 1. who do you contact to make a complaint on an attorney

- 2. what did blanca do during the riot us attorney

- 3. who is the texas attorney general 2019

- 4. which of the following can an attorney exercise in the selection of potential jurors?

- 5. how to get a cheap attorney

- 6. how to look up attorney license wisconsin

- 7. how to obtain power of attorney over parents in iowa

- 8. when do you give someone power of attorney

- 9. what exactly does a medical power of attorney mean

- 10. hawaii revised statutes where pro se attorney is mentioned