In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances. A durable power of attorney simply means that the document stays in effect if you become incapacitated and unable to handle matters on your own.

What is a power of attorney for health care?

Sep 22, 2021 · These are simple activities and do not require highly skilled people. A durable power of attorney also grants decision-making permission but in this case, these decisions are more important and require professional knowledge and skills. The two vital decisions that we talked about before (financial decisions and medical decisions) all fall under the authority of a …

What are the benefits of having a durable power of attorney?

A durable power of attorney simply means that the document stays in effect if you become incapacitated and unable to handle matters on your own. (Ordinary, or "nondurable," powers of attorney automatically end if the person who makes them loses mental capacity.)

Is medical power of attorney durable or nondurable?

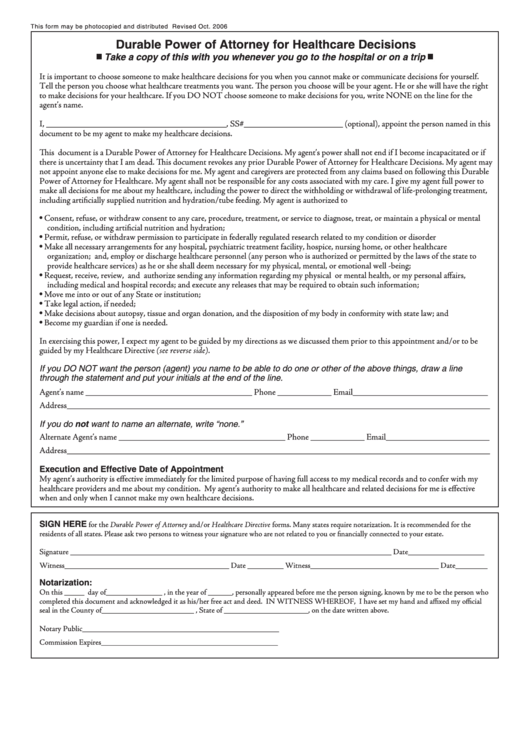

What is a Durable Power of Attorney for Health Care? A Durable Power of Attorney for Health Care (DPOA-HC) is a legal mechanism which allows you to appoint a person (agent/patient advocate) to make health care decisions for you should you become unable to do so. For many years, a Durable Power of Attorney was available to allow another person to handle personal,

What is the difference between ordinary power of attorney and durable Poa?

Creation of Durable Power of Attorney for Health Care I intend to create a power of attorney (Health Care Agent) by appointing the person or persons designated herein to make health care decisions for me to the same extent that I could make such decisions for myself if I was capable of doing so, as recognized by Washington law.

What Is A Power of Attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitate...

Medical Power of Attorney

A medical power of attorney is one type of health care directive -- that is, a document that set out your wishes for health care if you are ever to...

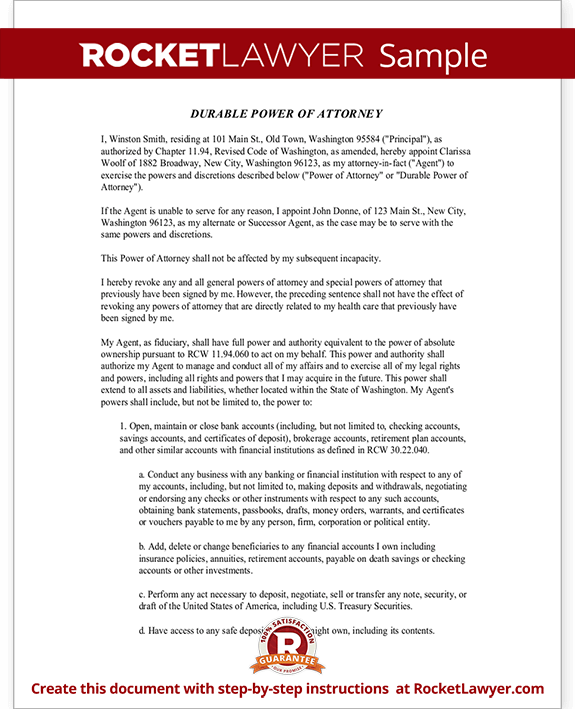

Financial Power of Attorney

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf....

What is a power of attorney?

A power of attorney is a legal document that gives someone you choose the power to act in your place. In case you ever become mentally incapacitated, you'll need what are known as "durable" powers of attorney for medical care and finances.

What is a financial power of attorney?

A financial power of attorney is a power of attorney you prepare that gives someone the authority to handle financial transactions on your behalf. Some financial powers of attorney are very simple and used for single transactions, such as closing a real estate deal.

How many separate documents do you need for a power of attorney?

To cover all of the issues that matter to you, you'll probably need two separate documents: one that addresses health care issues and another to take care of your finances. Fortunately, powers of attorney usually aren't difficult to prepare.

What does a health care agent do?

Your health care agent will work with doctors and other health care providers to make sure you get the kind of medical care you wish to receive. When arranging your care, your agent is legally bound to follow your treatment preferences to the extent that he or she knows about them.

Why do you need separate documents for your health insurance?

Making separate documents will keep life simpler for your agent and others. For example, your health care documents are likely to be full of personal details, and perhaps feelings, that your financial broker doesn't need to know. Likewise, your health care professionals don't need to be burdened with the details of your finances.

Can a power of attorney be used to pay bills?

With a valid power of attorney, the trusted person you name will be legally permitted to take care of important matters for you -- for example, paying your bills, managing your investments, or directing your medical care -- if you are unable to do so yourself. Taking the time to make these documents is well worth the small effort it will take.

Can a power of attorney prevent accidents?

While medical and financial powers of attorney can't prevent accidents or keep you young, they can certainly make life easier for you and your family if times get tough.

What is durable power in Michigan?

Michigan law allows you to grant as many or as few authorities and responsibilities to your patient advocate as you wish. The grants of power provided in this section cover all of the powers necessary for an advocate to have complete authority to make medical decisions for you. You may initial any, all, or none of the grants of power. If you do not initial any of the options, you will need to attach your own written grants of power to indicate what powers your patient advocate will have.

What is the first provision of Section V of the Michigan Power of Attorney?

The first provision of Section V ensures that you are aware that the acceptance must be signed before the power of attorney becomes effective. It also will indicate whether the designation and acceptance process was completed at one time.

How many advocates can direct care?

Only one advocate may direct your care at a given time . The successor advocate may act only after the primary advocate has relinquished, or been relieved from, his or her duties. The successor advocate must also sign an acceptance prior to acting on your behalf.

What is the distinction between ordinary and extraordinary?

The first concept entails a distinction between ordinary and extraordinary, or “heroic” medical treatment. It is rarely considered inappropriate if a person decides to forego an extraordinary treatment. Traditionally, the refusal of ordinary treatment was viewed as an intentional effort to cause one’s own death (a passive rather than active form of suicide). For example, a person who has diabetes or high blood pressure but is otherwise medically stable and decides to stop taking their daily medication is not exercising a right to refuse burdensome medical treatment, but rather is choosing to intentionally die.

Does prolife require medical intervention?

That’s right. The prolife position DOES NOT demand that every medical intervention be used at all times and never be removed. There are certainly times when extensive medical treatment should be withheld and the natural dying process be allowed to take its due course. We need to be cautious, however, not to bring about death intentionally by removing ordinary treatments of care.

Do you need a DPOA for a nursing home?

NO. A DPOA-HC is not required in order to receive proper health care. No insurance company, hospital, nursing home, or other health care provider can require that you have a DPOA-HC as a condition for receiving services. The purpose of a DPOA-HC is to provide others with directions on how you would like to be treated if you cannot make those decisions. You may determine what medical treatment you should or should not receive, and under what circumstances your preferences will be carried out.

Can you revoke a patient advocate designation?

The Durable Power of Attorney law allows you to revoke your patient advocate designation at any time and in any manner by which you can express that designation . The law places a requirement on any person aware of a patient’s desire to revoke their designation to report that desire in writing to the patient advocate. Unless you choose to waive your right to revoke for mental health purposes described below, you automatically retain the right to revoke your designation at any time.

What is a power of attorney for healthcare?

A healthcare power of attorney, on the other hand, names someone to make medical decisions any time you are unable to do it yourself, even if you are expected to make a full recovery.

Why do we need a durable powers of attorney?

Durable powers of attorney help you plan for medical emergencies and declines in mental functioning and can ensure that your finances are taken care of. Having these documents in place helps eliminate confusion and uncertainty when family members have to make tough medical decisions.

What does POA stand for in power of attorney?

When power of attorney is made durable, it remains intact if you cannot make decisions for yourself. A power of attorney (POA) authorizes someone else to handle certain matters, such as finances or health care, on your behalf. If a power of attorney is durable, it remains in effect if you become incapacitated, such as due to illness or an accident. ...

What is the purpose of a durable POA?

The purpose of a durable POA is to plan for medical emergencies, cognitive decline later in life, or other situations where you're no longer capable of making decisions.

What can an attorney in fact do?

An attorney-in-fact can handle many types of transactions, including: Buying and selling property. Managing bank accounts, bills, and investments. Filing tax returns. Applying for government benefits. If you become incapacitated and don't have a general durable power of attorney, your family may have to go to court and have you declared incompetent ...

What is a power of attorney?

A power of attorney allows someone else to handle your legal, financial, or medical matters. General powers of attorney cover a wide range of transactions, while limited powers of attorney cover only specific situations, such as authorizing a car dealer to register your new vehicle for you.

Can a POA be effective if you are incapacitated?

The POA can take effect immediately or can become effective only if you are incapacitated. The person you appoint is known as your agent, or attorney-in-fact, although the individual or company doesn't have to be a lawyer. An attorney-in-fact can handle many types of transactions, including: Buying and selling property.

Durable Power Of Attorney

When you grant someone as the durable power of attorney, they are in charge of making important financial decisions on your behalf if you were to ever become incapacitated. This includes financial, legal, and business interests.

Health Care Power Of Attorney

When it comes to granting someone as the health care power of attorney, that person is responsible for making important medical decisions on your behalf if you were to ever become incapacitated.

What is a medical power of attorney?

A power of attorney is a legal document that appoints someone as your representative and gives that person the power to act on your behalf. Different types of powers of attorney address different situations. With a medical power of attorney, you appoint someone—often referred to as your attorney-in-fact ...

Why is a power of attorney important?

While much of estate planning focuses on finances, a comprehensive estate plan should also help you prepare for any potential medical or healthcare decisions you may need to make in the future. That's why a medical power of attorney, also known as a durable power of attorney for healthcare, is essential.

What happens if you don't have a power of attorney?

If You Do Not Have a Medical Power of Attorney 1 Living will. If you have a living will, it will only be enacted if you are in a permanent state of incapacity. This is because a living will addresses with end-of-life situations, and a key requirement is that you are permanently incapacitated. But if you are temporarily incapacitated—for example, if you fall into a temporary coma after an accident but your doctors expect you to eventually come out of the coma—your living will won't be able to help with the healthcare decisions that may need to be made during this time. 2 Your loved ones know what you want. It's easy to see the potential for conflict that could arise in this scenario. Your loved ones may not correctly remember your instructions, may interpret your directions to them differently or may decide on religious or moral grounds that a different decision would be better for you. Having a medical power of attorney avoids these situations. Additionally, your state's laws may give one of your loved ones priority in terms of medical decision-making power over another loved one who may be more likely to make medical decisions following your wishes.

Can a power of attorney make healthcare decisions?

With a medical power of attorney, you can appoint someone to make healthcare decisions for you if you become incapable of making those decisions yourself. While much of estate planning focuses on finances, a comprehensive estate plan should also help you prepare for any potential medical or healthcare decisions you may need to make in the future.

Can an attorney be an attorney in fact?

It's important to carefully consider whom you want to appoint to be your representative or attorney-in-fact under your medical power of attorney. Note that, despite using the word "attorney" in the term "attorney-in-fact," this person is not required to be an attorney.

Is a medical power of attorney durable?

Unlike a regular power of attorney, which is nondurable, a medical power of attorney is always a durable power of attorney. A nondurable power of attorney expires and is no longer valid if you become incapacitated.

What is durable power of attorney?

A durable power of attorney is the most common document of its kind, and the coverage afforded by the form is sweeping. It allows the agent to make financial, business and legal decisions on behalf of a principal, and the durability aspect extends the agent’s powers to during an event of incapacitation.

What does it mean if you don't have a POA?

The absence of a durable and/or medical POA can mean that family members will not be able to access accounts to pay for healthcare, taxes, insurance, utilities, and other important matters, and they won’t have clear instructions as to how to care for you if you should be faced with incapacitation.

How long do powers stay in effect?

Once powers have been granted, they will remain in effect until their powers are revoked, the contract expires (if an expiration date exists), or until the principal expires. Here’s a list of common matters for which an agent may be responsible to maintain on behalf of the principal: Banking – Deposits and withdrawals.

What is the difference between an agent and a principal?

Principal – the person handing over decision-making powers. Agent – the chosen individual to manage affairs, usually someone the principal deeply trusts , such as a close family member (also called an “attorney in fact”) Incapacitation – when the principal is no longer able to make decisions for themselves .

What do I need for an estate plan?

What Else Do I Need for My Estate Plan? 1 Living Will – usually paired with a medical power of attorney. If this form isn’t included, you’ll want to create one as it puts your medical wishes into writing. 2 Last Will and Testament – designates who gets what upon your passing

Why does the principal have no say in who is appointed?

First, the principal has no say in who is appointed, because appointment will happen after an event of incapacitation. Often, the court will choose a single conservator to handle both financial and medical matters. Second, the process is costly, lengthy, and very draining and stressful for all involved.

What is a living will?

Living Will – usually paired with a medical power of attorney. If this form isn’t included, you’ll want to create one as it puts your medical wishes into writing. Last Will and Testament – designates who gets what upon your passing.

Popular Posts:

- 1. how to get your attorney to settle

- 2. how to find if an attorney is licensed in arizona

- 3. how can the attorney general help me

- 4. how long is us attorney general term

- 5. how to bill at non attorney on clio

- 6. if both spouses work why does husband have to pay for wife's divorce attorney

- 7. who is co 16th judicial district attorney

- 8. how to email attorney general william barr

- 9. how to fill out cook county attorney client affidavit

- 10. how can i find out the divorce attorney in nyc case richmond sullivan edward debra