What happens when you have a power of attorney on bank account?

Mar 14, 2022 · Powers of Attorney. Maintain current powers of attorney so that your family members can handle banking, insurance, vehicle, housing, and other legal and financial tasks on your behalf. Consider ...

What is a power of attorney for ecommerce?

Jun 26, 2019 · At Weisinger Law Firm, PLLC, our Texas estate planning attorneys have deep experience handling the full range of issues related to power of attorney. We provide compassionate, fully personalized legal guidance to our clients. For a review of your case, contact our law firm today (210) 201-2635. [cans_and_cants_markup]

What can I do with a power of attorney?

Jul 11, 2018 · Misconception #1: You can sign a power of attorney if you are legally incompetent. Someone cannot appoint a power of attorney (or sign any legal document) if they are incapacitated. According to Furman, this is one of the most common misconceptions about the power of attorney. “So many times I get a phone call from someone who says ‘I just ...

What are the regulations for power of attorney and joint accounts?

Nov 04, 2019 · Creating a limited durable power of attorney agreement is an excellent way to protect everyone involved from potential risk, but there are other precautions you can take to avoid being accused of negligence, fraud, or outright theft. First and foremost, never commingle grantor assets with your personal assets.

Does dime have Zelle?

It's easy – Zelle is already available within the Dime mobile banking app and your Dime online banking account! Simply login and follow a few simple steps to enroll with Zelle today.

What bank is BNB?

BNB Bank operates as a bank. The Bank accepts deposits, makes loans, as well as provides title insurance, online banking and bill payment, and merchant services. BNB serves clients in the United States.

Where is Dime Bank headquarters?

New York, NYDime Community Bank / Headquarters

What bank merged with Dime?

BNB BankBridge Bancorp and Dime Community complete merger, BNB Bank takes Dime name. The merger of BNB Bank and Dime Community Bank has been completed, the parent companies of the two banks announced this week.Feb 3, 2021

Who took over Dime Savings bank?

Dime Savings Bank of New YorkThe bank's original headquarters in Brooklyn at 9 DeKalb AvenueFateAcquired by Washington Mutual and rebranded all of its locations to Washington Mutual banksSuccessorWashington Mutual, JPMorgan ChaseHeadquartersBrooklynProductsFinancial services7 more rows

Is Washington Mutual?

Washington Mutual was a conservative savings and loan bank. In 2008, it became the largest failed bank in U.S. history. By the end of 2007, WaMu had more than 43,000 employees, 2,200 branch offices in 15 states, and $188.3 billion in deposits. 1 Its biggest customers were individuals and small businesses.

What happened to the Dime bank?

In 2017, Dime moved its headquarters to Brooklyn Heights. On Monday, February 1, 2021, Bridge Bancorp Inc. (BNB Bank) and Dime Community Bancshares (Dime Community Bank) successfully closed on a merger of equals. The bank headquarters is currently in Hauppauge, NY.

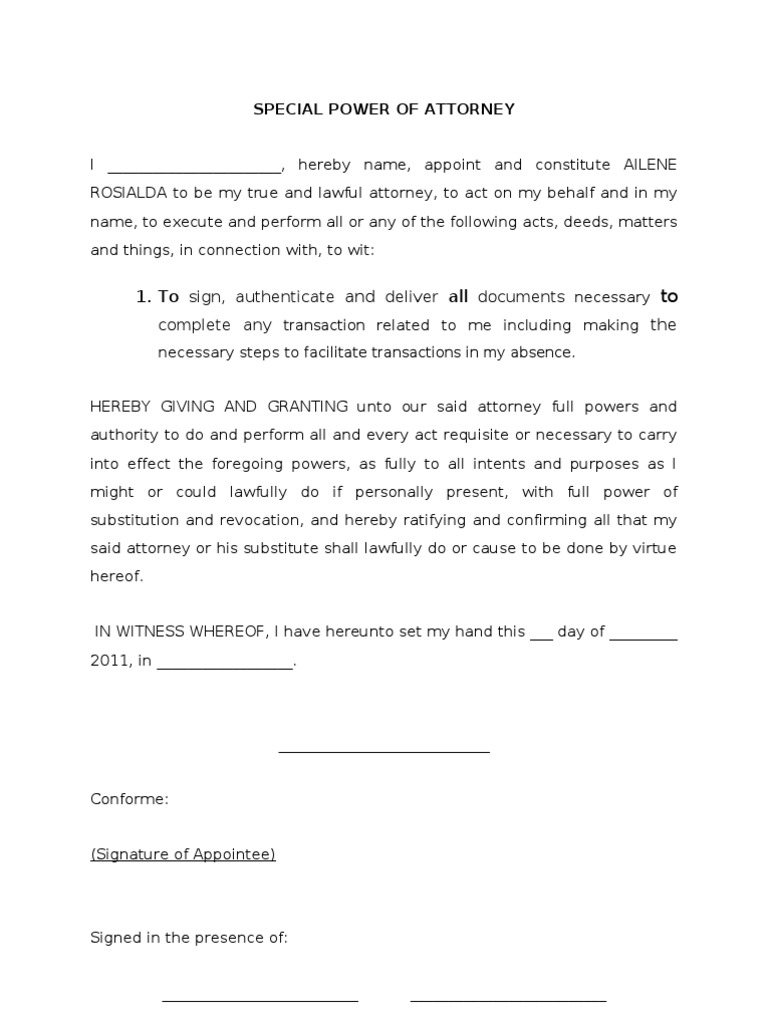

What is a power of attorney?

Powers of attorney are key estate planning documents. In the unfortunate event that you become unable to care for yourself, it is crucial that you grant a trusted party the authority to effectively make legal, financial, and medical decisions on your behalf. Through two key estate planning documents — the durable power of attorney and ...

Can you have multiple power of attorney?

Yes. You have the legal right to appoint multiple people as your power of attorney. You could even split your durable power of attorney and your medical power of attorney. The legal documents should state whether each agent has full, independent power or if they have to act jointly.

Can a doctor override a power of attorney?

Yes — but only in limited circumstances. If an advance medical directive is in place, the instructions in that document may override the decision of a power of attorney. Additionally, doctors may also refuse to honor a power of attorney’s decision if they believe that the agent is not acting in the best interest of the patient.

Do power of attorney have fiduciary duty?

Yes — but the agent always has a fiduciary duty to act in good faith. If your power of attorney is making such a change, it must be in your best interests. If they do not act in your interests, they are violating their duties.

Can a durable power of attorney make medical decisions?

Can a Durable Power of Attorney Make Medical Decisions? No. A durable power of attorney is generally for legal decision making and financial decision making. To allow a trusted person to make health care decisions, grant them medical power of attorney.

Can a power of attorney withdraw money from a bank account without authorization?

No — not without express authorization to do so. A person with power of attorney does not need to add their own name to the bank account. They already have the legal authority to withdraw money from your account to take care of your needs.

Can a person change their power of attorney?

Yes. A durable power of attorney is a flexible legal document. As long as a person is mentally competent, they can change — even revoke — power of attorney.

What does it mean to get a power of attorney from the internet?

Getting a power of attorney document from the internet means that you could be paying for a document that:: “If a power of attorney is ambiguous it is ripe for challenges and interjections,” Furman says. “The issue is that when problems with a power of attorney are discovered it is usually too late to do anything about it.”.

Why do people hesitate to get a power of attorney?

People hesitate towards getting a power of attorney because they are worried that the agent will mismanage their affairs and assets. Legally, your agent shouldn’t do something that is not in your best interests — that is their fiduciary obligation to you as your agent.

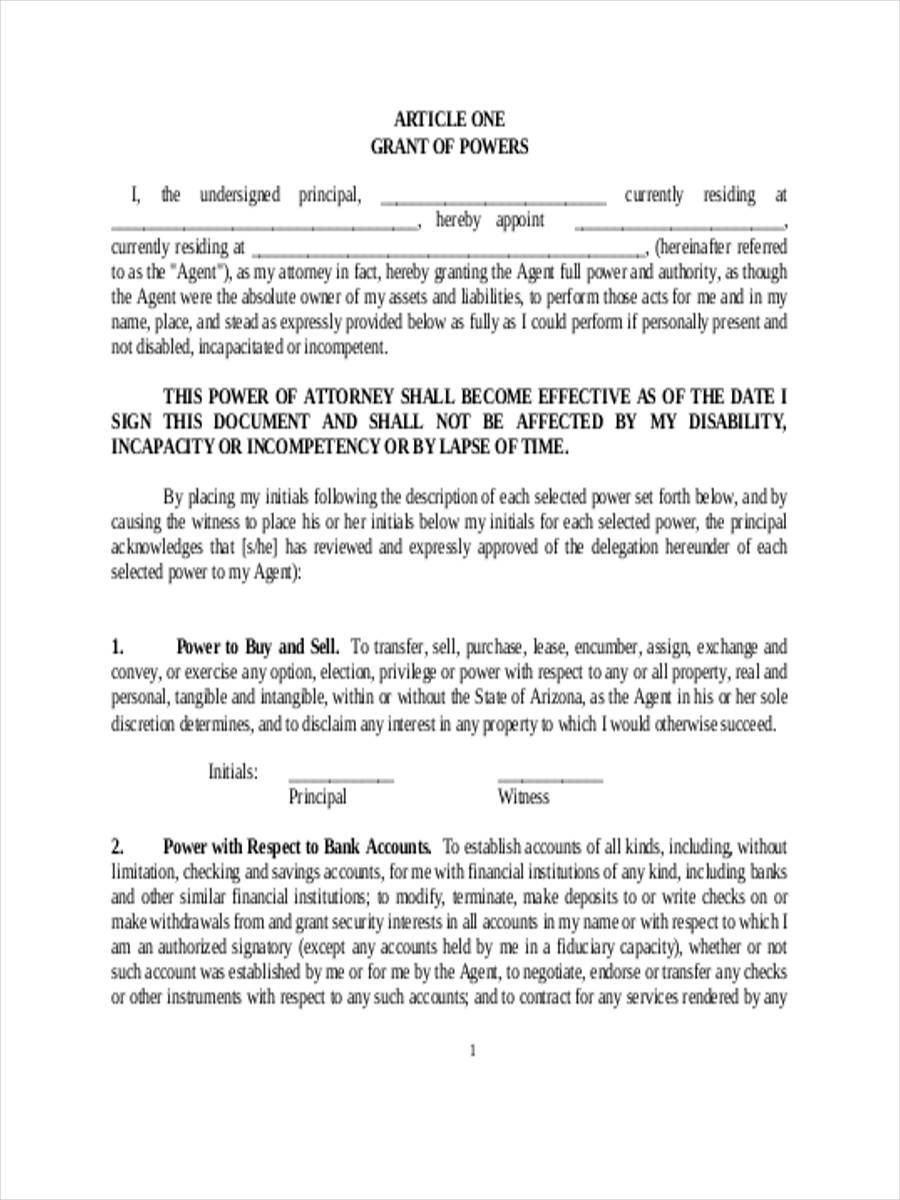

What is Durable Power of Attorney?

What Does a Durable Power of Attorney Mean?#N#In regard to a durable POA, the word “durable” specifically means that the effectiveness of the assigned power of attorney remains in effect even if the principal becomes mentally incompetent. Typically, there are four situations that would render powers of attorney null and void: 1 If you revoke it 2 If you become mentally incompetent 3 If there is an expiration date 4 If you die

What does "durable" mean in POA?

In regard to a durable POA, the word “durable” specifically means that the effectiveness of the assigned power of attorney remains in effect even if the principal becomes mentally incompetent. Typically, there are four situations that would render powers of attorney null and void: If you revoke it.

What is the fiduciary obligation of a power of attorney?

By law, the agent under a power of attorney has an overriding obligation, commonly known as a fiduciary obligation, to make financial decisions that are in the best interests of the principal (the person who named the agent under the power of attorney).

Why do we need a power of attorney?

A power of attorney should be created to appropriately represent the specifics of the unique circumstances and the decisions and care that need to be made on behalf of the person. “People should stay away from the internet and have a power of attorney custom drafted to your circumstances,” Furman advises.

When does a power of attorney end?

All powers of attorney terminate in the event of death. As such, once a person has passed away due to health issues, the authority granted to the agent under the power of attorney terminates.

What is a durable power of attorney?

General Durable Power Of Attorney. This is the standard POA agreement for wills, estates, and finances. Agents can buy and sell property, pay bills, and conduct other financial business for the grantor. Durable means it remains binding should the grantor become incapacitated or pass away.

What happens if you use a power of attorney fraudulently?

If you are found to be fraudulently using your power of attorney to enrich yourself, drain savings and other financial accounts, or default on lines of credit or loans, the law is going to shut you down quickly. Due to these restrictions, you want to make sure that you are an exemplary steward of the grantor’s affairs.

Why are POAs becoming more common?

These POAs are becoming more common due to the amount of fraud and theft committed by agents with a general durable power of attorney. The stipulations of limited durable POAs varies by individual, but well-written limited POA agreements have precise requirements to which the agent must follow.

What is a limited POA?

This is a simple, limited POA that allows the agent to make healthcare and medical decisions should the grantor become incapacitated and require guardianship. It’s essential to recognize that this type of POA carries an extremely low risk for the agent, and no agent will be held financially responsible for the medical bills of the grantor.

What to do before signing a POA?

Before you sign anything as an agent in a POA, you want to make sure you clearly and thoroughly understand the rules, stipulations, and limitations of the agreement. Even unintentionally violating any of those rules can result in legal and financial liability for you even though you were acting as the grantor’s agent.

Can you give a spouse a POA?

Spouses are considered the first next of kin in the eyes of the law. As such, it is generally unwise to give a spouse POA over your affair s as it could adversely affect them financially and legally should they need to use that POA. Suppose you insist on making your spouse or close relative an agent of your POA. In that case, the recommendation is to use a limited durable power of attorney and not a general power of attorney.

Can a POA cause financial chaos?

Sometimes, either through willful intent or blissful ignorance, agents of a POA can cause legal and financial chaos. If the terms of the POA are too broad (as with a general durable POA), the agent can buy and sell property at a loss, mismanage a business into the ground, or even create the appearance of theft or embezzlement unintentionally.

What happens to a power of attorney when you die?

They cease at death. A power of attorney loses all authority at the moment of death.

What to do if you do not believe a will is in keeping with your wishes?

If you do not believe that the document is in keeping with your wishes, then you should certainly consult with an attorney about how to get the document changed to reflect those wishes. They do not “trump” a will.

Can a power of attorney be amended?

A power of attorney is always able to be revoked or amended. As long as you have the capacity to make appropriate legal decisions on your own behalf, then you have the right to make changes to your power of attorney document. If you do not believe that the document is in keeping with your wishes, then you should certainly consult ...

Does a power of attorney remove the power to act?

A power of attorney does not remove your power to act, it just authorizes someone else to also act under the limitations that you have placed. It is not the same as a conservatorship, where a court removes your power to act and places that power in the hands of another. They are fully revocable.

Can you get yourself in trouble with a power of attorney?

At times, it is very easy to unintentionally get yourself in trouble through the use of a power of attorney. The guiding north star for any agent should always be to act solely in the best interests of the person who granted the power of attorney. You cannot use the power of attorney to provide any benefit to yourself.

Is a power of attorney valid if you are incapacitated?

There are powers of attorney that are limited in time. There are also powers of attorney that are no longer valid if you become incapacitated.

Can a power of attorney be used without oversight?

They are typically able to engage in such actions, without your direct oversight, because the document allows for that. There are many different types. People often think that one power of attorney document is like all others. This is simply not the case. There are powers of attorney that are limited to healthcare.

What happens if you give your assets to another person?

If you give your assets to another person, then the assets are subject to their creditors. You have simply traded one risk – the cost of nursing home care, for another, the risk that your child may get divorced, or get sued, or go bankrupt, or mismanage the asset.

Is Option 9 foolproof?

With all the negatives about Option 9 – the risk of loss to divorce, lawsuits, bankruptcy, or just plain refusal of the gift recipient to use your stuff for your benefit – Option 9 still doesn’t seem foolproof. But don’t lose heart yet.

Do you have to give up all control of your property if you put it into a Medicaid asset protection trust?

You don’t have to give up all control over your property if you put it into a Medicaid asset protection trust. However, you do have to give up something. Losing control over your own property is not for everyone. If you are considering this option, you should consider it very carefully.

Can you use your money to take care of your kids?

Yes , that is coming. #3 Use Your Money or House to Take Care of Your Child or Children. Special Needs Trusts, Supplemental Needs Trusts for. Asset Protection. Option 3 on our list of the Top Ten Ways to Protect Your Money and Your House from Medicaid or a Nursing Home is using your money to take care of your kids.

Can you transfer money from Mainecare to a child?

If you’re interested in saving your money or house from Mainecare or a nursing home, in some circumstances you can transfer it to a child or even a grandchild. If the child or grandchild is disabled, you could transfer money to a trust for the child’s benefit.

What is DPOA bond?

DPOA, on the other hand, is EXACTLY what is needed for those who are no longer capable of handling finances, bill paying, and other general issues. THAT is the whole purpose of it - it should never be used UNTIL that time comes. If you have DPOA, there should be NO issue cashing in/depositing the bond.

Is DPOA easier to get?

He is on the CU account and the trust, however any decisions or changes that need to be made, he does not have the legal backing to do it. DPOA is quicker and easier to get, less time consuming, is done with principal's agreement before becoming incapacitated, is less expensive and overall less invasive.

Is a DPOA a legal document?

DPOA should be enough, since it IS a LEGAL document, approved by the person when they WERE in their right mind... So, given that this is a Federal Government Bond, you are in that "gray area". I still think that if you have the right paperwork (DPOA) and just want to deposit it, THE BANK should do it.

Can I deposit a check into someone else's account?

ANYONE can deposit a check or cash into someone else's account, they just will not give you the receipt (unless you are joint on the account) - it would be mailed the your mother's last listed address. I've done it for others and had others do it for me, with NO POA of any kind.

Popular Posts:

- 1. how to file case with district attorney

- 2. how much should attorney get in wrongful death suit

- 3. who is bridgview illinois assistant district attorney

- 4. where is the attorney general office for philadelphia pennsylvania

- 5. how to get a power of attorney state of michigan

- 6. how to choose personal injury attorney

- 7. when should power of attorney be set up

- 8. what is necessary for power of attorney

- 9. how much is an attorney for a first time dui

- 10. what attorney do i need to sue my homeowners association