The requirements for a valid power of attorney vary by state. For medical decisions, you can set up a health care proxy, but for financial matters, if you become incapacitated and are unable to manage your own money, your agent (the person granted power of attorney) can do things like access your bank accounts and pay your bills.

How can I become a financial power of attorney?

May 02, 2022 · Many states have an official financial power of attorney form. How Does a Power of Attorney for Finances Work? Once the power of attorney is executed, the original is given to your agent, who may then present it to a third party as evidence of your agent’s authority to act for you (such as withdrawing money from your bank account, or signing papers for you at a real …

How long does it take to become a power of attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

Can you go to a bank for power of attorney?

Sep 22, 2021 · What Is Power of Attorney? Power of attorney is when you assign someone the authority to make legally binding decisions on your behalf. This can mean managing financial assets, making choices regarding medical care, signing contracts and other commitments. A power of attorney can access confidential materials and their decisions are as binding as if …

How do you obtain power of attorney over another person?

Jul 21, 2020 · The requirements for a valid power of attorney vary by state. For medical decisions, you can set up a health care proxy, but for financial matters, if you become incapacitated and are unable to manage your own money, your agent (the person granted power of attorney) can do things like access your bank accounts and pay your bills.

What does POA mean on a checking account?

What responsibility comes with power of attorney?

Can a power of attorney transfer money to themselves UK?

What three decisions Cannot be made by a legal power of attorney?

Can a power of attorney transfer money to themselves?

Can a power of attorney borrow money from the donor?

Is a power of attorney liable for debts UK?

Can I sell my mums house with power of attorney?

What is a Financial Power of Attorney?

A Financial Power of Attorney is the part of your Estate Plan that allows you to grant authority to someone you trust to handle your financial matters. Your Financial POA (also known as an Attorney-in-Fact) can step in when and if you’re ever unable to make financial decisions on your own due to incapacitation, death or absence.

What is a Durable Financial Power of Attorney?

A Durable Financial Power of Attorney is just the term used that denotes someone can act even after you become incapacitated and can’t express your will or make decisions. It’s not uncommon to wonder what powers does a Durable Power of Attorney have - and we’ll cover that in a bit.

How to Choose a Financial Power of Attorney

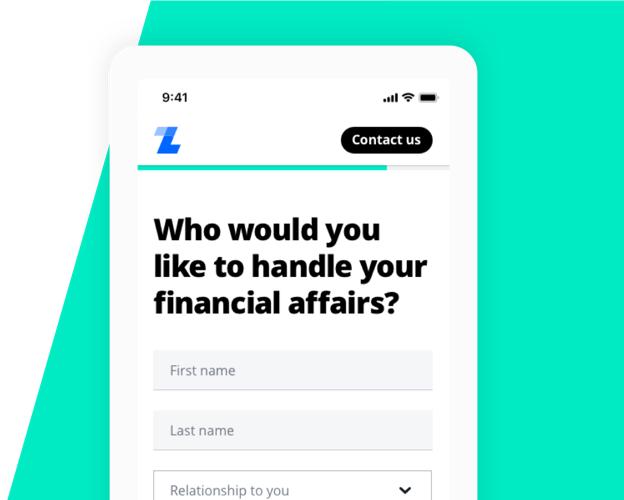

Choosing your Financial POA can be a bit daunting, but you want to take the time to make sure you’re confident with your decision and that you trust the person you name. In the long run, it will be well worth the time you’ll spend deciding.

Why do I Need a Financial Power of Attorney?

A Financial Power of Attorney is a component of your Estate Plan that ensures financial matters in your estate and are handled appropriately and responsibly. Knowing that your financial responsibilities, investments, retirement, bills and everything else in your financial world is in good hands can be a great source of comfort.

How to set up a power of attorney?

Here are some things to consider: 1. Assess your needs. A general power of attorney designates you as the "principal" and you appoint an agent (known as your "attorney-in-fact") who could be granted the authority during your lifetime ...

What is a power of attorney?

A general power of attorney designates you as the "principal" and you appoint an agent (known as your "attorney-in-fact") who could be granted the authority during your lifetime to make and carry out financial decisions you are unable to yourself.

What does a springing power of attorney mean?

A springing power of attorney would only "spring" into effect upon a described future event or date—such as your "incapacity.". For example, your estate lawyer might craft a power of attorney document for you that says you are only incapacitated when a doctor certifies that you cannot manage your own affairs.

What is the key decision in a power of attorney?

The key decision in any power of attorney is picking somebody you trust to be the agent. For a young, single person, a parent can be a logical choice, as can a spouse or domestic partner for couples. But if they can't serve for some reason, you will want to name someone to serve as a backup agent in the document as well.

What is a POA in medical terms?

A power of attorney (POA) is a document granting authority to another person to make certain decisions on a person's behalf.

Where to keep power of attorney?

The original power-of-attorney document should be kept in a safe place, either at home, in a safe deposit box, or at his lawyer's office. The person named as agent or attorney-in-fact in the document should be given a certified copy and told where the original is.

What is a durable power of attorney?

It's called a durable power of attorney for finances -- the word durable means that it remains in effect after the person is incapacitated. Although it's a good idea to have a lawyer review the document, preparing it is a relatively simple and inexpensive matter that can save untold distress.

Can a hospital witness a power of attorney?

However, hospitals often allow their staff to witness a Healthcare Power of Attorney document.

Who is Deb Hallisey?

Deb Hallisey is a caregiver knowledge expert. She earned this title helping her dad through his congestive heart failure and death. She continues to earn it as caregiver for her disabled mother. Deb brings a unique perspective to this educational blog. She has over twenty-five years’ experience as a consultant with Ernst & Young and Huron Consulting Group along with smaller boutique firms building and enhancing corporate training programs. Deb is an educator with a passion for helping others advocate for older adults and their families. Read more about Deb.

What is limited form?

Limited – allows you to choose someone to act as agent and handle a specific monetary matter on their behalf. The form becomes void upon completion of the act or at a stated expiration date. General – allows you to choose anyone to be your agent to handle financial affairs.

What is a power of attorney?

A power of attorney is essential ly a legal document. These types of legal forms generally give someone else the authority to act on your behalf as if they were you. It’s important to note that power of attorney forms can vary from state to state based on state laws .

Is a power of attorney fiduciary?

In general, a power of attorney has a fiduciary duty to act in your best interests. Unfortunately, this doesn’t always happen. It’s extremely important to very carefully select a power of attorney that you trust would do what you’d want them to do. General power of attorney. Durable power of attorney.

Do you need a power of attorney if you are incapacitated?

Chances are, you’ll need a power of attorney more when you’re incapacitated than when you can make your own decisions. For that reason, another type of power of attorney exists. A durable power of attorney is like a general power of attorney, except it continues to remain in effect after you become incapacitated.

What is a springing durable power of attorney?

Some states allow a special type of power of attorney form, called a springing durable power of attorney, that allows someone to have power of attorney after a certain event happens.

Can a power of attorney change beneficiaries?

In theory, certain power of attorney situations may give the attorney in fact access to change beneficiaries on your financial accounts. This is another reason to be careful with the powers you give. Even so, a person that has power of attorney is supposed to act in your benefit interests.

Who is Lance the CPA?

Lance is a licensed Certified Public Accountant (CPA) in the state of Virginia and he covers money management, budgeting, financial products, and more. He is also the founder of Money Manifesto, a personal finance blog, where he writes about his family's relationship with money.#N#Read more#N#Read less

What to do if you move from one state to another?

If you move from one state to another, you should review your power of attorney documents to make sure they’re still in effect. You should consult a lawyer before making any power of attorney decisions to make sure you’re not giving up any powers you aren’t aware of.

What is a power of attorney?

A power of attorney is a legal document for transferring the authority to make business and other legal decisions from the principal to their agent. It is frequently used when the principal has an illness or disability that renders it impossible for them to sign documents and make important decisions independently.

When to use POA?

It is frequently used when the principal has an illness or disability that renders it impossible for them to sign documents and make important decisions independently. The first thing you need to know before creating a power of attorney document is what POA type you need: With great power comes great responsibility.

Do you need a power of attorney to act on your behalf?

Your attorney-in-fact will need the original power of attorney document, signed and notarized, to act on your behalf. So, if you want your attorney-in-fact to start using the document right away, give the original document to the attorney-in-fact. If you named more than one attorney-in-fact, give the original document to one of them.

Can you use a power of attorney if you are incapacitated?

If your power of attorney won't be used unless and until you become incapacitated , however, it may seem premature to contact people and institutions about a document that may never go into effect. It's up to you. Be sure to keep a list of everyone to whom you give a copy.

Can you give copies of durable power?

If you wish, you can give copies of your durable power to the people your attorney-in-fact will need to deal with —in banks or government offices, for example. If the durable power is in their records, it may eliminate hassles for your attorney-in-fact later because they will be familiar with the document and expecting your attorney-in-fact to take action under it.

What is a power of attorney?

A power of attorney isn’t a person, but rather a document that gives someone the power to act on your behalf in case you die or become incapacitated. You can name someone to make decisions for you when you can’t.

What is POA in estate planning?

Estate planning: A POA can help you plan for potential events in the future, like a debilitating brain injury or dementia. Your agent can handle your affairs in advance.

What happens if you co-sign a loan?

If you co-signed a loan or jointly took one out, you’re each responsible for the outstanding balance. “So, if one of you dies or is unable to pay, the entire amount is still owed,” says Rampenthal. They hold a joint account with you.

Popular Posts:

- 1. what powers does a power of attorney give you

- 2. how can i find the attorney that did,slutman,family,trust helen slutman

- 3. an attorney must keep two different bank accounts. what are those accounts called?

- 4. how do you sign if durable power of attorney

- 5. who can arrest the state attorney general

- 6. do you ask attorney general of california to see who had succeeded to a company

- 7. 5min- under the constitution when is a defendant entitled to an attorney?

- 8. who is the attorney general for plymouth indiana

- 9. where can i get a form for power of attorney

- 10. who was the attorney that represented the guy in theeastern oregon deal before the were removed